2020 Gold Price Forecast And Gold Thesis

Gold is currently showing some strength, with a price over $1600. However, there is still a lot of paper gold selling (where the spot price is determined), and there is no clear direction in price. In fact, I have been saying all year that until silver gets above $18.50, I won't consider this a gold bull market.

Silver, Gold’s Little Sister

Why do I consider the silver price so important? Because I consider them tied at the hip. I consider silver to be gold's little sister. Gold is big brother and leads. Then little sister (silver) catches up once she sees that the coast is clear. In fact, little sister will easily outperform big brother once she sees the green light.

Little sister is down below $15! She doesn't like something. It looks like little sister is going to wait until gold makes a big move before she joins the party. That means we are going to need $1750 or $1800 before the gold bull market resumes.

At this time, there are reasons to be optimistic that gold will trend higher. First, there will be a lot of negative fallout from the coronavirus. Second, negative real-rates are good for gold. Third, physical gold is becoming scarce.

There are also reasons to be apprehensive that the gold price could be constrained. First, the banksters will do everything they can (selling and leasing paper gold) to contain the price from breaking out. Second, MMT could work and the economy comes back to life. The central banks will do everything they can to contain bond defaults.

So, the data point to watch now is silver. You can also watch and see if gold can get above $1700 and stay there. Surprisingly, the DXY (dollar index), is no longer hindering gold. Although, if the dollar explodes higher or collapses, then it will impact gold. If the DXY ranges from 95 to 100, then it really won't affect gold very much. I'm not worried about the dollar impacting gold at this time.

Like the DXY, I don't think the stock market will impact gold that much for the rest of the year. It's unlikely the stock market will get back above 27,000. But if the stock market gets back above 27,000, then gold could get sold.

In addition to silver, keep an eye on the bond market as well as liquidity issues in the financial markets, which impact bonds. Ideally, in 2020, we want to see silver get above $18.50, which will mean gold is over $1750 and safely in a bull market. Additionally, we want to see a plethora of bond defaults.

Gold Investment Thesis

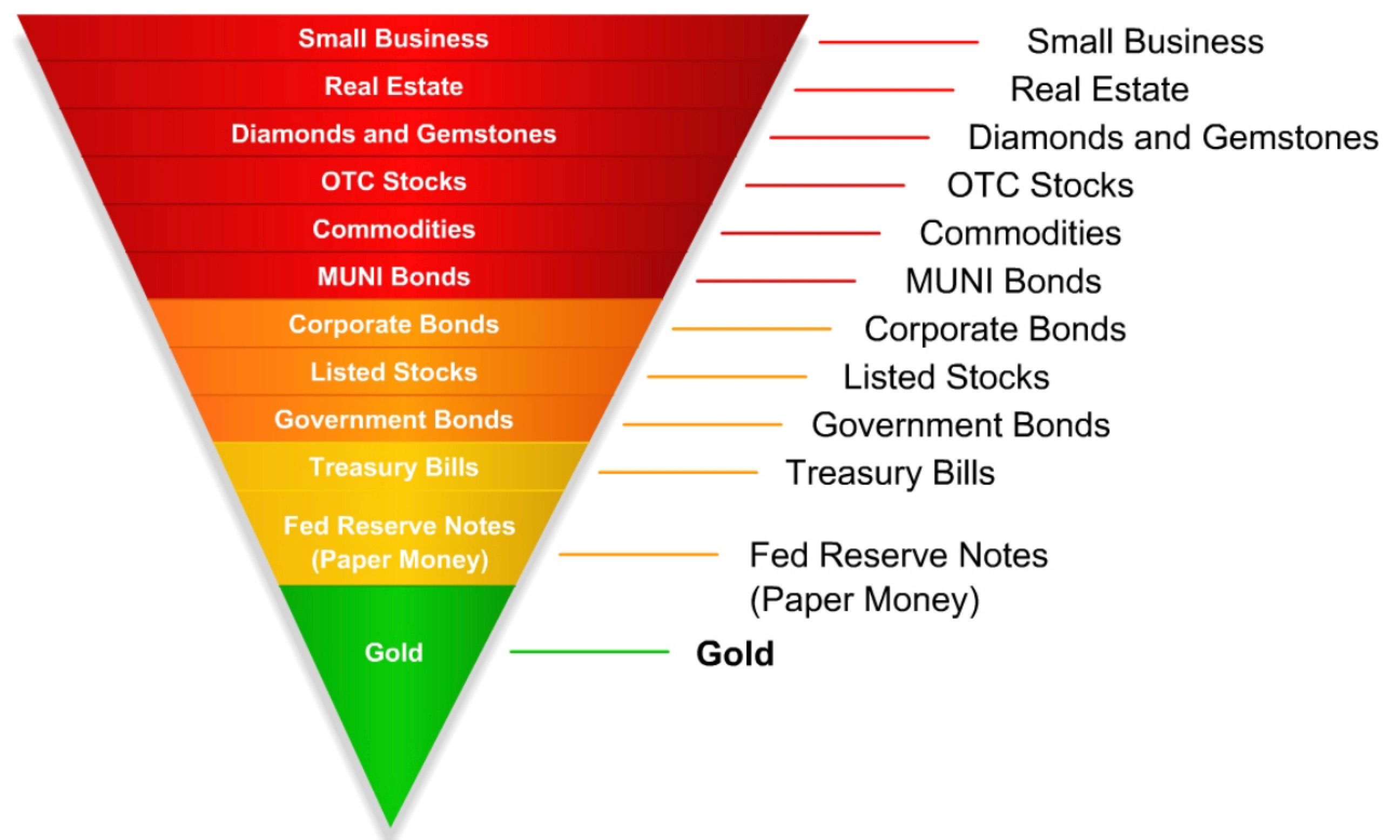

I have been investing in gold mining stocks for many years. The reason for my interest is based on the premise that Exter's Pyramid is valid and that bond investors will switch to gold (driving gold prices higher) as risk increases. It's a very bearish outlook. In fact, it is an extreme investment approach because it has never happened before in a big way.

Why would anyone want to be involved in gold mining stocks unless they had some type of angle? The risk is so high that it is very difficult to make money in the long term. Sometimes you can find good risk/reward stocks in the near term, but those are rare. Also, there are times when gold is trending upward, and you can jump on the bus and ride it up. In both of these scenarios, it is more of a trading market than buying and holding for the long term.

I am a long-term investor of gold mining stocks. Normally, this would be foolish, but I have an angle. In fact, I think my angle is about to pay off big-time. The coronavirus is the black swan no one expected. It is likely the pin that will pop the debt bubble, and make bonds risky to hold.

As a gold mining stock investor, I only need about 1% to 2% of the bond money to move into gold to make a boatload of money. The global bond market is huge. It is much larger than the global stock market. And most bond investors put their money there because it is perceived to be safe.

What the average investor does not realize is that gold mining stocks have huge leverage to the gold price. These stocks can go up multiples in a very short time if gold prices break out. Since that is true, if you have a position before the breakout, the returns can be phenomenal. I plan to catch that breakout.

Exter's Pyramid

According to Exter's Pyramid, gold is the safest asset to hold. It is followed by cash and then short-term government bonds (see below). This means that bondholders who perceive risk and want to move to a safer asset, only have two choices: cash or gold.

Looking at Exter's Pyramid above, you can consider gold as the ultimate hedge against uncertainty. There is a saying that if you have 10,000 ounces of gold, you are rich. If the price of gold goes up, you are richer. If the price of gold goes down, you are less rich but still rich. Thus, gold provides a level of certainty that no other asset offers. There is a reason gold is on central bank balance sheets, and that reason is certainty.

So, gold is the ultimate hedge against uncertainty. Unfortunately, for gold investors, we have been living in an era where bonds and cash are perceived as safe. Most investment professionals don't even consider gold as an asset worth owning. They would much rather own bonds and cash for uncertainty. In fact, that is what we have once again witnessed during this coronavirus outbreak.

As long as cash and short-term bonds are considered safe assets, then gold is not needed as a hedge. This is why most investors do not hold any gold in their portfolio. However, if the bond market begins to crack, the only place to go for safety is cash, and then gold. Moreover, if governments print money without constraint, then even cash becomes suspect due to inflation and debt concerns.

We have not had global bond fears since the 2008 recession, but they are now back. The reason why gold increased in value from 2009 until 2011 (in my opinion) was due to bond and currency fears, as investors moved down the Pyramid to acquire more asset safety. I call this the gold fear-trade, which appears to be back.

Gold is the ultimate asset, according to the Exter risk Pyramid. However, this asset is ONLY needed when the rest of the Pyramid becomes suspect. If the levels above gold hold their value (especially bonds), then gold demand wanes. Today we are seeing high demand for physical gold. This seems to imply that the investors are starting to question their bond and cash holdings, and are beginning to purchase gold. If this trend intensifies, then gold prices will rise, and gold mining stocks will blast off.

Ultimately, we want the fear that causes investors to run to gold to manifest into a plethora of bond defaults, along with inflation that devalues currencies. This is why I like gold mining stocks. If this scenario unfolds, and I think it will at some point, the run to gold will be breathtaking and historic.

Gold Initially Ignored

During recent market crashes of 2001, 2008, and again in 2020, investors initially sold gold to raise cash. Gold was considered an expendable asset and was mostly sold instead of bought. Because gold miners are dependent on gold prices for their share price, they are not hedged very well during a market crash. In fact, gold mining stocks are considered a risk-on asset, and thus are usually sold during market crashes. That happened again at the beginning of the coronavirus sell-off.

So, during a market crash, we usually see gold sold off and gold mining stocks as well. The ugly truth about investing in gold mining stocks is their risk is atrocious. Not only is it difficult to make money investing in gold miners, but they crash hard during market sell-offs.

Why even buy gold mining stocks if the risk is so high? Because if the bond market breaks, the move to gold will be historic. Yes, the risk/reward is not exactly compelling and this is speculation bet. But, the dots all point to gold going higher, much higher, from this debt bubble getting out of control.

Investment Allocations

Currently, the most common investment allocation is 60% equities and 40% bonds. Those bonds are held for safety. But what happens if bonds begin to fail? Suddenly, the ultimate safe haven (gold) becomes attractive. I realize that my thesis is a stretch looking at history, because since 1945, there has never been a global bond breakdown that pushed investors into gold in a big way.

I plan to sit tight in my gold mining stocks and wait for the bond market to pop. If I'm right, then the wait will have been worth it, and then I can get out. If I'm wrong, then it was worth the stretch.

Let's presume I am right, and the bond market is getting ready to pop. What's going to happen? Well, with that outcome, the price of gold is easily going to a new high above $1,935. I say easily because that is nowhere near the likely top. So, we are talking about $2,500, $3,000, even higher. At those levels, what do you think the gold miner valuations will be?

Big Returns

The average gold miner is worth about 5x free cash flow. Quality gold miners are valued around 10x free cash flow, and the elite gold miners can be valued above 20x free cash flow. If my thesis is right and gold breaks out in a big way, then the quality gold miners will be valued somewhere between 10x and 20x free cash flow.

Do the math for a few Canadian gold producers and see what kind of upside potential is possible if gold prices rise substantially. Here are some steps that can be used to easily calculate an estimated future market cap. This can be compared to their current market cap to calculate an estimated upside potential.

1) Go to Sedar.com, and you can easily find their last quarter financial statement. Find their net income for the last quarter and multiply it by 4 to get an estimated free cash flow for the next year.

2) Go to their website and find out how many ounces they will produce in 2020 from their company presentation.

3) Divide the total number of ounces of expected 2020 production (step 2) by the estimated free cash flow (step 1). This will give you the free cash flow per oz. of production.

4) Calculate their estimated future annual free cash flow per oz. by adding $500 per oz. to their current amount of free cash flow per oz. (step 3).

5) Calculate their future market cap as follows: Number of ounces of expected production x future cash flow per oz (step 4) x 10 (conservative multiplier).

6) Compare their current market cap to their potential future market cap (step 5).

You will find that most Canadian producers have the potential to be valued at multiples of their current market cap if my thesis holds.

The HUI (gold miners index for large-cap miners) is currently about 200. In 2011, when gold hit its high of $1,935, the HUI was at 635. Do the math. If we go back to a new high, the large-cap gold miners will rise in value about 300%, and that is the average return. What happens if gold reaches $2,500? The returns could be stunning, and this doesn't even include returns for mid-tier producers and juniors, which will be higher.

Conclusion

It's impossible to know if gold is going to break out in a big way. All we can do is analyze the various factors that could lead to a breakout and then make an assessment. I think that MMT (modern monetary theory) is economic insanity and will not work. Currently, MMT is all the rage, and debt is no longer considered dangerous. This week, Congress passed a bill to spend $2 trillion to help alleviate the coronavirus. I remember when people use to worry about $100 billion deficits. Now we don't even blink at $2 trillion.

MMT came from the analysis of what Japan did in the early 1990s. What Japan's central bank did was print huge amounts of money and buy assets. They flooded the economy with liquidity. This was supposed to create inflation, but it didn't. Voila, MMT was born. It was now perceived as okay for central banks to expand their balance sheet. This is why the US Fed has a balance sheet now of $5 trillion, and no one is concerned.

If you believe that MMT is our economic savior, then avoid gold and gold mining stocks. But if you think it can't save the bond market, then you might consider some gold mining stocks.

I've always considered MMT to be vulnerable to economic experimentation, because once you realize that you can print money for whatever you need, there is no constraint. For instance, the Japanese government or central bank, currently own more than half of their stock market ETFs and a large portion of their own bonds.

Now the US has fallen into the allure of MMT. The current coronavirus virus stimulus bill includes the following:

The Fed will create money out of thin air to finance a special purpose vehicle (SPV). They will print money into this SPV account (any amount the US Treasury requests) and then transfer it to Blackrock. Then Blackrock will acquire stocks and bonds (requested by the Treasury department), whereby the owner will be the US Treasury!

Why would they do this? Because the stock market is a pension program for many US citizens. We can't have a stock market crash. So, the US Treasury has decided to use printed money to prop it up. Do you think it is going to work without any fallout? Unlikely.

This has NEVER happened before in the US. It is another experimentation under MMT. The ramifications are huge because no one knows what fallout will occur. The one thing we do know is that more money is going into circulation, which will have the effect of devaluing the dollar and increasing the value of gold.

So, now we have two backstops for the financial system. We have the Fed, which can print money and buy various assets and put them on their balance sheet. And now we have the Treasury, which can do the same. It's total economic insanity if you asked me. We are about to find out if this insanity can insulate bonds and continue to keep gold in the shadows. I have my doubts.

Note: If you would like a free trial at GSD (www.goldstockdata.com), go to GSD and send me an email using the Contact link. The GSD database has 800 gold and silver mining stocks. I created it so that I could select a portfolio of mining stocks. There is no other comparable database that I am aware of.

Don Durrett

Goldstockdata.com