Gold Had Its Best Quarter In A Generation. So Where Are The Investors?

The last time gold had a quarter this strong, Ronald Reagan was a year into his second term as President, the Soviet Union was taking its final gasp and the US was still reeling from the Challenger explosion. In the first quarter, the yellow metal rose 16.5 percent, its best three-month performance since 1986, mostly on fears of negative interest rates and other global central bank policies.

The last time gold had a quarter this strong, Ronald Reagan was a year into his second term as President, the Soviet Union was taking its final gasp and the US was still reeling from the Challenger explosion. In the first quarter, the yellow metal rose 16.5 percent, its best three-month performance since 1986, mostly on fears of negative interest rates and other global central bank policies.

Bloomberg writes that the current gold rally has “cemented its status as a store of value.” Before now, a gold bear market persisted not because the metal had lost its status necessarily, but because of the strong U.S. dollar and, more significantly, positive real interest rates. According to Pierre Lassonde, cofounder of Franco-Nevada, gold is the fourth most liquid asset in the world.

As I’ve mentioned many times before—during interviews and in the Investor Alert and my CEO blog Frank Talk—gold has historically performed best when real rates turned negative. We were one of the earliest to discuss this important relationship on a regular basis, and now I’m starting to see it covered frequently in the mainstream media.

To get the real rate, you subtract the current consumer price index (CPI) reading, or inflation, from the government bond yield. When yields are low—or negative, as they are now—it encourages smart investors to seek other stores of value, including gold.

Below, you can see that when gold prices peaked at $1,900 per ounce in August 2011, real interest rates were close to negative 4 percent. A five-year Treasury bond yielded only 0.9 percent—and that’s before inflation took 3.8 percent. (Decades ago, when I was a young analyst in Canada, we would compare everything to the five-year government bond yield.) But as real rates rose, gold prices fell. Now the reverse is happening.

Double the Gold Returns under Negative Real Rates?

Most investors look only at nominal interest rates. This is only the tip of the iceberg. The British author and playwright Oscar Wilde wrote: “Nowadays people know the price of everything and the value of nothing.” Along those lines, smart investors know that money flows to the highest real interest rate.

I call this the Fear Trade.

“When real rates are negative, gold returns tend to be twice as high as the long-term average,” the World Gold Council (WGC) writes in its latest report. “Even if real rates are positive and as long as they are not significantly high (4 percent in our study), average gold returns remain positive.”

Negative rates erode confidence in fiat currencies, which typically has benefited gold. A currency itself, gold is “the only one that is not targeted directly by, and doesn’t respond negatively to, expansionary monetary policies,” the WGC writes.

The chart below shows the difference in the nominal and real yield curves for government bonds in a number of advanced economies. When you factor in inflation, investors of shorter-term government debt are actually paying the government to hold their money, a proposition that’s hard to swallow.

The WGC points out that about 30 percent of global soverign debt is now trading with subzero yields. That’s $8 trillion! A further 40 percent has yields below 1 percent.

This is just the latest reason why investors have been losing faith in central banks. In its most recent quarterly report, the Bank for International Settlements (BIS) notes that investors’ “confidence in central banks’ healing powers has—probably for the first time—been faltering,” as it becomes more and more clear that room for additional policymaking is narrowing. If asset-buying programs, helicopter drops of money and negative interest rate policies fail to reverse the economic slowdown, what more is there?

These conditions have led to a surge in gold coin and bullion sales around the world. American Eagle consumers bought 83,500 ounces of the coin in February, a 351 percent increase from the 18,500 ounces sold in the previous February. The Perth Mint in Australia is also reporting huge sales volumes.

Retail Investors Missing out on the Gold Rush

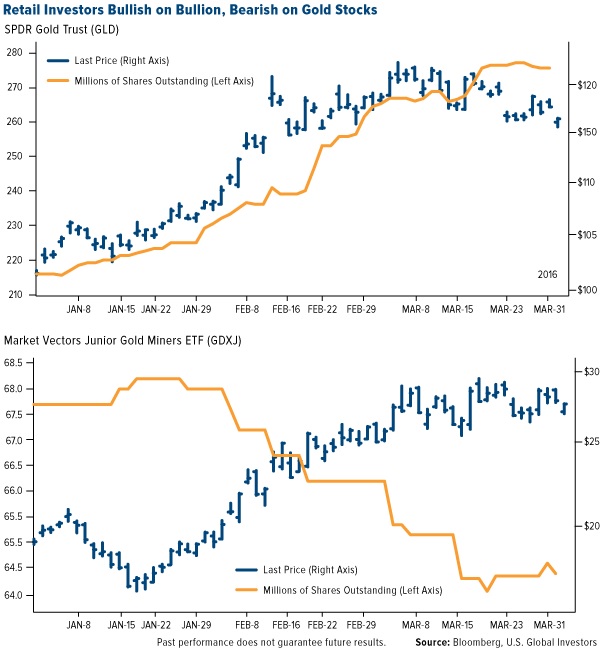

Interest in gold bullion, however, hasn’t seemed to translate fully into renewed interest in gold miners. So far this year, inflows into the SPDR Gold Trust (GLD), which invests in physical bullion, have accelerated as investors chase the rally.

At the other end is the Market Vectors Junior Gold Miners ETF (GDXJ), which holds junior gold equities such as Northern Star, OceanaGold, and Evolution Mining. Despite an increase in share price, we’ve seen a net decrease in shares outstanding. Year-to-date, outflows have totaled $84 million. Flows out of the Market Vectors Gold Miners ETF (GDX), which holds senior gold stocks, have been even more dramatic, at $94 million.

At the other end is the Market Vectors Junior Gold Miners ETF (GDXJ), which holds junior gold equities such as Northern Star, OceanaGold, and Evolution Mining. Despite an increase in share price, we’ve seen a net decrease in shares outstanding. Year-to-date, outflows have totaled $84 million. Flows out of the Market Vectors Gold Miners ETF (GDX), which holds senior gold stocks, have been even more dramatic, at $94 million.

This could be explained by investors taking profits off the table, unease with the volatile swings in the gold market lately or mistrust in mining stocks. In any case, many investors could be missing out on one of the most impressive gold rallies in a generation. Since the start of the year, Goldcorp has gained 38 percent, Randgold 45 percent, Barrick Gold 84 percent, Harmony Gold 300 percent.

Good News! Global Manufacturing Turns Up

Another concern investors have right now is to the health of the global economy. Since February 2014, we’ve seen the J.P. Morgan Global Manufacturing Purchasing Managers’ Index (PMI) trend steadily downward.

********

Courtesy of www.USFunds.com

Frank Holmes is the CEO and Chief Investment Officer of

Frank Holmes is the CEO and Chief Investment Officer of