Gold Forecast: With the USDX Rallying Again, Are Lower Gold Prices in Sight?

Although the dip buyers haven’t conceded yet, gold, silver, and mining stocks have started to decline. Is the precious metals upswing over?

A Reversal of Fortunes

While gold, silver, mining stocks and the S&P 500 bounced off their intraday lows, all four ended the Oct. 5 session in the red. Moreover, with the USD Index and the U.S. 10-Year real yield rallying sharply, a reversal of fortunes unfolded as reality re-emerged.

Please see below:

Source: Bloomberg/ZeroHedge

To explain, the red line above tracks the number of rate hikes priced in by the futures market, while the green line above tracks the inverted (down means up) number of rate cuts priced in thereafter.

If you analyze the right side of the chart, you can see that hike expectations decreased and cut expectations increased as the Fed pivot narrative gained steam. However, the far right side of the chart shows how hike expectations increased while cut expectations decreased over the last two days. Therefore, pivot prognostications are slowly fading, and a continuation of the trend is profoundly bearish for the PMs.

To that point, I’ve noted how Fed officials are united in their calls for a higher U.S. federal funds rate (FFR); and with more hawkish warnings hitting the wire on Oct. 5, officials continue to hammer home their message.

For example, Atlanta Fed President Raphael Bostic said on Oct. 5:

“The past couple of monthly inflation prints produced a mixed bag, with some evidence that the pace of month-to-month price increases has slowed. But the August inflation reports were a sobering reminder that price pressures remain broad and stubborn.”

He added:

“We should not let the emergence of [economic] weakness deter our push to lower inflation. We must remain vigilant because this inflation battle is likely still in early days.”

More importantly:

“I am not advocating a quick turn toward accommodation. On the contrary. You no doubt are aware of considerable speculation already that the Fed could begin lowering rates in 2023 if economic activity slows and the rate of inflation starts to fall. I would say: not so fast.”

Thus, with Bostic openly destroying the pivot narrative, it’s another example of how Fed officials remain unwavering in their fight against inflation.

No wonder – inflation is what the voters are most concerned with.

Please see below:

Source: Bloomberg

Echoing that message, San Francisco Fed President Mary Daly said on Oct. 5:

“The American people need confidence that we’re resolute.” If core inflation rises while employment cools, “well, that’s not very comforting to the American people, and I think then that the downshifting on the tightening would be a much harder decision to make.”

She added:

“I do see more rate increases as necessary. Remember, this is all about bringing demand – which is very strong – back in line with supply and bringing inflation down.”

Furthermore, she also went out of her way to quash the pivot narrative:

Please see below:

Source: MarketWatch

Thus, with the post-GFC crowd dealt another blow on Oct. 5, I’ve warned for months that as long as inflation and employment remain elevated, the Fed will keep its foot on the hawkish accelerator. In addition, it’s laughable to assume that initial declines in the Consumer Price Index (CPI) and JOLTS job openings signal the all-clear. In contrast, those metrics need to decline substantially to declare victory.

To that point, I wrote on Oct. 5 that while the pivot predictors gain confidence, the latest iteration is no different than their previously poor forecasts. As such, with Fed officials providing another reality check, gold, silver, mining stocks, and the S&P 500 should feel the pain over the medium term.

No Pivot: Part 2

With inflation well above the Fed’s 2% target and the U.S. labor market still on solid footing, the latter needs to collapse for the Fed to retreat from its inflation fight. Moreover, with the Institute for Supply Management (ISM) and S&P Global’s Services PMIs showing that we’re nowhere near that point, the FFR still has plenty of room to run.

For example, the ISM’s headline index decreased from 56.9 in August to 56.7 in September. However, the report revealed:

“Employment activity in the services sector grew in September for the second consecutive month after two previous months of contraction. ISM’s Employment Index registered 53 percent, up 2.8 percentage points from the August reading of 50.2 percent.

“Comments from respondents include: ‘organizational growth continues, although hiring continues to be a challenge’ and ‘cannot find qualified applicants; they require greater incentives because they have choices.’”

As a result, with demand still outweighing supply in the U.S. labor market, the Fed pivot predictors are materially out of touch with reality.

