Gold And Silver: COT Report Nirvana

I’ve talked at length about the relationship between US money supply velocity and interest rates…and done so in a positive way.

I’ve talked at length about the relationship between US money supply velocity and interest rates…and done so in a positive way.

A modest rise in nominal interest rates encourages banks to make loans, and it makes those loans profitable. Most of the QE money has either just sat in bank coffers, or it has been inefficiently invested in US government bonds.

I’ve strongly suggested that modest nominal rates can reduce real rates, by creating inflation. That’s negative for the US dollar, and positive for gold.

That’s the COT report for the US dollar, released yesterday by the CFTC.

Clearly, the deep pocketed commercial traders (banks with “thundercash”) are building a massive short position in the dollar, probably in preparation for an inflationary rate hike from Janet Yellen, on December 16th.

The COT report for gold is in sync with the report for the dollar. The market-leading banks are buying gold aggressively into the current price weakness, and eagerly booking profits on a lot of short positions.

I suggested shorting some gold in the $1170 area, and with the price about $100 lower now, it’s important for all gold price enthusiasts to be buyers. Short position profits also need to be booked.

It’s a waste of time for amateur investors to read bearish analysis now, while giant banks buy gold with both aggression and size.

The bottom line is that Western gold community investors can feel very comfortable, here and now, with their accumulation of the world’s ultimate asset!

In my professional opinion, Janet Yellen is an “inflationist”. Rather than using aggressive rate hikes to halt inflation, she plans to use very modest rate hikes to increase it.

The COT report for silver is also looking very good, and in an environment where inflation begins to rise, money managers will embrace this mighty metal with open arms.

On the big picture front, China continues to make spectacular progress towards internationalizing the yuan, and making it a key world reserve currency.

It’s important to compartmentalize gold’s price drivers. Many analysts appear to have tried to fit a “love trade circle” into a “fear trade square”.

That can’t work. China’s central bank has a stated goal of internationalizing the yuan, and gold plays a stated role in making that happen. The internationalization of the yuan is clearly good news for gold.

Unfortunately for fear trade enthusiasts, yuan internationalization won’t produce a “gold price parabola”. It will produce modest and sustained upwards price pressure, for many years to come.

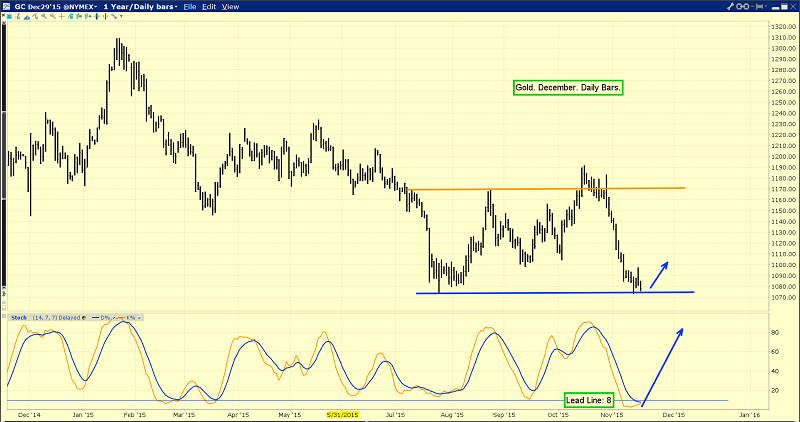

That’s the daily gold chart. Note the beautiful position of my 14,7,7 Stochastics series oscillator, as gold glides into key support. I’m an eager buyer, alongside the banks!

The internationalization of the yuan, and its relatively quick ascent to global reserve currency status, should also turn gold stocks into the world’s most respected equity asset class, and certainly into one of them.

That’s a monthly chart of the Dow. Consistent accumulation of strong assets, on price weakness, creates wealth that is retained during good and bad times.

While I run a highly successful gold-oriented swing trade service at www.guswinger.com, investors should only have a portion of their investable assets devoted to such endeavours. Trading is one part of a complete investment strategy portfolio.

Also, not every market decline is the same. Some are short and violent. Others are Chinese water torture. Some are very modest. It’s difficult to know what form a decline will take when it begins, but professional investors know the decline must be bought.

Amateur investors focus on their drawdowns during the accumulation phase, and professionals focus on the task at hand. For amateur investors that want to take themselves to the professional level, they need to reach deep into themselves, and find a higher level of intestinal fortitude.

I’ll ask all investors in the Western gold stocks community to think hard about that, and to take another hard look at the 10,000 area on my Dow chart. Amateur attempts to avoid drawdowns and pick “final lows” isn’t a proper way to build wealth. It’s financial poppycock. Intestinal fortitude in 2008 at Dow 10,000, and in gold stocks now, is what builds wealth that is here to stay.

That’s the daily GDX chart. I affectionately refer to my 14,7,7 Stochastics series oscillator as “Tony the Tiger”. Tony looks spectacular right now, and is ready to roar a very loud “Buy!” signal, for all gold stock enthusiasts.

Using Fibonacci retracement lines from the January highs near $23, to the September lows near $13, I’ve set an $18 target, which is the 50% retracement line. Gold stock champions (current and prospective) in the Western gold community should be eager buyers now, ready for mega-bank buying signaled by the COT reports to launch gold and gold stocks nicely higher. In the longer term, the role of gold in yuan internationalization will be one of the key price drivers, of a gold stocks bull era!

********

Special Offer For Gold-Eagle Readers: Please send me an Email to [email protected] and I’ll send you my free “Seniors Six Pack Blastoff!” report. I cover six senior gold stocks that appear ready to blast upside, on the price charts, with complete buy and sell strategies for each of them!

Stewart Thomson

Graceland Updates

Note: We are privacy oriented. We accept cheques. And credit cards thru PayPal only on our website. For your protection. We don’t see your credit card information. Only PayPal does. They pay us. Minus their fee. PayPal is a highly reputable company. Owned by Ebay. With about 160 million accounts worldwide.

Email: [email protected]

Rate Sheet (us funds):

Lifetime: $799

2yr: $269 (over 500 issues)

1yr: $169 (over 250 issues)

6 mths: $99 (over 125 issues)

To pay by cheque, make cheque payable to “Stewart Thomson”

Mail to:

Stewart Thomson / 1276 Lakeview Drive / Oakville, Ontario L6H 2M8 Canada

Stewart Thomson is a retired Merrill Lynch broker. Stewart writes the Graceland Updates daily between 4am-7am. They are sent out around 8am-9am. The newsletter is attractively priced and the format is a unique numbered point form. Giving clarity of each point and saving valuable reading time.

Risks, Disclaimers, Legal

Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualified investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is: 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line:

Are You Prepared?

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website:

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website: