Gold ETFs And Record Levels Of platinum Buying By Retail Investors

Strengths

- The best performing metal this week was platinum, up 5.65 percent, due to stronger retail buying. Gold and silver rose on Friday morning on safe haven buying. U.S.-China relations remain tense and China announced that it will impose new security laws on Hong Kong. Palladium rose the most since March, holding above $2,000 an ounce on Monday, due to renewed optimism about China’s economy and stimulus for automakers. The metal finished the week up 4.04 percent. Bloomberg notes that palladium had fallen by a third since hitting a record in late February.

- ETFs backed by gold have seen 20 straight days of inflows, adding 154,000 ounces on Thursday, and bringing year-to-date gains of 20 percent, according to BMO Capital Markets, citing Bloomberg data.

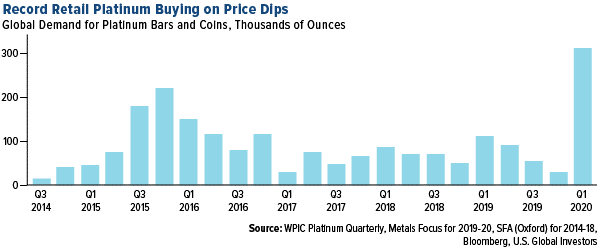

- Purchases of physical platinum by retail investors almost tripled to 312,000 ounces in the first quarter of this year – the most on record – according to the World Platinum Investment Council (WPIC). Prestige Bullion said that over 2,000 platinum coins featuring an elephant sold out to U.S. and Asian investors after being minted in March. The company says that more coins will be produced once South Africa’s virus lockdown is lifted and will feature other animals including the lion, rhinoceros, leopard and buffalo, reports Bloomberg. “The low platinum price in March was a buying opportunity, but the concerns regarding global risk and the huge negative fiscal impact of the COVID-19 pandemic are likely to continue the demand for precious metals, including platinum,” said Trevor Raymond, director of research at WPIC.

Weaknesses

- The worst performing metal this week was gold, down slightly by 0.77 percent. Russian President Vladimir Putin ordered the army to help Polyus PJSC, Russia’s largest gold miner, treat an outbreak of COVID-19 at its Siberian unit, reports Bloomberg. 77 doctors and nurses set up a field camp and mobile hospital near the Olimpiada mine, the nation’s largest mine. There are approximately 866 virus infections in the area.

- According to Johnson Matthey Plc, the coronavirus pandemic will cut the use of platinum-group metals in autocatalysts by at least 15 percent to 20 percent in 2020. The autocatalyst manufacturer said in a report on Monday that automakers are “expected to look closely at potential opportunities to reduce the PGM content of their systems, or to substitute some palladium with platinum, if they can do so without compromising their ability to meet current or future emissions limits.”

- Venezuela’s central bank sued the Bank of England (BOE) for access to $1 billion in gold reserves, reports Bloomberg. The troubled South American nation asked the BOE to liquidate its gold and send the funds to the United Nations Development Programme, which is working with Venezuela to prepare for an increase in COVID-19 infections. This new lawsuit is another twist to the long dispute of cutting off President Nicolas Maduro’s regime from its overseas assets.

Opportunities

- Joe Foster, portfolio manager and gold strategist at Van Eck Absolute Return Advisers Corp, says the yellow metal is expected to hit $2,000 an ounce in the next 12 months. Foster said in a webcast this week that “gold has had a V-shaped recovery as a response to the pandemic shock.” Bullion could trade even higher over the next several years if there is an inflationary cycle or unforeseen worst-case scenario, added Foster and as reported by Bloomberg.

- The falling gold-silver ratio could be an indication that silver is on its way to outperforming the yellow metal. In March, the ratio rose as high as 127 and this week it is down to below 102, reports Kitco News. George Gero, managing director with RBC Wealth Management, says the ratio could fall back down to the 90s and that “silver was held back because of its industrial component. Now with the reopening of many of the economies, the industrial component is a tailwind instead of a headwind.”

- Bloomberg’s Vincent Cignarella thinks the gold rally is real and not a bear trap due to the gold-copper ratio. The ratio of gold, the most widely recognized haven asset, and copper, a key industrial metal used globally, is often used as an indicator of the economy’s strength. “Since March 23, the 2020 low in equities and the ratio of copper to gold has stabilized and trended sideways – a potential indication stocks and yields have put in a bottom.”

Threats

- Crispin Odey, one of Europe’s highest-profile hedge fund managers, said governments may ban private gold ownership if they lose control of inflation, reports Bloomberg. Odey wrote in a letter that “it is no surprise that people are buying gold. But authorities may attempt at some point to de-monetize gold, making it illegal to own as a private individual.” In 1933 the U.S. government forced purchases of private gold holdings as a part of a devaluation of the dollar. Odey has compared the coronavirus pandemic to the Great Depression of the 1930s and argues that governments before having resorted to debasing coinage.

- Bloomberg’s Mark Cudmore has a bearish outlook for gold: “Like a teenager rebelling against the smothering love of over-protective parents, gold may upset a lot of people in the weeks ahead.” Cudmore notes that the yellow metal’s big drivers – global stimulus amid the pandemic and the U.S.-China trade war – are both stale now. Gold was supported by “shock-and-awe” policy support in March and April, and if there isn’t “something fresh soon” there could be a correction ahead.

COVID-19 remains a major threat globally as the virus continues to spread and lockdown measures ease in only in some countries. Brazil, a top miner and exporter, has seen a surge in infections. Reports out of China this week show that the virus is manifesting differently than doctors have seen before, raising concerns of a second wave of infections.

*********

Frank Holmes is the CEO and Chief Investment Officer of

Frank Holmes is the CEO and Chief Investment Officer of