As further evidence, S&P Global’s U.S. Services PMI increased from 43.7 in August to 49.3 in September. The report stated:

“September data indicated only a modest rise in employment at service providers. The rate of job creation was the slowest since December 2021, as firms stated that challenges hiring new staff and difficulties offering high wages to retain certain employees hampered efforts to expand workforce numbers.”

Therefore, while input and output inflation slowed in both reports, employment is still increasing. Remember, "a modest rise in employment" is profoundly hawkish because the Fed needs a higher unemployment rate to cool wage inflation. As such, if firms are still increasing their headcount, demand destruction has not materialized, and the resiliency gives the Fed the green light to hammer inflation.

On top of that, S&P Global's service sector report showed that 12-month business confidence rose to its highest level since May, and the optimism is bullish for Fed policy.

Please see below:

Source: S&P Global

Also supportive, ADP released its private payrolls report on Oct. 5. For context, it doesn’t correlate well with U.S. nonfarm payrolls (which are released on Oct. 7). However, the results outperformed expectations and highlight the strength of the U.S. labor market.

Please see below:

Source: Investing.com

To that point, Nela Richardson, Chief Economist at ADP, said:

“There are signs that people are returning to the labor market. We're in an interim period where we're going to continue to see steady job gains. Employer demand remains robust, and the supply of workers is improving, for now.”

Furthermore, ADP’s wage inflation data shows why the pivot crowd is living in la-la land.

Please see below:

Source: ADP

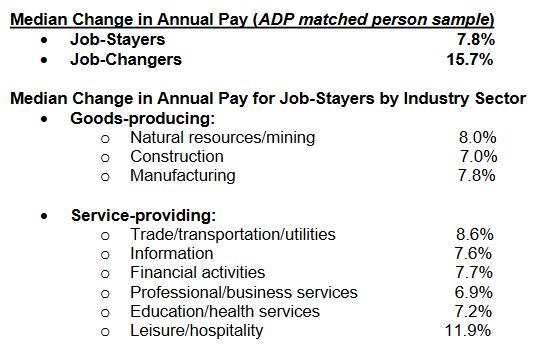

To explain, the figures above highlight the median percentage change in Americans’ annual pay, according to ADP. If you analyze the first two bullet points, you can see that job-stayers and job-changers enjoyed median annual wage increases of 7.8% and 15.7%, respectively.

Thus, while I’ve been warning for months that demand was much more resilient than the consensus realized, is it realistic for the CPI to decline to 2% if wages are running at ~8% plus? Of course not. The Fed needs these figures to decrease dramatically for the wage-price spiral to unwind. However, we’re not even close.

In addition, notice how all of the industries tracked by ADP have realized wage inflation of ~7% or more? As a result, the consensus misses the critical point: peak inflation is irrelevant, and the final destination of the FFR is what matters. Therefore, even if input, output, and wage inflation have peaked, reducing them to 2% requires much more economic weakness than the bulls realize.

The Bottom Line

With the USD Index and the U.S. 10-Year real yield resuming their uptrends on Oct. 5, the PMs headed in the opposite direction. Moreover, with Fed officials intentionally pushing back against the pivot narrative, investors are buying hope and selling reality. However, with 2021 and 2022 proving it's a losing strategy, the dip buyers should suffer mightily over the medium term. As such, while the unwinding of bearish bets may keep them supported in the short term, gold, silver, mining stocks, and the S&P 500 should hit lower lows in the months ahead.

In conclusion, the PMs declined on Oct. 5, as risk assets were under pressure. However, the dip buyers were active throughout the day, as the pivot camp has more than a few believers. So, while a consolidation period may ensue until the next catalyst emerges, the bear market is likely far from over. Still, it could be the case that the rally has already burned itself out and that lower precious metals values are just around the corner.

Summary

As far as this quick corrective upswing is concerned, it seems that it might already be over (or about to be over).

I hope you enjoyed the above free analysis. If you’d like to read premium details that are included in its full version, we have good news for you. As soon as you sign up for our free gold newsletter, you’ll get a free 7-day no-obligation trial access to our premium Gold & Silver Trading Alerts. It’s really free – sign up today.

Thank you.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Sunshine Profits - Effective Investments through Diligence and Care

* * * * *

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be subject to change without notice. Opinions and analyses are based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are deemed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

********

Przemyslaw Radomski,

Przemyslaw Radomski,