Gold Forecast: Gold Still Feeds On Rumors Of War

The situation from less than a month ago repeats itself, and gold once again confirms that it likes international tensions. However, since history does rhyme, its upward activity may not last for too long.

The situation from less than a month ago repeats itself, and gold once again confirms that it likes international tensions. However, since history does rhyme, its upward activity may not last for too long.

With another dire warning from the White House uplifting gold and mining stocks on Feb. 11, Russia and Ukraine's “will they or won't they” saga has shifted sentiment. However, it's important to remember that geopolitical risk rallies often have a short shelf life and dissipate over the medium term.

To explain, I wrote on Sep. 21:

When terrorists attacked the World Trade Center roughly 20 years ago, gold spiked on Sep. 11, 2001. However, it wasn’t long before the momentum fizzled and the yellow metal nearly retraced all of the gains by early December. Thus, when it comes to forecasting higher gold prices, Black Swan events are often more semblance than substance.

As further evidence, when Russia annexed Crimea from Ukraine in 2014, similar price action unfolded. For example, when rumors swirled of a possible invasion, gold rallied on the news. Then, when Russia officially invaded, the yellow metal continued its ascent. However, after the short-term sugar high wore off, bearish medium-term realities confronted gold once again. In time, the yellow metal gave back all of the gains and sank to a new yearly low.

Please see below:

Thus, while conflicting reports paint a conflicting portrait, the medium-term algorithms don’t care whether Russia invades Ukraine or not. With the rumor enough to pique investors’ interest, quantitative traders see it as an opportunity to capitalize on the momentum. However, once that momentum fizzles, history shows that the quants rush for the exits. As a result, is this time really different?

Let’s keep in mind that the above assumes that Ukraine would indeed be invaded, which, in my view, is unlikely, despite news coming from the White House.

To that point, the USD Index is also a major beneficiary of geopolitical tensions. However, in contrast to gold, the greenback’s rally on Feb. 11 aligns with its medium-term fundamentals.

To explain, while the EUR/USD has been in style in recent weeks, ECB President Christine Lagarde provided another dose of reality on Feb. 11. Speaking with Redaktionsnetzwerk Deutschland, she reiterated all of the points that I’ve been making for months. For example, when asked about inflation and why the ECB hasn’t raised interest rates, she responded:

“Hold on! We first need to understand the source of the rise in prices. Just over 50 per cent of it can be attributed to the surge in energy prices. Oil, gas and electricity have become more expensive. And as we import a lot of energy, these prices are, to some extent, beyond the sphere of influence of our economy.”

She added: “The second main factor driving up prices is supply bottlenecks: shortages of microchips, container jams, disrupted supply chains. Let me ask you: what can the ECB do about that? Can we resolve supply bottlenecks? Can we transport containers, lower oil prices or pacify geostrategic conflicts? No, we can’t do any of that.”

As a result, while euro bulls continue to hope for a hawkish shift, Lagarde threw cold water on that idea.

Please see below:

Source: ECB

For context, I wrote on Feb. 8:

While the EUR/USD held on to its ECB-induced gains, the bearish fundamental realities confronting the currency pair were confirmed on Feb. 7. To explain, while euro bulls think that the ECB will have a hawkish awakening, I warned on Feb. 4 that the prospect is much more semblance than substance.

Investors have priced in two ECB rate hikes in 2022. However, with the central bank still planning to purchase bonds “from October onwards” and Lagarde saying that rate hikes will only be considered thereafter, short-term sentiment should crumble over the medium term.

If that wasn’t enough, Lagarde also highlighted the U.S.-Eurozone fundamental dichotomy that I warned about throughout 2021.

Please see below:

Source: ECB

What’s more, ECB Governing Council member Olli Rehn echoed her sentiment on Feb. 11. He said:

“If we reacted strongly to inflation in the short term, we would probably cause economic growth to stop. It’s better to look beyond short-term inflation and look at what inflation is in 2023, 2024.”

As a result, while the ECB continues to disappoint euro bulls, the reality is that the Eurozone fundamentals have never changed. I’ve highlighted on numerous occasions that oil and gas are the main drivers of Eurozone headline inflation, and more importantly, core inflation actually declined in January. To explain, I wrote on Feb. 4:

Source: Eurostat

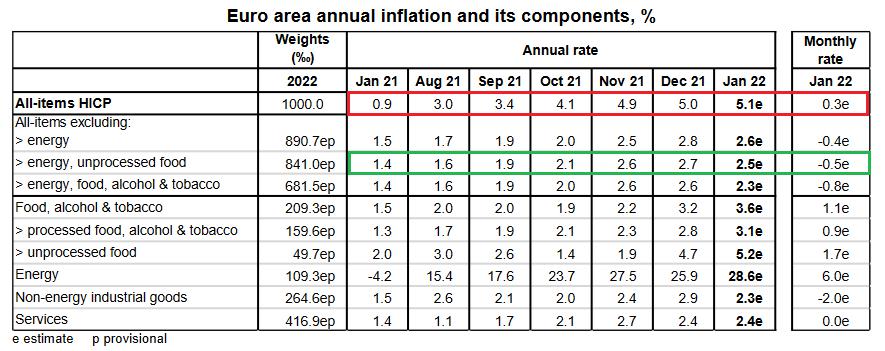

Follow the trajectory of the red rectangle above. As you can see, headline inflation (which includes food and energy) went from a 0.9% year-over-year (YoY) increase in January 2021 to a 5.1% YoY increase in January 2022. Pretty troublesome, huh?

However, if you focus your attention on the green rectangle, you can see that Eurozone core inflation (which excludes food and energy) declined from 2.7% YoY in December 2021 to 2.5% YoY in January 2022. As a result, while investors assume that abnormally high headline inflation will elicit a hawkish response from the ECB, the reality is that oil & gas remains the region’s only problem.

On the flip side, while the USD Index has suffered in recent weeks, Bank of America told clients that the Fed should win the "race to the top" when it comes to interest rate hikes.

"USD is no longer broadly perceived as having a strong monetary policy tailwind behind it. We disagree, less with the impulse to re-price global central banks (CBs) higher, and more with the failure of markets to preserve the Fed's lead," said Ben Randol, G10 FX & Rates Strategist.

As a result, Bank of America expects the EUR/USD to hit 1.10 in 2022.

Source: Pound Sterling Live

Furthermore, RBC Capital Markets expects the EUR/USD to fall below 1.10 in 2022. Strategists wrote: “The question is whether late January marked the bottom for EUR/USD and we will stay at higher levels (end-2022 consensus is 1.14) or it will prove to be another false dawn and EUR/USD will make new lows. We are still in the latter camp.”

The bottom line? While gold often outperforms in the short term when geopolitical tensions rise, history shows that the momentum fades over the medium term. Moreover, with the recent rally contrasting gold’s bearish medium-term fundamentals, the ascent sets the stage for an even harder fall over the next few months. As a result, while the quants may “buy the rumor,” it’s often a mad dash for the exits once sentiment shifts.

As the Ukraine-related tensions subside as there’s no attack (in particular, there’s no attack this week), the precious metals market could start its decline quite soon.

In conclusion, the PMs were mixed on Feb. 11, and mining stocks outperformed. However, while the headline risk may seem monumental, fundamental factors like the USD Index and U.S. Treasury yields will hold more weight in the coming months. As such, the recent strength is likely a countertrend rally, and lower lows should confront the yellow metal over the medium term.

Summary

To summarize, despite appearances to the contrary, the outlook for the precious metals sector still remains bearish for the next few months.

Once again, gold benefited from the geopolitical turmoil. This time, as in January, the disturbing information about the alleged increase in tension on the Russian-Ukrainian border allowed it to surge. However, as history shows, even if a military conflict broke out and gold continued to rise, this is a short-lived move and the likely decline could be painful. The medium-term outlook remains pessimistic.

Since it seems that the PMs are starting another short-term move lower more than it seems that they are continuing their bigger decline, I think that junior miners would be likely to (at least initially) decline more than silver.

From the medium-term point of view, the key two long-term factors remain the analogy to 2013 in gold and the broad head and shoulders pattern in the HUI Index. They both suggest much lower prices ahead.

As silver often moves in close relation to the yellow metal, when gold falls, silver is likely to decline as well – it has probably already started its slide. The times when gold is continuously trading well above the 2011 highs will come, but they are unlikely to be seen without being preceded by a sharp drop first.

Thank you for reading our free analysis today. Please note that it is just a small fraction of today’s all-encompassing Gold & Silver Trading Alert. The latter includes multiple premium details such as the outline of our trading strategy as gold moves lower.

If you’d like to read those premium details, we have good news for you. As soon as you sign up for our free gold newsletter, you’ll get a free 7-day no-obligation trial access to our premium Gold & Silver Trading Alerts. It’s really free – sign up today.

Thank you.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Sunshine Profits - Effective Investments through Diligence and Care

* * * * *

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be subject to change without notice. Opinions and analyses are based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are deemed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

*********

Przemyslaw Radomski,

Przemyslaw Radomski,