Is The Price Of Gold Going Ballistic?

This past Friday, April 29th, 2016, GOLD entered its “first phase” of its new long-term bull market. This has created a whole new world of opportunity, for my subscribers. The global Central Banks opened the floodgates encouraging us to go on a gold buying spree.

This past Friday, April 29th, 2016, GOLD entered its “first phase” of its new long-term bull market. This has created a whole new world of opportunity, for my subscribers. The global Central Banks opened the floodgates encouraging us to go on a gold buying spree.

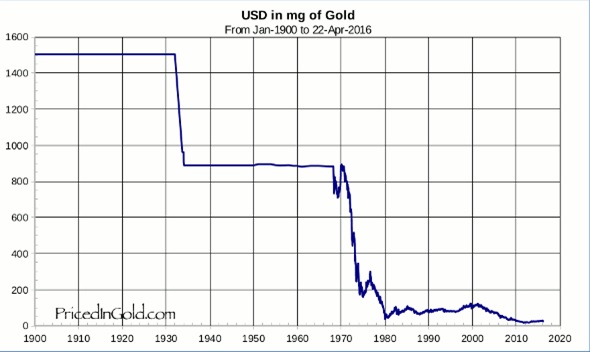

Jim Rogers, a famous successful investor, states that the US Dollar is a seriously flawed currency which has lost close to 98% of its’ value in dollar terms. Although many experts will offer debates as to why the chart below does not reflect the correct metrics: you can judge for yourself seeing as this is a very basic and valid comparison.

Gold has remained as a form of currency for many centuries. Whenever countries followed a strict gold standard and used it as their currency the economy was very stable. But, governments have always surpassed their means with their costly spending and have to leave their gold standard so they can fund their inefficiencies by printing more and they repeatedly keep going broke.

The Government Is Like an Unethical Banker Playing Monopoly

What the government has been doing and continue to do is such a joke. In Laymen’s terms, it’s like all of us playing the game Monopoly. We all start off with some money, slowly accumulate properties, rental income and build wealth, while closely managing our money and making sure we have enough cash on hand to buy more properties and/or pay rent and other fees as we move around the board. We are honest players paying our debts as required and expected.

Then there is the banker, who helps with the transactions of paying fees, rents, properties etc.

Unfortunately, the banker is also a player at the table (banker = Government). This banker always happens to be the worst/dumbest/unethical player one could ever be forced to play with.

As the game goes on, the banker goes broke and cannot afford to pay rent and other fees. But instead of going bankrupt and forced to leave the game, they decide to keep borrowing and/or stealing money from the banker’s money tray to stay in the game. He keeps going this until eventually all the other plays eventually go bankrupt and lose, or they all give up on the system and no longer use the free money he keeps taking because it’s worthless.

In the end, the banker (Government) is the only one left standing but he killed the game and trust of all the players (Players = anyone owning/using US dollars, and bonds) and they are left sitting at a table and no one wants to play with them anymore.

See what the government is doing to hide its debt and lack of demand for their bonds in this recent article called: The Fed Is Exporting Quantitative Easing!

Now, if we focus on where we are at currently in this giant game of fraudulent financial activity, gold is now just beginning its’ muti-year “BULL MARKET”. Why? Because gold is the only ‘asset class’ which will maintain its’ ‘store of value’ during this impending crisis which is on the horizon. The famous hedge fund manager, Stanley Druckenmiller, has a large investment in gold.

Should you invest in gold at this time?

‘Gold mania’ is about to be ‘unleashed’. While global Central Banks are now implementing ‘negative interest rates’, this is the perfect scenario for gold to surge much higher.

Gold is the final safe haven left to securely invest in which has stood the test of time over thousands of years. It has maintained its’ value throughout at least the last five thousand years. The sudden and most recent ‘break out’ in gold is proof that its’ safe-haven status is still intact. The price of gold is rising more on the expectation of the next financial crisis. Imagine how high the price of gold could go when the real crisis impacts world economies.

You can talk with Chris Seebert, the President and CEO Gold Gate Capital, who specializes in helping individuals roll over their IRAs and 401k into Physical Gold that they can store at their house or in a depository, to help protect their assets from the next crash.

While Central Banks are trapped in their current scenario, this is now presenting an incredible opportunity that is a once in a lifetime opportunity in which you can prosper an incredible amount of money when the system crumbles.

How high can gold go? I believe it can reach $5,000/oz. in the next few years, but during a full-blown crisis we could see 4-5x that price. With a limited downside risk and huge profit potential, my subscribers are long gold bullion because - Gold is money.

You can stay ahead of the curve and grow your wealth as long as you have an IRA, 401K, are an active trader or long term investor.