Gold Forecast: Are Gold Miners In A Stalemate On The Market Chessboard?

With the GDXJ ETF suffering a mild drawdown on Apr. 27, the recent rout has calmed for the time being. However, with the medium-term fundamental outlook remaining profoundly bearish, the junior miners and the S&P 500 are fighting a losing battle.

With the GDXJ ETF suffering a mild drawdown on Apr. 27, the recent rout has calmed for the time being. However, with the medium-term fundamental outlook remaining profoundly bearish, the junior miners and the S&P 500 are fighting a losing battle.

To explain, the Fed needs to lower asset prices to help calm inflation. Moreover, with the earnings season delivering some hit-and-miss results, market participants are dumping the losers and holding on to the winners for dear life. However, while investors rotate from one scarred corner of the stock market to another, the hiding places are shrinking. Therefore, when the walls close in, the only place left to go is down.

For example, Microsoft hit, Alphabet missed, and RBC Capital Markets analysts said that Microsoft’s “solid” fourth-quarter guidance “should allay investor fears of a macro slowdown.” As a result, the bull is alive and well.

Please see below:

Source: Barrons

Missing the forest through the trees, investors fail to realize that some companies have succumbed to the medium-term realities sooner than others. For context, I’ve been bullish on the U.S. economy for some time, and I still am RIGHT NOW. However, with each Fed rate hike and each passing quarter, that will change materially, and so should investors’ optimism.

Please see below:

Source: Google Finance

- You Gain, the Fed Inflicts Pain

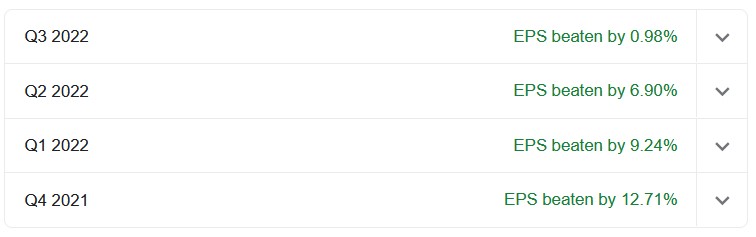

To explain, the figures above represent Google Finance’s tally of how much Microsoft outperformed analysts’ earnings per share (EPS) estimates over the last four quarters. Notice the trend? After beating estimates by 12.71% in Q4 2021, Microsoft’s EPS outperformance declined sequentially to a slight 0.98% in Q3 2022. Moreover, its revenue outperformance showcased a similar pattern.

Furthermore, the decelerating trend is also present with Alphabet, only ahead of schedule. As a result, with the Fed poised to slow the U.S. economy to calm inflation, it’s only a matter of time before the stock market’s winners (Microsoft) turn into losers (Alphabet).

Source: Google Finance

Speaking of winners, Visa reported its second-quarter earnings on Apr. 26. CEO Al Kelly said during the Q2 earnings call:

“After the short four to five-week impact of Omicron in December and January in the United States and many other parts of the world, the recovery continues to be robust…. In the U.S., payments volume index to 2019 was 144 in the quarter. Volume growth relative to three years ago has been stable and strong now for four quarters in a row.”

“When looking at specific spend categories for credit cards, we saw greater than a 10-percentage point improvement in the three-year index from Q1 to Q2 in travel, retail goods, food and drug, restaurant, QSR and fuel.”

As a result, while investors hope that a slowing U.S. economy will allow a dovish 180 by the Fed, Visa hasn’t seen any demand description.

Please see below:

Source: Visa/The Motley Fool

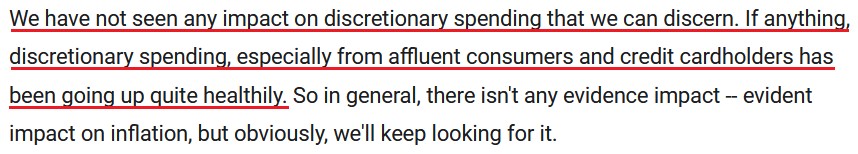

Furthermore, with consumers eager to spend, companies are eager to raise prices. For example, Mondelez released its first-quarter earnings on Apr. 26. The company is home to confectionary brands like Oreo, Cadbury, Ritz and Toblerone. CFO Luca Zaramella said during the Q1 earnings call:

“We now expect input cost inflation in the low double-digit range for 2022 versus our prior view of approximately 8%, despite our coverage is approaching 90% for the year. The revise view of inflation reflects the war in the Ukraine and the related step-up in cost pressure to our commodity basket, including energy, wheat, oil and packaging.”

He added:

“We continue to expect pricing to be a larger driver of top line growth, given its impact in Q1 and we are also announcing price increases across a number of markets for the rest of the year tied to inflation.”

As a result, the Fed can’t wish its problems away, and these hawkish realities should spook investors over the next few months.

Please see below:

Source: Mondelez/Seeking Alpha

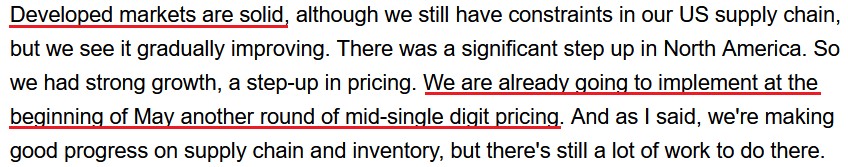

Singing a similar tune, PepsiCo released its first-quarter earnings on Apr. 26. CFO Hugh Johnston said during the Q1 earnings call:

“Inflation has clearly gotten a bit more challenging for the year. No question about that. We had previously indicated it was low teens. It’s several points higher than that now (…).”

“We think the consumer is very early in this process of adjusting to the new inflationary environment. I think there’s going to be new behaviors adapting to the new realities.”

As such, while Johnston didn’t mention any specifics on pricing, “new realities” are not what the Fed had in mind. Moreover, CEO Ramon Laguarta raised PepsiCo’s full-year guidance and added that elasticities are still outperforming. Therefore, with inflation “several points higher” than previously expected, would you bet that PepsiCo isn’t riding the inflationary merry-go-round?

For context, positive elasticities mean that when PepsiCo increases prices, it’s not seeing a drop-off in demand.

Please see below:

Source: PepsiCo/Alpha Street

Thus, while the U.S. economy remains on solid footing RIGHT NOW, the reality is that all of this data is bullish for Fed policy. With companies still raising prices and receiving little pushback from consumers, we're nowhere near the demand destruction needed to reduce annualized inflation from 8.6% to 2%. As such, the Fed will have to do the heavy lifting.

Moreover, while investors breathe a sigh of relief that corporate profits haven't collapsed, the optimism is short-sighted. Of course, a recession isn't upon us; the Fed has only hiked interest rates once. The damage occurs after the fourth, fifth, sixth, etc., rate hike, as higher interest rates eat away at consumers' disposable income and depress corporate profits. Therefore, the current environment is full of clear skies. However, if you want to get 8.6% annualized inflation down, everything else likely goes down with it.

Also noteworthy, the Richmond Fed released its Fifth District Survey of Manufacturing Activity on Apr. 26. The data was largely bullish for Fed policy. The report revealed:

“Our wage index increased to 41 in April from 37, and firms don’t expect the increase in wages to let up. The average growth rate of prices paid increased slightly in April while the growth rate of prices received from customers edged down slightly. Firms expect growth rates for both prices paid and prices received to decrease somewhat in the next 12 months.”

Please see below:

Source: Richmond Fed

Likewise, with employment also moving higher, continued strength in the U.S. labor market is also bullish for Fed policy.

Source: Richmond Fed

In addition, the Dallas Fed released its Texas Manufacturing Outlook Survey on Apr. 25. Showcasing similar results, the data is also supportive of Fed policy. An excerpt from the report read:

“Prices and wages continued to increase strongly in April, though the indexes eased off their historical highs. The raw materials prices index fell 13 points to 61.5, its lowest reading in more than a year, though still well above its average of 27.7. The finished goods prices index moved down from 47.8 to 43.5. The wages and benefits index came in at 50.9, down slightly from its high last month of 55.2 but still markedly elevated from its average reading of 20.1.”

Finally, the Dallas Fed released its Texas Service Sector Outlook Survey on Apr. 26. Similar to the other reports above, inflation increased, though at a slower pace in April. The report stated:

“April saw continued upward pressure on wages and prices, though growth in wages and input prices eased slightly. The wages and benefits index fell from 36.5 to 33.0, still near a record high. The selling prices index was unchanged at 33.7, with 37 percent of respondents noting monthly price increases, while the input prices index declined five points to 54.2.”

The bottom line? While investors are supposed to be forward-looking, they fail to realize that current earnings and guidance don’t reflect the impact of future rate hikes. Moreover, with the Fed on a mission to curb inflation, quarterly price increases and robust elasticities are not helping the situation. As a result, once this reality hits home, the PMs will suffer mightily as the negativity cascades across Wall Street.

In conclusion, the PMs declined on Apr. 27, as commodities have lost some of their mojo. Moreover, while technical conditions may present an opportunity for a short-term rally, both technicals and fundamentals signal lower lows over a medium-term time horizon. As such, long-term buying opportunities will likely present themselves later in 2022.

Summary

Despite the ongoing Russian invasion of Ukraine, and despite gold being the traditional safe haven in times of turmoil, the overall outlook for the precious metals sector remains bearish for the next few months, and the medium-term outlook for the yellow metal remains pessimistic.

Since neither the USD Index nor real interest rates are likely to stop rising anytime soon, the gold price is likely to fall sooner or later. Given the analogy to 2012 in gold, silver, and mining stocks, “sooner” is the more likely outcome.

As silver often moves in close relation to the yellow metal, when gold falls, silver is likely to decline as well – it has probably already started its slide. The times when gold is continuously trading well above the 2011 highs will come, but they are unlikely to be seen without being preceded by a sharp drop first.

Thank you for reading our free analysis today. Please note that it is just a small fraction of today’s all-encompassing Gold & Silver Trading Alert. The latter includes multiple premium details such as the outline of our trading strategy as gold moves lower.

If you’d like to read those premium details, we have good news for you. As soon as you sign up for our free gold newsletter, you’ll get a free 7-day no-obligation trial access to our premium Gold & Silver Trading Alerts. It’s really free – sign up today.

Thank you.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Sunshine Profits - Effective Investments through Diligence and Care

* * * * *

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be subject to change without notice. Opinions and analyses are based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are deemed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

*********

Przemyslaw Radomski,

Przemyslaw Radomski,