Gold Chartbook: Profit-Taking in the Gold Market?

Since breaking above USD 2,530 in late August, gold prices have only known one direction: upward. Following a meteoric rise, a new all-time high of USD 2,790 was reached last week on Wednesday. A significant consolidation or even a genuine correction have been notably absent so far. Amid increased volatility, there have only been two sharp but overall very modest pullbacks. Instead, gold bulls have been charging from one all-time high to the next.

The broader rally in the gold market has been ongoing since autumn 2022, already. The triple bottom at USD 1,615 marked the trend reversal at that time. However, the uptrend has only gained significant momentum in the last 13 months. Starting at USD 1,810 on October 5th, 2023, gold has recorded an impressive increase of over 54%.

“War premium” in the gold market

The geopolitical escalation in the Middle East, particularly since the Hamas invasion, has been one of the main drivers. Of course, the ongoing drama in Ukraine, strong physical demand from Asia, and the progressing BRICS move away from the US dollar have also played crucial roles. Consequently, one could argue that the significantly increased gold price incorporates a certain “war premium.”

Should Donald Trump win the 2024 US presidential election, there are strong indications that he would pursue a de-escalation strategy for both the Ukraine conflict and tensions in the Middle East. Regarding Ukraine, Trump’s advisors outline a model of a “frozen conflict” with autonomous regions and a demilitarized zone, with Ukraine remaining outside NATO. Trump himself criticizes the current situation, emphasizing that any deal, even a bad one, would be better than the present state. A similar approach can be anticipated for the Middle East, where Trump would likely rely on his perceived deal-making abilities to defuse conflicts through negotiations and economic pressure, rather than resorting to military solutions. Whether Donald Trump will actually bring about de-escalation remains uncertain. Currently, our interest as investors lies in whether markets might begin to price in a future easing of tensions under a Trump presidency. This could indeed lead to profit-taking in the overbought gold market.

Democrats and Republicans been driving up the national debt

Of course, Trump will not be able to solve the problem of dramatic US debt. In fact, both Democrats and Republicans have demonstrated remarkable skill in driving up the national debt. But his election victory could trigger a multi-week pullback in precious metal prices, similar to what occurred in 2016. At that time, his surprising victory initially caused a sharp spike to nearly USD 1,340 on election night. However, by the next morning, gold prices collapsed, plummeting to USD 1,122 (-16.6%) over the following six weeks!

Consequently, we would be somewhat cautious in the short term. According to a Bloomberg survey, over two-thirds of the experts surveyed recommend gold as a hedge against the uncertainties of a Trump presidency. As convinced contrarians, we become alert to such rather one-sided expectations and suspect the opposite, as the potential for a larger surprise lies in a falling gold price. In the medium to long term, however, Trump’s announced economic policies, particularly regarding tariffs, tax cuts, and trade wars, could weaken the US dollar and reignite inflation. This, in turn, could make gold even more attractive.

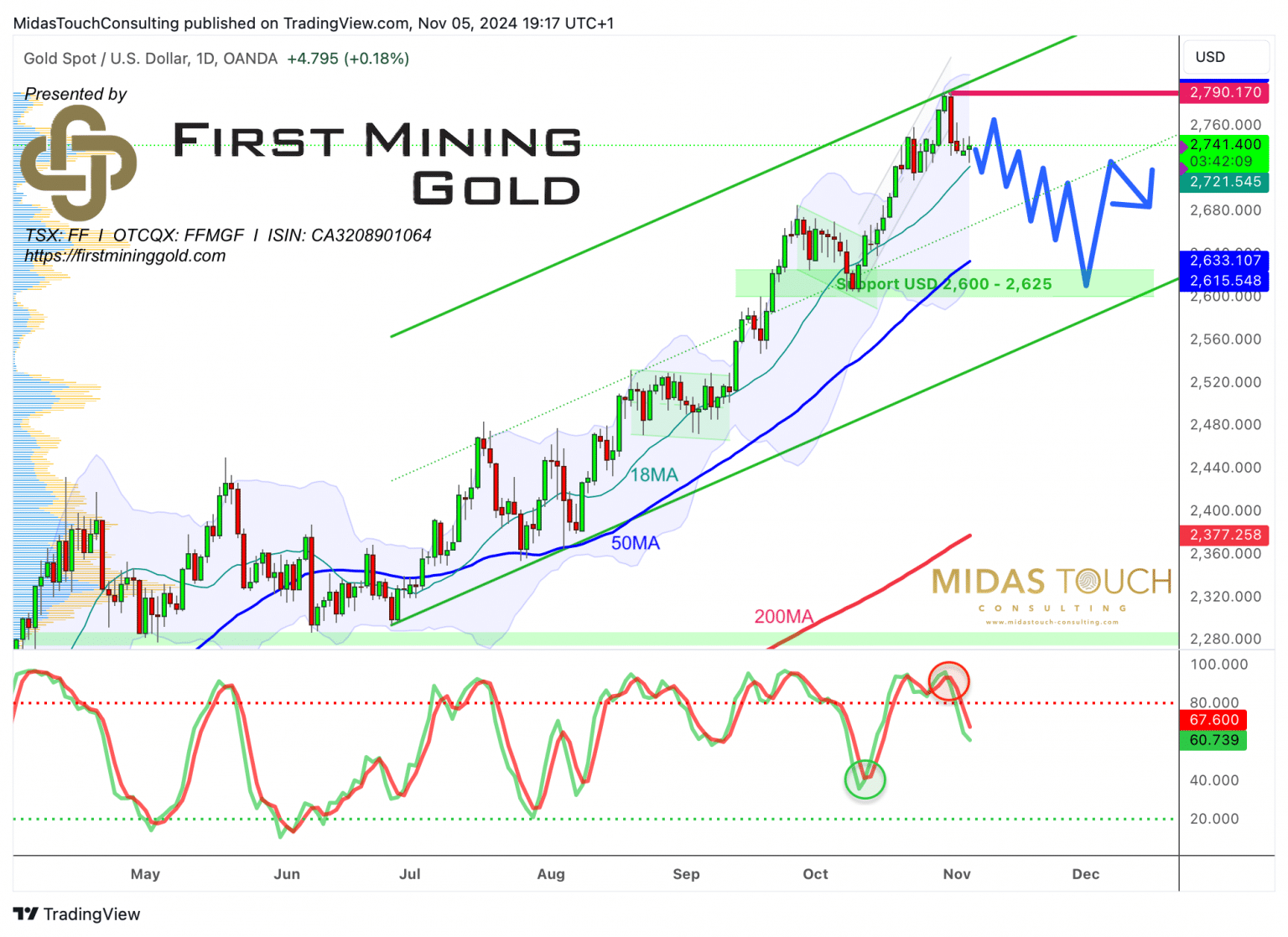

Gold in US-Dollar, Daily chart

Gold in US-Dollar, daily chart as of November 5th, 2024. Source: Tradingview

The gold price has been showing an almost linear upward trend on its daily chart for months. Even during the few multi-week consolidations, the bears had little to celebrate. A break in the established uptrend would only be considered at gold prices below USD 2,500. However, increased volatility and potential profit-taking could lead to testing of various support zones in the coming weeks. A particularly strong support zone awaits around USD 2,600.

As of last Thursday, the daily stochastic has lost its bullish embedded status and activated a sell signal. But so far, bears have only been able to push gold prices down by around USD 65 towards the first support zone at around USD 2,730. Already at these levels we are seeing gold’s typical behavior of the last six months. After a steep and rather sudden sell-off, new buyers quickly come into the gold-market and prices start to creep higher again.

However, many leveraged speculators are sitting on exceptionally high profits, which could be realized at any time in the paper gold market with a mouse click. Regardless of the fundamental conditions but due to the heavily overbought situation, this could trigger a larger wave of healthy profit taking. With some patience and a solid liquidity position, a good buying opportunity might present itself in the coming weeks, as the overall uptrend remains intact and gold has not yet reached all its mid-term price targets. In particular, a revisit of the fast rising 50-MA (USD 2,633) is what we have in mind.

Trump’s Potential Election Victory: Profit-Taking in the Gold Market?

The gold price has been in an impressive uptrend for months, driven by geopolitical tensions, strong physical demand from Asia, and the increasing move away from the US dollar by BRICS countries. Western investors have only been returning to the precious metals sector since spring, with both the silver price and mining stocks still showing considerable catch-up potential.

These factors have led to a certain “war premium” in the gold price, driving it to new all-time highs. Despite the overbought market condition and the possibility of short-term corrections, particularly in view of the upcoming US presidential elections, the overall uptrend remains intact.

A potential election victory for Donald Trump could initially lead to profit-taking in the Gold Market and a short-term correction, similar to what happened in 2016. However, in the long term, Trump’s economic policy approaches, such as tariffs and tax cuts, could weaken the US dollar and fuel inflation, which in turn would support the gold price. Investors should therefore remain vigilant and consider possible corrections as buying opportunities, as the gold market has not yet reached all its price targets and the fundamental drivers for a higher gold price continue to exist.

Gold above USD 3,000 by spring 2025

Our price target of “about USD 2,745 to USD 2,800” has been pretty much achieved with USD 2,790. We expect the gold price to continue rising to at least USD 3,080 to USD 3,100 by spring 2025. A possible pullback to the range of about USD 2,600 to USD 2,625 in the coming weeks could therefore provide a promising entry point.

********

Florian Grummes (born 1975 in Munich) has been studying and trading the Gold market since 2003. In 2008 he started publishing a bi-weekly extensive gold analysis containing technical chart analysis as well as fundamental and sentiment analysis. Parallel to his trading business he is also a very creative & successful composer, songwriter and music producer. You can reach Florian at:

Florian Grummes (born 1975 in Munich) has been studying and trading the Gold market since 2003. In 2008 he started publishing a bi-weekly extensive gold analysis containing technical chart analysis as well as fundamental and sentiment analysis. Parallel to his trading business he is also a very creative & successful composer, songwriter and music producer. You can reach Florian at: