Gold: Chinese Gamblers Take Centre Stage

China. The citizens of this economic superpower have been the “prime mover” for the latest collapse of global government fiat money against gold.

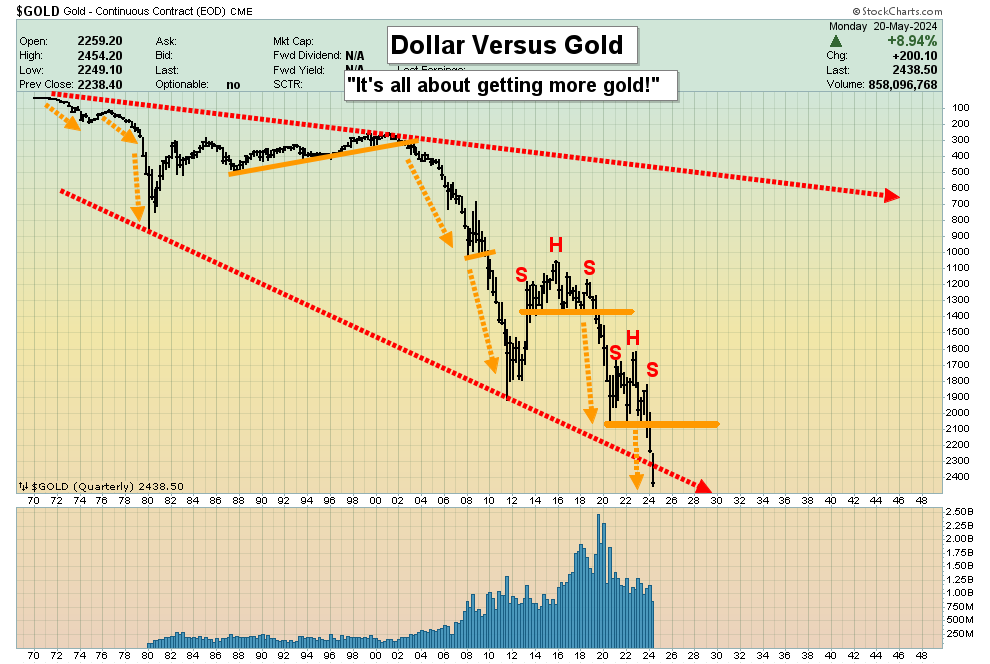

Double-click to enlarge what is arguably the greatest chart in the history of financial markets. The collapse of fiat against gold is incredible!

Chinese and Indian citizens eagerly gobble up most of the gold produced by the mines of the West, and their gobbling is set to intensify over the coming decades.

Chinese gold bullion imports have been averaging 100+ tons/month.

That’s solid action and if gold does swoon a bit more significantly in the coming weeks, Indian citizens are ready to buy. That would put a new floor of size under the price. The bottom line:

Gold is incredibly stable here, even after the huge move up. For a look at the daily chart:

There was a breakout from a drifting rectangle (a bull flag on some charts) but basis RSI and Stochastics, gold is again overbought.

Chinese citizens are the world’s biggest gamblers and they’ve been gambling with gold on their futures market (SHFE).

The April 12 high for gold at about $2448 was created by the exchange hiking margins, and another hike was announced yesterday.

It takes a few weeks for these gamblers to adapt to the new capital requirements. The good news is that the Indian election results will be announced soon.

Once that’s out of the way the citizens there will be ready to buy any sale in the price. That’s likely to be quickly followed by Chinese gamblers racing to buy. The bottom line is that the month of June could see gold and silver wearing space helmets… and heading straight for a fiat price moon!

This is the palladium ETF chart. This metal is showing signs of basing.

For a look at platinum:

This is the PPLT ETF chart. A large base pattern is also in play.

A lot of commodities look very perky and grocery store inflation is obvious. Governments want lower rates so they can borrow more fiat to spend on themselves with outrageous recklessness, but “man on the street” inflation and buoyant commodity markets are going to make those cuts a very difficult task for the Fed to accomplish.

To view one way that it could happen:

While the Nasdaq and SP500 have made strong new highs, the Dow Industrials have only barely done it.

The action of the Dow Transports is even more concerning.

The US government’s failed proxy wars in Ukraine and Gaza could soon become much bigger quagmires than they already are. An ominous turn of events in either war could create a stock market crash and the Fed would race to cut rates.

Many black swans are in flight. Any one of them could crash the market. Aug 1-Oct 31 is US stock market “crash season” and out-of-control US government debt, war mongering gone wrong, and marked to model bond market losses held by banks are just three of the many catalysts that could take the market down.

A daily focus on the big picture (fundamental, cyclical, and technical) is critical for investors as inflation, recession, the 2021-2025 war cycle, a wildly overvalued stock market, debt ceiling horror, and empire transition dominate the investing landscape. I cover this big picture 5-6 times a week in my flagship Galactic Updates newsletter. At $199/year, investors feel the price is too low, but I’m offering a $179/15mths “special offer” that investors can use to get in on the winning action and meticulous analysis. Click this link to get the offer or send me an email and I’ll get you a payment link. Thanks!

What about crypto?

While bitcoin has failed as a currency, it’s a great tool to make fiat profits that are then converted to ultimate money gold. I walk new investors through the maze that is crypto with simple zones to buy and sell (with ETFs) in my crypto palace newsletter.

With all fiats heading to the dust bin and de-dollarization moving into a more aggressive stage, Western gold bugs are wisely transitioning their focus from making temporal fiat profits… to getting more gold.

Importantly, with the stock and bond markets ridiculously overvalued and crypto a niche market, it’s clear that mining stocks are the best way to quickly make large fiat profits that can later be converted to gold.

This is the phenomenal silver stocks ETF chart. A situation much like that of the 1970s is emerging, except this time the most exciting futures trading and margin hikes are in China. The metals and miners surge and the authorities try to temper the action, but then the rallies resume even more aggressively than before.

This is the fabulous GDX daily chart. The oscillators are slightly overbought, but any pullbacks can be bought… with the expectation of an even bigger upside surge being imminent.

This is the stunning GDX versus gold ration chart. Mainstream analysts and even some gold bugs are puzzled by the gold stock rally that “just won’t quit”, but this chart suggests that the party is just getting started!

Thanks!

Cheers

St

Special Offer For Gold-Eagle Readers: Please send me an Email to [email protected] and I’ll send you my free “Get Jacked With J!” report. I highlight key GDXJ stocks that could surge after Fed man Jay’s speech this week! Both core and trading position tactics are included in the report.

Stewart Thomson

Galactic Updates

Note: We are privacy oriented. We accept cheques, credit card, and if needed, PayPal.

Written between 4am-7am. 5-6 issues per week. Emailed at aprox 9am dailyhttps://www.gracelandupdates.com/

Email:

Rate Sheet (us funds):

Lifetime: $1299

2yr: $299 (over 500 issues)

1yr: $199 (over 250 issues)

6 mths: $129 (over 125 issues)

To pay by credit card/paypal, please click this link:

https://gracelandupdates.com/subscribe-pp/

To pay by cheque, make cheque payable to “Stewart Thomson”

Mail to:

Stewart Thomson / 1276 Lakeview Drive / Oakville, Ontario L6H 2M8 Canada

Stewart Thomson is a retired Merrill Lynch broker. Stewart writes the Graceland Updates daily between 4am-7am. They are sent out around 8am-9am. The newsletter is attractively priced and the format is a unique numbered point form. Giving clarity of each point and saving valuable reading time.

Risks, Disclaimers, Legal

Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualified investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is: 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line:

Are You Prepared?

********

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website:

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website: