Gold Bulls: Don’t Count On Yield Curve

Are we going to fall into the trap of a self-fulfilling prophecy? Could investors trigger recession only because they are so worried about inversion of the yield curve? We invite you to read our today’s article about the yield curve and find out whether the popularity of the yield curve as an indicator of recession will bring on the recession that everyone is so afraid of.

In the last edition of the Market Overview, we have discussed whether gold investors should worry about the yield curve. Or should they keep their fingers crossed for its inversion? We concluded that not necessarily, as its predictive power has weakened and it doesn’t say anything about the timing of recession.

However, the yield curve theory of recession has become extremely popular. It’s so hot topic that even Congressmen have been asking the Fed Chair about it in recent times, in particular Chairman Powell on July the 17th and the 18th. So the key question arises: if investors are so afraid of the inversion, is it possible that it will eventually cause recession? It might be an objectively wrong predictor, but if investors believe that it is the right indicator, will they not start selling assets, triggering correction, or even recession?

In other words: can we fall into the trap of a self-fulfilling prophecy? What is it? As American sociologist Robert K. Merton defined, it is initially “a false definition of the situation evoking a new behavior which makes the original false conception come true.” The key here is the observation that people’s actions are determined not only by the actual reality, but also by its perceptions and expectations. For example, if people are convinced that the war is inevitable, they can start it, fulfilling the prophecy. Or if people expect inflation tomorrow, they can buy goods today, which boosts prices, creating an inflationary spiral. Or, if people are certain that the inversion of the yield curve will bring recession, they can stop investing in risky assets or even start selling them in anticipation of the crash. If investors do it en masse, they can bring on the recession they were so afraid of!

Although it seems convincing, there are some problems with that approach. First of all, psychology is a powerful driver of the human behavior, but we shouldn’t neglect the objective reality. Expectations and beliefs don’t come out of nowhere. The war cannot outbreak without the real hostility. Inflation cannot emerge without too many dollars chasing too few goods. Recession cannot start without the liquidation of the wrong investments.

Are entrepreneurs guided by the slope of the yield curve? I doubt it. You see, the yield curve is just a symptom. It’s not an independent factor. It is the curve, which depicts the yields of securities of different maturities. So it’s a result of myriad investment decisions undertaken by traders acting in distinct segments of the interest rate structure.

Another problem is that if people are supposed to anticipate the inversion of the yield curve and act accordingly earlier, why couldn’t they anticipate that and act even earlier? Or, if everyone talks about the yield curve, shouldn’t it be already priced in?

We are not saying that it is not a relevant factor for investment decisions (it is, especially for financial intermediaries), but it shouldn’t be analyzed in isolation and in abstraction of the broader context. Instead, we should look at the underlying drivers. Such as? Oh, we don’t know, maybe the Fed’s actions? Usually, the yield curve inverts when the Fed tightens, as it increases the short-term interest rates relatively to the long-term yields. But the crucial thing is that the recession occurs when the central bank tightens too much. A lot of bad can be said about the Fed, but its monetary policy remains too loose rather than too tight.

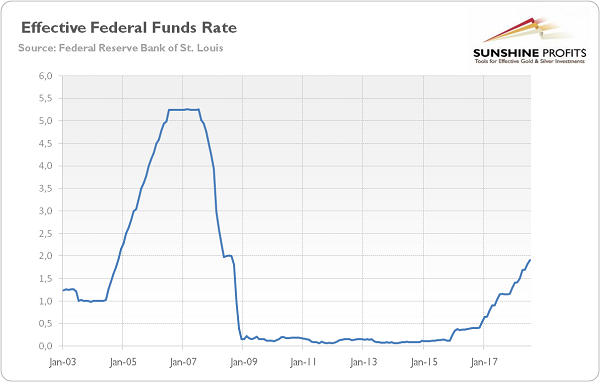

Just take a look at the chart below, which shows the effective federal funds rate since 2003, enabling us to compare the current tightening cycle with the previous one. As one can see, the Fed ended lowering rates in mid-2003 and kept them unchanged for a year. It started to lift them up in June 2004 and continued hiking them until July 2006. In that, the US central bank raised rates from 1.00 to 5.25 percent, which means an increase of 4.25 percentage points over two years. It translates into an average hike of 16 basis points each month.

Chart 1: Effective Federal Funds Rate from January 2003 to July 2018.

Meanwhile, after the Great Recession, the Fed kept the interest rates unchanged for seven years. And it raised the target from 0-0.25 percent in December 2015 to 1.75-2.00 percent currently. It implies an increase of 1.75 percentage points in 33 months, or 5 basis points per month, which is ridiculously little (if we add two more hikes in 2018, the average goes up to 6 basis points, still not a very impressive number).

The conclusion is clear. The yield curve might inverse in the near future. And people may overreact to that. In the short-run, it could support gold as the save-haven asset. But it might be also the case that the markets will just shrug the inverted yield curve off. As the media sow fear about the potential disastrous effects, when the actual event finally comes, nobody cares about it. Think about North Korea or trade wars. The same might happen with the yield curve, which will be rather negative for the gold prices. Anyway, although we remain long-term gold bulls, the medium-term outlook for the yellow metal is unfavorable. The yield curve is not likely to change it.

Arkadiusz Sieron

Sunshine Profits - Free Gold Analysis

* * * * *

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.