Contrarian Investors – Go For The Gold!

Strengths

- China devalued the yuan by the most in two decades as policymakers stepped up efforts to introduce more market-based reforms. China’s exporters have been hurt by keeping the yuan pegged to the dollar. The new policy spooked markets, prompting fears of a currency war with their Asian rivals. Gold, in response, climbed to a three-week high.

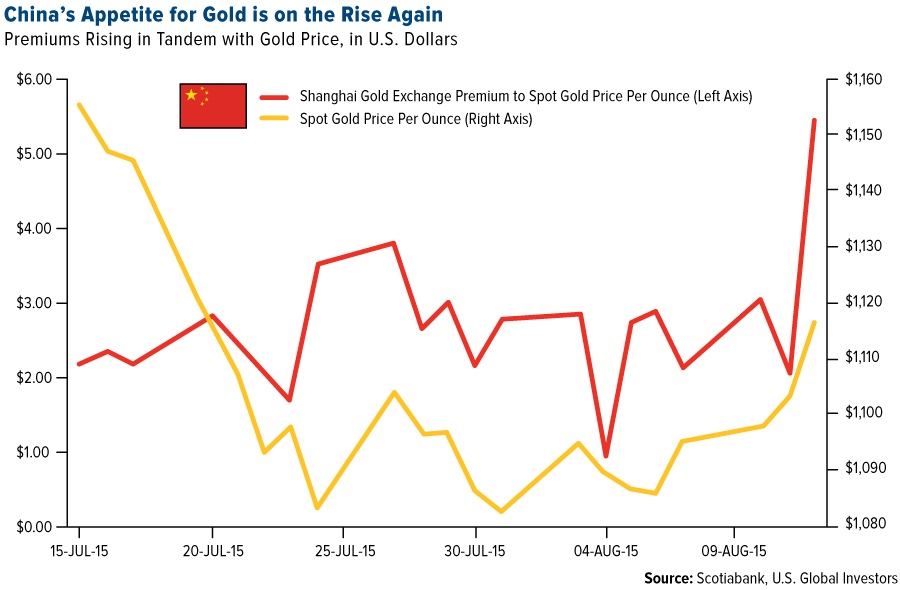

- Gold withdrawals from the Shanghai Gold Exchange this year so far have totaled a massive 1,464 tons, which is running around 116 tons ahead of the record 2013 year at the same time and 370 tons ahead of the 2014 figure. If the average monthly withdrawal level for the current year keeps up we will be looking at annual withdrawal totaling more than 2,500 tons. With Chinese demand trending to be strongest in the last four months of the year this level could indeed be achieved. In the first six months of the year, gold production in China jumped 8 percent year-over-year, further cementing China’s dominant position in the sector. Additionally, in what could be a new trend towards more transparency as it pushes for the yuan’s inclusion in the IMF’s currency basket, China disclosed its monthly gold purchases for July. It increased its reserves by 1.1 percent, rising to 53.93 million ounces. That pace of purchases would put it at a rate of 240 tons per year, ahead of prior years’ pace of 100 tons per year.

- While gold seems to be falling out of favor amid a looming rise in U.S. interest rates, Germany’s Commerzbank has advised investors to hold on to the precious metal rather than sell it. The bank said gold has already hit a low and the expected announcement will not affect it much. Additionally, gold promises more stability than the Euro currency thanks to the loose monetary of the European Central Bank.

Weaknesses

- According to a report by the World Gold Council, demand for gold shrank to the lowest in six years last quarter as buyers in China and India, the two biggest markets, saw incomes fall as a result of a volatile stock market in China and a weak harvest in India. However, central banks remained net buyers, increasing purchases by 11 percent from the previous quarter. That’s their eighteenth consecutive quarter of purchases and the World Gold Council sees them buying 400 to 500 tons by the end of the year.

- While the finance ministry’s draft released in May would let banks set the interest rate on gold lending, it doesn’t adequately allow them to hedge their exposure, according to the managing director of MMTC-PAMP India Pvt. That’s because banks will have to hold onto small deposits of as little as 30 grams and pay interest to customers until they accumulate a large enough amount to pass onto jewelers.

- Piling on the bearish sentiment for gold, UBS cut its one-month gold forecast by 13 percent to $1,050/oz, with the key driver being the possible interest rise in the U.S. Further, according to analysts at Oversea-Chinese Banking Corp., Itau Unibanco and Barclays, the recent rally in gold will crumble as investors move past the yuan drop and focus on the Federal Reserve’s plan for raising interest rates.

Opportunities

- Underscoring the risk of competitive devaluations stemming from China’s currency devaluation move, traders are now pricing in about a 40 percent chance the Fed will raise interest rates at its September meeting. That’s down from 54 percent on August 7. Over the last month, liquidations from gold ETFs have surged. However, the news from China did trigger net purchases in the past week.

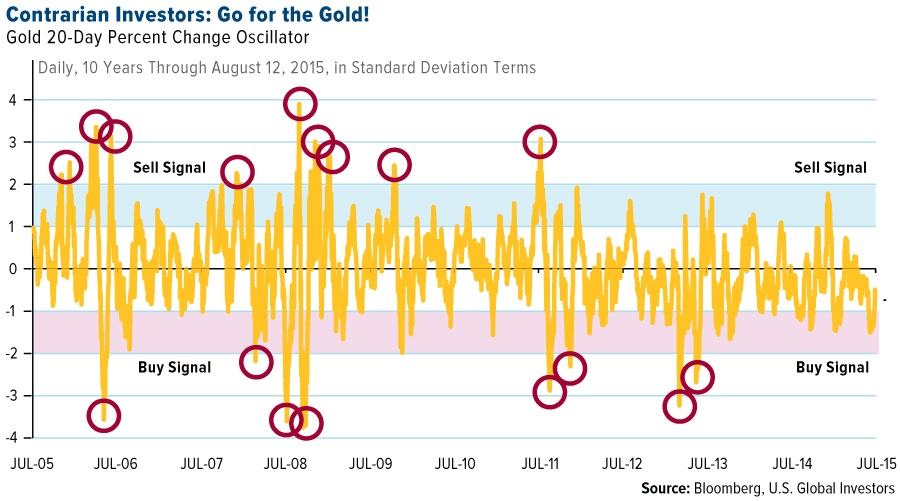

- Gold speculators and futures traders added to their bullish gold positions last week following five weeks of declines. As shown in the price oscillator chart below, gold was significantly oversold. Ironically, for all the negativity that some brokers prognosticate on the woes of owning gold, it was reported on August 6 that both Goldman Sachs and HSBC took large gold deliveries of 3.2 tons and 3.9 tons, respectively. In both cases, the purchases were registered as being for the benefit of the bank’s own house account, rather than the accounts of customers.

- According to the World Gold Council, gold consumers in India are expected to increase purchases for festivals in the second half of the year since the metal has become cheaper. In addition, we are coming into a seasonal window of price strength in gold as fall approaches.

Threats

- Goldman Sachs believes that while appreciation pressure on the dollar and the pound may delay “lift-off,” both central banks will ultimately have to accept stronger currencies given how far below neutral their policy rates are. Thus, Goldman Sachs has reiterated a call for the dollar to rise 20 percent and the British pound 12 percent in the next three years.

- The Oversea-Chinese Banking Corp. believes that when the Federal Reserve raises rates it should translate into a firmer dollar, sending gold toward $1,050/oz.

- The two biggest unions at South African gold mining companies have said that wage negotiations have broken down, bringing the industry closer to a strike.

Frank Holmes is the CEO and Chief Investment Officer of

Frank Holmes is the CEO and Chief Investment Officer of