Bitcoin Myths

“Money is a matter of functions four: a medium, a measure, a standard, a store.”

Most of the talk was structured around discussing these functions. Medium is pretty obvious: the dollar is the universal medium of exchange. It is basically frictionless, trading at zero spread (with perhaps a fee to wire dollars internationally). Bitcoin claims to be a medium, but it’s slow, can be expensive due to limitations of the blockchain. And as later confirmed by bitcoin proponents, bitcoin’s bid-ask spread is wide and can widen unpredictably for large orders. Like $5,000.

Even in cases where bitcoin is a medium, there is a third-party currency exchange broker who finds a fourth party who wants to buy bitcoin. The merchant gets the dollars he really wants, the customer pays in bitcoin, and the fourth party buys the bitcoin and provides dollars to the merchant. All for a fee charged by the broker.

Store is also pretty straightforward. The dollar’s managers issue an Orwellian statement, states that objective #2 is:

“stable prices for the goods and services we all purchase”

That would be all well and good (though impossible to achieve, and not sound money), but below that on the same page, the Fed asserts:

“…inflation at the rate of 2 percent … is most consistent over the longer run with the Federal Reserve's statutory mandate.”

Got that? Chronic monetary debasement (the Fed believes that the value of the dollar is 1/prices) is stable prices! Orwell would be glowering if he could see this, 1984 was not supposed to be a how-to manual.

So the dollar is not a store of value. And bitcoin is not a store, even in the first phase of its cycle, the skyrocket. And, wow, did it have that phase on Friday! Bitcoin was up more than $2,500.

Measure is trickier for many people to grasp. Keith suggested to the audience to imagine if they formed a business in 2009, when bitcoin was $1. The business was capitalized with BTC 1,000,000, and keeps its balance sheet in bitcoin. The value of the business plunged from BTC1,000,000 to BTC50 from 2009 to 2017.

What explains this epic collapse? Is it just an epic business failure? Well, assuming the business is going along at an even keel, the explanation is simple but counterintuitive. Bitcoin went up. It went up 20,000 fold.

A visual might help. Picture a millimeter. It is about the thickness of a credit card (not quite, but to keep the picture simple, let’s go with that). What if a millimeter could grow 20,000 times longer? A house could then be said to be one millimeter long. And that credit card? It is now 1/20,000mm thick.

Of course, the credit card does not get thinner. And it is preposterous that a unit of length would grow. We only accept such change for a unit of economic value, not for a unit of length. Most people tolerate that the dollar is supposed to shrink by 2% per year, and some even tout the benefits of this.

Neither the dollar nor bitcoin are good measures of economic value. The dollar works for short periods of time, but over decades it gives distorted measurements. If you get a 5% raise this year, you can be sure you are doing OK. It’s just when you make an investment in a long-term project, such as a power plant, that you cannot tell if you are creating or destroying capital. Which is the existential question for any enterprise—and for civilization itself. No society can survive if it renders it impossible to tell creation from destruction.

Later in the program, a 20-something bitcoin enthusiast went on stage and made some extraordinary claims. Keith had a chance on a panel Q&A to partially respond to them (and the audience responded with spontaneous applause). But let’s look at two of them in more detail here.

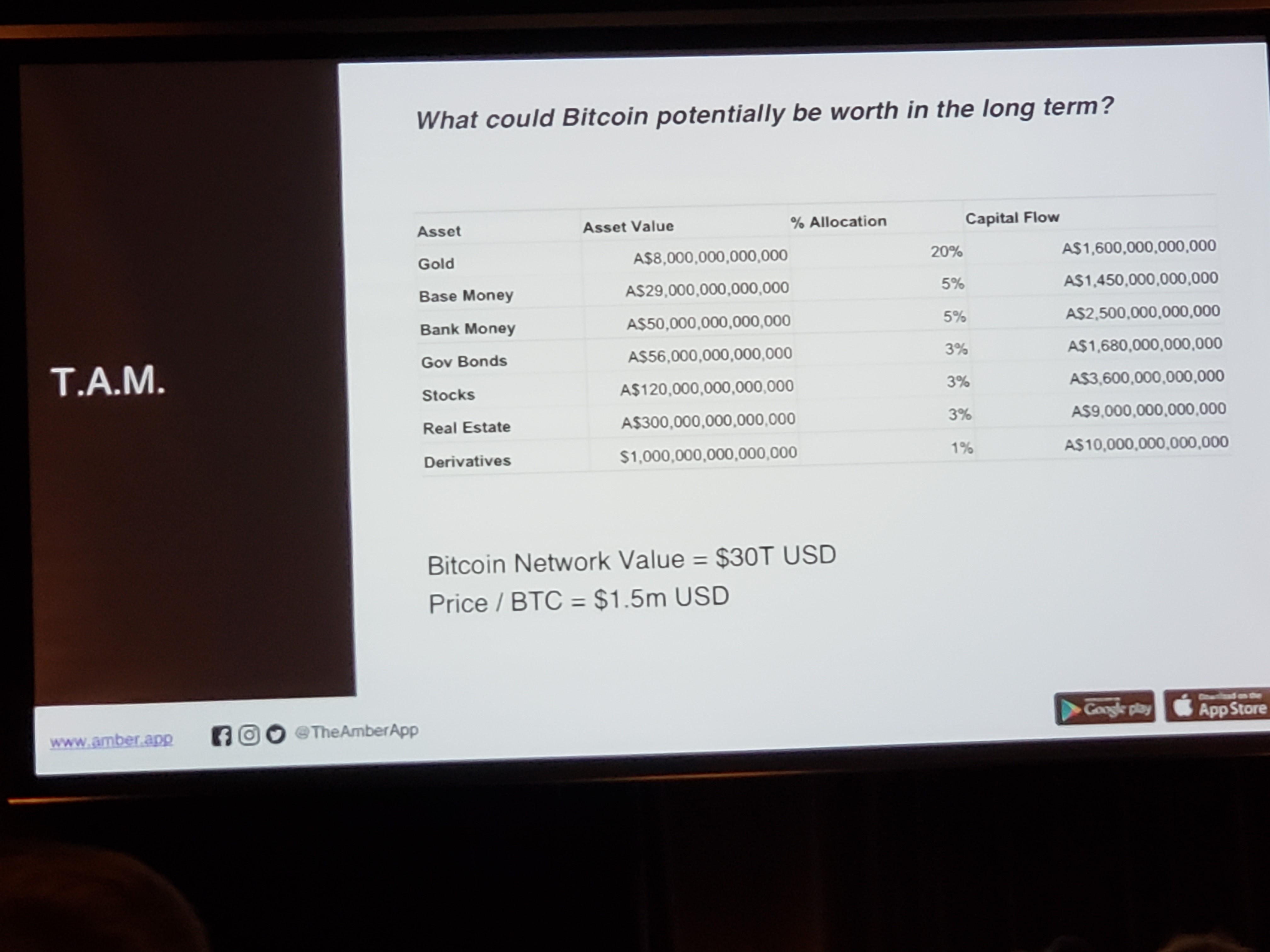

One is that bitcoin could replace all assets extant: base money, bank money, bonds, stocks, etc. Here is his slide, which Keith took a picture of.

The multicolored inverted tetrahedron is known as Exter’s Pyramid. It is a ranking of asset classes, with gold at the bottom representing the smallest and safest and going up from there.

This speaker tried to convince the audience that bitcoin could displace these other assets, and hence the market cap of bitcoin could grow to tens or hundreds of trillions. Therefore, he wanted the audience to imagine the value of one bitcoin to be $1,500,000 or more.

Can people really stop buying businesses (forget real estate) and just go all-in to a crypto coin? We write about the pathology of replacing investing with speculating. The source of your profit in investing is the new production enabled by your investment. The source of your profit in speculating is the next speculator’s wealth (Keith covered this briefly in his talk).

In a few slides and a few minutes this speaker was touting the absurdity of going all the way. He imagined it was a stairway up to Heaven, but it’s really the road down to Hell. Just think of buying bitcoin at $10,000 and selling it at $1,500,000! Heady stuff, provided that everyone else is still investing and working to produce all the cars, and jets, and champagne that a new bitcoin billionaire wants to consume. But if they’re all doing that, then they can’t be bidding up bitcoin as he wants you to imagine.

He said that gold’s monetary premium will collapse to zero, as the quantity is increased by more mining such as on asteroids. This is an appeal to the debunked Quantity Theory of Money. That the value of a currency unit is 1/N. On the panel, Keith had a chance to ask a pointed question. Which currency has by far the most units in circulation? It ought to be—by this theory—the least valuable currency, by far. It’s actually the most marketable, most universally recognized, most widely used, and most widely held.

It is interesting that bitcoin always seeks to compare itself to gold. Bitcoin is mined, has scarcity, and trust, etc.

Meanwhile, the dollar is still entrenched. Here is a picture of the back of the landing card that all passengers who fly to Thailand must fill in.

Not yuan, even in Asia. Not euro. Not pound or franc. Not even Thai baht. Definitely not bitcoin (who would even know or recalculate his income in something so volatile—after Friday, everyone’s income dropped over 25% as measured in btc).

To the list of the four functions, we add one more. Extinguisher of debt. The dollar, being a debt instrument itself, cannot extinguish a debt. Only shift it. Bitcoin being that it is going up—according to all of its proponents—means that it is not suitable for borrowing. If that fictional business had borrowed BTC1,000,000 in 2009 it would long since have declared bankruptcy. No one can survive a 20,000 fold increase in his debt and monthly payment.

Gold is the extinguisher of debt (and silver). Which is why it is so important that borrowing begins to shift back to gold. Once, not too long ago by a historical perspective, bonds were gold bonds. They will be again, if Monetary Metals succeeds in our project.

Supply and Demand

The prices of gold and silver were up $19 and $0.48 respectively. But that’s not where the massive inpouring of groceries went.

When Friday began (Arizona time), bitcoin’s purchasing power was under 75 groceries (assuming a grocery unit is $100). By evening, speculators added 25 more groceries to the same unit of bitcoin. Think of it this way, if you forked over 75 groceries worth of farmland to buy a bitcoin Thursday night, the next speculator would fork over 100 groceries worth of tractors to buy it off you on Friday night. You could buy back your farm land, and consume a quarter of his tractor.

Viewed this way, bitcoin is not the anti-dollar. It’s just another chip in the dollar casino, which people can speculate on to increase their purchasing power. And by that, we mean give up their capital in the hopes that someone else will give up even more of theirs. Because, that’s what acute yield deprivation makes people do.

Congratulations to anyone who caught this wave. We do not blame the speculators, we blame the Fed for forcing us to play this game.

Read on for a look at that the only true picture of the supply and demand fundamentals of gold and silver. But, first, here is the chart of the prices of gold and silver.

Next, this is a graph of the gold price measured in silver, otherwise known as the gold to silver ratio (see here for an explanation of bid and offer prices for the ratio). The ratio dropped this week.

Here is the gold graph showing gold basis, cobasis and the price of the dollar in terms of gold price.

The cobasis increased again, slightly, while the price was up.

The Monetary Metals Gold Fundamental Price, was up another $28 this week, to $1,511.

Now let’s look at silver.

In silver, the December cobasis rose slightly, though not the silver basis continuous.

Despite the rise in market price, the Monetary Metals Silver Fundamental Price fell 8 more cents to $16.87.

© 2019 Monetary Metals

*********

Dr. Keith Weiner is the CEO of Monetary Metals and the president of the

Dr. Keith Weiner is the CEO of Monetary Metals and the president of the