Gold And Silver Performance Leave All Else Dead In The Water Since 2001

Wall Street incessantly bombards the media ad nauseam with their hoopla regarding stock investment returns. But let’s take a careful look at what several investment alternatives are available. We will discard out of hand a saving’s account in your local bank…as interest paid on deposits is so ridiculously low.

Wall Street incessantly bombards the media ad nauseam with their hoopla regarding stock investment returns. But let’s take a careful look at what several investment alternatives are available. We will discard out of hand a saving’s account in your local bank…as interest paid on deposits is so ridiculously low.

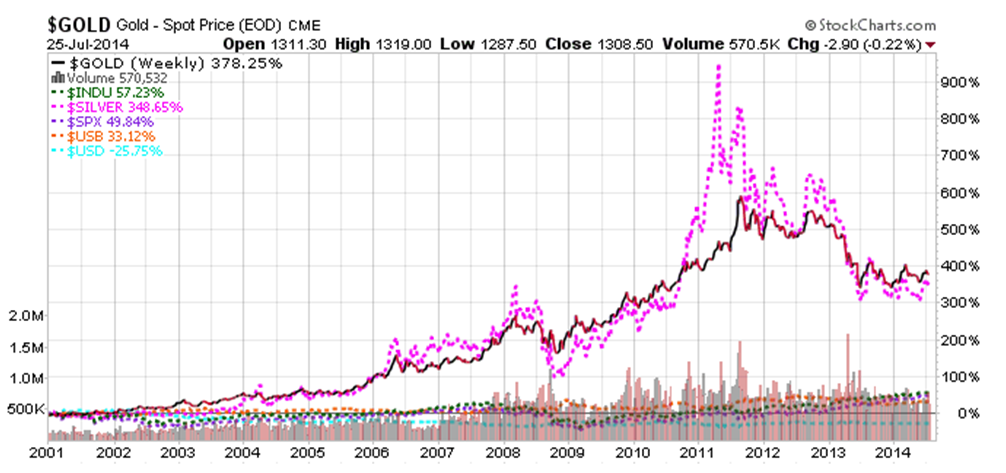

Here is the performance (return) of GOLD & SILVER compared to...since 2001:

It ain’t even close, folks! During the past 14 years Gold’s performance was:

- more than 7 times the return of the DOW Stock Index

- more than 7 times the return of the S&P500 Index

- more than 11 times the return of US T-Bonds

What About Gold’s Consolidation Since October 2011?

History is testament all bull markets eventually experience a period of consolidation. It goes with the turf so to speak. From 2001 to September 2011 the shiny yellow rose parabolically +650%...that’s a staggering +22% Compound Annual Growth Rate (CAGR). Since its peak in 2011 gold dropped to about the $1,200 level, where it subsequently formed a bullish Double Bottom. Additionally, dramatic upside breakouts have occurred in MACD and RSI Technical Indicators. Moreover, more emblematic that the bottom is indeed in, is the fact gold’s weekly price trend has staged a 16-month Breakout early this year (see chart below).

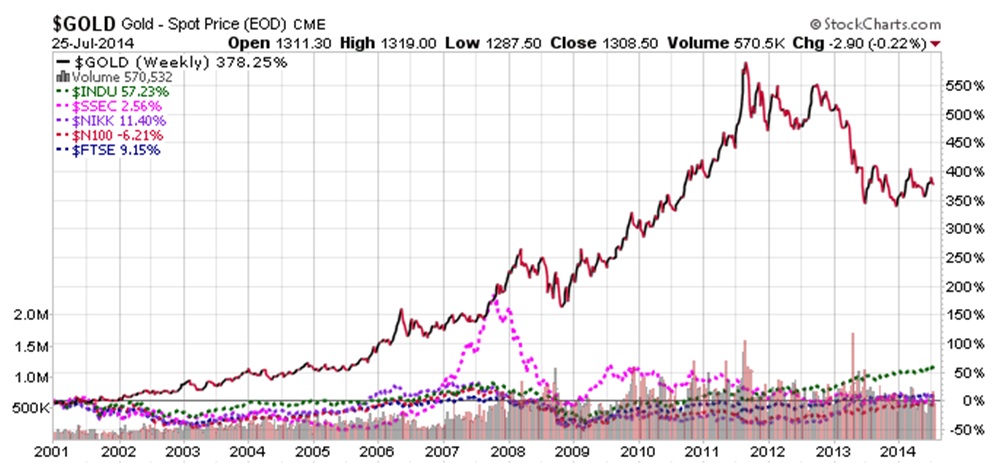

Gold Out-Performs All Global Stock Markets Since 2011

To be sure there are skeptics who point out that since 2011 gold and silver have been consolidating, while stocks and bonds have enjoyed material appreciation. True…but we would be remiss not to observe that the vast majority of investors are long-term prudent investors rather than short-term speculators. The most distinguished and prudent long-term investor is today the richest man in the world…namely, Warren Buffett with a total net worth estimated at $62 billion by Forbes, overtaking Bill Gates, who had been number one on the Forbes list for 13 consecutive years.. Moreover, this analyst cannot name one short-term speculator who can hold a candle stick to guru Buffett’s monumental success in wealth building via his long-term investing philosophy. Indeed and fact most short-term speculators are eventually wiped out as they try to “time” the markets.

It is safe to say that since the turn of the millennium, long-term investments in any form of precious metals have performed in sterling fashion vis-à-vis common stocks in the USA, Euro Union, China, Japan, Shanghai and FTSE-UK. See comparative returns in the chart below:

Gold’s Performance vs Stock Indices of the USA, Euro Union, China, Japan, Shanghai and FTSE-UK since 2001:

In light of the astounding difference in total returns during the past 14 years, it is astonishing that so few investors have taken profitable advantage of precious metals spectacular performance. It is a well-documented fact that less than 2% of investors worldwide have any form of precious metals in their portfolios. Nevertheless, this will change in the next 5-10 years as investors worldwide will stampede into all forms of precious metals in order to escape the global devaluation contagion that is brewing on the horizon. Bank on it, because Central Banks around the world have recently been accumulating gold.

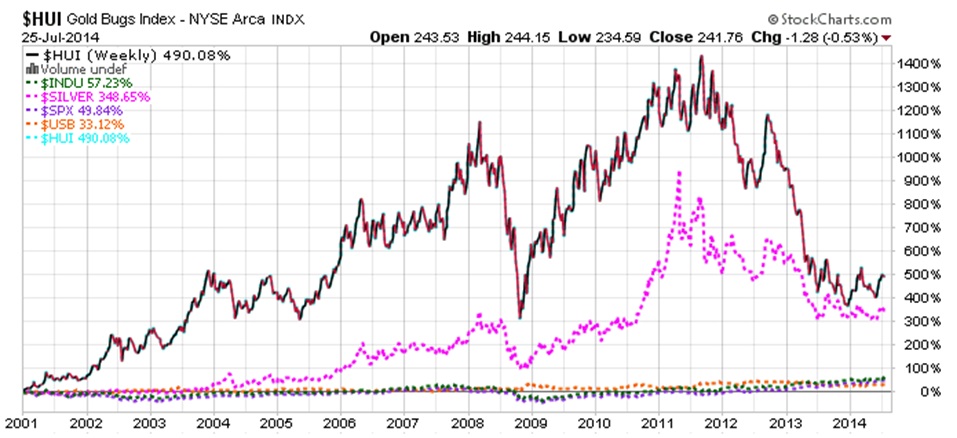

Gold & Silver Stocks Did Even Better (HUI)

HUI Index………………………………..soars +490%

Gold & Silver Stocks Index (HUI Index)

Read More: Gold Price Prediction Based On Technical Analysis & China Demand

Gold Price Prediction Based On Technical Analysis & China Demand

Since September 2011 gold has been consolidating in a traditional bear market correction. However, this Gold Bear is already too long in the tooth when compared to all Bear Markets since 1972. In the period 1972-2006 there have been 13 Gold Bear Markets. The average Bear Market saw gold losing -33% of its value over an average period of 538 days. Compare this to the current Bear Market where the gold price has fallen -38% in approximately 660 days. Ergo, one may reasonably conclude the present Gold Bear is indeed very long in the tooth – and most probably ended with the creation of the bullish Double Bottom at about $1190. Please see supporting analysis “Gold To Rise Like The Proverbial Phoenix In 2014-2015”

https://www.gold-eagle.com/article/gold-rise-proverbial-phoenix-2014-2015

It behooves to also read: “Gold Price Prediction Based On Technical Analysis & China Demand”

Related Analysis:

Soon Rates Will Spike and So Will Gold

What will Fuel And Drive Precious Metals Higher In the Next 5-10 Years?

Soon Rates Will Spike and So Will Gold

More Technical Analysis strongly suggesting gold has indeed put in a bottom with screaming (monthly) Buy-Signals of CCI, RSI and Slow Stochastics (see chart below).

Compelling Reasons why the Gold Bull is Alive and Well…and will make record all-time highs during the next 2-5 years:

- Gold’s consolidation since 2011 is long in the tooth and appears to have put in a bottom

- Gold’s Technical Indicators are extremely bullish with 16-month price trend breakout

- Few investment alternatives with comparable performance since 2001

- Newsletters heralding the profitable benefits of precious metals

- Ease of pervasive global communication via the Internet

- Growing threat of global devaluation contagion

- Possible worldwide stock market crash

- Central Banks aggressively increasing gold accumulation

- The China Factor

The wild trump card in the golden deck is CHINA. Today, China is the world’s largest consumer of GOLD. The Sino nation surpassed India in gold demand in 2013. China has four pressing reasons why its gold consumption will go viral in the not too distant future:

- No Investment Alternatives with comparable returns for its 1.3 Trillion population

- Their covert objective is to have a gold backed Renminbi (yuan)

- China’s Money Supply is exploding 3 times faster than USA’s M2

- $1 Trillion US Treasury Holdings over loaded with FOREX risk with a mere 2% of its Total Foreign Reserves in gold vs 74% of most major world nations (see chart)

The future price of gold will far surpass the forecast of the most bullish predictions in view of all the above.

********