Can Gold Extend Its Rally?

While it hasn’t affected gold significantly, the price of oil has fallen quite dramatically over the past couple of months, and that’s bad news for oil companies. Profit margins are shrinking and layoffs could be coming, if the situation doesn’t improve.

While it hasn’t affected gold significantly, the price of oil has fallen quite dramatically over the past couple of months, and that’s bad news for oil companies. Profit margins are shrinking and layoffs could be coming, if the situation doesn’t improve.

If oil continues to decline, the shale oil producers could get into serious trouble, and that could send America back into recession.

Mainstream media promotes the idea that lower oil prices are good for consumers, but most consumers are deeply in debt, and it’s questionable whether lower oil prices are going to lead to any increase in consumer spending.

All investor eyes should be focused on the upcoming OPEC meeting in Austria. It takes place on Thursday, which is Thanksgiving Day for Americans.

That’s an oil options chart from Goldman Sachs. It suggests that the price of oil will move up or down by about $3.60 a barrel, as the OPEC production decision is announced.

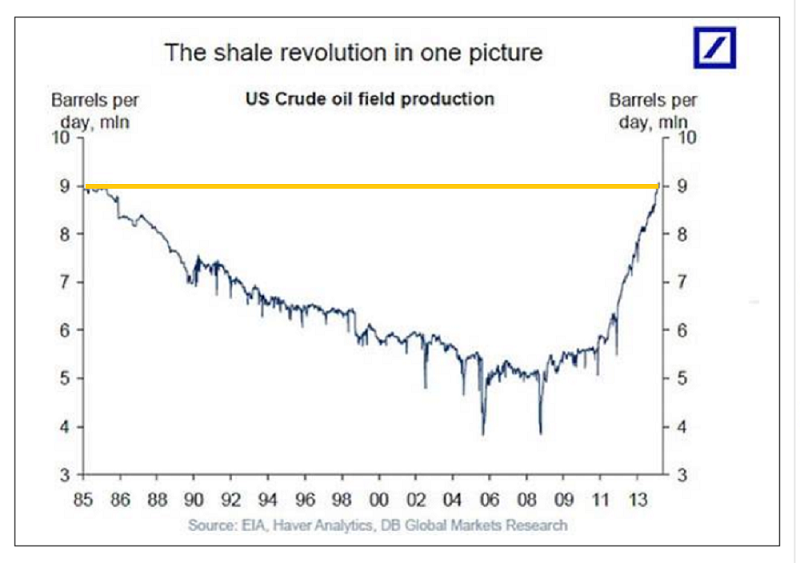

This chart shows US oil production reaching nine million barrels a day.

High prices are needed to keep that production growth in a rising trend.

Even if OPEC were to announce a major cut in production, that would only create a further rise in US oil production, putting renewed pressure on OPEC to cut production again.

It’s a self-defeating exercise for OPEC to keep cutting production, while America increases production. Thus, I expect only token action to be taken by OPEC this week.

How would a failure by OPEC to cut production affect the price of gold?

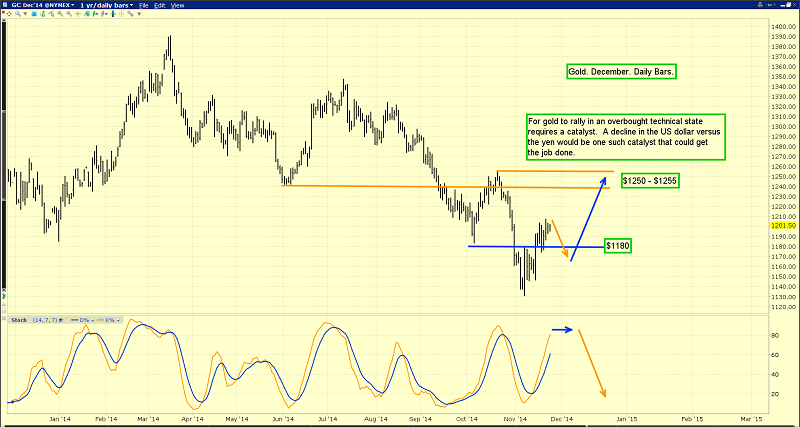

That’s the daily gold chart. Note the position of the 14,7,7 Stochastics oscillator. The lead line is near 80, suggesting the gold rally from the $1130 area lows is “long in the tooth”.

If OPEC disappoints commodity bulls, I think gold could decline, but only modestly, to the $1170 - $1180 area, and it might do so in anticipation of the OPEC decision.

For any market to continue to rally in a technically overbought situation like gold is entering into now, it needs a catalyst to do so. Is there such a catalyst on the horizon?

That’s the daily chart of the US dollar versus the Japanese yen. There’s a 14,7,7 Stochastics sell signal in play, and the dollar has definitely lost upside momentum over the past week.

In the big picture, gold has performed admirably, while both the yen and oil have collapsed.

If the yen can begin to rally, gold could gallop higher, to the $1250 - $1255 area, even while being technically overbought.

It’s important for Western investors not to get overly-obsessed with the fear trade for gold, and ignore the love trade.

The city of Dubai has long been recognized as the “city of gold”, and rightfully so. Five hundred jewellers are now in forces to build the world’s longest piece of gold jewellery, to promote the industry.

The love trade (gold jewellery) has always been the biggest and most consistent driver of the gold price. I don’t expect that to change, regardless of what happens in America.

The good news is that jewellers in China, India, and Dubai are in expansion mode, and it’s clear that Western mining stock shareholders stand to reap substantial reward from the relentless growth in gold jewellery demand.

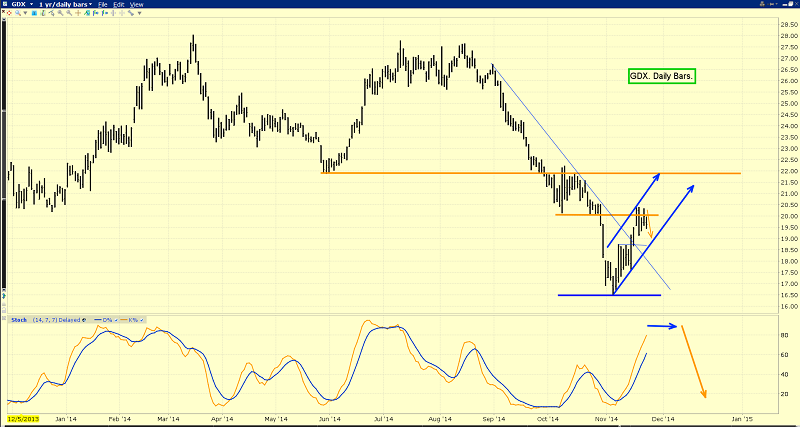

That’s the daily chart for GDX. It’s performing “according to plan”. There’s clear sell-side HSR (horizontal support and resistance) in play in the $20 area, and the rally has stopped there.

Simply put, the traffic light has turned red, and the gold stocks sports car has stopped. After a brief rest, I expect higher prices. There’s nothing I see here that is fundamentally negative for gold stocks. Nothing.

Gold stocks are well supported by the enormous expansion in the global gold jewellery business, and so is silver.

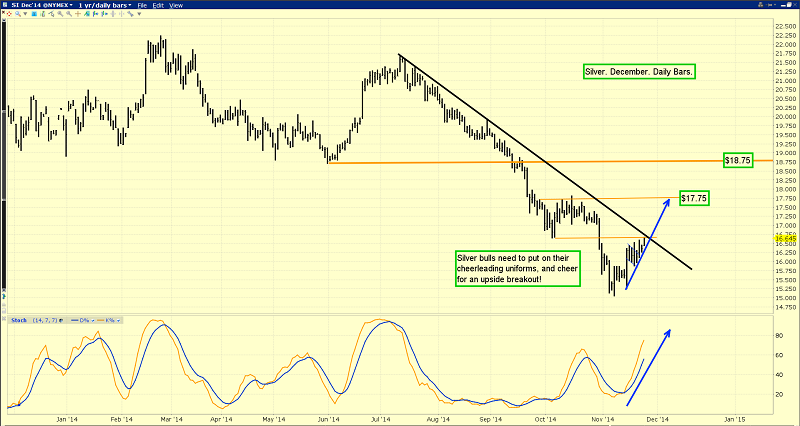

Silver tends to substantially outperform gold in the later stages of a rally, regardless of whether that rally is short term or long term. A move above the black downtrend line should attract lots of hedge fund buying, and extend the rally. A two day close above $16.75, should get that job done!

********

Special Offer For Gold-Eagle Readers. Please send me an Email to [email protected] and I’ll send you my free “Newcrest Leads The Seniors!” report. I’ll show my buy and sell plan for four senior miners, and include some startling Elliott Wave analysis for Newcrest!

Note: We are privacy oriented. We accept cheques. And credit cards thru PayPal only on our website. For your protection. We don’t see your credit card information. Only PayPal does. They pay us. Minus their fee. PayPal is a highly reputable company. Owned by Ebay. With about 160 million accounts worldwide.

Email: [email protected]

Rate Sheet (us funds):

Lifetime: $799

2yr: $269 (over 500 issues)

1yr: $169 (over 250 issues)

6 mths: $99 (over 125 issues)

To pay by cheque, make cheque payable to “Stewart Thomson”

Mail to:

Stewart Thomson / 1276 Lakeview Drive / Oakville, Ontario L6H 2M8 Canada

Stewart Thomson is a retired Merrill Lynch broker. Stewart writes the Graceland Updates daily between 4am-7am. They are sent out around 8am-9am. The newsletter is attractively priced and the format is a unique numbered point form. Giving clarity of each point and saving valuable reading time.

Risks, Disclaimers, Legal

Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualified investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is: 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line:

Are You Prepared?

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website:

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website: