Gold And Fed Rate Hikes

Gold’s sharp early-year surge has fizzled in recent weeks as investment demand faded. The primary reason is the universal belief that the Fed’s upcoming rate hikes are very bearish for gold. Higher rates will make zero-yielding gold relatively less attractive, argues this popular thesis. But history proves just the opposite. Gold actually thrives in rising- and higher-rate environments, so rate hikes are nothing to fear.

This notion definitely seems counterintuitive today. When the Fed finally begins letting interest rates start to normalize after actively suppressing them for years on end, yields on bonds and cash in the form of money-market funds will rise. That will make these asset classes more appealing to investors. So they will migrate out of gold, which yields nothing, into the new higher-yielding bonds and money-market funds.

This logic is simple, which is why the great majority of investors and speculators today believe that gold is going to face relentless selling as rates rise. But rather than accepting this conventional “wisdom” at face value, why not see what’s happened in the past? Did the earlier periods of rising and higher rates suck vast amounts of capital out of gold, deflating its price? If not, then this popular thesis is dead wrong.

It’s funny how ideas take root and flourish in the financial markets. Traders are highly emotional, with most of their trading decisions based on greed and fear. They also have an overwhelming status-quo bias, expecting current market conditions to persist indefinitely. Thus any rationalization of why stock markets will rally on balance forever while gold fades into oblivion are quickly seized on and trumpeted as truth.

With traders’ collective greed and fear constantly overriding their rationality, popular fallacies always exist. They include widespread beliefs today that market history proves are ridiculous. Such as the ideas that stock markets can rally perpetually without corrections or bears, that stock-market valuations don’t matter, and that central banks can successfully manipulate prices forever. History makes a mockery of these!

Yet traders believe what they want to, whatever seems to bolster their views that existing trends have turned permanent in some new era. But the past record is crystal-clear, financial markets are forever cyclical. Asset classes rise as they grow popular, but then inevitably subsequently fall as they drift out of favor again. Gold is no exception. Gold can’t drift lower forever any more than stock markets can rally forever.

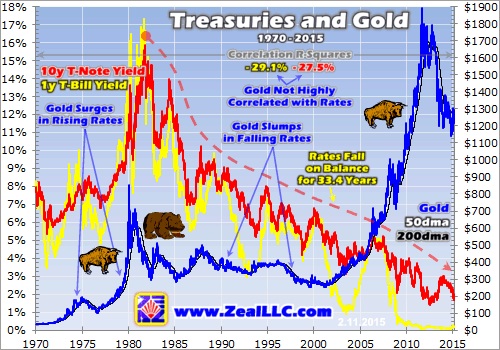

So instead of just blindly accepting today’s belief that the Fed’s rate hikes are bearish for gold, why not check the historical record? This first chart includes over 45 years of daily gold-price and interest-rate data. For interest rates I used the yields on benchmark 1-year Treasury bills and 10-year Treasury notes to represent both the short and long ends of the yield curve. Are rising and higher rates really bearish for gold?

The simple answer is absolutely not. Gold’s mighty secular bull of the 1970s, which greatly dwarfed the 2000s one, happened during a time of high and rising interest rates! And then gold’s subsequent multi-decade secular bear in the 1980s and 1990s unfolded during a long span of interest rates relentlessly falling on balance. Gold rallying with rising rates and slumping with falling rates? That’s not in the script.

And over this chart’s entire nearly-half-century span, gold and interest rates were actually not highly correlated at all. While gold indeed had the negative correlation with rates that many today expect, it was actually very weak. Gold’s correlation r-squares with 1-year and 10-year Treasury yields ran merely 29% and 28% respectively between 1970 and 2015. For all intents and purposes, this is essentially uncorrelated.

Mathematically, only well under a third of gold’s daily price action was directly explainable by short- or long-term interest rates. This wouldn’t be the case if higher rates made gold far less attractive to investors and vice versa, so today’s popular thesis about gold and rates is simply false historically. Actually well over two-thirds of the gold-price action in our lifetimes had nothing to do with the changing interest rates!

Like all other prices, gold’s are driven by global supply and demand. And since it takes over a decade to advance a deposit into an operating mine, gold’s supply changes very slowly. All the real fundamental action in the yellow metal comes on the demand side. And the big wildcard on that half of the equation comes from investment demand, which can fluctuate massively at the margin. It drives all gold’s big moves.

So interest rates could only affect gold through investment demand. Today’s traders believe rising and higher rates retard gold investment demand as investors shift capital to higher-yielding bonds. But they have a monumental historical problem in the form of the biggest secular gold bull of our lifetimes. Back in the 1970s when gold skyrocketed over 24x higher in nominal terms, it actually moved with interest rates!

Way back in March 1971, short rates as represented by 1-year T-Bill yields bottomed at 3.5%. And by October 1979, they would nearly quadruple to 13.6%! Now no one today even thinks the Fed hiking the Federal Funds Rate it directly controls to double-digit ranges is even possible. So there is truly no more extreme example than the 1970s to reveal how rising and higher rates affect gold investment demand.

And obviously gold bucked today’s consensus and soared right alongside interest rates! It actually had very high positive correlations with 1-year and 10-year Treasury yields, enough to generate very strong r-squares of 64% and 83% respectively. So from two-thirds to over four-fifths of gold’s bullish upside price action between 1970 and 1980 was directly mathematically explainable by the rising interest rates.

Gold was actually strongest when the short-term interest rates utterly dominated by the Fed Funds Rate were rising the fastest. Note gold’s giant spikes in 1973 and 1974 as rates soared in direct response to Fed rate hikes. And then gold actually slumped in 1975 and 1976 as interest rates fell, which again flies in the face of what traders expect today. Then it soared again in 1978 and 1979 as rates skyrocketed.

So in the biggest secular gold bull of our lifetimes by far, rising and higher rates were as far from being bearish for gold as they can get. Just the opposite was true, the faster the rate hikes and the higher the rates went, the more investment demand for gold soared! This relationship only seems counterintuitive today because traders’ status-quo bias has temporarily blinded them to normal cyclical market behavior.

Rising and higher interest rates are actually bullish for gold for one simple reason. And that is they are actually very bearish for stocks and bonds. Gold is an alternative asset that shines the brightest when the conventional asset classes are suffering. And nothing pummels stock and bond markets like rising interest rates. That is the sole reason the Fed has been so darned slow in normalizing interest rates!

Rising and higher rates hit the stock markets in a variety of ways. They make bond investing relatively more attractive for stock capital. In periods of low interest rates, bond investors are often forced into the stock markets to chase yields. But they never like being there, as stocks paying healthy dividends are always at risk of seeing major price declines. There is essentially zero principal risk in bonds held to maturity.

So as rates rise, the bond investors grudgingly holding stocks exit to migrate back into their favored asset class. Since the pools of bond-market capital are so vast, this selling pushes the stock markets lower. Rising and higher rates also make stock markets look more overvalued in several ways. When bond yields are higher, investors are far less willing to pay high prices in price-to-earnings-ratio terms for stocks.

So the lower demand won’t support overvalued stock markets, and they sell off. The higher rates also directly hit corporate profits, which further erode valuations. Companies’ debt-servicing expenses rise with rates, reducing earnings. And their customers also face the same higher borrowing costs, so they buy less which dampens corporate sales. And lower sales also naturally lead to lower profits of course.

When stock markets start flagging significantly, which rate hikes usually ensure, investors start flocking to alternative investments led by gold that thrive when general stocks are weak. The reason that gold rocketed 186% higher in 1973 and 1974 despite 1-year Treasury yields climbing from 5.7% to 7.4% with far-higher 9.2% and 10.0% rate spikes within this span was the S&P 500 plummeted by 42% during it!

Rising and higher rates crushed stock markets, so gold investment demand exploded as a safe haven that wouldn’t get sucked into the stock markets’ downside maelstrom. And conversely when the S&P 500 rebounded out of its 1973-1974 cyclical bear to soar 57% higher in 1975 and 1976, gold plunged 28% despite short rates falling from 7.4% to 4.9%. The stock-market fortunes were the key to gold in the 1970s.

And they still are today. The only reason gold plummeted in 2013 on epic extreme GLD-gold-ETF and gold-futures selling was because the Fed’s radically-unprecedented open-ended third quantitative-easing campaign and associated jawboning catapulted the general stock markets far higher. When conventional investments are surging, investment demand for alternatives naturally fades away to nothing.

The Fed’s artificial prolonging of this latest cyclical stock bull with extreme money printing is the sole reason gold fell so deeply out of favor in the past couple of years. But these lofty Fed-goosed stock markets are long overdue to roll over into the next cyclical bear, and when that happens gold will shine as investors again seek out alternative investments. The Fed’s rate hikes will accelerate this process.

The benchmark S&P 500 has soared an astounding 209% higher in 5.8 years as of late December, far beyond the average ranges of normal cyclical bulls. Its elite component stocks were trading at a nearly-bubble-level average trailing-twelve-month price-to-earnings ratio of 25.1x at the end of last month! And it’s been a staggering 3.4 years since the last stock-market correction exceeding 10%. A major selloff is inevitable.

And whenever it happens, gold will catch a huge bid regardless of what interest rates are doing. Again the only reason the Fed has kept its risky and asinine zero-interest-rate policy in place since December 2008 despite the soaring stock markets and improving jobs picture is because it is rightfully terrified of what rate hikes will do to these wildly-overextended stock markets. But it will soon have to act regardless.

Fleeing into bonds isn’t a great option for stock-market capital either, as rising and higher rates are even more devastating for bond markets. Bonds are debt contracts with yields fixed at issuance, yet those yields have to trade at current prevailing rates. So as rates rise, bonds are sold until their prices fall low enough for their fixed payments to equal current yields. This means big principal losses for investors.

Long-term investors can hold bonds to maturity to avoid the inevitable mid-term principal losses. But this is a tough bet to make, since new bonds are always coming out in rising-rate periods with higher yields. This makes bond investing an utter minefield when the Fed is hiking rates, an unforgiving realm that makes capital appreciation very difficult for even the best traders. Gold can be much more appealing.

If investment capital is flowing into gold due to rate hikes’ serious adverse impact on stocks and bonds, investors in both are attracted to its high returns. When gold is rallying while both stock and bond prices are falling, the gold investment demand grows dramatically and feeds on itself. So contrary to popular “wisdom” today, rising- and higher-rate environments are super-bullish for gold investment demand.

This final chart looks at gold and the benchmark Treasury short and long rates during the last secular gold bull of the 2000s. While neither gold’s bull run nor the interest-rate cycles were anywhere near as extreme as in the 1970s, they still prove how wrong today’s universal belief is that Fed rate hikes are bad news for gold. Gold actually soared during the Fed’s last rate-hike cycle, and thrived in much higher rates.

It is true that interest rates meandered lower on balance during gold’s last secular bull. As gold blasted 7.4x higher between April 2001 and August 2011, 1-year and 10-year Treasury yields plummeted by 98% and 58% respectively. But it wasn’t the Fed-imposed artificially-low interest rates that drove this latest gold bull. Gold peaked fairly early in the Fed’s ZIRP campaign, and well before 10-year yields bottomed.

And that entire massive gold bull happened in a far-higher rate environment than today’s. Over its long 10.4-year span, 1-year and 10-year Treasury yields averaged 2.2% and 4.1%. These are way higher than today’s prevailing yields, 10.2x and 2.0x respectively. If gold enjoyed such incredible investment demand at these far-higher yields than today’s, then why are Fed rate hikes back up to these same levels bearish?

Obviously they’re not. But today’s emotional investors and speculators want to irrationally believe the Fed’s conjured fiction of stock markets rallying forever. So they always look to rationalize their status-quo bias, to latch on to any thesis, no matter how flimsy, if it supports their worldview. And that is today’s absurd belief that financial markets are no longer cyclical, that stocks rally forever while gold slumps forever.

Why succumb to this dangerous groupthink instead of simply consulting the historical record? If Fed rate hikes are bearish for gold as everyone assumes these days, then it must have been pounded in the last major rate-hike cycle. That happened between June 2004 and June 2006, a two-year span where the Fed more than quintupled its Federal Funds Rate from 1.00% to 5.25%. Did gold utterly collapse?

Not so you’d notice. Over the exact span of that last major Fed-rate-hike campaign, from FOMC day to FOMC day, gold blasted 49.5% higher! Its young secular bull actually accelerated dramatically while the Fed was aggressively raising rates. Since rising and higher rates make stocks and bonds look a lot less attractive and a lot more overpriced, alternative investments led by gold return to favor. Don’t forget that.

Today’s universal belief that the Fed’s next rate-hike cycle is bearish for gold is total garbage. It just blows my mind that anyone actually believes it. How can anyone be so foolishly susceptible to herd groupthink that they can’t spend a couple hours studying gold’s actual reactions during past rising- and higher-rate environments? If rate hikes are bearish for gold, then it would be readily apparent in historical data.

Gold’s latest woes were exacerbated by last Friday’s big upside surprise on the US monthly jobs report. It ignited heavy gold selling that ultimately pounded the metal down 2.4% that day alone. Why? Because the better-than-expected jobs read led gold-futures traders to think the Fed’s rate hikes are going to start sooner rather than later. And these naive speculators chose to believe rationalizations instead of history.

Just like in the past, the inevitable upcoming Fed rate-hike cycle is going to be super-bullish for gold. The rising and higher rates are going to hammer these lofty, overvalued, and overextended stock and bond markets. And that will lead prudent investors to seek alternatives, places to park their capital that move inversely to stocks. There’s zero doubt gold investment demand will surge during the coming rate hikes.

And since gold investment demand on the margin determines gold prices, the yellow metal will soar too. You can ride it higher in physical gold coins or the flagship GLD gold ETF. And if you want to leverage gold’s coming gains as the Fed pricks its own stock-market bubble, the beaten-down gold stocks will greatly outperform gold to the upside. Only brave contrarians fighting the crowd now will maximize their gains.

Because of all the popular falsehoods plaguing the markets today like this gold-and-rate-hikes one, it’s never been more important to cultivate an excellent contrarian source of information. That’s what we do at Zeal. We’ve long published acclaimed weekly and monthly subscription newsletters for contrarian speculators and investors. They draw on our decades of hard-won experience, knowledge, wisdom, and ongoing research to explain what’s going on in the markets, why, and how to trade them with specific stocks. With big changes afoot, you need to subscribe today. Transcend the false groupthink to thrive!

The bottom line is contrary to the popular belief today, rising- and higher-rate environments are actually very bullish for gold. Rather than making a zero-yielding asset look relatively less attractive, rate hikes serve to hammer conventional stock and bond markets. This leads investors to seek alternatives that rally in times of general-stock weakness. And gold has always been the leading safe-haven investment.

This was certainly true during the epic rate hikes of the 1970s, where gold soared when the Fed was the most aggressive with its extreme rate hikes. And it was also true during the Fed’s last major rate-hike cycle of the mid-2000s, when short rates more than quintupled yet gold still surged. And gold is set to defy today’s silly universal groupthink delusion and power higher again in the coming Fed rate hikes.

********

So how can you profit from this information? We publish an acclaimed monthly newsletter, Zeal Intelligence, that details exactly what we are doing in terms of actual stock and options trading based on all the lessons we have learned in our market research. Please consider joining us each month for tactical trading details and more in our premium Zeal Intelligence service at … www.zealllc.com/subscribe.htm

Questions for Adam? I would be more than happy to address them through my private consulting business. Please visit www.zealllc.com/adam.htm for more information.

Thoughts, comments, or flames? Fire away at [email protected]. Due to my staggering and perpetually increasing e-mail load, I regret that I am not able to respond to comments personally. I will read all messages though and really appreciate your feedback!

Copyright 2000 - 2015 Zeal LLC (www.ZealLLC.com)