Gold And Silver Chart Updates

With 2019 progressing along the path of our 2010+9 thesis, and with the next FOMC meeting slated for next week, we thought this week would be an excellent time to update the charts and begin to look ahead to the back half of the year.

Again, if you haven't yet read our forecast from January, you should do so now. The year 2019 is unfolding in a manner that is strikingly similar to the year 2010. History doesn't repeat, but there sure is a lot of "rhyming" in these posts:

• https://www.sprottmoney.com/Blog/gold-and-silver-2...

• https://www.sprottmoney.com/Blog/recalling-2010-cr...

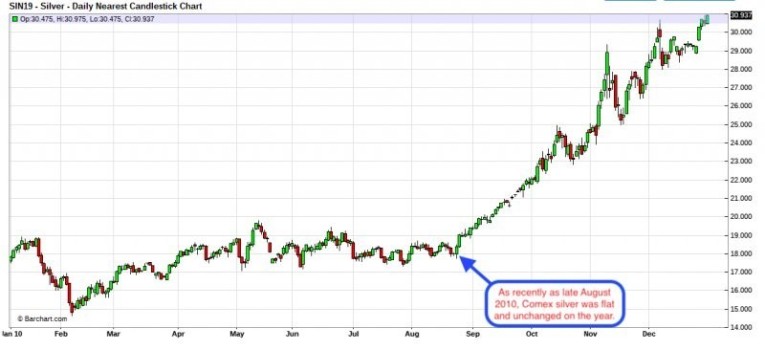

So now here we are already in June and the year is nearly half over, with gold and silver mostly unchanged since January. A few weeks ago, though, we reminded you that the precious metals were mostly flat through the first half of 2010 too. See below:

And here's the thing: just as in 2010, The Fed is about to reverse course. Whether or not they cut the fed funds rate next week is of little import. What matters is that the bond market has already placed Powell and his buddies about 75 basis points "behind the curve"... meaning The Fed needs to cut the fed funds rate by 0.75% just to re-establish a positive slope to the yield curve. But they won't move this quickly, and thus the U.S. economy will continue to slow until the worsening contraction and recession is finally apparent to all.

In the meantime, COMEX gold and silver prices will continue to rally. This will unfold slowly at first, with The Banks fighting price for every tick. However, once clear breakouts are confirmed, momentum and sentiment will increase and prices will begin to accelerate.

For COMEX Digital Gold, be sure to note the most glaringly obvious signal on the chart below. The 200-day moving average of price is the single most important technical indicator of trend, and notice how price came down to this level in April and May and then, on multiple occasions, HELD THIS LEVEL AS SUPPORT. This is an extremely positive development, and one that is indicative of an ongoing bull market and rally.

COMEX Digital Silver is also forming a technical pattern that looks to foreshadow higher prices in the near future. One of the most common technical features seen at price reversals is called a head-and-shoulder formation. At price tops, you'll sometimes see a head-and-shoulder pattern, and at price bottoms you might find a reverse head-and-shoulder pattern that is simply the opposite. On the chart below, do you see what appears to be a textbook, reverse head-and-shoulder low forming? Note the left "shoulder" at $14.60, the "head" at $14.30, and the growing right "shoulder" at$14.60.

By now, you've likely heard of the near-record amount of hedge fund and "managed money" short positions in COMEX silver. As long as price is below the 200-day moving average, these computer traders are mostly pre-programed to sell all rallies, thereby adding to established short positions.

However, once price breaks above the 200-day, the bias will shift to buying the dip. Short contracts will be bought back and "covered", and new long positions will be established. Price will then rally toward $15.80 and $16.00 before staunch Bank-created resistance slows things down once again.

In conclusion, though prices will never be allowed to move uninterrupted straight up, they are definitely headed higher in the back half of 2019 as The Fed loses credibility by fighting against the deflation and economic contraction they created. Halfway through the year, the charts also seem to clearly indicate that this is the case. Therefore, the time is now to establish, or add to, physical precious metal positions.

And acquisition of physical metal is easy... you can even hold it in your IRA! You can store it at a trusted gold bullion storage company or in your own, personal safe. You can hold it in gold bullion coins or silver bullion bars. Take your pick. Just be sure that you understand the tenuous position of the central bankers and their global economy in 2019...and then act accordingly.

The views and opinions expressed in this material are those of the author as of the publication date, are subject to change and may not necessarily reflect the opinions of Sprott Money Ltd. Sprott Money does not guarantee the accuracy, completeness, timeliness and reliability of the information or any results from its use.

********