Gold Cycle Update; A Look at U.S. Stocks

With the most recent market action, I wanted to post a quick update on the Gold cycles, then to take a detailed look at the U.S. stock market.

With the most recent market action, I wanted to post a quick update on the Gold cycles, then to take a detailed look at the U.S. stock market.

Gold's 72-Day Cycle

The 72-day cycle is currently the most dominant cycle in the Gold market, and is shown on the chart below:

Until proven otherwise, the downward phase of our 72-day cycle is still deemed to be in force, though is at or into bottoming range. While it is possible this wave has already bottomed, we don't yet have confirmation - though are waiting for the same to develop in the coming days.

Once this 72-day cycle does trough, its next rally is set to take Gold higher into mid- January, 2025 or later - a move currently anticipated to be a countertrend affair, due to the position of our bigger 310-day wave, shown below:

In terms of patterns until proven otherwise the next rally phase with our smaller 72-day cycle (into January, 2025 or later) is favored to end up as a countertrend affair - holding below the 2825.90 swing top, which is the currently-labeled peak for this bigger 310-day component.

If correct, what follows should be another 72-day cycle downward phase playing out into next Spring, which would take Gold back to its 310-day moving average - before setting up our next mid-term buy. From there, the ideal path would favor a sharp rally of some 20-25% or more, playing out into later next year.

With the above said and noted, we are currently in 'wait-and-see' mode in regards to Gold, and with that I thought we would take a more detailed look at the cyclical position of U.S. stocks - which is in the process of forming a mid-term top.

U.S. Stocks, Short-Term

For the short-term picture, the upward phase of the 10 and 20-day cycles is deemed to be in force on the SPX (S&P 500 index), though are into extended range for a peak. Shown below is the smaller of these waves, the 10-day cycle:

In terms of patterns, it would currently take a reversal back below the 6070.84 SPX CASH figure to confirm these 10 and 20-day cycles to have turned, a number which could/should continue to rise in the days ahead, with the most current number always posted in our Market Turns advisory.

Stepping back slightly, the next correction with the 10 and 20-day cycles should see the 9-day moving average acting as the minimum expected magnet, though with the decent potential for a drop on down to the 18-day moving average. Until proven otherwise, that correction would be expected to end up as countertrend - with support around the 5990-6000 SPX CASH region, near that 18-day average, which is rising daily.

Stepping back further, if the coming correction with the 10 and 20-day cycles does end up as the expected countertrend affair, then the probabilities are good that a push back to higher highs will be seen on the next swing up. At that point, the next peak for the larger 45-day cycle would be due:

In terms of price, it was the 11/6/24 reversal above the 5865.82 SPX CASH figure which confirmed the current upward phase of our 45-day cycle to be in force. In terms of time, that action projected strength into early-to-mid December.

With the above said and noted, this 45-day wave is moving back into topping range, with its next correction phase expected to see a drop back to the 35-day moving average on the SPX. In terms of price, the 6130-6150 SPX CASH level has been noted as the potential target for this 45-day wave - and could also act as key resistance.

Stepping back, from whatever high that is seen with our 45-day wave, the odds will favor a quick correction playing out. In terms of price, the 35-day moving average would be a normal magnet to that decline phase, and could also act as key support - if the upward phase of the bigger 90, 180 and 360-day cycles is to remain intact.

The 180-Day and 360-Day Cycles

Above the 45-day wave, there are the bigger 180 and 360-day cycles in U.S. stocks. The last trough for the smaller 180-day cycle was the August low of 5119.26 SPX CASH, with this wave seen as pushing higher into the late-2024 to early-2025 region. Here is that 180-day cycle on the SPX:

Noted in past months in our daily/weekly Market Turns report, the current upward phase of the 180 and 360-day cycles was projected to remain intact into the late-2024 to early-2025 window - which we are moving into. If the next correction phase with our 45-day wave ends up as countertrend, then the ideal path would be looking for higher highs into mid-January, 2025 - before peaking this 180-day cycle.

Going further with the above, the next peak for our 180-day wave is also expected to end up as the top for the next larger cycle in U.S. stocks, the 360-day wave:

With the above, higher highs into mid-January, 2025 - if seen - should end up topping these 180 and 360-day cycles, for what should be the biggest percentage (or second biggest) decline of next year. That decline is expected to be something in the range of 10-14% off the peak on the SPX.

Going further, the coming correction phase with our 180 and 360-day cycles should see the lower 360-day cycle band acting as a minimum magnet, though with the full potential for a drop down to test the lower 360-day moving average as these waves trough. In terms of time, the next combination low for these waves is projected for Spring, 2025.

Market Breadth

With the action into last week, the NYSE advance/decline line - a key measure of the long-term health of the U.S. stock market - is now starting to diverge from price action, a technical warning signal. Shown below is the advance/decline line:

While the current divergence between the advance/decline line (in red) and price may or may not be an immediate bearish indication for the market, the longer this divergence pattern remains intact, the more negative it will become.

Going further, our Mid-Term Breadth index (shown in blue) is also showing a divergence from price - and has actually begun to turn down slightly with the recent action. I view the position of this indicator as being the strongest technical signal that a peak is forming with the 180 and 360-day time cycles, and with that some caution is warranted.

Market Sentiment

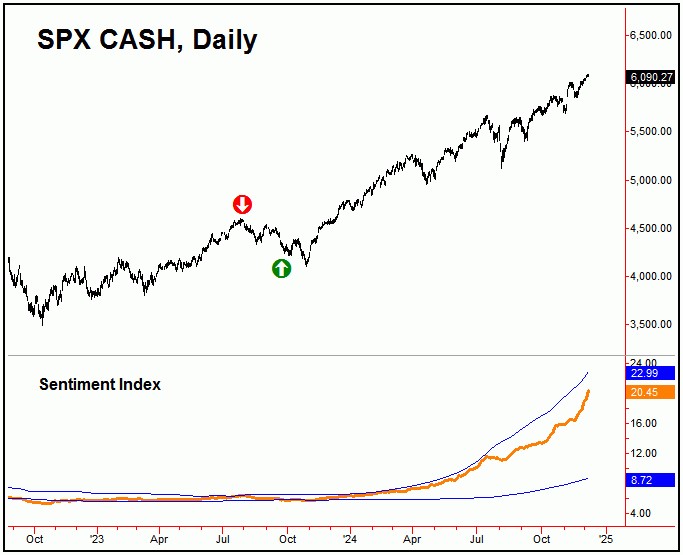

In addition to breadth, we also track sentiment in our Market Turns report. With that, our proprietary market sentiment index is shown on the chart below:

Our market sentiment index for U.S. stocks is currently on a mid-term buy, last coming way back at the September 22, 2023 close of 4320.06 SPX CASH. Going further, since this is a longer-term model, buy and sell signals are infrequent, with the prior sell signal coming in late-July of 2023 - just before the sharp correction seen into the Autumn of that year.

With the action seen into last week, our sentiment indicator has continued to rise sharply, and appears to be closing in on a potential sell signal in the coming days/weeks. This now looks to be key - in light of the cyclical configuration of the aforementioned 180 and 360-day time cycles in U.S. stocks.

Jim Curry

The Gold Wave Trader

Market Turns Advisory

http://goldwavetrader.com/

http://cyclewave.homestead.com/

********