Fed Funds Rate Being Dragged to a Date With the 2-Year Yield

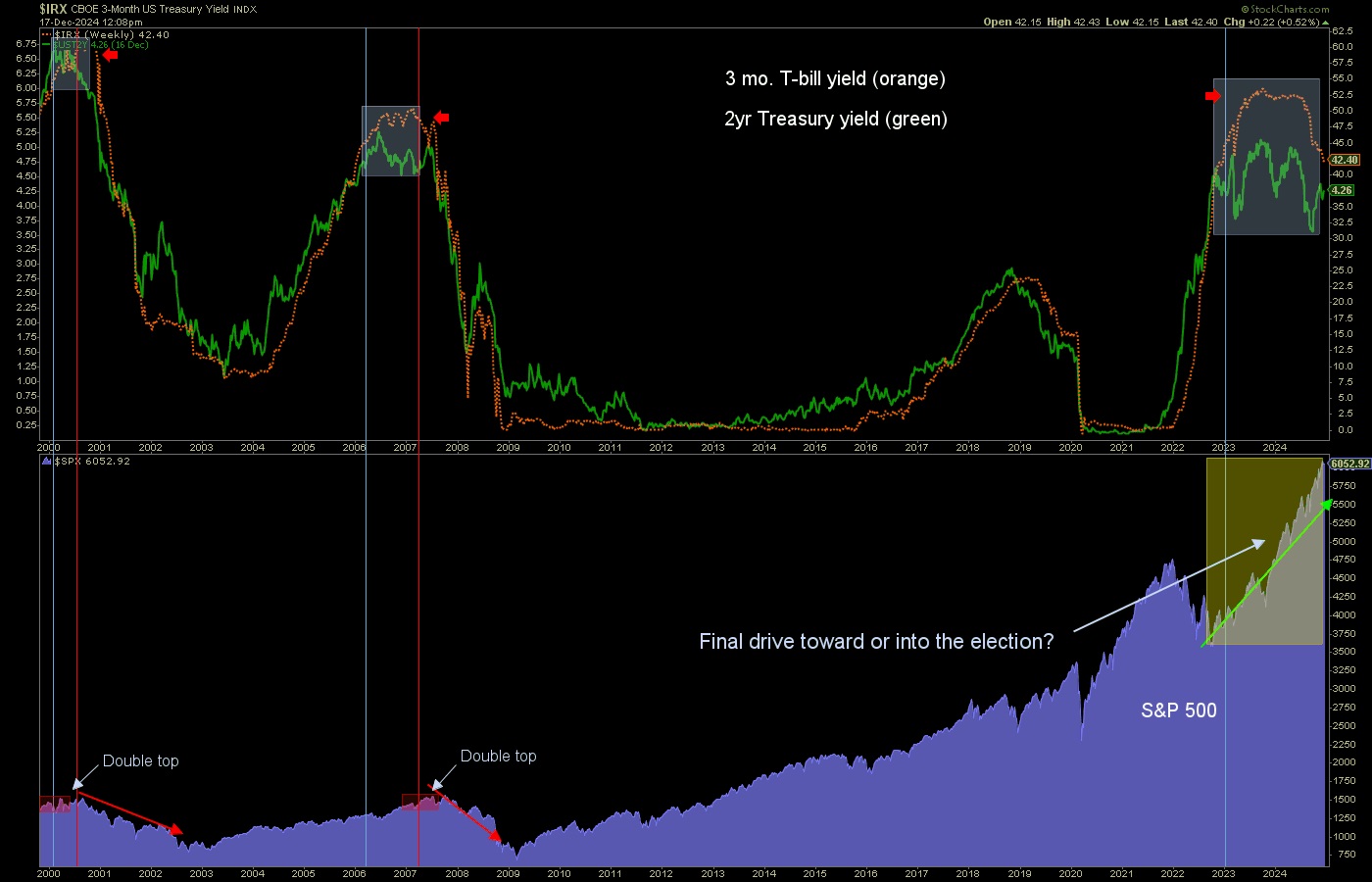

The Fed Funds Rate is being guided down by the 3mo. T-bill yield, while the 2yr yield rises.

CME wiseguys are 95% sure of a .25% Fed Funds rate cut by FOMC tomorrow. We know this, and we know that it is the assumption by a vast majority.

But the 2-year Treasury yield (purple) has been rising while the 3 month T-bill yield (candles) guides the Fed Funds rate (red) downward.

Our oft-used big picture chart shows that such a situation occurred in 2007, prior to the big crash in these yields and the bear market in stocks. There are slightly different inputs to the yields in these two charts, but the message is that the bond market is driving short-term yields while the Fed is widely thought to be in rate cutting mode.

Far be it from me to go against 95% of the CME wiseguys, who do this for a living. But even assuming that the Fed does what everyone thinks it will do tomorrow, there appears to be another end-stage marker developing, at least if 2007 is a good guide. What happened back then was that the 2yr began rising while the Fed proxy T-bill was declining, then the T-bill said “oops, better get in line with the 2yr!” and popped. Then? Well, you know.

For “best of breed” top down analysis of all major markets, subscribe to NFTRH Premium, which includes an in-depth weekly market report, detailed market updates and NFTRH+ dynamic updates and chart/trade setup ideas. You can easily subscribe by Credit Card or PayPal (see all info and options). Keep up to date with actionable public content at NFTRH.com by using the email form on the right sidebar, or take it to another (intermediate) level with our free eLetter. Follow via Twitter@NFTRHgt.

********