The ‘Counter Trend Rally!’

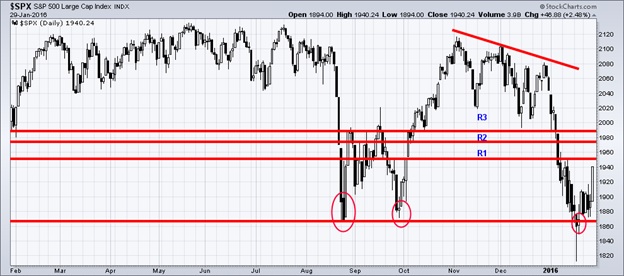

The stocks markets worldwide last week rocked back and forth every day until January 29, 2016. That Friday the SPX rallied very sharply. So, with its biggest weekly gains of the year, does this mean the bull market in equities is back? No!

The stocks markets worldwide last week rocked back and forth every day until January 29, 2016. That Friday the SPX rallied very sharply. So, with its biggest weekly gains of the year, does this mean the bull market in equities is back? No!

However, this does indicate that the “counter trend rally” will likely continue…but will likely be a choppy ride over the next week or two. The momentum oscillators are still oversold. We could visit the lows, if we do, I still expect the continued bounce. This is not “buy the bounce”, but rather a unique situation to sell your stocks into strength.

In January 2016, the broad stock markets fell below its 2007 high which means investors have zero gains over the last 8.5 years.

It is still a bear market. The market continues the classic bear market pattern of consecutively displaying a sequence of lower highs/ lower lows. This pattern has to break before this is a new bull market. This is how cycle studies define a bull or bear market. The media would have you believe meaningless measurement of a 20% gain or loss that ineffectively defines bull and bear markets.

The Bank of Japan’s decision to go negative on interest rates collapsed the Yen and strengthened the US Dollar, which puts the FED in a difficult position. This week on Friday, February 5, 2016, the employment reports for January 2016 will be released. If the jobs report is solid, this will put more upward on the Dollar because the FED will then be expected to stay on course to raise their short-term rates. This in turn creates pressure on U.S. companies that do business overseas. This will lead to a sharp reversal in the stock markets.

The Congressional Budget Office (CBO) announced that our deficit has begun to rise again. “The Deficit Rises Again!” The CBO estimates that deficits will continue to rise each year after Mr. Obama leaves office. This is the fiscal time bomb that Mr. Obama has created for the next impending “Global Financial Meltdown”. Last week, there was a run on banks in Italy. Many are leading us to believe the next round of “bail ins” are beginning in Europe.

Massive central bank intervention in the financial system has done nothing but falsify inflate the prices of financial assets.

This fraud is coming to an end. Consider what's happening to the market's high fliers, the 'FANGs' (Facebook, Amazon, Netflix and Google). These stocks have actually been the “canary in the coal mine” of a massive “asset bubble” Now, their warnings signals are being noticed.

The FANGs were the 'jewels ' that hid the market's initial breakdown during 2015. They gained $485 billion of market cap while the other 496 companies in the SPX actually declined by more than half a trillion dollars.

When a stock market's advance drastically narrows to just a handful of “ultra-momentum stocks”, the days of the bull have come to a conclusion, and their days are numbered. The key factor for the stock market has been and remains the FED. The near term future is so freighting for the stock market because the FED has said very little about its recent decline or what its response might be. The only central banks potentially responding to troubles in the stock market are the European Central Bank and Bank of Japan. The FED appeared to have stepped away from the issue since its December 2015 rate hike. This is pretty scary.

Guess what the best investments of 2016 is going to be? This fall in equities in 2016, will prompt a new multi-year rally in gold, silver and oil.

We all agree on one thing, that the market economy functions at its best without central banking manipulations, which has been shown to be a complete failure. Today, democracies have implemented a system that is basically run by a bunch of “nerdy professors” and they target inflation, they target exchange rates, they target the quantity of money produced. Is the world crazy to have given them so much power?

Big things are starting to unravel and investors will experience one of two things: Severe financial losses in their savings and retirement accounts, along with a sharp decline in high end real estate. Or they will thrive and become wealthier than ever before by profiting from the collapse of the global banking systems and stock markets.

Follow my lead as we navigate these unprecedented times and thrive from the the pending economic collapse.

********

If you like this type of trading: Slow, Simple, Logical, Tradable Ideas then be sure to watch my video and join me at www.TheGoldAndOilGuy.com

Recently we have closed 10 trades with 8 of those being winners and we still have another winning trade open as of this article.

Chris Vermeulen