Cyclical Macro: “Slowly I Turn…” (In Favor of Gold Mining)

The transition to a post-bubble macro continues making progress.

When the bubble makers are finally banished, when their policies are shown in the light of day (and of a rebellious bond market) to have been mere macro parlor tricks played against a previously compliant (disinflationary) bond market trend…

…the bubble will be seen in hindsight by the masses, for what it was. A creation of man and woman, monetary policymaker (Fed) and fiscal (government, on both sides of the aisle).

I have written about a million words on the dynamics and macro structures that have supported the policy bubble, which in my opinion symbolically, if not yet literally, ended in 2022 with the big trend change in our Continuum indicator. More details on that are beyond the scope of this article, but are all over my writing over the last several years if you would like to search nftrh.com, including Premium reports that become public after 10 weeks.

The macro is turning, slowly… it toins (obligatory Brooklyn accent):

While stocks are finishing up the epic upside (all year our target has been “to or through the election” and at an extreme, into H1, 2025) instigated not only since 2020 under Trump and intensified under Biden since, but instigated in one form or another most intensely since 2001 as Alan the Maestro Greenspan kicked off the Age of Inflation onDemand and his offspring have concocted ever more ingenious variations of it right up until the bond market rebellion of 2022.

While stocks are finishing up the epic upside (all year our target has been “to or through the election” and at an extreme, into H1, 2025) instigated not only since 2020 under Trump and intensified under Biden since, but instigated in one form or another most intensely since 2001 as Alan the Maestro Greenspan kicked off the Age of Inflation onDemand and his offspring have concocted ever more ingenious variations of it right up until the bond market rebellion of 2022.

Gold will be the heavy anchor in the midst of these changes as the tide goes out on the masses who believe what has been, still is. Who believe that the modes of operation from 2000-2022 will be the same as 2025 forward. We are, in my opinion, in a transitional phase where outcomes will be surprising to those who do not believe fundamental changes have come. It is more important than ever now to have a “top-down” view, picking your stocks from that view than to have a “bottom-up” view, picking stocks and hoping the macro (environment) will be okay.

Gold Will be the Anchor, Gold Stocks Will Be the Leveraged “Play” in the New Macro

Why? For the simple reasons I’ve discussed all along, for years, two decades, actually. Cyclical inflationary bailouts have worked temporarily in favor of the economy during each boom cycle, enriching asset owners while systematically disenfranchising the working and lower classes and by extension, doing long-term damage to not only the economy, but society itself.

Interlude

To the surprise of many (including many wary gold bugs) gold stocks will leverage the post-bubble macro because the anchor in the stormy seas, gold, will appear to have its price marked up as the bubble beneficiaries of the last 23 years decline in relation to gold, and likely nominally as well.

The big picture monthly chart of the HUI Gold Bugs Index below has been telling the story all along. The story is a bull market that began in 2016, which has been a terribly volatile thing as the bubble makers would remain in complete control until 2022. We have all sorts of noise on shorter-term time frames and charts (the latest being a supposed confirmed H&S top in HUI), but if you quieted things down and just appreciated this chart (or one like it), as I have, you go all Old Turkey (Reminiscences Of A Stock Operator): “It’s a bull market, you know.”

With this type of volatility, holding from 2016 to today was not a good idea if you valued your sanity and your investment capital. But a bull market it was and still is.

We have put in a lot of weekly micro-management in NFTRH to arrive at the breakout point of the 4+ year corrective channel positioned correctly. We continue putting in weekly management to take the pulse of the bull and to illustrate some still buyable opportunities as well. While I have held my main preferred items for most of 2024, there are always new opportunities. There will also be opportunities for risk management, as there have been all along the way of this volatile bull.

I don’t think I am giving away nuclear secrets when I repeat the targets: 375+ next, and after that the 500 round number at resistance. It is debatable whether 500 can be reached prior to the next corrective leg. But it is certainly doable, technically, if this new breakout leg of the bull market is to end in an accelerated upside blow off. That is all left to forward management. Right now it’s time to enjoy the bull market.

Back on the Macro

Here are several important indicators to changing the macro from bubble to post-bubble, and hence, cyclical to counter-cyclical and further hence, the proper healthy backdrop for the gold mining industry, as gold would out-perform the cyclical stuff, the bubble stuff, including gold mining cost inputs like energy, materials and yes, human capital and human aspirations (it’ll be easier to find capable humans to run these oh so non-automated operations if they are not hopped up on speculations like Bitcoin or employed at the latest sexy startup.

