Are Gold And Silver Stocks The Best Area For “New Money Right Now”?

Strengths

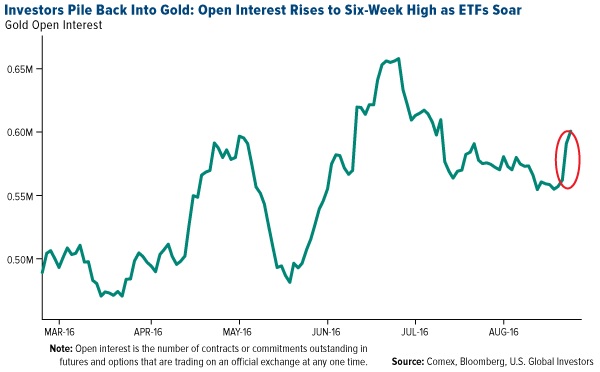

- The best performing precious metal for the week was gold, up 0.22 percent. According to Bloomberg, gold traders and analysts were bullish for the first time in three weeks on the back of the Federal Reserve outlook. In fact, holdings in ETFs backed by the metal climbed by 13.8 metric tons in the first two days of the week, as seen in the chart below.

- On the back of Friday’s jobs numbers, gold and silver have reversed back to the upside and the sector has new buy signals in daily momentum gauges, reports Bloomberg. Stocks related to both gold and silver remain the best area for “new money right now,” according to BMO analyst Russ Visch. BullionVault’s Gold Investor Index agrees with Visch’s analysis—the gauge measuring the balance of client buyers against sellers rose to 56 versus 53.4 in July.

- Pure Gold Mining reported a drill intersect of 50.2 grams per tonne over four meters at its McVeigh Horizon, Madsen Gold Project this week. In addition, mineralization is now extended to a vertical depth of 370 meters. The four drill rig exploration program is designed to expand the high-grade gold resource in close proximity to the existing permitted infrastructure, the company reported.

Weaknesses

- Silver was the worst performing precious metal for the week, down 2.03 percent. Precious metals showed signs of slowing a recent advance, with silver halting a five-day winning streak, reports Bloomberg, and gold trading little changed after the biggest advance since June.

- One of the top gold forecasters, ABN Amro, cut its outlook for gold prices at year-end, reports Bloomberg. The bank lowered its price forecast to $1,325 per ounce compared to a previous estimate of $1,350 per ounce. “We had expected a larger Brexit fallout on financial markets reflected in negative investor sentiment,” ABN Amro analyst Georgette Boele said.

- Gold imports by India slumped in August to the lowest level in five months, reports Bloomberg, as increasing prices reduced spending on the yellow metal. Inbound shipments slumped 85 percent to 21.6 metric tons from a year ago, the article continues, but foreign purchases could recover this month due to festival season.

Opportunities

- Andrew Quail of Goldman Sachs notes that over the past two years, gold miners have adapted well to the new gold price environment. He says companies have executed on the “shrink to profitability” strategy by: 1) lowering operating costs, 2) reducing financial leverage and 3) prudently allocating scarce capital resources. So what now? Quail says the next steps include a focus on productivity, growth and dividends.

- ICBC Standard Bank sees gold rising above $1,400 an ounce in the coming weeks, reports Bloomberg. “There is little prospect that the U.S. Fed will raise rates in September, and most likely not in December either,” the bank said in an email on Thursday.

- The Federal Reserve Bank of Atlanta publishes a special inflation index called, in the words of MarketExclusive.com’s Rafi Farber, the “Sticky-Price CPI.” This index measures prices for goods and services that do not normally experience wild swings. Currently this index is at the highest level since April 2009, which, according to Farber, has “big implications for gold and especially gold mining stocks” because gold usually rises quickly when inflation fears become mainstream. The Sticky-Price CPO has been trending up since 2009, while the flexible CPI has been negative since October 2014. If inflation starts to become obvious—and, according to the Sticky-Price CPI, this could happen soon—Farber writes that “any upside revaluation in the price of gold is likely to be quick and intense.”

Threats

- According to a recent note from BCA Research, the recent “Fedspeak” has hinted strongly at a rate hike later this year. Although a September rate hike is still a possibility, the note goes on to point out the recent batch of disappointing U.S. economic data, combined with lackluster inflation readings and election uncertainty—all suggesting that a December hike is more probable.

- According to the National Australia Bank, the outlook for gold is “mildly bearish” over the rest of 2016. The bank states that central to this outlook are assumptions that the Fed will lift rates in December by 25 basis points and Hillary Clinton will win the U.S. presidential election, reports Bloomberg. The European Central Bank (ECB) can also have an effect on the yellow metal, according to gold traders this week, who saw bullion swing between gains and losses. Investors and traders assessed the outlook for economic stimulus after the ECB president said officials will look at redesigning the quantitative easing program. With no new measures being announced, gold languished for the rest of the week.

- New Gold underperformed as much as 7.6 percent in Canada this week, lagging its gold peers, reports Bloomberg. The drop came after Rainy River capex rose “yet again” by $105 million along with a downgrade of New Gold by Canaccord to hold versus buy. Earlier reports by management have suggested capital requirements would rise by just $35 million due to the need to redesign the tailing containment structures.

Courtesy of http://usfunds.com/

Frank Holmes is the CEO and Chief Investment Officer of

Frank Holmes is the CEO and Chief Investment Officer of