Gold Charts Eye Candy

Technically, all sectors of the gold market look bullish.

Technically, all sectors of the gold market look bullish.

Regardless of whether a daily chart, weekly chart, or a monthly chart is used, all technical lights are green.

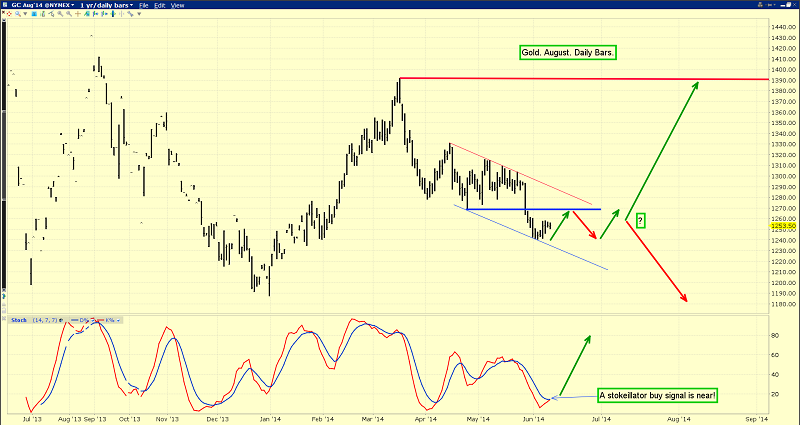

Note the bullish position of my stokeillator (14,7,7 Stochastics series) on this daily gold chart.

On a historical basis, crossover buy signals on this key daily chart oscillator are typically followed by $50 -$150 gold price rallies.

Silver looks stronger than gold. A buy signal for the stokeillator is already in play, and silver is often a leading indicator for gold.

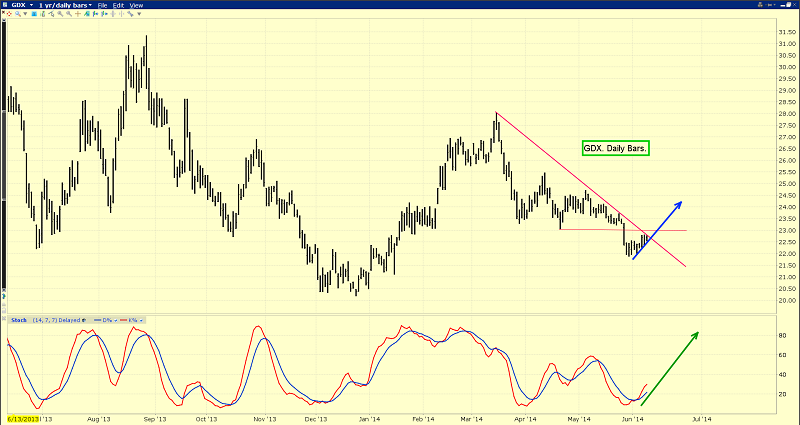

The daily charts for gold stocks also look great. A tentative uptrend is now in play on this daily GDX chart.

The weekly charts suggest that investors who are waiting for gold to bottom in July are at risk of missing an enormous rally that appears to already be underway. The technical price patterns that tend to be the most reliable, tend to be what I call “eye candy”.

When a weekly chart pattern of decent size is also aesthetic, it gets my attention, and the bullish wedge that I’ve highlighted on this weekly gold chart is simply “drop dead gorgeous”.

What about the fundamentals? On the American front, inflation is the key driver of institutional liquidity flows into gold stocks, or out of them. ‘There is evidence that inflation is now "moving higher," said James Bullard, the president of the St. Louis Fed, on Monday. This is a significant shift in Bullard's outlook.’ –MarketWatch News, June 9, 2014.

In the late fall of 2013, I predicted the Fed would taper its QE program “all the way to zero” in 2014.

Some mainstream analysts made the same prediction, but their view was based on a US economic recovery.

In contrast, my view was that the Fed was anticipating a surprisingly sudden rise of inflation, and trying to prevent it with the taper.

That’s why I predicted the taper would be a bullish event for gold. I suggested the US stock market would not crash as the taper occurred, but it would lose momentum, creating a lot of disappointment for investors.

Bullard’s statements made yesterday, suggest to me that the Fed will continue to taper its QE program, and may even accelerate the rate of the taper, as more Fed governors and presidents voice concerns about inflation. That’s bullish for gold.

This ratio chart compares the daily price action of an Indian stock market ETF (INDA-NYSE) to a well-known US stock market ETF (DIA-NYSE).

The picture clearly speaks a thousand words.

As terribly as the US market is performing now against gold-hungry India, an acceleration in the rate of tapering could make a bad US stock market situation much worse.

Sadly, a number of gold stock investors appear to have sold their gold stocks at the December 2013 lows, and moved into the US stock market.

As “crash season” (August – October) approaches, the danger of a significant sell-off in Western stock markets is growing.

Many value-oriented money managers have already exited the US stock market, and an uptick in inflation would send many more managers to the exit door.

Investors who have managed to eke out gains of perhaps 2 – 3% in the US stock market in the past few months, are taking on tremendous risk now, to make marginal returns. I own Indian dividend-oriented stock, and I’m thrilled with the risk-reward profile of this vibrant market.

Importantly, as the stock market makes Indians wealthier, they tend to use that wealth to buy more gold at key “gold tonnage festivals” like Diwali.

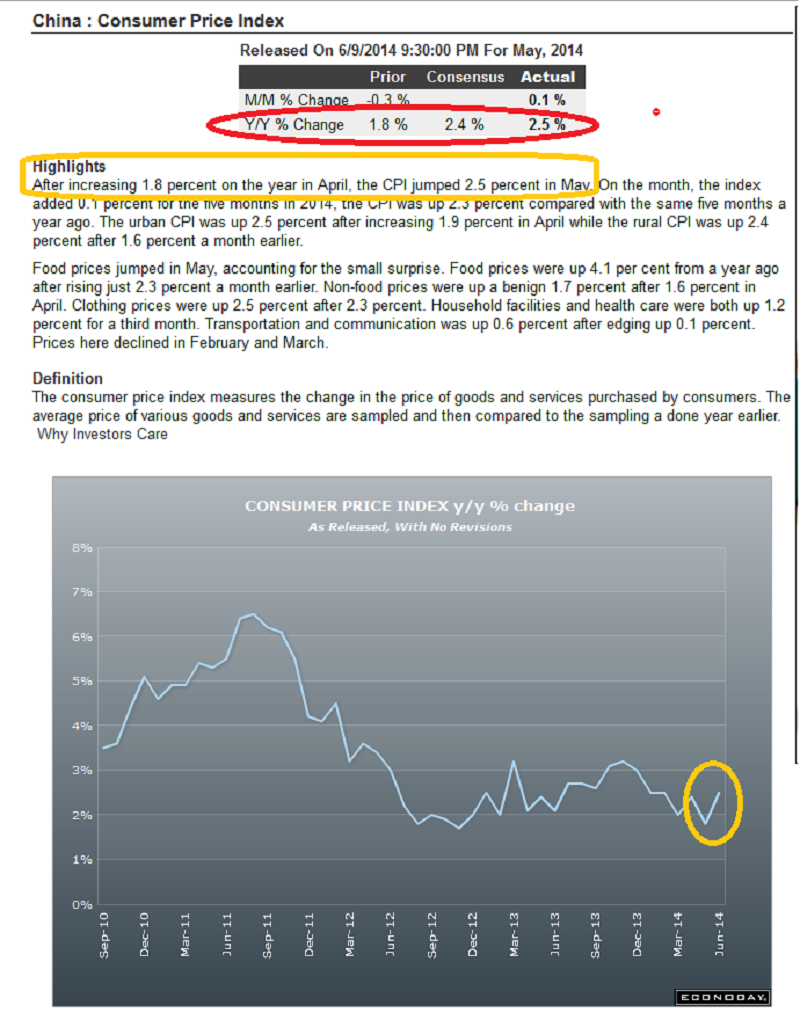

Rising inflation is not just a US problem. Chinese consumer inflation has also started to rise, and it could rise more, as the nation tries to transition from exports to consumption.

With precious metals “eye candy” charts in play and inflation acting as a friend to gold, it could be a truly golden summer for the Western gold community!

Special Offer For Gold-Eagle Readers: Please send me an Email to [email protected] and I’ll send you my free “China Crash: Implications For Gold!” report. I don’t believe China will crash, but recent events at metals warehouses present a global markets risk that needs to be professionally managed. I’ll show you how I do that in the market, and what the issue means for gold!

Note: We are privacy oriented. We accept cheques. And credit cards thru PayPal only on our website. For your protection. We don’t see your credit card information. Only PayPal does. They pay us. Minus their fee. PayPal is a highly reputable company. Owned by Ebay. With about 160 million accounts worldwide.

Email: [email protected]

Rate Sheet (us funds):

Lifetime: $799

2yr: $269 (over 500 issues)

1yr: $169 (over 250 issues)

6 mths: $99 (over 125 issues)

To pay by cheque, make cheque payable to “Stewart Thomson”

Mail to:

Stewart Thomson / 1276 Lakeview Drive / Oakville, Ontario L6H 2M8 Canada

Stewart Thomson is a retired Merrill Lynch broker. Stewart writes the Graceland Updates daily between 4am-7am. They are sent out around 8am-9am. The newsletter is attractively priced and the format is a unique numbered point form. Giving clarity of each point and saving valuable reading time.

Risks, Disclaimers, Legal

Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualifed investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is: 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line:

Are You Prepared?

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website:

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website: