CPI Goes Up In July. Will Inflation Dragon Take To The Air With Gold?

CPI rises again in July. But will the inflation dragon take to the air, taking gold with it?

The U.S. CPI inflation rate rose 0.6 percent in July, for the second month in a row. The move was driven to a large extent by higher energy prices (the energy index increased 5.1 percent in June as the gasoline index rose 12.3 percent). The core CPI rose also 0.6 percent, following a 0.1 percent drop in May. It was the biggest monthly increase in the core rate since 1991.

On an annual basis, the overall CPI increased 1 percent (seasonally adjusted), following 0.7 percent increase in June. Meanwhile, the core CPI rose 1.6 percent, which implies the acceleration from 1.2 percent recorded in the previous month. So, as the chart below shows, inflation remains low, but it is no longer very low.

In other words, inflation rebounded from the pandemic lows, ending the period of disinflation, as we correctly predicted last month. After the release of the June report, we wrote “inflation remains very low, but the period of disinflation have possibly ended. We mean here that although we do not expect the outbreak of high inflation in the near future, inflation rate could reach the bottom, at least for some time.”

But will inflation finally rear its ugly head? Where is the inflation we predicted? Nowhere. But we never predicted that the pandemic of Covid-19 would trigger massive inflation. What we wrote was that the coronavirus crisis could be simply more inflationary than the Great Recession, as the former was also a supply shock. And we were right, as the chart below shows.

But we were fully aware of deflationary forces operating during economic crisis, so we wrote that “in the short term disinflation pressure should prevail” and that “while in the short term the disinflation scenario seems more likely, in the longer run the risk of stagflation increases”.

And indeed, the disinflation occurred, but inflation has rebounded somewhat recently, which raises the odds of stagflationary scenario. There are a few reasons while inflation could increase later on the way. First, the economy will recover one day, which means that the demand will be back. Second, high and rising public debts increases the possibility that the central banks will monetize the government’s obligations. After all, inflation is often the best way to lower the real burden of sovereign debt. Third, both the Fed and the commercial banks have expanded the money supply as crazy, as one can see in the chart below. To be clear, I do not mean the monetary base which does not necessarily enters the circulation, but the broad measure of the money supply called the M2.

Last but not least, the American central bank is now even more dovish that during the global financial crisis I mean here two facts. The first is that the quantitative easing is now a new normal and it has an indefinite character compared to amount-limited or time-limited rounds several years ago. The second is that the FOMC members are now much more eager to accept zero interest rates for very long period and inflation rate above the Fed’s target. As Fed Chair Jerome Powell said during his July press conference, the American central bankers are not even thinking about ending the very easy monetary policy:

So as I—as I said earlier, or a while back, we’re not even thinking about—thinking about raising rates. We’re—we’re totally focused on providing the economy the support that it will need. We think that the economy will need highly accommodative monetary policy and the use of our tools for an extended period.

Implications for Gold

What does it all mean for the gold market? Well, it’s true that low inflation does not have to be detrimental for gold, as the yellow metal can shine during both inflation and deflations. And that although inflation rebounded somewhat, it is far from being elevated. Actually, it remains below the Fed’s target and pre-recession level.

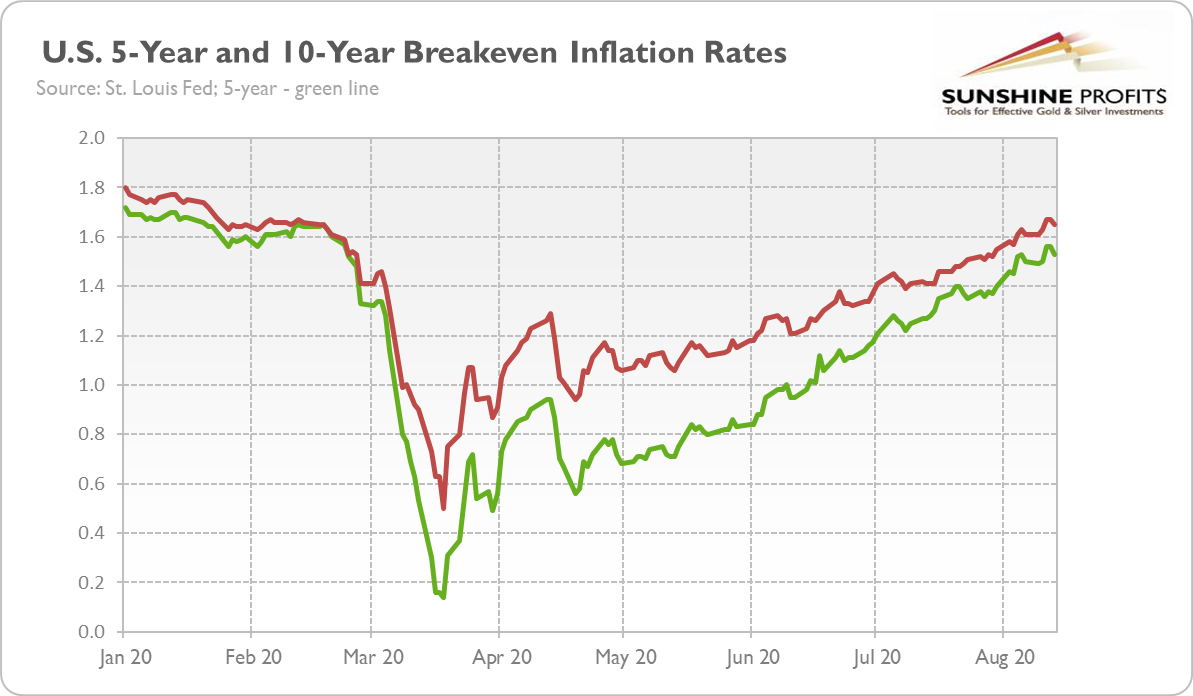

However, the two last CPI reports suggest that the inflationary bottom could be already behind us and that inflation could rise in the future. Even if it does not happen, what really counts is what Mr. Market expects. As the chart below shows, inflationary expectations have practically rebounded after the coronavirus crisis.

This indicates that investors – rightly or not – worry that mammoth injections of liquidity will translate into higher inflation one day. This is something that creates additional demand for gold as an inflation hedge, supporting its prices.

If you enjoyed today’s free gold report, we invite you to check out our premium services. We provide much more detailed fundamental analyses of the gold market in our monthly Gold Market Overview reports and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. In order to enjoy our gold analyses in their full scope, we invite you to subscribe today. If you’re not ready to subscribe yet though and are not on our gold mailing list yet, we urge you to sign up. It’s free and if you don’t like it, you can easily unsubscribe. Sign up today!

Arkadiusz Sieron, PhD

Sunshine Profits: Analysis. Care. Profits.

********