Energy Stocks No Bear Refuge

The lofty US stock markets have stalled out, looking more and more top-heavy with each passing day. This is spawning growing unease among prudent investors, who sense the long-overdue major selloff is nearing. Many are seeking shelter in sectors they hope will weather the storm. And energy stocks, with their lower valuations, are a leading one. Unfortunately history proves they too offer no refuge in stock bears.

The stock markets are topping, essentially grinding sideways near nominal record highs for the better part of 3 months now. The American S&P 500 benchmark stock index is now trading at incredibly high valuations between 23x to 26x trailing earnings, dangerously expensive. And after rocketing 180.5% higher over 5.2 years, this truly extraordinary bull market stocks have enjoyed is getting ominously long in the tooth.

It’s been an astounding 31 months since the end of the last 10%+ correction, fully half of this bull’s entire 62-month lifespan! Typically these essential selloffs happen about once a year or so, rebalancing sentiment to keep bulls healthy. This lack of normal corrections has naturally bred extreme complacency and greed, with bullish sentiment off the charts. All this is the perfect breeding ground for a major selloff.

Best case, it’s going to be a full-blown correction approaching 20% in the S&P 500. The bulls are sure hoping for this, as the worst-case scenario is a new cyclical bear looming. These tend to cut stock prices in half. Unfortunately the latter is far more likely given the rampant overvaluations and this huge and geriatric cyclical bull. Either way, investors are looking for safer sectors to park their capital during a selloff.

And energy stocks have been a popular one, which is readily evident in their year-to-date capital flows. While the SPY SPDR S&P 500 ETF is up 2.7% so far in 2014, this index’s energy sector has well more than doubled those gains. The XLE Energy Select Sector SPDR is up 6.7% this year, revealing a big rotation into energy stocks. XLE holds the 44 S&P 500 component stocks that are energy companies.

As a long-time energy-stock investor, I can certainly understand the allure of this sector. Oil and gas are the lifeblood of the world economy, absolutely essential. Demand for these finite resources continues to grow all over the world. And once they are consumed, they are gone forever. Despite some amazing technologies like hydraulic fracturing and horizontal drilling, it is still hard to find sufficient new reserves.

So oil and gas remains a super-lucrative industry. The producers in particular generally spin off huge cash flows and pay large enticing dividends. Despite this, energy-stock valuations remain low relative to the broader markets. For all its merits, energy just isn’t sexy enough to attract the kind of outsized valuations that hot sectors like technology command. But it’s certainly a strong and safe business.

Thus prudent investors girding for the coming selloff have been shifting capital from overvalued sectors like technology into energy stocks. And that sure sounds wise. As of the end of last month the NASDAQ 100 tech-stock index traded at a bubble-level market-capitalization-weighted-average trailing P/E ratio of 28.7x earnings! This same metric for the classic XOI oil-stock index came in at less than half that at just 14.0x.

In any major selloff, more-overvalued stocks indeed suffer larger declines than less-overvalued ones. So energy stocks definitely seem a heck of a lot safer than this past year’s super-overvalued market-darling sectors. But this sound idea that energy stocks are a good place to weather a major stock-market selloff is crushed on the anvil of market history. Energy stocks still perform wretchedly in bear markets!

Since the last secular stock bull topped in March 2000, we’ve suffered two cyclical bears. The first stealthily awoke in that very euphoria, and ultimately led to a 49.1% S&P 500 loss by October 2002. The second and most recent slashed 56.8% off the S&P 500 between October 2007 and March 2009. These offer recent examples of how chronically-undervalued energy stocks fare during cyclical stock bears.

That early-2000s bear wasn’t relevant to energy stocks today. With oil averaging under $26 in 2001, and falling as low as $17, the companies in this industry were loathed. The secular oil bull wasn’t born until late 2001, and energy stocks didn’t start to win a following until well after that. But that late-2000s bear was very relevant to today. Energy stocks really regained favor just as the stock markets were topping.

This first chart overlays the XLE ETF (S&P 500 energy stocks) over the SPY ETF (the entire S&P 500) across that latest cyclical bear’s span. This chart is exceedingly important for investors to understand, as energy stocks offer no refuge in bear markets. Yes it’s a great industry, yes its stocks always trade at lower valuations than the broader markets, but no this doesn’t translate into a get-out-of-bear-free card.

The parallels between mid-2007 and today are legion. Back then there was extreme complacency and widespread euphoria after the S&P 500 had more than doubled in a massive 5.0-year bull run. Today the same is true in sentiment terms after the stock markets nearly tripled in 5.2 years. Back then smart investors knew the markets were overvalued and toppy, so energy stocks’ popularity started to surge.

While SPY stalled out in mid-2007, much like it’s done this year, XLE surged on major capital inflows. Unlike today, that buying made a lot of fundamental sense because crude-oil prices were also rallying dramatically. Oil prices of course are the dominant driver of oil companies’ earnings, and the higher their profits the higher their stock prices will ultimately be bid. Oil stocks were very popular in late 2007.

Their valuations were much lower than the broad markets’, they were a great industry then as they are today, and they were enjoying a powerful oil upleg to boot. They seemed like a great refuge for the coming cyclical bear, that a small minority of contrarians like me were warning about in late 2007 just like we are today. Nobody listened then either, as most investors’ greed blinds them to seeing toppings underway.

Despite energy stocks’ inarguable fundamental advantages, they stalled out as evidenced by the XLE for the first couple quarters of that new stock bear as SPY ground lower. This was still solid relative performance with XLE only down 1.0% in Q4’07 and Q1’08 while SPY fell 13.5%. But the only reason oil stocks held up so well then was oil, which enjoyed an utterly massive 24.5% rally over that same span!

You may recall the dawn of the last stock bear in late 2007 helped unleash a commodities speculative mania. Investors and speculators were looking for somewhere else besides toppy stock markets to deploy their capital, so they flooded into raw materials. Without the major oil upleg that ignited, oil stocks would have been sucked into the general-stock selloff. Weaker oil prices crush oil stocks, another huge risk today.

The energy stocks couldn’t decisively rally until the broad stock markets finally bounced and enjoyed a major bear-market rally. And during that 9-week span from mid-March to mid-May 2008, XLE’s huge 24.0% gain far exceeded SPY’s 11.8% bounce. But once the bear market resumed after that big rally, the energy stocks just got slaughtered. Despite lower valuations, XLE followed SPY straight down.

During that entire last cyclical-bear span between October 2007 and March 2009, XLE suffered a total loss of 48.8% while SPY plummeted 56.5%. No refuge. But at worst from energy stocks’ atypical mid-bear peak, XLE was down 57.8%! No matter how awesome the fundamental merits of energy stocks are, no matter how cheap they are relative to other sectors, they still get sucked into major stock-market selloffs.

Energy stocks are simply not an alternative investment, they are not one of those rare counter-cyclical sectors than can move contrary to the general stock markets for long. The cold hard truth of market history is the energy stocks are highly correlated with the S&P 500. So whatever happens to the general stock markets will also eventually be reflected in the energy stocks. They are truly no bear-market refuge.

So investors today looking to energy stocks as a relatively-undervalued safe haven in today’s overvalued and toppy stock markets are going to be sorely disappointed. When the broad stock markets get sold off, energy stocks get hammered too. The monstrously-large popular S&P 500 ETFs greatly contribute to this high correlation. As their shares are sold, their custodians have to dump all holdings including energy stocks.

SPY’s mission is to track the S&P 500. When stock markets are falling and investors get scared, they dump SPY shares faster than the S&P 500 itself is falling. This threatens to decouple SPY’s price to the downside, which would effectively break it. So SPY’s custodians have to quickly sop up the excess supply of ETF shares sold. They buy everything offered beyond what is necessary to follow the S&P 500 lower.

They raise the capital to make these massive purchases by liquidating some of their holdings. And when they sell, they sell all 500 component stocks proportionally. So the baby of the undervalued oil stocks is thrown out with the bathwater of the overvalued tech stocks. The more capital investors park in ETFs rather than individual stocks, the more correlated the vast majority of stock-market sectors become.

Oil stocks dominate the energy-stock space, and they have another great vulnerability in major stock selloffs that is exacerbated by those very stock selloffs themselves. Oil-stock prices also generally follow the oil price since that ultimately drives their profitability. Incredibly and rather counterintuitively, oil itself is also highly correlated with the S&P 500! So stock-market selloffs also hit oil, further pressuring energy stocks.

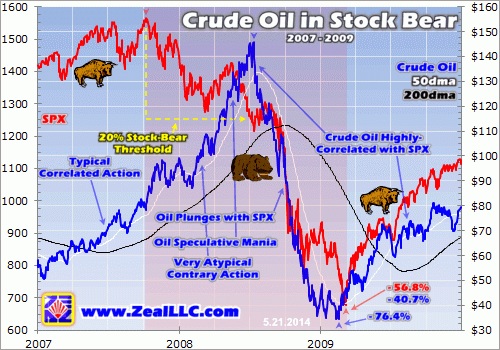

This next chart looks at that same last cyclical bear in the late 2000s, but replaces XLE and SPY with crude oil and the S&P 500 itself (SPX). Most of the time, oil prices generally follow the US stock markets. This is both amusing and vexing considering that oil commentary is perpetually dominated by talk about geopolitics and supply and demand. But American stock-trader sentiment amazingly usually trumps all that!

Near the end of the last cyclical bull in stocks in mid-2007, oil prices were rallying strongly from low levels. Once stock markets started rolling over, capital flowed into oil sparking a speculative mania. That led to some very atypical contrary action in the first half of 2008 where oil soared when the stock markets were selling off. But once that flood of new capital waned, oil soon resumed mirroring the S&P 500 and plunged.

Provocatively, that oil speculative mania failed right when the SPX crossed through that critical 20% selloff threshold that signals a bear market. A major selloff between 10% to 20% is a correction, while one larger than 20% is a bear market. Once bear-market territory in US stocks hit, traders’ appetite for risk pretty much vanished globally. Before 20%, almost no one believes a new bear market is even possible.

Over the course of that entire last cyclical bear, oil prices fell 40.7% compared to the SPX’s 56.8%. At worst from their mania peak, oil prices plummeted a mind-boggling 76.4%! If oil prices too get sucked into major stock-market selloffs, then energy stocks don’t stand a chance. Just as investors get scared and want to sell, falling oil prices ramp up energy-stock valuations and make them look far more risky.

This little-discussed but ironclad link between crude-oil prices and the S&P 500 is also readily evident in major selloffs within ongoing bull markets. This final chart carries that oil-and-SPX comparison forward to the first three full years of our current cyclical bull. Every time the general stocks markets sold off seriously, either in full-blown corrections or even very large pullbacks, oil itself soon got sucked right in.

During this bull’s first correction in mid-2010, oil lost 15.1% over the span where the SPX fell 16.0%. Note how incredibly tightly correlated the oil and S&P 500 price action were in 2010, these data series are essentially interchangeable! As always there was tons of geopolitical news and supply threats then, but it doesn’t matter. Oil prices are effectively slaved to the fortunes of the US stock markets at a high level.

During this bull’s second correction in mid-2011, oil plummeted a blistering 32.4% during the months the SPX plunged 19.4%. Again note the stellar correlation during that major stock selloff, oil prices tracked the US stock markets nearly perfectly on a day-by-day basis. And this continued later even in this bull’s largest pullback. Oil plunged 20.9% in spring 2012 as the SPX retreated by 9.9%, the correlation was perfect.

So not even mid-stock-bull corrections or even large pullbacks are safe for energy stocks! No matter how low their valuations are, no matter how big of dividends they pay, they always get sold hard when oil gets crushed. And rational or not, oil-futures traders always dump oil aggressively whenever a major US stock-market selloff is underway. So energy stocks offer no refuge in not only bears, but bull corrections too.

I learned of this weird relationship in my studies and trading many years ago, and it still irritates me to this day. Oil prices should be set by global supply and demand, not what is happening in the US stock markets. But once a major selloff gets underway, in bull or bear alike, oil traders soon begin ignoring oil’s own fundamentals to become fixated on the US stock markets. So oil latches onto the SPX and doesn’t let go.

The reason is purely psychological. Everyone wrongly assumes stock-market levels are an accurate and fair reflection of the underlying US economy. So when stock markets are high like today, people think the economy has to be good. Earlier this year, stock traders brazenly ignored very weak US jobs reports and US GDP data because the high stock markets convinced them not to worry. That’s why oil is high today too.

If the US economy is roaring forward like today’s lofty stock markets suggest, oil consumption is going to rise as economic activity increases. So oil-futures speculators bid up oil to high levels. But once the stock markets start materially selling off for any reason, this often-false psychological construct becomes a double-edged sword. The oil traders assume the stock-market selloff reflects a worsening in the US economy.

And a slowing economy means slower oil-demand growth, so oil is aggressively sold. The faster and farther the stock markets sell off, the worse oil traders believe the economy actually is. Thus oil prices are always highly correlated with the US stock markets, but become super-correlated with the S&P 500 during major selloffs. This really amplifies the risks that stock-market selloffs present for energy stocks.

As a lifelong investor, I love energy stocks. They are one of my favorite sectors, a great industry that is always trading at too-cheap valuations. After the coming cyclical stock bear, energy stocks are at the top of my buy list for new investments. But no matter how great they are, the time to buy them is not after a long stock bull leads to dangerously-overvalued general stock markets. The resulting selloff will suck in energy stocks too.

The only sure refuge in stock bears and even major corrections is cash, which holds its value and grows your effective purchasing power as stocks fall. Gold is an even superior alternative though, as capital floods in during cyclical bears. During the last two in the 2000s, gold climbed 12.6% and 24.8% while the SPX lost 49.1% and 56.8%! But energy stocks? No way, they just get massacred in stock selloffs.

Everyone should know energy stocks and oil are highly correlated with the general stock markets, but surprisingly few do. Why? Because most investors only listen to Wall Street and fail to seek out wise contrary opinions. While Wall Street always says now is a great time to buy, contrarians tell it like it is. We buy low when others are afraid, then later sell high when others are brave. And now is a selling-high time.

********

At Zeal we’ve long published acclaimed weekly and monthly subscription newsletters to help speculators and investors cultivate that critical contrarian worldview. In them I draw on our decades of hard-won experience, knowledge, wisdom, and ongoing research to explain what is going on in the markets, why, and how to trade them with specific stock trades. Since 2001, all 664 stock trades recommended in our newsletters have averaged outstanding annualized realized gains of +25.7%! Subscribe today, learn to think like a contrarian, and watch your wealth grow.

The bottom line is energy stocks offer no refuge in major stock-market selloffs. Despite their relatively-low valuations, they too get sucked into both bull-market corrections and bear markets. Not only are the major oil stocks sold off indiscriminately as the broad stock indexes fall, oil is dumped in lockstep too as futures speculators fear the falling stock markets signal a major economic slowdown. So energy stocks crumble.

Energy stocks are simply not the place to be if you wisely fear a major stock-market selloff looming. They are highly correlated with the general stock markets, and not even their cheapness grants them any resistance to major broad-market selloffs. Energy stocks won’t shield investors from even a correction, let alone a new bear. So if you want to protect your hard-earned capital, look to cash or gold for refuge.

Adam Hamilton, CPA

May 23, 2014

So how can you profit from this information? We publish an acclaimed monthly newsletter, Zeal Intelligence, that details exactly what we are doing in terms of actual stock and options trading based on all the lessons we have learned in our market research. Please consider joining us each month for tactical trading details and more in our premium Zeal Intelligence service at … www.zealllc.com/subscribe.htm

Questions for Adam? I would be more than happy to address them through my private consulting business. Please visit www.zealllc.com/adam.htm for more information.

Thoughts, comments, or flames? Fire away at [email protected]. Due to my staggering and perpetually increasing e-mail load, I regret that I am not able to respond to comments personally. I will read all messages though and really appreciate your feedback!

Copyright 2000 - 2014 Zeal LLC (www.ZealLLC.com)