Avoid The Coming Debacle With Your Personal Gold Bank

The failure of Western financial structures, including the currency system, is in its final stages.

Sadly, no one takes any notice – YET!

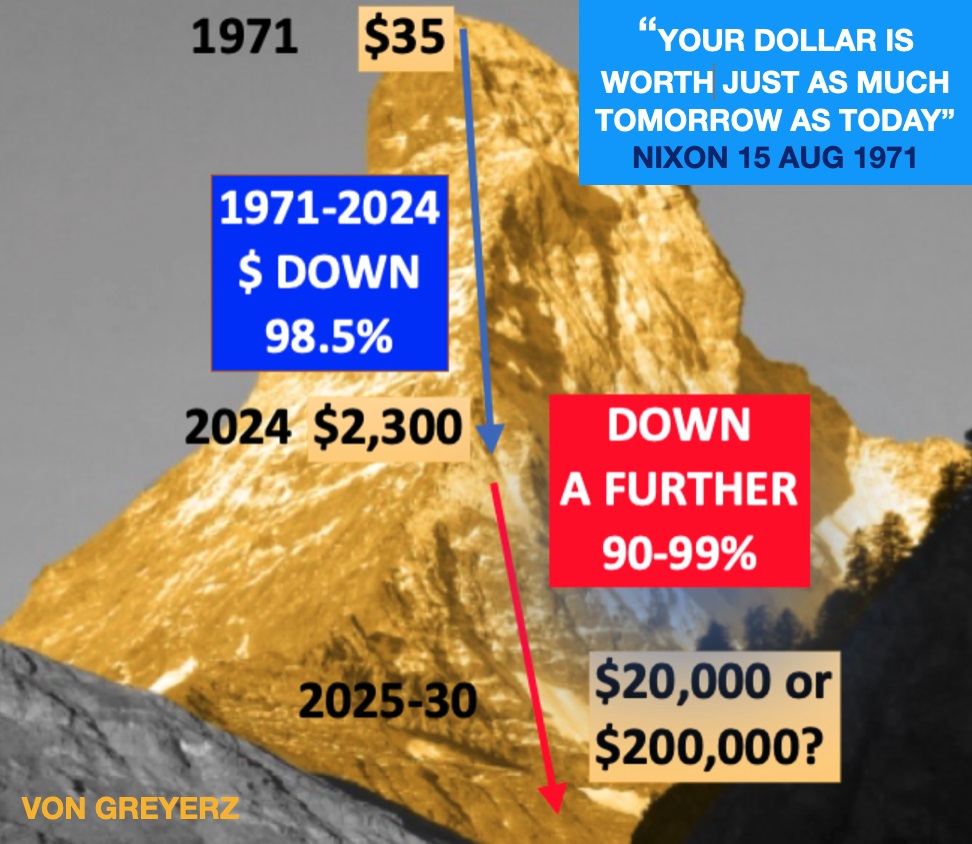

Global debt has already tripled this century, with the dollar and most currencies having lost 98.5% of their purchasing power since 1971.

Experts say the US can never default as they have a printing press. Whatever lies the US and European governments come up with, a 98.5% fall in the value of a nation’s currency is an absolute default. All other explanations are just noise.

With global debt at around $350 trillion and global GDP $100 trillion, the Global Debt to GDP is 350%.

Over 100% Debt to GDP is unsustainable and cannot be financed over the longer term.

And 350% Debt to GDP is bankruptcy – Banca Rotta.

With financial markets distorted and leveraged to the hilt, global risk today is greater than ever.

There is an obvious path that small and big investors can take to minimise this risk.

The best solution is to create your own Gold Bank that will almost entirely eliminate financial risk and provide instant liquidity. In addition, compared to virtually all other asset classes, it will enhance your wealth substantially in the coming years.

US & EUROPE – TERMINAL ILLNESS

We are not just talking about terminal illness for the US, European and probably Japanese, which are all fatally wounded by debt, deficits and decadence with no chance of recovering in the next few hundred years.

We are also talking about China and many emerging markets with debts, as well as demographic and structural problems, which, even though not incurable, will slow down their economies for many years. And yet, not to the same extent as in the West.

So, are the US and Europe now Banana Republics?

Banana Republic can be described as:

A highly stratified, politically unstable socioeconomic structure, with a small ruling class that controls access to wealth and resources.

That definition certainly fits the US and Europe, with a small elite of 1% owning 1/3 of the total wealth in the US.

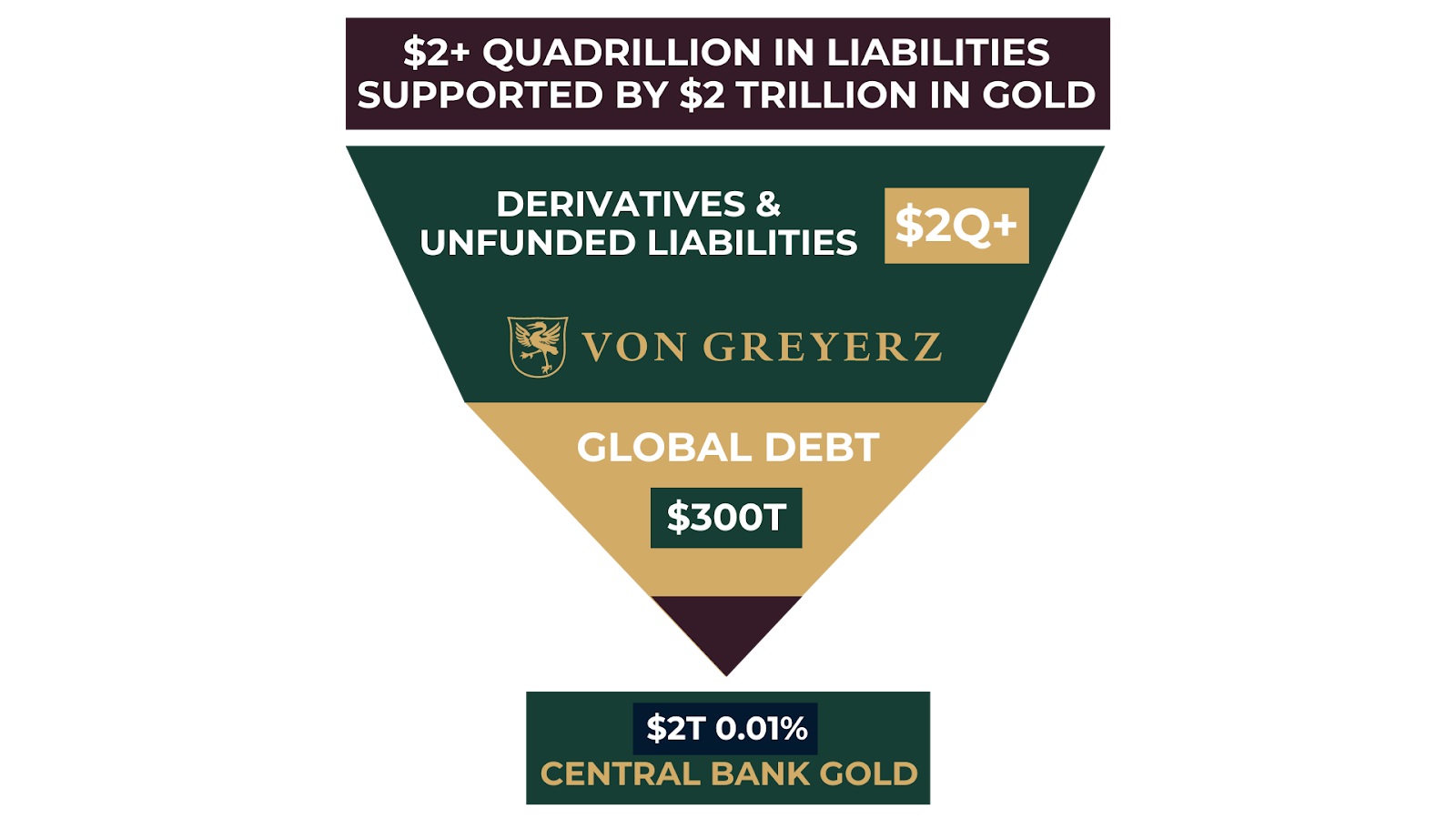

Global financial assets are $600 trillion (incl. PNFC – Private Non-Financial Corporations) plus potentially $2+ quadrillion of derivatives, much of which will become debt when counterparties fail.

How can we expect a global value of the output of goods and services (GDP) totalling $100 trillion to support debt of $350 trillion-plus the high risk of derivatives of $2 quadrillion exploding or rather imploding one day?

This is a daisy chain and Ponzi scheme scam all in one.

Print money to inflate markets and then print some more to keep it all going. As history tells us, this can only end in one way.

As Joe Biden finally decided not to stand for re-election, this will have little bearing on America’s insoluble financial problems.

The upcoming US election will not change this risk. Donald Trump, Kamala Harris or someone else cannot stop the avalanche of debt triggered back in 1971 with the closing of the Gold Window. It will reach its maximum force in the next 3-7 years. It could be earlier, but it could take longer. Most of the signs we see tell us that it will be sooner. But as I often say, forecasting is a mug’s game. So, let’s focus on imminent risk rather than if it happens tomorrow or the day after.

NO EMPIRE AND NO CURRENCY SYSTEM HAS SURVIVED

History tells us that no empire has ever survived, nor has any currency system.

So anyone who believes that “it is different this time because …” ignores thousands of years of history.

This is not meant to be sensational – it is based on history, which tells us that, without exception, a debt crisis leads to a currency crisis with inflation, asset and debt implosion, political and geopolitical instability, including social unrest and wars.

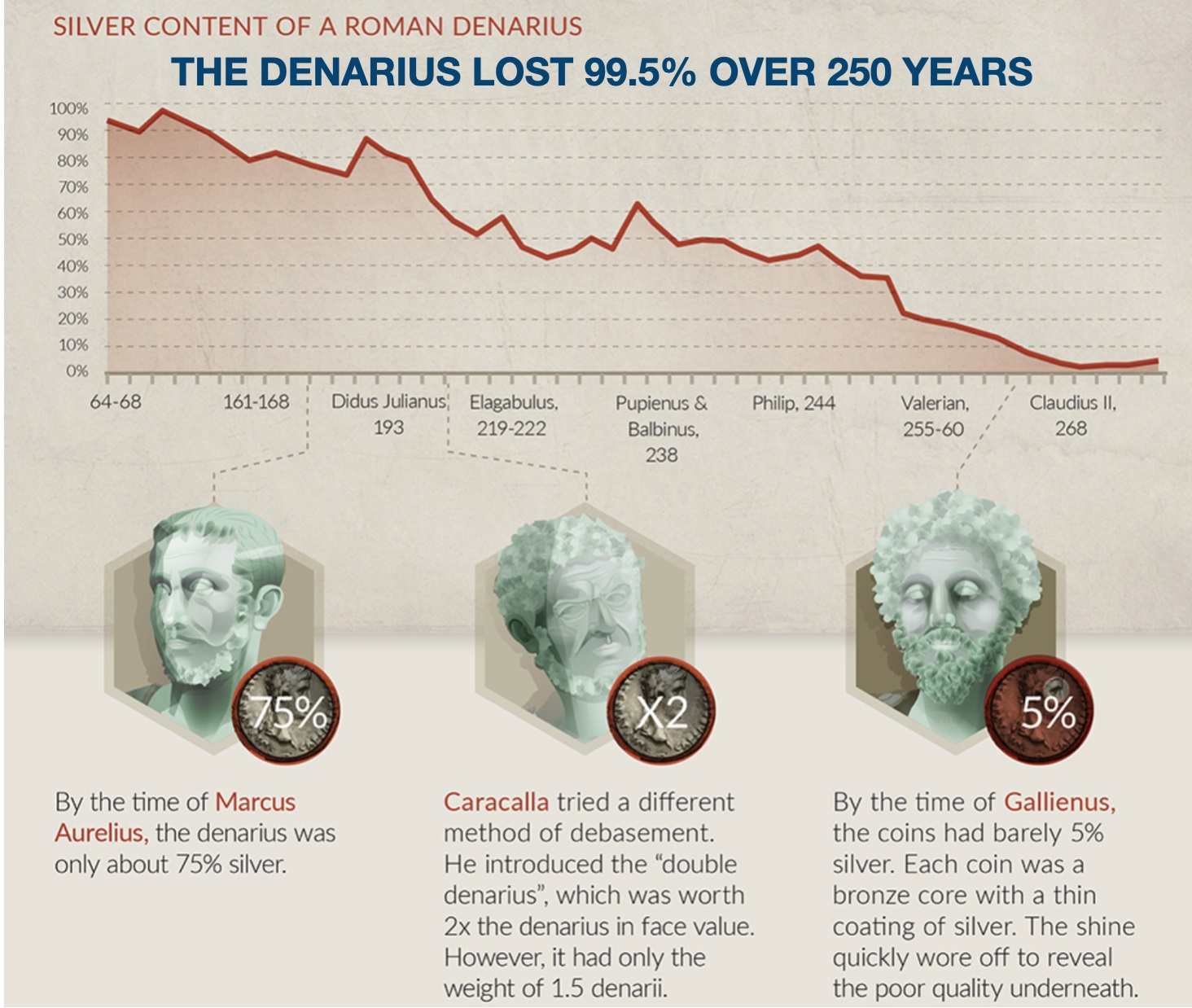

Let’s look at the collapse of the Roman Empire, which underwent the same decline as we see today. It doesn’t matter which empire we pick since they all end the same way.

The current US empire with its European “colonies” is more of a financial than a geographical empire. I call Europe “colonies” (tongue in cheek) because whatever the US decides (e.g., attacking Iraq or Libya, FATCA (control of global banks), sanctions or freezing Russian assets, etc.), Europe conforms without any resistance.

The peak of the Roman Empire was around the birth of Jesus. The decline started gradually, and by the time of Marcus Aurelius (161 AD), the Denarius, the Roman silver coin, was already down 25%.

The build-up of debt and the debasement of the currency created the Crisis of the 3rd Century (235- 283 AD). During that period, there were more than 50 emperors, most of them assassinated and some killed in battle. During that period there were also barbarian invasions and migration into the Roman territory. Multiple civil wars and peasant rebellions also occurred, enabling many to grab power illegally or by force.

The financial and economic decline of the empire continued unabated, with more debts and deficits. By the time of Gallienus (260 AD), the Denarius had lost 99.5% of its silver content. At the end of the Crisis of the 3rd Century, the Empire split into three political entities.

ROME’S DECLINE

This gradual decline led to the weakening of central political control, power struggles, budget deficits, increasing debts, corruption, a weakening currency, hyperinflation, higher taxes, plague, as well as a decreasing army not paid enough to deal with great numbers of invading barbarians.

Finally, in 476AD, the Goths (Germanic people), led by Odoacer, captured Rome and deposed Romulus Augustulus. Odoacer became the new ruler.

So, 476AD became the official end of the Roman Empire, although parts of the Eastern Empire still survived.

Looking at the bolded paragraph above, there is virtually no difference between the fall of the Roman Empire and the fall of the US-Western Empire today.

La plus ça change, la plus c’est la même chose. (translation: The more it changes, the more it stays the same)

There is actually not one single word or description that differs. The Plague, for example, is today’s COVID-19, while the Barbarians in ancient times were people who did not belong to one of the great civilisations (Greek, Roman, Christian).

In the same way today, the migrants are coming in great numbers from other non-Western cultures. And since there is no political will to stop the migration, the numbers are more likely to increase than decline. Thus, it’s obvious, the US and Europe will look very different in 50-100 years.

So, it is similar today, and all major Empires end in the same fashion. How the US-Western Empire will end is already described in old history books. But sadly, no politician ever studies history, which, if they did, they would see the description of their own destiny.

COMING DESTRUCTION OF INVESTORS’ ASSETS

There are several major risks in the next few years that can destroy investors’ assets, for example:

- Systemic failure of the financial system

- Bank collapses

- Custodian failure

- Derivatives failure

- Currency debasement

- Political/Social risk – civil unrest

- Geopolitical risk – war

It is no surprise that the final stages of empires, such as the Han, Roman, Mongol, Ottoman, Spanish and British, always included all the above ingredients.

Let us start with currency debasement.

Most people don’t understand what fiat (paper) money stands for.

It is not your money that always has a guaranteed value. History has clearly proven that no fiat money has ever survived – WITHOUT FAIL!

All currencies have gone to ZERO through the irresponsible and incompetent management of the economy.

Voltaire said it already in 1729:

Paper money eventually returns to its intrinsic value – ZERO.

Or as JP Morgan testified before Congress in 1912:

Gold is money – Everything else is credit.

A bank credit balance in your bank account is just a promise by the bank to pay.

The money you deposited in the bank is not your money.

The only right you have is a claim on the bank. You are just a general creditor of the bank.

However, the bank has leveraged your deposit 10x or more. So, for your deposit to be repaid, all debtors of that bank (clients who have borrowed money) must repay their loans.

The banking system is like a Ponzi scheme. It depends on a never-ending stream of new deposits or printed money.

With derivatives and other synthetic instruments, the real leverage of some banks can be 30x or more.

Yes, the government can save the depositors of a few small banks, but there after only massive money printing can save them, leading to a total debasement of the currency once again.

You take insurance for the potential of your house burning down.

When you insure your house, you don’t expect it to burn down, but if it does, fire insurance becomes critical.

The same goes for your money. You don’t expect the financial system to collapse, but if it does, you will lose all your money, whether it is deposits or securities that are held in custody in the system.

Yes, securities held in custody by a financial institution should, in theory, be yours. However, as we saw in 2008, banks used customer assets as security for their trading positions.

The other danger with securities is that a big percentage is actually not in financial assets such as stocks or bonds, but instead in synthetic securities or derivatives with no underlying real investment.

GOLD BANK

Back in 2002, I created my own gold bank. That was the same year that in my father of the bride speech, I told all of the guests to buy physical gold. Gold was then only $300.

As global debt has grown more than 3x since 2002 to $350 trillion, risk has grown exponentially, including the explosion in derivatives.

The best way to protect your financial assets is to create your own gold bank.

It is incredibly simple.

You acquire gold for the percentage of your financial assets that you find appropriate.

Our clients hold up to 25% of their financial assets in physical gold and silver. Many of us have a much higher percentage.

The metals should be stored in a professionally managed ultra-secure vault in a safe jurisdiction. Preferably outside your country of residence, enabling you to “flee” to your gold in an emergency. Personally, I prefer Switzerland and Singapore.

This also makes it more difficult for your government to seize your gold like the US did in 1933.

Then, whenever you need liquidity, the vaulting company (like VON GREYERZ) that organises the storage for you will also provide liquidity. We also ship clients’ gold from anywhere in the world to our vaults in Switzerland or Singapore.

Remember that gold is instantly liquid, so you can have the funds transferred to your bank account within a few days.

It is advisable to keep at least three months’ spending in your bank account plus a small reserve. If you have no other income, you can sell sufficient gold every three months.

Gold and silver then become your reserve asset.

More importantly, gold is no one else’s liability.

