Bank Of America Is Bullish On Uranium, Aluminum, Nickel, Silver And Gold For 2022

Strengths

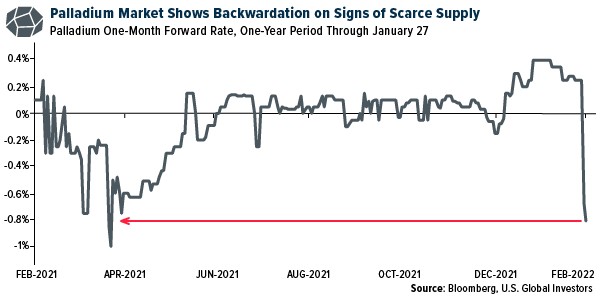

- The best performing precious metal for the week was palladium, up 12.68%. Palladium soared to the highest in four months, writes Bloomberg, with traders looking to secure supplies amid growing tensions over Ukraine as Russia, the top metal producer, amassed troops near the border. The metal that is mostly used in catalytic converters rose as much 8.3% on Wednesday, extending this year’s rally to almost 25%. Looking at the over-the-counter market, Bloomberg notes that the metal has sunk into backwardation, which is a market structure in which spot prices are higher than those for forwards. This signals tightening availability.

- Gold imports by India accelerated to the highest level in a decade last year as jewelry sales almost doubled, with the demand outlook remaining bright, according to the World Gold Council. Demand revived after two bleak years as Indians once again flocked to jewelry stores in 2021 as fears of the pandemic eased. Weddings and celebrations picked up in full swing in the three months through December, more than doubling full-year imports to about 925 tons, the highest since 2011, according to the council data.

- Endeavour Mining provided formal 2022 production guidance of 1,450,000 ounces, ahead of 1,410,000-ounce consensus. Fourth-quarter production was 398,000 ounces, a beat versus the 370,000-ounce consensus. Full-year 2021 production was 1,536,000 ounces, above the top end of guidance (1,495,000 ounces).

Weaknesses

- The worst performing precious metal for the week was silver, down 7.51%, falling at a more volatile factor of three times the price drop of gold. Gold extended losses, after falling the most in two months, as a more hawkish-than-expected U.S. Federal Reserve underscored the central bank’s aggressive approach to tackling inflation. A stronger U.S. dollar on Thursday pressured bullion, which plunged 1.5% Wednesday, as Fed Chair Jerome Powell did not rule out raising interest rates at every meeting to rein in the fastest inflation in a generation.

- West African Resources took a +20% hit to its share price as a new military coup emerged in Burkin Fasso Western Africa. Their Sanbrado Gold Mine is reported to be operating without interruption. Notably, this is the sixth coup in Africa in the past 18 months, of which four were in West Africa.

- Gatos Silver lost more than 70% of its share price this week after the company concluded that there were errors in its technical report from July 2020, as well as “indications that there is an overestimation in the existing resource model.” On a preliminary basis, the company estimates a potential reduction of the metal content of Cerro Los Gatos’s mineral reserve ranging from 30% to 50% of the metal content remaining after depletion, it said in a statement.

Opportunities

- Bank of America is bullish on uranium, aluminum, nickel, silver, and gold for 2022. Cost inflation for the miners in 2022 is real. However, Bank of America finds those with volume growth tend to be shielded from cost inflation, in that per-unit costs are expected to decline despite higher absolute costs, thus protecting margins. Free cash flow (FCF) for the group’s coverage is forecast to rise 69% to $12.3 billion in 2022.

- Despite the negative price action around gold this week, Goldman Sachs Group raised its 12-month price target for the yellow metal on expectations of slower growth, a rebound in emerging markets, and higher inflation. The group’s expectations are now $2,150 an ounce versus $2,000. Contrary to conventional opinion, gold prices tend to go up when the Fed is raising interest rates.

- With much of the retail money allocated to gold stocks held by passive ETFs, capital is not getting allocated efficiently in the gold sector. New cash allocations are just proportionally allocated to the same names. This is creating a field day for the royalty companies to currently be the sole providers of risk capital to structure royalties and or streams with companies that need cash now. Some recent deals even involve placing a royalty and stream on the same asset. If gold continues to move higher over the year with rising rates and passive money moves over to actively managed mutual funds, a significant amount of value could be unlocked.

Threats

- Fresnillo shares fell as much as 15%, the most since November 2020, as the company cut its silver production forecast for the full year. “This negative outlook has been caused by ongoing operational challenges with staff availability as well as new geotechnical constraints at Saucito,” writes Panmure Gordon analyst Kieron Hodgson.

- The end of an easy-money era should normally spell bad news for gold, explains Bloomberg. But right now, fund managers are keeping their holdings. At a time when equities and Bitcoin -- often touted as digital gold -- are sinking as loose monetary policy draws to a close, bullion exchange-traded fund holdings are proving resilient. Despite expectations for multiple U.S. interest-rate hikes this year, bets for real rates to stay negative and demand for an inflation hedge are supporting the appeal of the time-honored haven, the article continues.

- Illegal artisanal gold mining in the Madre de Dios region of Peru has surged in recent years leaving behind toxic levels of mercury in the Peruvian Amazon. The mercury is used to absorb the gold from the ores. Unfortunately, the gold is then separated from the mercury by evaporating the later away over a fire, spreading the mercury out over the immediate environment. In 2016, the Peruvian government declared a health emergency when 40% of the people tested in the region across 97 villages showed dangerous levels of mercury in their systems.

*********

Frank Holmes is the CEO and Chief Investment Officer of

Frank Holmes is the CEO and Chief Investment Officer of