The Debate Between Gold And Bitcoin Intensifies

Strengths

- The best performing precious metal for the week was platinum, up 9.59 percent on supply shortfalls and expectations that the metal will have a roll in fuel cell technologies. Platinum extended its rally to hit a four-year high of $1,048.34 an ounce. The precious metal gained nearly 14% in November, its best month since 2008 and wiping out its loss for the year. The rally is in large part due to a projected record production deficit.

- The Perth Mint reported November gold sales rose due to a significant increase in demand from international wholesale customers, particularly in Germany. Gold coin and minted bar sales totaled 84,158 ounces, the highest since April and up from 38,367 in October.

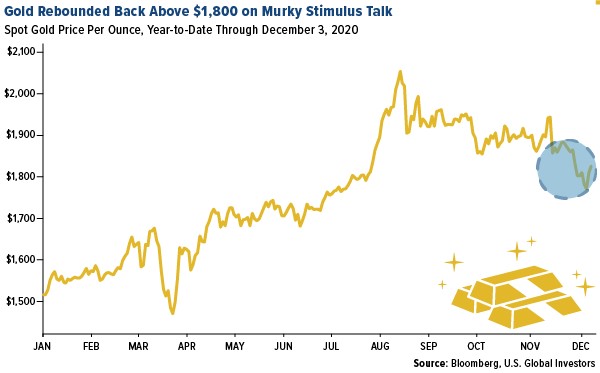

- Gold had its first weekly advance in a month after rising back above $1,800 on Tuesday and as prices steadied on Friday. Bullion rose to a one-week high on Thursday as investors weighed prospects for a vaccine and the murky outlook for U.S. stimulus negotiations, reports Bloomberg.

Weaknesses

- The worst performing precious metal for the week was palladium, down 3.13%, perhaps on some traders rotating out of palladium which seem to have lost its momentum relative to platinum. Citigroup cut its forecast for net inflows into gold ETFs to just 800 tons, 75 tons less that previously predicted, reports Bloomberg. The bank expects inflows to be 50% lower in 2020 and sees support for gold in the short term at $1,700 an ounce.

- Gold imports by India fell in November despite hopes for stronger buying during the festival of lights. Overseas purchases dropped 41% last month from a year earlier to 33.1 tons. Purchases were up from the 29 tons in October.

- The Industrial and Commercial Bank of China suspended account opening by individuals for gold and silver trading due to rising market risks and uncertainties amid precious metal price volatility. China Construction Bank did the same two days later. China is the world’s largest consumer of gold.

Opportunities

- Centamin Plc is taking steps to turn around its flagship Sukari gold mine in Egypt after years of operational setbacks. The miner said it could produce as many as 540,000 ounces a year but is scaling back and aims to mine less than 500,000 ounces a year through 2023. CEO Martin Horgan said the miner is now focusing on margin and cash flow generation, which is “more important” to shareholders. Centamin hopes to cut costs and pay $100 million in dividends in 2020 and 2021, reports Bloomberg.

- Russia’s MMC Norilsk Nickel PJSC, the world’s biggest palladium and nickel producer, plans to sell 20% of its output through a new digital trading platform to target financial investors, reports Bloomberg. According to a company presentation on its website, the miner plans to start using digital tokens in December to trade metals with industrial clients.

- Bloomberg’s Kyoungwha Kim highlights that gold’s haven credentials are “ready to shine” for investors who think equities are close to overheating. The CNN Fear & Greed Index, which tracks indicators including market breadth, options skew and relative bond performance, is near a record high. Gold could be primed to grab attention from investors eager to reduced risk exposure by capturing gains gold equities have seen so far this year.

Threats

- As bitcoin rises to new all-time highs and gold loses steam, the debate between the two assets intensifies. More and more investors are calling for bitcoin as the new haven asset to replace gold. “Gold was really the safe asset of the past world and baby boomer generation. Now it’s being replaced by automated assets like bitcoin,” said Jean-Marc Bonnefous, a former commodities hedge fund manager, in a Bloomberg interview. Gold-backed funds have dropped 93 tons of the metal since November 6, while the Grayscale Bitcoin Trust has doubled in dollar terms since the start of August.

- Gold had its biggest monthly slide in four years, down more than 5% in November. The metal has lost steam as a COVID-19 vaccine nears global approval, which is sparking hopes of an economic recovery. Bullion tends to perform well during periods of economic and geopolitical uncertainty. The question is whether investors will keep buying gold even when the economic situation improves.

- Just like gold, silver has lost love for investors. Silver ETFs had their biggest weekly outflow since 2011 in the week ended November 27. Although silver has more industrial applications than gold, it typically tracks the price of its relative, writes Bloomberg’s Eddie Spence.

*********

Frank Holmes is the CEO and Chief Investment Officer of

Frank Holmes is the CEO and Chief Investment Officer of