Gold Fear Buy VS Gold Ecstasy Buy

I’m becoming increasingly concerned by emails that I’m receiving from amateur investors. These emails tout a fabulous future for the American stock market. Many stock buybacks have occurred, but actual earnings growth for American companies is highly questionable.

"I am very cautious on equities today. This market could easily have a big drop…. Very simplistically put, a lot of the earnings are a mirage." – Reuters News, November 18, 2013.

That’s legendary activist investor Carl Icahn, speaking at the Reuters Global Investment Outlook Summit.

He doesn’t sound very enthusiastic, and nor do other powerful money managers who control enormous amounts of risk capital. “U.S. stocks are grossly overpriced, according to asset management firm Grantham Mayo Van Otterloo (GMO) & Company, which estimates fair value for the S&P 500 Index at 1,100 - or almost 40 percent below current levels. In a quarterly letter published on Monday, Ben Inker, co-head of global asset allocation at GMO said the expected rate of return on the stock market index is minus 1.3 percent per year, adjusted for inflation, for the next seven years.” – CNBC News, November 19, 2013.

If gigantic funds like GMO (with over $100 billion under management) see the American stock market as “grossly overpriced”, while amateur investors are touting the market as a “fabulous bargain, with gains that are here to stay”, I would urge gold community investors to exercise extreme caution.

Investors who are selling gold stocks now, and buying general stock market equities on American stock markets, may soon find they become part of one of the biggest “out of the fry pan and into the fire” horror shows in history.

I expect the Fed to taper their quantitative easing (QE) program in 2014, and perhaps in December of this year. If the Fed tapers in December, many institutional money managers are likely to quickly move a lot of capital from the stock market to bonds.

If there is no taper in 2014, the reason is likely to be that the American stock market has crashed. If the stock market crashes, it’s possible that the Fed increases QE.

The bottom line is that whether the Fed increases QE, tapers, or does nothing, the American stock market is at great risk, because value-oriented fund managers are pulling out. Stocks that were held by the strongest hands are now held by what appear to be very weak hands.

It’s possible to make money in an asset class with “momentum investing” (price chasing), but it’s extremely difficult, and arguably impossible, to keep that money. Most of the world’s greatest investors are value-oriented.

Gold stock investors who want “action” should probably look at the Chinese stock market, which is far below its all-time highs.

“China has pledged to make the most sweeping changes to the economy and the country's social fabric in nearly three decades with a 60-point reform plan that may start showing results within weeks.” – China Daily News, November 18, 2013.

You are viewing a daily chart for FXI-NYSE. I call it the “Chinese Dow”. Institutions are buying Chinese stocks aggressively, and volume is enormous.

That’s a longer term look at FXI, using the weekly chart. Technically, it’s on the verge of a major breakout from a symmetrical triangle formation.

The Chinese stock market is now about 37% below its 2007 highs. Reforms there should increase urbanization, and increase the standard of living for most Chinese citizens.

As Chinese citizens get more disposable income, including capital gains from the stock market, they are likely to dramatically increase the amount of gold jewellery they buy. That’s very good news for gold mining companies.

Janet Yellen recently told US congress that she doesn’t know much about gold, except that people buy it when they are afraid. Does the above Chinese lady look like she’s afraid? Most of the gold that is mined by Western mining companies is bought in the form of jewellery, by the citizens of China and India. They don’t buy it because they are afraid. With all due respect to Janet Yellen, I think she may need to ask the Bombay Bullion Association for a pamphlet on the basics of gold market supply and demand.

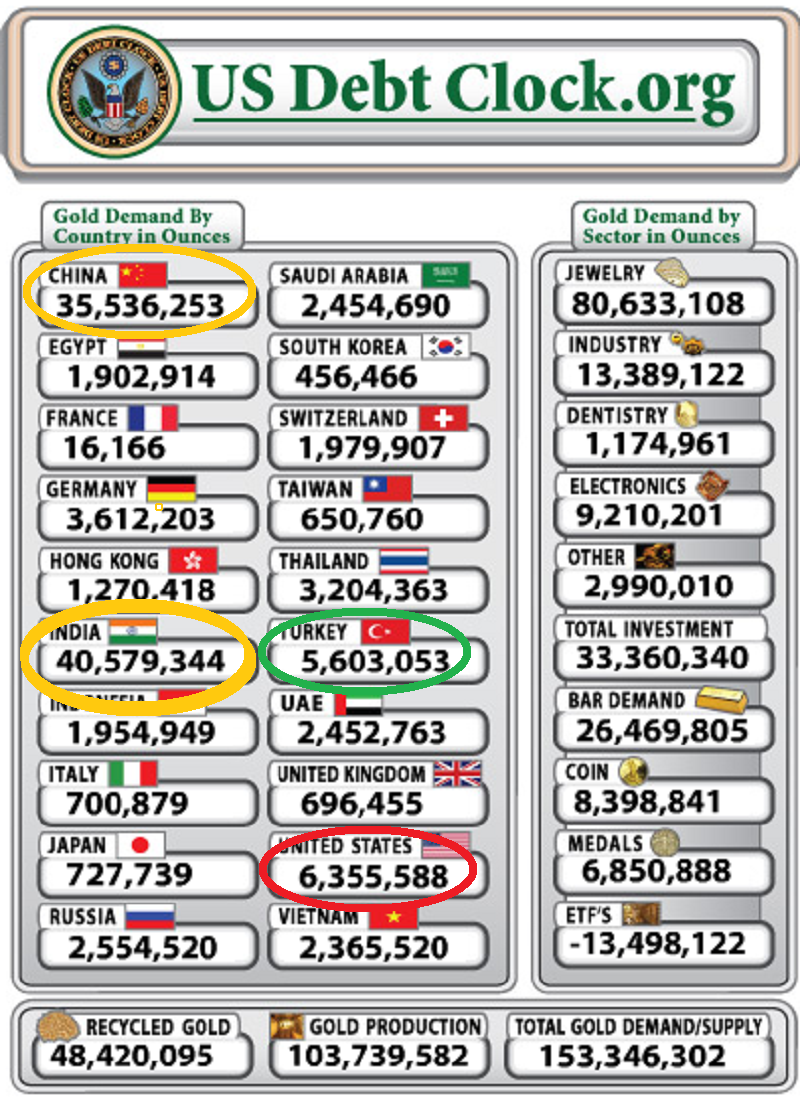

I showed you this table of gold demand about a week ago, courtesy of usdebtclock.org. It shows that whether gold buyers are afraid or ecstatic when they buy gold really doesn’t matter. What matters is how much gold they buy. Unfortunately, you can see that compared to China and India, Americans don’t buy very much gold at all, even when they are afraid.

That’s a freshly updated table of gold demand. You can see that according to the usdebtclock.org people, American demand has fallen over the past week. In contrast, Chinese and Indian jewellery demand continues to grow.

American economic events like the jobs report and QE announcements are powerful short term drivers of the gold price. In the big picture, it is the enormous growth in demand for gold jewellery that will drive the gold price vastly higher. Ironically, the American super-crisis caused terrified Western investors to buy gold and gold stocks, but it will be the ecstatic Chindian (Chinese and Indian) jewellery buyer that makes them richer.

You are viewing the daily T-bond chart. In the short term, “where goes the T-bond, so goes gold”. Look at the stokeillator oscillator at the bottom of the chart. It looks spectacular, and there’s an upside breakout in play from the thin black supply line. I realize that many analysts are talking about a coming crash in the gold market, but powerful value investors are pulling a lot of money out of the stock market and pouring it into bonds. That’s bullish for gold.

That’s the daily gold chart. Gold feels “soft” right now, because the Indian government has imposed draconian gold import rules. Given the fact that Indian imports have dropped from about 100 tons a month to 20 tons a month, gold is remarkably strong. From a technical standpoint, gold is “hanging around” the thick green line of a large symmetrical triangle, but the action in the bond market seems to be supporting gold nicely. The stokeillator suggests a substantial rally should begin soon.

What about silver? Some silver bears see a head and shoulders top pattern in play. I think it’s more of a shape than an actual price pattern, and Indian silver demand has surged. Silver can’t replace gold in India, but it can serve as a kind of “stop gap” measure. A move to $23.10 should ignite bullish reports from technical analysts at major banks.

You are viewing the daily chart for GDX. The stokeillator looks decent. I haven’t drawn any trend lines on this chart, because I think this is a time where they don’t work. When a major asset class makes a bottom, huge numbers of analysts struggle to identify the turning point. Whipsaw price action can be very frustrating to both bulls and bears. Rather than focusing on QE “taper caper” action, my suggestion is to contact the directors of mining companies and ask them what they are doing to prepare for the accelerating growth of the Chindian middle class. Or should I say, the growth of the Chindian gold buyer class!

********

Special Offer For Gold-Eagle readers: Uranium has been on a bit of a tear recently. Please send me an Email to [email protected] and I’ll send you my free “Radioactive Hot!” report on uranium stocks that may be poised to move.

Note: We are privacy oriented. We accept cheques. And credit cards thru PayPal only on our website. For your protection. We don’t see your credit card information. Only PayPal does. They pay us. Minus their fee. PayPal is a highly reputable company. Owned by Ebay. With about 160 million accounts worldwide.

Email: [email protected]

Rate Sheet (us funds):

Lifetime: $799

2yr: $269 (over 500 issues)

1yr: $169 (over 250 issues)

6 mths: $99 (over 125 issues)

To pay by cheque, make cheque payable to “Stewart Thomson”

Mail to:

Stewart Thomson / 1276 Lakeview Drive / Oakville, Ontario L6H 2M8 Canada

Stewart Thomson is a retired Merrill Lynch broker. Stewart writes the Graceland Updates daily between 4am-7am. They are sent out around 8am-9am. The newsletter is attractively priced and the format is a unique numbered point form. Giving clarity of each point and saving valuable reading time.

Risks, Disclaimers, Legal

Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualifed investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is: 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line: Are You Prepared?

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website:

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website: