Gold At $2000+. So Why The Fuss?

There appears to be no way out for the bullion banks deteriorating $53bn short gold futures positions ($38bn net) on Comex. An earlier attempt between January and March to regain control over paper gold markets has backfired on the bullion banks.

Unallocated gold account holders with LBMA member banks will shortly discover that that market is trading on vapour. According to the Bank for International Settlements, at the end of last year LBMA gold positions, the vast majority being unallocated, totalled $512bn — the London Mythical Bullion Market is a more appropriate description for the surprise to come.

An awful lot of gold bulls are going to be disappointed when their unallocated bullion bank holdings turn to dust in the coming months — perhaps it’s a matter of a few weeks, perhaps only days — and synthetic ETFs will also blow up. The systemic demolition of paper gold and silver markets is a predictable catastrophe in the course of the collapse of fiat money’s purchasing power, for which the evidence is mounting. It is set to drive gold and silver much higher, or more correctly put, fiat currencies much lower.

This is only the initial catalysing phase in the rapidly approaching death of fiat currencies.

Sections to this article

- Introduction

- The rescue attempt has already failed

- The financial system depends entirely on inflationary fiat

- Forget currency resets

- Transition pains on Comex

- London’s hidden liabilities

- Conclusion

Introduction

Measured in dollars, the current bull market for gold started in December 2015, since when the price in dollars has almost doubled. Other than the odd headline when gold exceeded its previous September 2011 high of $1920, only gold bugs seem to be excited. But in our modern macroeconomic world of government-issued currencies, which has moved on from the days when gold operated as a monetary standard, it is viewed as an anachronism; a pet rock, as Jason Zweig of the Wall Street Journal called it in 2015, only a few months before this bull market commenced.

Despite almost doubling, Zweig’s view of gold is still mainstream. His comment follows the spirit of today’s macroeconomic hero, John Maynard Keynes, who called the gold standard a barbaric relic in his 1924 Tract on Monetary Reform. Keynes went on to invent macroeconomics on the back of his 1936 General Theory, and whether you profess to be Keynesian or not, as an investor you will almost certainly kowtow to macroeconomics. It has been well-nigh impossible to have a successful career in the investment industry unless you subscribed to inflationist Keynesian theories. You are required to substitute the economics of aggregates for those of the human action of individuals, upon which classical economics was based. And with it, you must unquestionably accept the state theory of money.

Well, we are now witnessing the cataclysmic ending of the Keynesian fallacy; the destruction of macroeconomics in a systemic failure centred on paper markets for gold and silver.

The rescue attempt has already failed

You may have missed the establishment’s last-ditch attempt earlier this year to save itself. Figure 1 below shows its failure.

Comex open interest peaked in January, when the gold contract was being overwhelmed by global demand. Never before had open interest been this high: the previous all-time record had been in July 2016, when it hit 658,000 contracts. At that time, the market had recovered strongly from a deeply oversold condition, the price rallying from the December low in our headline chart, from $1049 to $1380. That was successfully crushed with open interest taken down to 392,000 and the gold price to $1120. However, the take-down which commenced in earnest in January this year did not succeed.

There is no question it was a coordinated attempt by the bullion bank establishment to contain a developing crisis. From its peak of 799,541 contracts on 15 January open interest fell to 553,030 on 23 March. Initially, the gold price continued rising to $1680 on 9 March, but by 18 March it finally reacted, falling to $1471 in only nine trading sessions. But while open interest went on to fall to 470,000 in early-June, the price exploded higher with unprecedented price premiums developing on Comex from 23 March onwards. The bullion banks’ short exposure net of longs on Comex in a rising market had risen to $35bn and the gross position was $53.5bn before the attempt to drive the market lower. Today, the respective figures are $38.3 and $53bn.

The failure of this well-worn tactic precludes it from being used again. We look at the seriousness of the current position on Comex and the LBMA later in this article.

The financial system depends entirely on inflationary fiat

In the investment industry it is monetary debasement that gives you your living. For the rise in the general level of prices of financial assets, measured by various indices, is little more than a reflection of the loss of purchasing power of your state’s currency. The world has been enjoying the phenomenon particularly from the mid-1970s, four years after the last vestiges of Keynes’s barbarous relic, when President Nixon removed pet rocks from the monetary scene. A continual decline in the dollar’s purchasing power ensued. Apart from the occasional hiccup, from 1982 when the S&P500 Index rose from 291.34 to today’s 3,270 the general public has appeared to make money.

It has not been an easy environment to convincingly challenge, being populated by group-thinkers believing their stock and property gains have been the consequence of their individual financial acumens. But one of those periodic hiccups is now upon us, threatening to be more disruptive than anything seen hitherto in our lifetimes, which the macroeconomists in the central banks and governments tell us will require virtually unlimited inflationary finance to resolve.

The distinction between unlimited fiat currency being issued by the state compared with gold is important, because gold was always the money of the people, disliked by governments because its disciplines are limiting. History has always seen the right to issue money taken away from the failures of kings, emperors and governments and handed back to the people, so the empirical evidence is that it will happen again. But macroeconomists argue that their science is an advance on former economic science, so what went before is irrelevant. Therefore, so is gold.

For these reasons, the investment industry is not attuned to gold. Physical gold is not even a regulated investment, which means that government regulators do not permit the funds they license to hold physical metal beyond, if permitted at all, a small exposure. The uncontentious position, taken by nearly all compliance officers, is for investment managers not to hold any. But besides mining stocks, today there are exchange-traded funds that do offer some investment exposure to gold for fund managers. Assuming, that is, they are willing to contradict the Keynesian views of their colleagues.

But even then, the context is wrong. Gold is not an investment but money, driven out of circulation over the last hundred years by the steady encroachment of gold substitutes evolving into pure unbacked fiat. It is no one’s liability, unlike the dollar, for instance, backed only by the full faith and credit in the Donald — or will it be Joe Biden. In the case of the euro or the yen, with negative interest rates and having banking systems arguably on the point of collapse, their central banks are similarly committed to accelerating debauchment of their currencies.

Even semi-official gold bugs, like the World Gold Council, promote gold as a portfolio investment, with its income arising from the securitisation of gold through the GLD ETF. An audience of professional investment managers, which subsists on an intellectual diet of macroeconomics, does not readily accept that gold is money, and if the World Gold Council argued that it is money and not an investment, they would doubtless fail to attract institutional investors.

But an understanding that gold is money is a vital distinction. When you regard it as an investment, you expect to sell it when its positive trend ends. You assume your government’s currency will always have the objective transactional value and gold is the subjective variable. Accounting conventions force investment managers and advisors to ignore the reality that it is the currency failing and not the price of gold rising. Even the overwhelming majority of gold bugs cheer a rising gold price, instinctively treating it as an investment which rises in value, measured in fiat.

The objective/subjective confusion is the most important concept to understand when it comes to gold. If the wider public begins to understand that measured in goods, the state’s currency is no longer fit for an objective role in day to day transactions, it will be doomed. For that marks the point where fiat money begins to be discarded, and the public then ultimately decides what is its preferred money. That is where all this is going.

Forget currency resets

In recent years, suggestions that a monetary reset, centred on the dollar, is planned by the monetary authorities have been made by a number of observers. Central bank research into blockchain solutions have added to this speculation, but a recent paper by the IMF shows there is no consensus in central banks as to how and for what purpose they would use digital currencies — the central banking version of cryptocurrencies.

In any event, it is likely to take too long for a central bank digital currency to be implemented, given the speed with which monetary events are now unfolding. Empirical evidence suggests that once initiated, a fiat currency collapse happens in a matter of months. Today, the Fed has tightly bonded the future of financial asset values to the dollar — one goes and they both go. The credibility behind financial asset values is already stretched to the limit, and the inevitable collapse, taking fiat money with it, is likely to be sudden.

As a side note, the last time a collapse in financial assets took the currency down in similar circumstances was exactly three hundred years ago — in 1720 when John Law’s Mississippi bubble failed. Interestingly, Richard Cantillon made his second fortune by shorting Law’s currency, the livre, and not his shares. His first fortune was made acting as a banker lending money to wealthy speculators taking in Mississippi shares as collateral, which he then promptly sold, pocketing the proceeds.

An attempt at a currency reset, with or without blockchains, can only be contemplated after the public has begun to abandon existing currencies. But the speed with which events unfurl when fiat currencies die precludes advance planning of currency replacements. Any attempt to produce a new fiat money after the existing one has failed will also fail — rapidly. The idea that the state can take control of the valuation of a new currency in a fiat reset in order to make it durable is the ultimate conceit of macroeconomics, the denial of personal freedom to make choices in favour of the management of the aggregate.

One of the specious arguments that arises time and again is that inflation reduces the true burden of debt. This is true for existing debt, but its advocates as a remedy for government indebtedness fail to understand that it also increases the cost of the government’s future debt. And while it similarly reduces the burden on private sector debtors, by destroying savings inflation leads to capital starvation and hampers any recovery.

It is possible, and desirable, that the ills of fiat currencies will be properly addressed. But that will require an abandonment of inflationism, and a commitment to balanced budgets. It requires governments to rein in their spending, reducing their role in the economies they oversee. Statist interventions, both regulatory and mandated by law have to be axed, and full responsibility for their actions handed back to the people. And only then, sound money, preventing governments from reverting to their inflationary ways, can be successfully introduced.

Assuming all this is possible, the only sound money is one with a track record and where governments have no control over it as a medium of exchange. In other words, metallic money. They will have no alternative to turning their currencies into substitutes fully convertible into gold, with silver in a subsidiary coinage role. Coins in both metals must be freely available on demand from all banks at the fixed rate of exchange for gold, and for silver equating to its monetary value. The circulation of gold and silver coins ensures the public fully understands their monetary role, thereby deterring future governments from inflationary policies. Bank credit must also be backed by gold, and not expanded by banks out of thin air.

But the pervasive and mistaken beliefs in macroeconomics appear to be an unsurmountable impediment to an orderly change towards sound money. Imposing their fervent denial of economic reality, macroeconomists are in charge of both economic and monetary policy in America, Europe and Japan — and by extension those of almost all other nations. It is not even certain that a currency collapse will dislodge them from their position of power, prolonging the chaos that will ensue.

Talk of a monetary reset only makes any sense if those doing the resetting understand what they are doing. And one thing will become immediately clear: the Americans, who stand to lose power over global affairs, will be the most reluctant of all nations to accept that the days of its hegemonic currency are numbered and that a return to a credible gold standard is the only solution.

Transition pains on Comex

Only through knowledge of why fiat currencies’ days are numbered can one understand what is happening to the gold price. For now, those who do not appreciate the fallacies behind macroeconomics and think of gold as an investment see gold’s move from December 2015 as a bull market which sooner or later will probably come to an end — perhaps when interest rates or bond yields rise. But those who see gold as sound money and no one else’s counterparty risk will understand that a rising price for gold should be regarded as part and parcel of a fall in the purchasing power of their fiat currency. In fact, it is a change of purchasing power for both. As fiat money loses purchasing power, gold gains it disproportionately because of its relative scarcity, while the collapse in fiat money progresses.

In the increasingly likely event that fiat currencies will lose all function as money, measured in them the gold price will trend to infinity. It is now difficult to see how the dollar can avoid this outcome, or something close to it. That being the case, in this context a price move for gold above $2000 per ounce is an insignificant event, except for those trapped with short positions, which brings us to the chaos on the Comex futures market. Figure 2 shows the position in US gold futures markets on 28 July (the last Commitment of Traders information available) with the spread positions removed.

The swaps are bullion bank trading desks, which typically take positions across more than one derivative market, notably London forwards settling unallocated accounts. Together with the Producers and Merchants category, they almost always run net short positions on Comex. Producers, miners and their agents acting for them, hedge against falls in the gold price and make up the bulk of the short positions in their category. Merchants, typically jewellers and buyers for industrial and other purposes, hedge against price rises by holding long contracts.

The concept of futures markets did not originally include banks in the non-speculative category, because futures markets were a means for farmers to unburden themselves from price risk, due to seasonal factors, to speculators willing to take the risk upon themselves. However, banks managed to persuade the CME to be categorised as non-speculators, on the basis they often acted as agents for producers in non-agricultural contracts. And in gold, which is what concerns us, they also ran positions in London which they wished to hedge on Comex. But as has been seen in Figure 2, the bullion banks now account for 70% of the shorts, when in the past they would typically account for significantly less. And as we show later in this article, they have no physical gold in London to hedge. The result is their gross short position of 262,796 contracts is now an uncovered commitment of $53bn spread between 27 traders. Figure 3 puts this in an historical context over the last ten years.

Bullion banks’ shorts net of longs (the blue line) are at record levels, and gross shorts are almost at record highs, only exceeded at the beginning of the year when open interest had risen to an unprecedented level of 799,541 contracts on 15 January.

On the speculator side, the dominant category is nearly always Managed Money, which is predominantly hedge fund traders. They are rarely interested in taking delivery and will close or roll their positions. They are nearly always biased to the buy-side, and over the long term have averaged a net long position of about 112,000 contracts, which we can call the neutral position. But currently, they are an unusual minority 42% of the speculator longs and are only moderately positioned above their neutral net long average.

Far from being the masters of the investment universe, hedge funds have proved to be an easy target for the bullion banks, regularly spooking them out of their long positions. And by acting in the fashion of committed macroeconomists, hedge funds have used the current strength in the gold price to take profits, reducing net longs from the previous week’s COT report by 21,362 contracts. They seem unaware of or disinterested in a bigger picture. Furthermore, at 42,758, the level of their short contracts is above average, which could contribute to the bear squeeze in the coming weeks as they realise their mistake.

The Other Reportable category is for traders that do not fit into the other three categories described above. The longs in this category are close to a previous record level, which was on 24 March at 158,963 contracts. Unusually that was recorded two business days after the market turned higher following the price collapse in early March from $1700 to $1455. We can therefore count the Other Reportable category as smart money, at least in the current climate, less likely to be shaken out of their positions by swap dealers trying to trigger stops.

We can only conclude that swap dealers have not only ended up nearly record short, but the liquidity on Comex provided by hedge funds, which normally enables them to close their shorts, is restricted. Furthermore, mark-to-market losses come at a time when their banks’ wider operations are cutting back on risk exposure to financial commitments where they can. But these near-record losses are likely to increase significantly as central bank money-printing accelerates in an attempt to prevent an economic slump and to maintain financial asset prices. If something else does not break before, a full-scale banking crisis could evolve from the paper gold market.

The authorities can be expected to do everything to avoid a failure on Comex, because the damage to the wider market would be extremely serious. Instead, banking members of the London Bullion Market Association (LBMA) would probably be expected to bid up the gold price in the forward market in an attempt to square their books and for banks to swallow the losses. That cannot happen as will be explained in the next section.

In short, over the coming weeks, we can expect a transition phase as the crisis refocuses on London’s forward settlement market, which is the casino hidden from view.

London’s hidden liabilities

Trading in London for forward settlement is a far larger market than Comex. According to the Bank for International Settlements, at the end of 2019, the notional amount of over the counter (OTC) gold forwards and swaps outstanding stood at $512bn, which compares with Comex open interest of $120bn on the same day, noting that open interest at 786,166 futures contracts at that time was an elevated level.

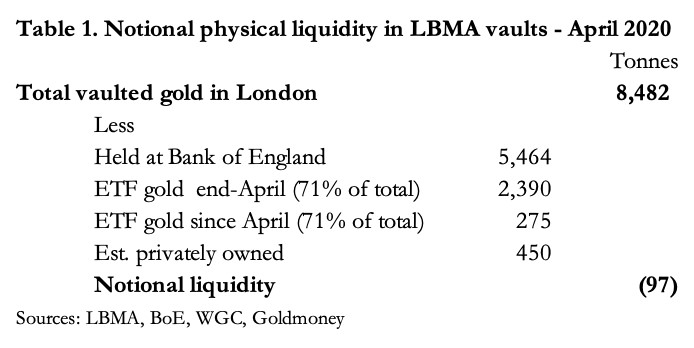

The London Bullion Market Association makes great play of its liquidity, in its last press release claiming total physical backing for its forward market was 8,424 tonnes in April. But of that total, 5,464 tonnes are gold vaulted at the Bank of England, of which perhaps 95% is earmarked for central banks and foreign exchequers. We have discovered from the SPDR Gold Trust’s quarterly filing with the SEC (the GLD ETF) that 45.91 tonnes of its gold was held at the Bank of England on 27 April. The fact that GLD’s custodian, HSBC, was forced to use the Bank of England as a sub-custodian suggests a serious lack of available bullion in LBMA member vaults. To explore this issue, Table 1 below shows the notional bullion position in London, confirming the lack of free float.

While admittedly simplistic, these figures show that there is no liquidity in London. According to the World Gold Council, total ETF physical holdings at end-April were 3,364 tonnes, of which, according to Paul Mylchreest’s Hardman report, over 70% is vaulted in London, or 2,390 tonnes in Table 1. To this figure must be added gold privately vaulted by sovereign wealth funds, institutions, family offices and agglomerating businesses on behalf of retail customers. These bullion stocks are held with the vaulting companies (Brinks, G4S, Loomis and Malca-Amit), and are likely to amount to a further 400-500 tonnes.

Since April, ETF holdings have increased by a further 387 tonnes, of which we will again assume over 70%, 275 tonnes, is stored in London (24 July – source WGC). While there are some guesses concerning underlying changes in these figures since end-April, they could easily result in a negative figure, as Table 1 suggests. Furthermore, if ETF and private demand for bullion escalate further a crisis in London is bound to emerge.

It is here that the Bank of England might have intervened by leaning on its central bank clients to lease some of their earmarked gold – vide the 45.91 tonnes reported to be held for the GLD ETF in April. But there is a further problem: the notional lease rate has been negative since March, which means that a central bank leasing at the market rate has to pay the lessee for the privilege. This suggests that leasing can only occur if market rates are ignored and a fee is paid instead.

It is important to note that under a lease agreement, ownership remains with the lessor. Gold leased through the agency of the Bank of England is unlikely to leave the Bank’s vaults, merely credited through book-entries to lessees. Therefore, for the lessor there is no counterparty risk because if the lessee defaults, the Bank of England merely reallocates the bullion back to the lessor. But in a wider bullion crisis, the double counting of bullion “ownership” through leasing will be exposed, the liabilities falling entirely on the bullion banks. Holders of the GLD ETF should seek confirmation that none of its gold in the Bank’s vaults is so leased.

The alternative to central banks providing liquidity is unthinkable: that bullion banks obtain their liquidity by illegally using bullion held in their custody. Unfortunately, suspicions are compounded by the LBMA’s secrecy over market operations, only releasing selected information when it is no longer relevant. The LBMA’s press releases are also misleading; headlining total gold vaulted in London creates the impression of physical liquidity, which is patently untrue.

For their wealthier customers, bullion banks offer gold accounts in two forms: allocated and unallocated. They are discouraged from opening an allocated account, through expensive fees, notionally covering the vaulting and insurance of physical metal and administrative costs. The real reason is that banks prefer their customers to open unallocated accounts, encouraging them with minimal fees, because these can be fractionally reserved if they are reserved at all. In other words, a bullion bank can hold enough just enough gold to cover the random demands for withdrawals. But as Table 1 above demonstrates, not even that physical liquidity now exists.

While physical settlement involving allocated gold accounts obviously does occur, it is unallocated accounts settling through the AURUM electronic settlement system which accounts for almost all day to day London trade settlements. AURUM is the means of settlement between members of the LBMA through the London Precious Metal Clearing Limited. Transactions for settlement in unallocated form are funnelled through one of the five members who net them down into a single settlement through AURUM. The five members of LPMCL (JPMorgan, UBS, HSBC, ICBC Standard Bank and Scotiabank) all have unallocated accounts with each other, and the settlements determined by AURUM are for currency on one side and unallocated bullion on the other.

Therefore, the massive quantities of gold being settled are divorced from physical settlement, and amount to nearly all the BIS derivative estimate quoted above of $512bn in positions outstanding at the end of last year. But depositors with unallocated gold accounts undoubtedly believe they have exposure to the gold price, otherwise they would insist at the least on their accounts being allocated with their bullion bank acting as custodian. As the current crisis in paper markets evolves, loss of faith in the ability of bullion banks to settle unallocated accounts in gold will risk generating a run on these accounts and a rush to secure physical gold before prices rise further.

While the authorities in America will do everything to avoid a gold and silver crisis on Comex, any thought that it can be buried behind closed doors in London is fanciful. The same bullion banks trade both markets. A crisis in the bullion banks threatens to leave at the last count about $500bn of unallocated gold accounts in London plus a further 262,796 Comex contracts ($53bn at $2,030 – see Figure 2 above) swinging in the wind. The expansion of paper gold since the early 1980s which has put a lid on the gold price is coming to its end, and the removal of this obstacle will only serve to push the price significantly higher.

Conclusion

We appear to be witnessing the early stages of a breakdown in the paper gold markets on Comex and in London, brought forward by central banks committed to accelerating their inflationary policies in an act of macroeconomic desperation to save their government finances and their economies. The method employed is a dead ringer for an earlier experiment in France exactly three hundred years ago when John Law’s Mississippi bubble imploded, destroying his currency, the livre.

If you bind the fate of financial assets to that of your fiat currency, as John Law did, and which is now the policy of the Federal Reserve, when the bubble pops the currency goes pop as well. This outcome is so obvious that the smart money is now getting out of fiat and into physical gold and silver, as witnessed through deliveries on Comex active contract expiries and the disappearance of all physical liquidity in London.

This being the case, a gathering stampede out of paper currencies and derivative contracts into physical bullion has just started. Unless it is somehow stopped, it will destroy paper markets and with them the banks that have benefitted from them over the last forty years. The acceleration in the destruction of fiat money will gather pace in the next few months, and anyone who spouts macroeconomic nonsense instead of acting in the face of these developments will end up with nothing.

Alasdair Macleod

HEAD OF RESEARCH• GOLDMONEY

Twitter: @MacleodFinance

MOBILE: +44 7790 419403

Goldmoney

The Most Trusted Name in Precious Metals tm

NEW YORK | ST. HELIER | TORONTO

Publicly Traded Symbols: CA: XAU | US: XAUMF

© 2020 GOLDMONEY INC. ALL RIGHTS RESERVED. THIS MESSAGE MAY CONTAIN CONFIDENTIAL OR PRIVILEGED INFORMATION. IF YOU ARE NOT THE INTENDED RECIPIENT, PLEASE ADVISE US IMMEDIATELY. THIS MESSAGE IS FOR GENERAL INFORMATION ONLY AND SHOULD NOT BE CONSTRUED AS AN OFFER OR SOLICITATION OF AN OFFER TO BUY SECURITIES OR ANY OTHER FINANCIAL INSTRUMENTS. WE DO NOT PROVIDE TAX, ACCOUNTING, OR LEGAL ADVICE, AND RECOMMEND THAT YOU SEEK INDEPENDENT PROFESSIONAL ADVICE IF NECESSARY. WE CONSIDER INFORMATION IN THIS MESSAGE RELIABLE BUT WE DO NOT REPRESENT THAT IT IS ACCURATE, COMPLETE, AND/OR UP TO DATE AND IT SHOULD NOT BE RELIED ON AS SUCH. OPINIONS EXPRESSED ARE OUR CURRENT OPINIONS AS OF THE DATE APPEARING ON THIS MESSAGE ONLY AND ONLY REPRESENT THE VIEWS OF THE AUTHOR AND NOT THOSE OF GOLDMONEY INC OR ITS SUBSIDIARIES UNLESS OTHERWISE EXPRESSLY NOTED.

Notice: This email may contain confidential or privileged information. If you received this email in error or believe you are not the intended recipient, please notify the sender immediately and delete this email without forwarding or opening any attachments. Thank you for your cooperation and attention.

********