Crashing US Dollar vs. Gold & Silver Prices (Part 3)

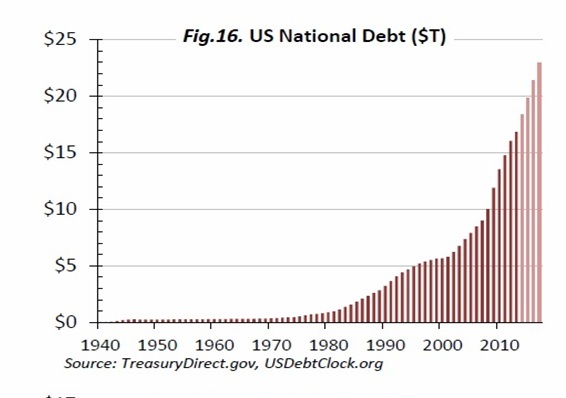

The chart of the U.S. National Debt shows marked increased acceleration from 2002 to date. In fact the yearly speed of accumulated debt has gone parabolic. Effectively, the Compound Annual Growth Rate of the nation’s indebtedness since 2002 is +10.4%. And if we assume the CAGR remains constant, then we tax-paying Americans will be drowning in $28.2 TRILLION National Debt by late 2018.

Undoubtedly, this will have a lethal impact upon the greenback’s value. Most monetary pundits know there are only three possible ways to pay down crushing debt:

- Default, or

- Dramatically increase taxes, or

- Inflate away the debt burden via yearly devaluation of the currency

Without a doubt, Default on the Debt and Increasing Taxes now are out of the question, because the Republicans in congress would not agree to either. This leaves only one viable alternative for our government to reduce the onus weight of the viral debt: A methodical monthly devaluation of the U.S. Dollar. To be sure this is well within reach of President Obama, as he is aided and abetted by the U.S. Fed. The Fed need only print more money into circulation…as it has done for some time.

But Ben Bernanke is due to leave the Fed by yearend. However, ever resilient President Obama has an inflationary replacement…enter Dr Janet Yellen, whose nomination is seen as friendly for gold. Here is an enlightening article about the new Fed chief Janet Yellen: https://www.gold-eagle.com/yellen-nomination-seen-friendly-gold-eventual-tapering-still-expected

Janet Yellen makes Helicopter Ben look like a hawk, she’s an uber-dove. A life-long Democrat, she is a dyed-in-the-wool Keynesian believing the government’s role is to spend unlimited amounts of money to stimulate the economy. Reuters described her as “an advocate for aggressive action to stimulate U.S. economic growth through low interest rates and large-scale bond purchases”.

CNBC wrote “Yellen is seen as a dove on monetary policy, favoring strategies that bring down unemployment even at the risk of driving inflation higher.” In a past speech, the Dr. Yellen said, “When the goals conflict and it comes to calling for tough trade-offs, to me, a wise and humane policy is occasionally to let inflation rise even when inflation is running above target.” Yellen is a hardcore inflationist, and having her as Fed chair virtually guarantees QE will be larger and last longer than if almost anyone else had the helm. This announcement is long-term wildly bullish for gold.

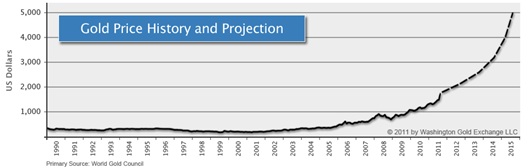

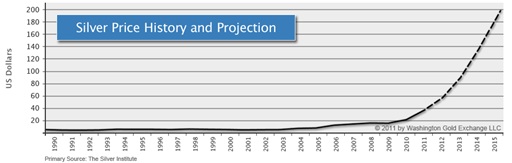

All the above will necessarily have a monumental effect on the price of gold and silver during the next 5-10 years as the USA becomes ever more insolvent. The charts below show the prices of gold and silver since 1990…and how they seem to be trending asymptotically higher in the future.

When any logical person takes into account the out-of-control spiraling National Debt, plus the incalculable costs of Obamacare, it boggles the imagination of where the price of gold and price of silver are destined to reach in the next 5 to 10 years.

Shown to the right is the ominous real-time U.S. National Debt Clock…ticking…Ticking…TICKING: http://www.usdebtclock.org

Related Articles:

Crashing U.S. Dollar…and the future price of gold (Part 1) :;

https://www.gold-eagle.com/article/crashing-us-dollar%E2%80%A6and-future-price-gold-part-1

Crashing U.S. Dollar vs Gold (Part 2)

https://www.gold-eagle.com/article/crashing-us-dollar-vs-gold-part-2