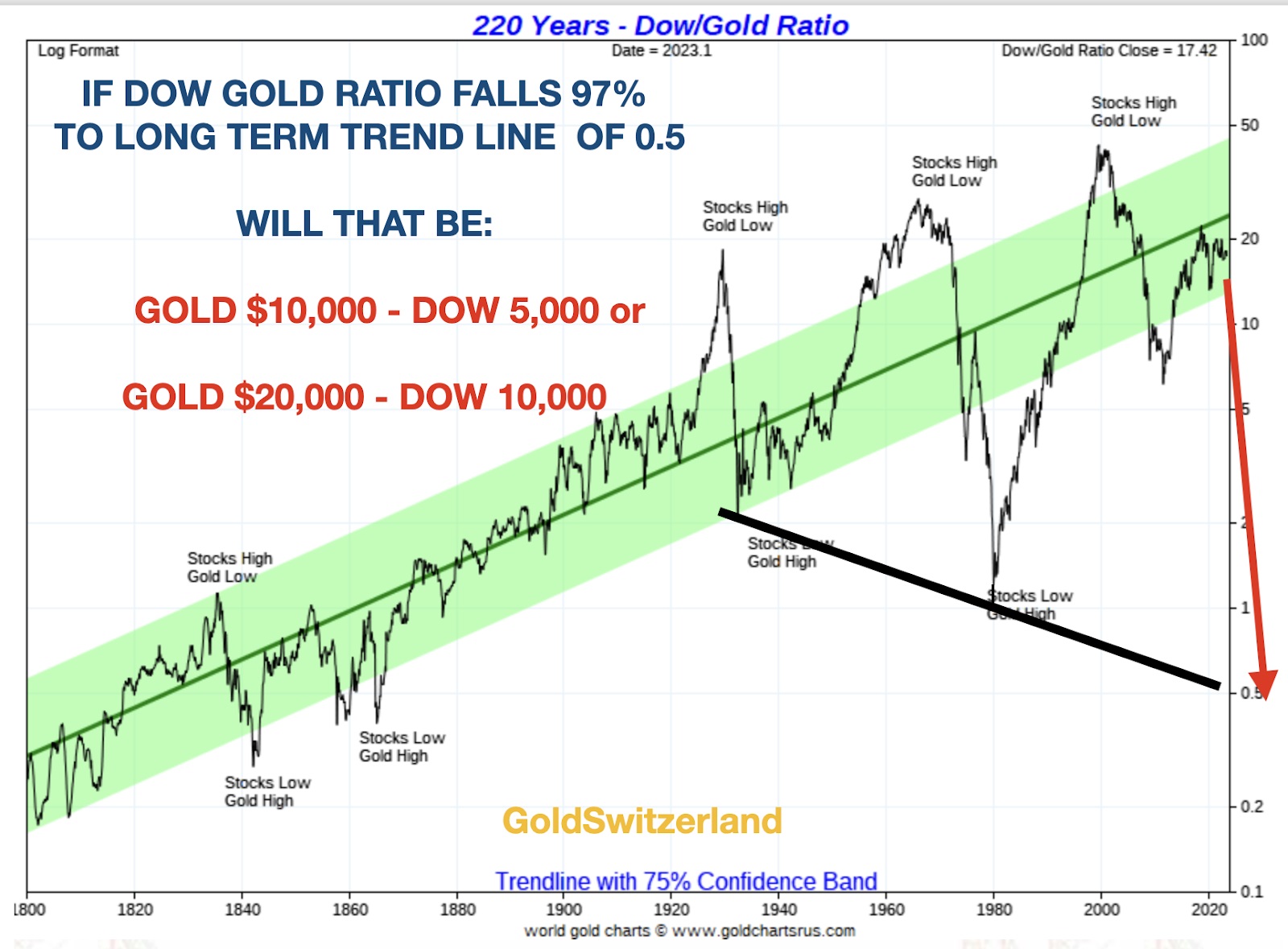

Just to remind investors that since the year 2000, gold is up 8x or 700%.

More importantly, gold has outperformed all major asset classes in this century.

The compound annual return for gold since 2000 is 9.6%, and for the S&P with dividends reinvested, it is 7.5%.

With the bubble in stocks bound to burst at some point, whether it is soon or in the next few years, I wouldn’t be surprised to see the Dow vs Gold ratio decline by 75-95%.

Stocks can never be a reserve asset or insurance for preserving wealth.

Only physical gold fulfils that role.

Gold is nature’s money

Gold is real wealth

Gold is wealth preservation

Courtesy of VonGreyerz.Gold

********

Egon von Greyerz – Founder and Managing Partner of Matterhorn Asset Management (MAM) and

Egon von Greyerz – Founder and Managing Partner of Matterhorn Asset Management (MAM) and