Buy Gold To Ride Over The ‘Global Reset’

The world is moving towards a “cashless society”. Sweden, which was the first nation in Europe to issue paper money in 1661, is presently moving towards becoming the first cashless society. Do you ever wonder why the current Central Banks, all over the world, want to now alter the system which has been effective for centuries? It is probably best explained by ex-congressman Ron Paul, who stated; “The cashless society is the IRS’s dream: total knowledge of, and control over, the finances of every single American.”

The definition of “Freedom” will need to be redefined in the future:

There have been numerous instances of the government “spying” on individual citizen’s privacy while using different excuses in order to justify their behavior. Although the larger companies are attempting to ward off inquiries by the government, it is only a matter of time before a law will be enacted and companies will be forced to part with all of your private financial data. There will no longer be anything private about yourself; the purchases you make, the places you frequent, the people you have contact with, even the foods you purchase, will soon be easily tracked and monitored within a “cashless society”.

Large amount of data theft occurring:

Before the government enacts any policy, we should first analyze whether we, as private citizens, are ready for the change. A large amount of personal and financial data breaches in 2015, makes one shudder at the thought of living in a “cashless society”. The breach at the U.S. Government’s Office of Personnel Management, is the most reigning of them all. When the government, which wants us to enter into a “cashless society”, is unable to keep the employee’s data safe, how can it possibly keep national data safe and protected?

Your personal finances are at the mercy of the “Government and Hackers”

Hackers are after your money and after your personal data and what is most frightening is the fact that neither the large institutions nor the government can/will rescue you from these data breaches. If our society moves into a “cashless one”, you may be left with nothing if your account is hacked.

Software and hardware issues:

How many times have you logged into your computer to make a payment, only to discover that you are unable to access your banking website? These are issues we face on a regular basis. Visualize you are in an emergency and the software system fails and consequently, there is nothing you can do until the system recovers. The proponents of digital currencies will say that the percentages of this occurring are low, but when you consider that a few hundred million people will be unable to access their own money going cashless, even 1% is a large enough amount to create panic and pandemonium!

Most of the world’s currencies’ are flawed:

The famous investor, Jim Rogers, calls the U.S. Dollar “a seriously flawed currency”. The U.S. dollar has lost approximately 98% of its value in dollar terms within the last 100 years. Although many experts will offer arguments as to why the chart below is not the correct metrics, you can judge for yourself.

With the massive amounts of QE that has been created, globally, our current financial system is on the verge of collapsing!

Did you think that crypt-currencies are safer and better?

Let’s view Bitcoin as an example. If you like an adrenaline rush, it’s better to go and sit in a roller coaster rather than using this crypt-currencies and lose all of your hard-earned money. Even if you have the desire to digest this ride, the Mt Gox scandal should deter you from even looking at crypt-currencies, bitcoins, as an investment asset.

Mt Gox was the largest bitcoin exchange, which was handling 70% of all transactions in 2013. 774,000 bitcoins (equal to $409,000,000) were reported missing and the exchange sought bankruptcy. Only 200,000 bitcoins have been found since then. This clearly shows that the crypt-currencies are not as safe as advertised and will likely not survive for long. Gold is what will keep us free from government manipulations.

Gold is the only savior during the Global Financial Reset:

Gold has remained as a form of currency for centuries. Whenever the countries followed a strict gold standard and used gold as a currency, inflation, and the economy were stable. But the governments always went out of their means with their spending and had to leave the gold standards to fund their ineffencies. Though gold is out of favor now, it’s the only asset class which will hold value during the next crisis financial. The famous hedge fund manager Stanley Druckenmiller has a large investment in Gold. So should you buy gold now?

Conclusion:

For individual traders and investors, it’s best to time the market to earn the maximum profit. Back on Fabruary 2009 I co-authored a book where we talked about an iminant stock market bottom and that gold, silver and oil were headed drastically higher. The following month the stock market bottomed and both precious metals and crude oil confirmed they has started a new bull market.

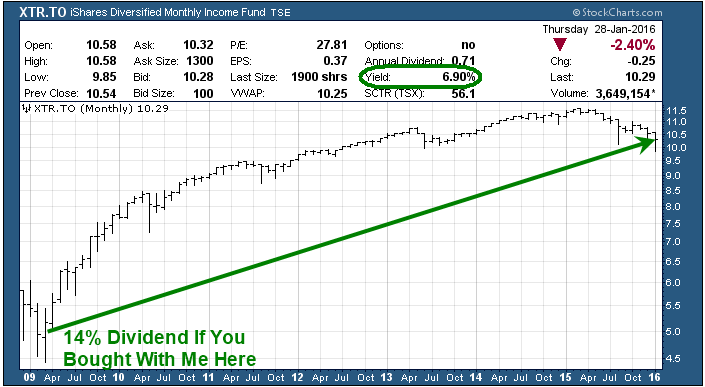

At that time I recommended fellow Canadians to buy the diversified income fund XTR listed on the TSX exchange. At that time it was paying a hefty 14% dividend and the fund itself has been in a strong uptrend making new all time highs until last year up over 100% on the fund price alone, not including the 14% dividend return per year. What that said the fund has changed the way its run. This time around Canadian’s and myself may play a coupld differents for the next bull market when the time comes.

Right now, its time to abandon stocks and move to cash and bonds. When the time is right gold, silver and gold miners will be an incredible play but that time is not yet. In fact, the stock market is topping and there are some huge opportunities to make money with a couple special ETFs which im going to share with my followers in the coming week. I do talk about this on the home page of my website.

Market timing is not an easy task for a newcomer, keep watching articles from us, we will update you when the is right to invest in Gold and protect you during the next “Global Reset” which is slowing infolding.

Watch My Video About What Is About To Happen Next: www.TheGoldAndOilGuy.com

Chris Vermeulen

********