Gold And Stock Market Cycle Update

Last week's action was a choppy affair, with gold forming its low in Wednesday's session - here doing so with the tag of the 1474.30 figure. From there, a bounce back was seen into a Thursday high of 1485.80 - before backing slightly off the same to end the week.

Gold, Short-Term Picture

For the near-term action, the upward phase of the 10-day cycle was recently deemed to be in force, with the downward phase of this wave seemingly back in force - but is back into bottoming territory. Here again is that 10-day wave:

In terms of patterns, our favored path has been for a countertrend decline with this 10-day wave, which simply means that the metal should try and remain above the prior 10-day trough of 1463.00 (February, 2020 contract). In terms of time, we are now at or into our projected bottoming date for this wave, which was noted in our Gold Wave Trader report as being the December 20-23 region.

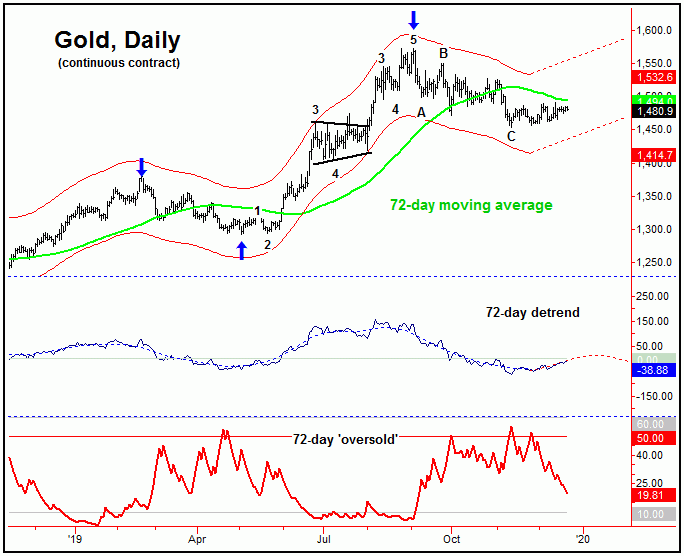

With the above said and noted, a countertrend decline with this 10-day cycle should give way to a push back above the 1491.60 swing top in the coming days, due to the configuration of our larger 72-day component, shown below:

In terms of time, this 72-day cycle is ideally pushing up into the mid-January, 2020 timeframe or later, where we are expecting a countertrend high to materialize - holding below the early-September peak of 1573. If correct, another correction of significance is expected to play out into the Spring of 2020, where we are looking for a more important bottom to materialize.

Going further with the above, the next mid-term low for gold should come from the larger 310-day component, shown again on the chart below:

In terms of price, we are looking for an eventual drop back to the 310-day moving average or lower in the coming months, though with a 72-day cycle (countertrend) upward phase playing out in-between. In terms of patterns, the probabilities favor the downward phase of the larger 310-day wave to also end up as countertrend, against the August, 2018 bottom - the prior labeled trough for this larger-degree cycle.

Gold Sentiment

In looking at the latest numbers from the CFTC, the commercial hedgers added back to the short side some 16,000 contracts last week, which puts their current net bearish total up to 318,619 contracts - with the data current to the December 17, 2019 close. As mentioned in prior months, the current net shorts held by the commercial hedgers is seen as the most bearish indication for the gold market, at least until we can get our 310-day cycle bottom out of the way next Spring.

U.S. Stocks Melting Up into January

As noted in recent weeks, the last semi-important bottom for stocks was registered back in early-December, doing so with the tag of the 3070.33 SPX CASH figure. That low was our expected bottom with the 45-day cycle, which is seen as pushing higher into early-to-mid January of next year:

In terms of price, I mentioned in prior articles the decent potential for a push up to the 3216 SPX CASH figure or better, simply due to a statistical analysis of price regarding this 45-day wave. With the action seen into late last week, this assumption has now been met. Having said that, with so much time left for the upward phase of this 45-day wave to play out, the natural assumption has to be for higher highs in the days ahead - such as a test of the 3250's or better on the SPX.

Stock Market Sentiment

In looking at sentiment with U.S. stocks, the commercial hedgers here have started to scale into the short side of the market. Take a look:

With the latest data, the commercial hedgers for stocks have added around 2,500 contracts to the short side, which puts their current net short total up to some 2,779 contracts - with the data current to the December 17, 2019 close. This is not a large position, and is currently not supportive of a larger correction with stocks - at least at the present time. We are expecting this to change in the coming weeks, however, as the next decent swing top attempts to form in January.

The bottom line with the above is that both stocks and gold are favored higher into January, then to be on the lookout for the next semi-important peak for both markets. Stepping back, a mid-term correction phase (i.e., 8-10% or more) is expected to play out with stocks into next year, with gold looking for an important bottom around early-Spring. We'll take a look at the bigger picture assessment as we move along. Happy holidays to all, and best wishes heading into the year 2020!

Jim Curry

The Gold Wave Trader

http://goldwavetrader.com/

http://cyclewave.homestead.com/