Going Up? Looking At The Next Big Move In Gold

Despite arriving late to Thursday’s press conference - ironically, held up by the new ECB elevator system that just wouldn’t cooperate… Draghi delivered the goods. The ECB would buy over 1 trillion euros through September 2016 - or until there is a “sustained adjustment in the path of inflation”. True to monetary form, the program exceeded expectations, even surprising by 20 percent the tactical “leak” of 50 billion euros/month floated just the day before.

Despite arriving late to Thursday’s press conference - ironically, held up by the new ECB elevator system that just wouldn’t cooperate… Draghi delivered the goods. The ECB would buy over 1 trillion euros through September 2016 - or until there is a “sustained adjustment in the path of inflation”. True to monetary form, the program exceeded expectations, even surprising by 20 percent the tactical “leak” of 50 billion euros/month floated just the day before.

Well played Super Mario - well played, however:

- Will it work?

- Will it be enough? - or,

- Is it too late?

Considering it is Europe’s first salvo fired at the QE range, it’s probably wise to let the dust settle some more - although conventional wisdom yesterday echoed expectations that the program will further suppress yields. As we described in our previous note - count us skeptical of such sentiments over an intermediate time-frame (~6 months), especially considering the size of the program that was brought to the table. While there remains a widespread belief that QE helps lower yields or that the market simply front-runs this dynamic, all evidence is to the contrary when you look at what these programs achieved in the States. QE by all accounts succeeds by stimulating participants away from the safe-haven shores of the government bond market and into a concerted reach for yield in riskier assets.

Generally speaking, exceptionally low yield environments result from a lack of demand for capital. Bond yields in Europe haven’t been falling over the past year because investors believed they could sell these assets to the ECB in the future at a higher cost, they’ve fallen because investors lacked confidence in the eurozone itself as economic conditions deteriorated and deflationary concerns emerged. We witnessed a similar dynamic during the massive deflationary squall in the financial crisis in the U.S., where investors were certainly not front-running the Fed before QE1, but parking their capital while the dust settled. Nevertheless, it’s an elegant silver-lining and surely doesn’t hurt the next reflexive scramble that these safe-haven assets inevitably get bid to what some consider icarus heights in the latent stage of the move. While it remains to be seen whether the ECB can achieve the same volatility and market psychology that rustled confidence and yields higher over the past six years, we do think it could help put a floor under yields globally as well as the euroover the next several months. That said, in the first shot administered in the U.S. in late 2008, the market took a few weeks to find it’s footing before yields moved materially higher. We suspect a similar reaction this time around.

When it comes to inflation, our leading proxies in gold and silver have made significant progress over the past several weeks, as the expectation gap illustrated below between durations in the Treasury market - closed with an anticipated rally in precious metals.

While strength has been sold over the past eighteen months, coincidentally or not - gold is breaking above trend line resistance - as the ECB opens their large country kitchen.

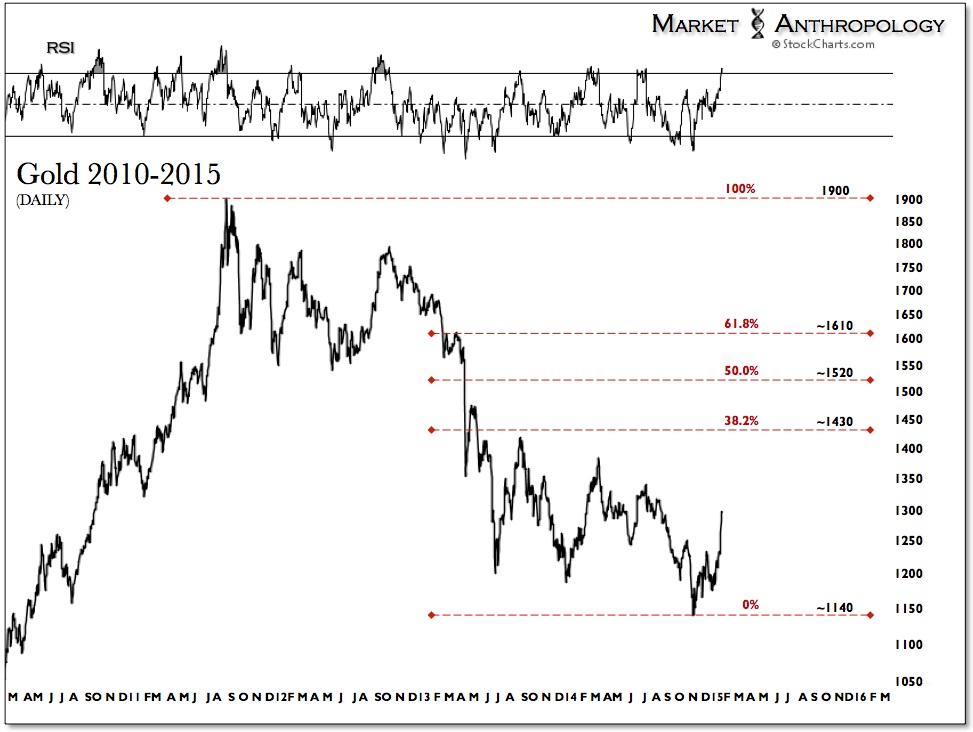

Although the mid-cycle bear in the 1970’s was marginally more severe but only half as long, the current breakout and overall market structure is quite similar.

Assuming the current rally has legs, the next big test should take place above $1400 as the market either accepts or rejects the first retracement level.

A vote of confidence in shifting the inflation vane north has been the performance of the silver:gold ratio - which continues to trend higher out of a possible cyclical low. Similar to the Nasdaq:SPX ratio that marked a top for broader risk appetites in 2000, the blowoff in the silver:gold ratio in 2011 led and capped a reflationary high in commodities and tangential trends such as emerging markets.

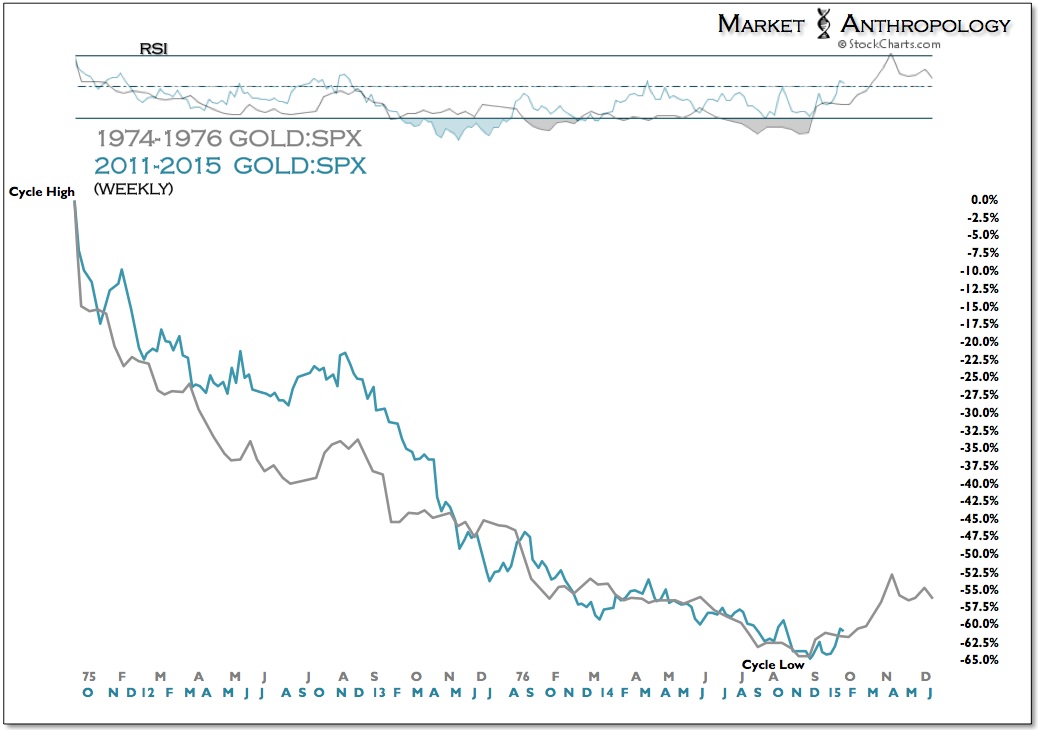

Another congruence with the 1970’s mid-cycle retracement, is the disinflationary performance of the Gold:SPX ratio - which similar to silver outperforming gold leads a broader turn in commodities.

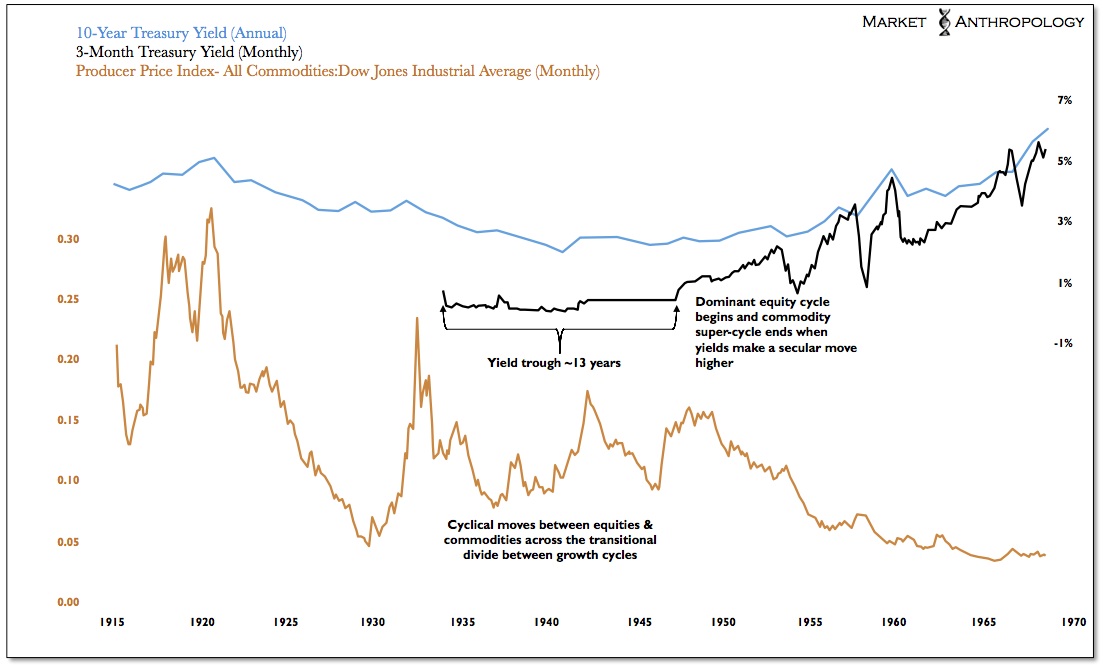

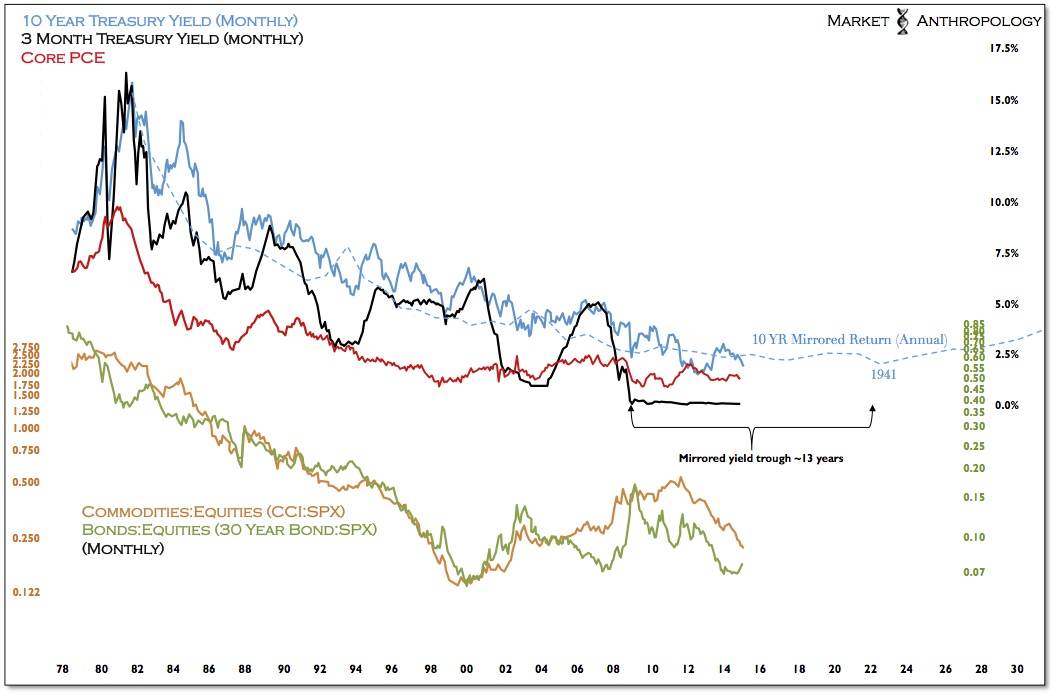

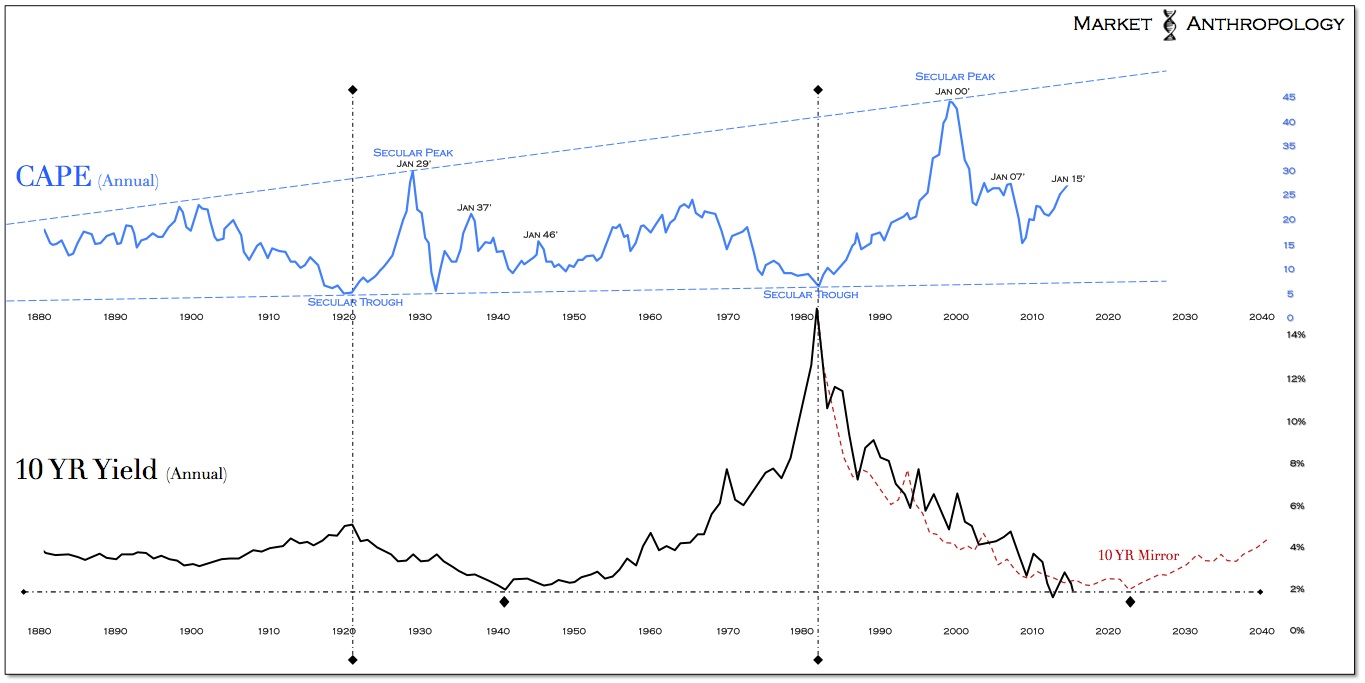

From a long-term perspective, we expect the gold:SPX ratio to cycle higher once more as the equity and commodity markets trade moves across the yield trough - largely motivated by inflationary trends. This would be similar to what occurred on the mirror of the long-term yield cycle from the 1930’s to early 1950’s.

- Photo courtesy of Sharon Drummond

********

This post from Erik Swarts (@MktAnthropology) originally appeared on Market Anthropology.

Erik Swarts is an independent trader and creator of the online market research site -- Market Anthropology. He uses a synthesis of technical and asset relationship analysis to determine a market's respective risk profile.

Erik Swarts is an independent trader and creator of the online market research site -- Market Anthropology. He uses a synthesis of technical and asset relationship analysis to determine a market's respective risk profile.