Gold/SPX ratio on the big picture has not yet broken the macro. But who’s the bubble beneficiary and who is not? Beuller?

Dialing in, let’s take an update on gold ratios over shorter (weekly) time frames.

Gold/SPX ratio is ambling sideways as players cling to the last vestige of the bubble that was.

HUI/SPX ratio is actually constructive to have made a bottom.

Gold/ACWX sees gold trending up in relation to the balance of world markets.

Gold/Commodities have changed the macro within the “inflation trades”.

Gold/Oil ratio is fundamentally supplying a tailwind to energy intensive gold mining operations and their internal operating margins.

Gold/Copper ratio sees the counter-cyclical metal rampaging into the new macro vs. the cyclical metal.

Returning to stocks, Gold/Small Caps has been rising since 2021.

Gold/XVG ratio shows that gold has also been rising vs. the median stock since 2021.

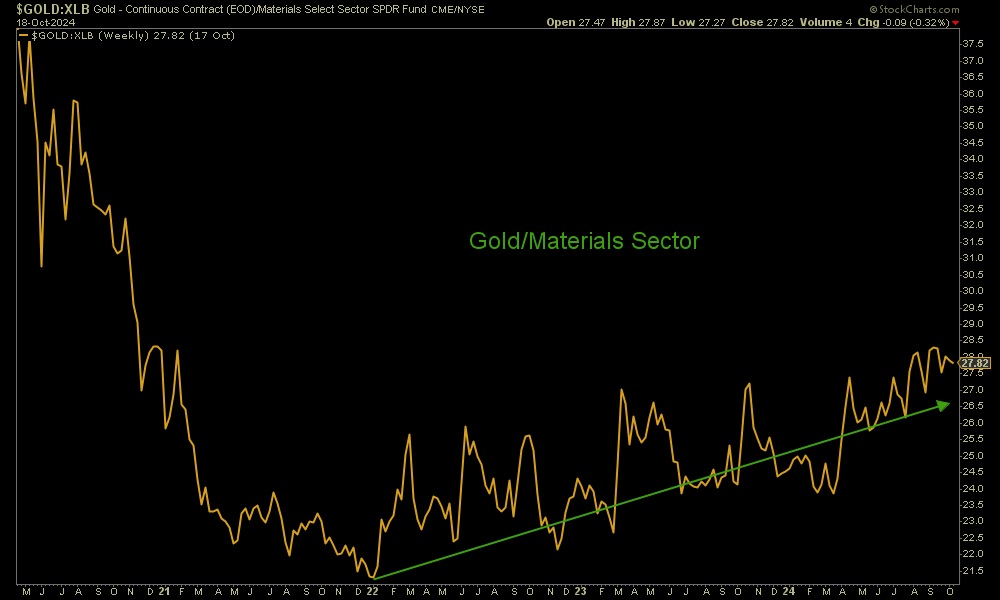

Gold/US Materials sector is trending up.

Bottom Line

Not only are gold stocks in a bull market and busting to a new phase of that bull market, their macro fundamentals are steadily progressing to the point where the macro is a majority of the way to “complete” for a constructive fundamental view of the gold mining industry. Everybody KNOWS that gold stocks suck. Well, you know what they say about what “everybody knows”…

The macro is turning, after all. It is toining counter-cyclical and a majority are going to miss its signals, which are well in play at this time. We (NFTRH) are not going to miss it. We have managed it every step of the way and will continue to do so. Consider joining this affordable service, not only for the near-term prospects, but also for the long-term changes taking effect. What worked in 2001-2022 is no longer likely to work going forward. It’s a wide open investing world now, where honest and hard work will yield results and herding and group-think… not so much.

The macro is turning, after all. It is toining counter-cyclical and a majority are going to miss its signals, which are well in play at this time. We (NFTRH) are not going to miss it. We have managed it every step of the way and will continue to do so. Consider joining this affordable service, not only for the near-term prospects, but also for the long-term changes taking effect. What worked in 2001-2022 is no longer likely to work going forward. It’s a wide open investing world now, where honest and hard work will yield results and herding and group-think… not so much.

For “best of breed” top down analysis of all major markets, subscribe to NFTRH Premium, which includes an in-depth weekly market report, detailed market updates and NFTRH+ dynamic updates and chart/trade setup ideas. You can easily subscribe by Credit Card or PayPal (see all info and options). Keep up to date with actionable public content at NFTRH.com by using the email form on the right sidebar, or take it to another (intermediate) level with our free eLetter. Follow via Twitter@NFTRHgt.

*********