Gold: Maganomics, Fact or Fiction?

God took 7 days to make the world. Hitler transformed Germany from a democracy to a violent authoritarian state in only 100 days. Today’s US political climate too is changing as President Trump’s Maganomics remakes America and the world. It might take less than 100 days as this chief executive breaks rules, stretches laws and uses his unbridled powers to remake the world. How?

First, under the 1977 International Emergency Economic Powers Act, Congress had already given the president a large portion of its constitutional authority. The president only needs to declare a "national economic emergency" to achieve his goals. Furthermore, Mr. Trump can enact his “America First” agenda, which includes extending the 2017 tax cuts, because Republicans control majorities in both Houses of Congress. In just a few days after taking office, he fired government workers, issued a flurry of executive orders, and even revoked over 70 of Biden's instructions to make the federal government a "leaner operation." It is noteworthy that these directives helped solidify his power even though they were not subject to congressional approval and may be revoked by the courts or a future president. The statute has been utilized by Mr. Trump to paint immigrants as "invaders," obfuscating the distinction between existing immigration and war laws already on the books. Because of disagreements over how to interpret presidential authority, we even have a politicized judiciary. Mr. Trump has carte blanche as long as he is president since the Supreme Court has already ruled that the president is immune from criminal punishment for actions taken.

Constitutional powers aside, Mr. Trump has unique abilities to create disorder. Disruption is essential for Mr. Trump’s makeover of geopolitics, the global economy, technology and the environment. Americans want change, they are going to get it.

Trump’s Second Coming

The president will have the help of the world’s richest people. Billionaires have decided the next new thing is government. We have had the Rockefellers, Michael Bloombergs and Ross Perots try their hand at office, but the bureaucracy or “deep state” wore them down. It’s no wonder that we have an angry middle class, angry media and today those angry billionaires are taking the reins of government, because “they” think they can do a better job. Billionaires have enough money to get what they want. Another billionaire, Mr. Trump, has now surrounded himself with like-minded people who are prepared to tear down regulations and usher in a more transactional world that will go down in history.

But we are told that it is different now. Mr. Trump stocked his cabinet with the most billionaires who are about to pull the levers of government. Elon Musk, the richest man in the world doesn’t even have a cabinet position but has the president’s ear after spending $250 million helping to re-elect Donald Trump. Mr. Musk gained his fortune by placing large bets on high-speed trains, electric vehicles, and space based on the maxim, "high risk, high return." He is now using this against the government, even vetoing the Congressional budget agreement that nearly caused the country to shut down. And as Mr. Musk develops a plan to remove UK Prime Minister Starmer, the richest man in the world is advocating for regime change in Britain, while governments worry about "foreign influences." Risks? We are all in the same boat but Mr. Musk just has a bigger life preserver.

In remaking the world, Trump 2.0 promises no new wars in a form of MAGA imperialism and would like to redraw the map of America. However unlike Trump 1.0, this time he should be taken literally as well as seriously as he goes about remaking the world. America’s populist revolt was inevitable as government became the elites and the elites, the government. Of concern is that peace and stability are no longer the world’s default, and within this new geopolitiks of broken treaties such as USMCA, and burning the house down, diplomacy ceases and instead strongman politics rules. What is certain, disorders will prevail and with it, uncertainty. Trump’s tariffs may well be a means to an end, but what happens if he is wrong? History has the answer.

The new politics has big business, Hollywood, Silicon Valley chiefs and world leaders descending on Mar-a-Lago to bend the knee. Among other things, the US economy and stock market reached all-time highs as a result of expectations that Trump's American exceptionalism will lower taxes, promote deregulation, and remove antitrust restrictions in order to restore America's greatness. Additionally, investors have wagered that the war on inflation was won. A larger percentage of investors' wealth is now held in the stock market, with trillions of dollars flowing into exchange-traded funds (ETFs), which ironically mimicked the once-illegal investment trusts of the past. Of concern is that a large part of that wealth is concentrated in a handful of technology companies (Magnificent 7) that dominate artificial intelligence, bringing new risks with China coming up with a cheaper alternative.

While the roaring 2020s stock market has enjoyed a record run, so has inflation on concerns of Mr. Trump’s economic policies. Under Trump 2.0, rule busting, protectionism and other disruptive policies are set to return, having a high risk of inflation. Under a tariff war the nation will face even higher inflation borne not by foreigners but America’s consumers. We also think investors have overlooked the obvious, which is that the government's decision to prioritize both "guns and butter" is largely responsible for the country's prosperity.The current disarray of America’s finances resulted in a surge in money supply that goosed asset prices making the very rich, very rich. Of concern is that debt service today is the fastest growing item in the budget at $1 trillion, three times higher in the past decade. The problem is not the big bureaucracy that Mr. Musk’s DOGE will attack, but that public spending now accounts for over one third of GDP of which most goes to entrenched entitlements. That spending is paid by debt. New jobs? More than 20 percent of new jobs were actually government-related, up from 1 percent in the 2010s. While stocks have been on a run lately, the tariff showdown has sown the seeds for the market’s collapse.

Making America Great, By Being Bigger?

Today the world is grappling with multiple foreign policy crises and now an inconsistent American foreign policy, acting with impunity on the global stage. As a result, the world is destabilized as cracks open fast and at a furious pace. From Beijing to Washington, to the hotbed of conflict in Gaza and Ukraine, to instability in Africa, political unrest is present everywhere. There are new alignments emerging. For generations the US has been the dominant military power, albeit with a series of misadventures. Mr. Trump in his first term showed that power was conditional, reminding them that NATO was to be the security umbrella for Europe, but only if they paid for it. Today great power rivalries are testing America’s vaunted war machine. And after Joe Biden’s debacle in Afghanistan, Mr. Trump naturally is reluctant to get embroiled in another military disaster, particularly since there are wars on three continents, despite the presence of US troops everywhere. Consequently in Trump’s second term, America’s support will have huge caveats in his promise for no new wars. Despite the continuation of Russian aggression in Ukraine, not only is American protectorate support conditional but comes at a time when Europe faces depleted gas reserves and thus higher costs, following Ukraine’s refusal to renew its gas transit agreement with Russia. Ironically, America, which has grown to be the world's biggest LNG player, has benefited the most. Here, American mercantilization was undoubtedly successful.

This time Mr. Trump decided to demonstrate his power by employing sweeping tariffs more for political not economic purposes against his country’s three largest trading partners. Instead of military power to get his way, he has no qualms of using the economic might of the US to achieve his goals even abrogating the USMCA deal that he negotiated. Ironically, his reluctance to confront adversaries did not preclude Trump’s musings to take control of the Panama Canal, Greenland and Gaza, annex Canada or rename the Gulf of Mexico to the Gulf of America. The president similarly hit Columbia with 25 percent tariffs after the close ally refused to allow migrant flights. Note that it is the mid-sized nations that has drawn Mr. Trump’s ire, picking a battle with lesser-sized nations and using them as an example to cower them to submission, intimidating the bigger ones to follow his wishes. Greenland only has a population of 56,000. America’s closest allies have ratcheted up military spending in response to his imperialistic threat to redraw America’s borders. The cost of American exceptionalism will be steep for everyone.

It is concerning that Mr. Trump's "might is right" philosophy is a holdover from a military Russia or a more nationalist Asia that was popular in the 1930s, rather than relying on international treaties or the courts. America’s new-found nationalism comes at a time when other global powers are opening long standing sectarian divisions and thus fomenting political change, reinforcing the anti-US axis, joining Moscow, Islamic Tehran and Beijing. Today Russia is claiming sovereignty over parts of Ukraine, increasing its influence over central Europe. China is increasing its influence in Asia. America’s hegemony? Greenland, Canada, Panama and Gaza? Economic coercion to Trump is everything.

All the while the Chinese and US great power rivalry continues with the US ratcheting up the cold war with an opening round of 10 percent tariffs, deepening the schism between those who side with US and those with China. China’s symbolic response to Trump’s tariffs was the imposition of a 15 percent tariff on coal and LNG, as well as 10 percent on crude and agricultural products. Tariffs remain a clear and present danger. Of concern, Mr. Trump’s populism is an aggressive form of nationalism and his imperial-type presidency harkens back to the late 19th century, a time of not only technological advancements, but wide disparity between rich and poor and, hostility to immigration. Similarly, the tearing up of a network of alliances leaves America exposed to a growing authoritarian rule which is the stuff of the Thucydides Trap, when a rising power challenged those in decline, the majority of the time, the end result was bloodshed. The threat to the world order is not Russia, nor even China, it’s America.

Enter The Dragon

Within this hostile environment where the US sees itself as first, others see China as the world’s next hegemon. Mr. Xi Jinping’s view of China clashes with Mr. Trump and his “China hawks” coterie of advisors’ anti-China sentiment. Both are chest-thumping nationalists, both purged their parties to strengthen their control, both are central planners and both seek to transform or change the international order. However Mr. Trump has little regard for international rules and as an agent of chaos in his first term, Trump’s strategy was to divide China and Russia. That didn’t work. India deepened ties with Russia. Although he may be preoccupied in the growing security crises in the Middle East and Europe to pivot to China, of concern is that Mr. Trump will be more radical, unstrained and much more transactional than his first term.

But what about those far-reaching tariffs? Tariffs are central to Mr. Trump’s agenda. No question Mr. Trump is the negotiator par excellence of “The Art of the Deal” fame and his much-feared tariffs might well prove to be an opening gambit or a transactional tool, used to extract concessions to destabilize his opponents. China is the target number one. China too is saber rattling, bracing itself for another salvo of tariffs as part of the continuation of the trade war Trump launched in 2018. Then China responded by slapping a 25% levy on America’s farm products which saw China’s soyabean purchases shrink in half. Then the trade deficit reached $418 billion but in Trump’s second year in the office, China posted a trade surplus of almost $1 trillion last year with the rest of the world. This time however China is not a paper tiger.

China Rivalry

It will be difficult to decouple. In addition to Tencent and Bytedance, China has new heavyweights like Temu, which is larger than Alibaba. Shein is larger than Zara and H&M combined and controls 50% of the US fashion market. Compared to Apple, Huawei sold more phones. Tik Tok, a Chinese-owned app, claims 170 million users in the United States. Where are Teslas made? China. China? Apple's iPhones. China has so far been able to successfully resist American actions, placing a significant wager on industrial strategy and even developing the ability to reshape its supply chains. China's exports to more than 160 nations contributed to the country's 5% GDP growth. China has already rerouted its supply chains into Mexico and Latin America as a backdoor into the US. Chinese exports to Mexico boomed as “nearshoring” helped Mexico become the US top trade partner, ahead of China. US/China tensions will also drive the demand for commodities and in a worsening tit-for-tat trade war, China has countered tariffs, moving to ban key critical minerals, striking at America’s Achilles heel – technology. And despite tariffs, export controls and sanctions, China grew its export markets 5% last year.

And then in the brave new world of artificial intelligence, US high tech exceptionalism took a $1 trillion bloodbath on Wall Street when China’s artificial intelligence start-up DeepSeek claimed performance comparable to the US best models, at a fraction of the cost. China’s low cost DeepSeek AI model was created despite US export controls and walls on AI technology. Chinese manufacturers initially became the workshop for the world then, high-speed trains, EVs and now the DeepSeek software erases America’s AI headstart. Many will argue that this was accomplished because they stole chips and technology. No, the Chinese were better at innovation, backed by a Chinese hedge fund billionaire. The disrupter was disrupted.

China has other options, unveiling vigorous fiscal and monetary bazookas. For a half century, China and America had a profitable co-existence as China moved up the value chain rising to the top with their companies producing everything from semiconductors to consumer electronics, to automotive and more importantly, renewables. China consequently became an adversary and not a competitor. And today China is far ahead in the race for supremacy in green technology with a stronghold on vital critical minerals, silicon and technology. China has already won the race to go electric with better battery technologies and affordable cars such that Chinese carmakers are among the largest in the world, reshaping the global auto industry. Chinese EV sales last year were up 40 percent. In the West, billions are being spent in a catch-up effort, but the war has already been lost.

High Risk, High Reward?

China’s strength remains its manufacturing prowess allowing them to dominate supply chains. America? Financial prowess. We think there are significant risks associated with Trump's plan to use its financial dominance as a weapon. While China has the world’s largest navy, a huge population of 1.4 billion people or four times that of the US and a rising middle class, its ultimate weapon is financial. China is the world’s largest creditor nation with $3.2 trillion reserves including $1 trillion of the second largest holdings of US Treasuries. Unloading this position would crush financial markets and America’s deficit-laden economy. It can’t happen? Trump’s honeymoon will be short as sentiment is as bearish in China as it is bullish in America.

After sanctions were imposed on Russia and Iran, most countries dedollarised to protect themselves from sanctions and the weaponization of the dollar. Trump’s trade war with allies has caused a scramble to find new trading partners and ironically China may be a more reliable trading partner. US economic power relies on the financial system and the dollar but in weaponizing the dollar, America also undermines its usage. Decoupling comes at a price. Earlier, the barn door closed on the dollar when the oil-rich nations protected themselves from the weaponization of the dollar by selling oil for renminbi instead of dollars. To be sure Trump may get what he wishes for, as his mercurial policies creates uncertainties, which we believe will send global investors for cover, from the dollar into gold. The best Trump trade is gold.

The popular opinion is that Mr. Trump is a successful negotiator and his tariffs are like sanctions, tools to win. Think again. Examine the causes of the Great Depression in 1930. Nearly a century ago, Hoover's Smoot-Hawley Act set off a tit-for-tat worldwide retaliation, transforming a stock market triumph into a time of instability and the gloomy days of the Great Depression, followed by the Hitler years. The country then was beset by isolationism and a hostility towards immigrants. Other parallels include the Roaring Twenties-style stock market on steroids, today's populist policies, and even a Republican president and GOP-controlled Congress that are ready to restore America's greatness. It seems unbelievable that as we are facing the same conditions as in the Thirties and that we are following the same failed solutions with politicians again becoming the source of increased instability. And we know how that ended. Tariffs then and now will make America poorer.

Climate Change

Climate change is another threat to global financial markets from the tens of billions in losses from the LA fires to floods, to droughts that cost trillions, to the insurance and banking sectors. Nonetheless, the US withdrew from the Paris climate agreement for a second time. Although there is a critical minerals boom driven by electrification, the demand is expected to spread out to a dozen or so countries for supply chains, tariffs and mining infrastructure. China already dominates critical minerals, controlling two-thirds of global lithium and cobalt processing as well as control of critical supply chains.

The electricity requirements for AI are so large that Big Tech are signing up nuclear companies to power their data centers. However the technology is years from production despite the retirement of a third of the old conventional clunkers, many of which are sitting idle today. In fact, Microsoft hopes to restart the old Three Mile Island Nuclear plant in Pennsylvania to handle its AI requirements. Although no company has successfully deployed the technology, the bet is that small reactors can deliver enough energy to run AI systems. Also the bet requires thousands of pounds of uranium fuel of which the only supplier is Russia.

China is the world’s largest importer of oil and has the upper hand in a world of surpluses just when Mr. Trump is urging his oil industry to drill baby, drill. While China has developed strategies that work, needed because we can’t stop climate change, Mr. Trump not surprisingly scrapped his predecessor’s excessive IRA boondoggle but also put on the brakes on other green initiatives like solar and windmills in favour of fossil fuels. However the L.A fires notwithstanding, climate change knows no political boundaries. China is also a major player in the pulp and paper market, raising potential supply chain issues with the West as duties are imposed on allies. The US doesn’t produce enough lumber to meet domestic demand, particularly after the fires and must depend on imports for as much as a third of its need, mostly from Canada. Then there is America's voracious customer base, which is mostly reliant on low-cost Chinese appliances, furniture, and commodities. The inconvenient truth is that both countries have much to lose. So the looming trade war will be a war of metals, particularly at a time of heightened geopolitical tensions.

What Are Friends For?

Mr. Trump’s view is that the world is a big monopoly game. If Putin can take over Ukraine, and China could have Taiwan, then why can’t he have Greenland or the Panama Canal or Canada or Gaza? Why not?

Trump’s opening gambit to impose a 25% tariff against its neighbour and closest ally caused turmoil in Canadian politics with the resignation of its finance minister and Prime Minister Trudeau. After promising border action, both Canada and Mexico obtained a month reprieve delaying a costly and damaging trade war that jolted world markets. Canada ships about 80 percent of its exports to the US. Within this turbulent world, Canada is vulnerable and more exposed than ever before and should try to insulate itself by becoming more self-sufficient or, become the 51st state. What to do? Rather than spend billions on bailouts, we should adopt free trade within Canada by removing the barriers to growth such as interprovincial trade barriers. Canada has our own tariff walls with each province having a myriad of separate regulations for food, wine, trucking, labour to energy. Canada has an internal competitive problem, and part of it is provincial red tape. For example, Canada would be self-sufficient in energy but a cross-Canada pipeline that would have brought Alberta oil to Maritime shores was vetoed by Quebec. Alberta’s oil output instead goes south of the border with little to our big population centers in Ontario and Quebec because we don’t have enough pipeline capacity. Oil and gas represents about 25% of all Canadian exports – yet the East must import our energy requirements. And rather than spend billions of taxpayers’ dollars on battery plants, we should look at pipelines to reduce our reliance on one customer, when we could have ten local customers. LNG? Canada has huge gas reserves rivaling the US, yet we only have one LNG project despite the Japanese, German and Taiwanese requests for our help. Canada once had 10 LNG projects, but while we dithered, the US became the world’s largest LNG producer.

America may well be a financial and economic powerhouse but Trump’s extreme protectionism and isolationist policy will eventually undermine the US dollar and is in conflict with the need to finance its fiscal deficit. Who will finance America’s needs? Despite his desire for a weaker dollar, Mr. Trump is determined to keep the dollar as the dominant currency and has threatened to impose sanctions on the BRICS countries (Brazil, Russia, India, China, and Saudi Arabia) should they introduce their own currency. That could backfire and instead encourage BRICS to hedge their dollar bets and accelerate their currency plans rather than continue to finance America’s deficit. Global trade has shifted and his tariffs has created uncertainty in the North American economy. America’s increasing usage of sanctions to cut off rivals’ reliance on the dollar-based Trump’s financial ecosystem and tariffs have sown the seeds of an anti-US alliance and already spurred many countries to trade among themselves, with the US share of global trade down to 15 percent. The BRICS countries are already big commodity producers with large domestic markets and they will buy from the most friendly producer, not necessarily from the US or Europe. The big winner is not America, but China.

A Debt Reckoning Is Coming

It is not Trump’s tariffs that will hurt America, it is their huge debt. Mr. Trump mused that abolishing the debt limit (created in 1917) would be the “smartest thing” Congress could do. Currently at $32 trillion, the debt limit ball was pushed down the road into March. Each time the nation flirts with default and each time it gets extended. President Trump is right – abolishing the debt limit would be a realistic admission of default, particularly when the government penchant to spend stores up problems in the future with the national debt at $36 trillion. That large and growing spending is the most since World War II with almost $1 trillion of interest payments on the national debt that is more than they spend on defense. There is the need to refinance another $7 trillion of debt as well as another $7 trillion for Mr. Trump’s deficit expanding extension of 2017 Tax Cuts, all at higher borrowing costs. His proposed reduction of corporate taxes from 21 percent to 15 percent is worrisome since Fed revenues are only $7 trillion despite Musk and friends’ optimistic promise of $2 trillion in spending cuts. And Trump’s $2 trillion budgetary deficit at 8% of GDP with debt to GDP at 125 percent must somehow be borrowed. Government outgoings are a problem and the growing fiscal deficit will lead to higher costs of borrowings and yet another round of massive money printing at a time when Trump wants to boost spending for tax breaks as well as higher defense spending.

At the same time, the president wants the Fed to lower rates even though the Federal Reserve has already loosened policy markedly since the fall. Of concern, America’s stretched finances, profligate spending and lack of firepower leaves them vulnerable to black-swan events such as the insurance industry’s losses in the wake of the devastating California fires. The bigger concern is whether the bond vigilantes will co-operate, particularly since 10-year Treasuries have risen a quarter percentage point since yearend, pushing near 5% before pulling back. In the past couple years, other profligate governments from Brazil to the UK have been punished for less. A debt reckoning is coming.

At another time in 1971, when America’s finances were dangerously stretched, Richard Nixon took America off the gold standard and in essence devalued the dollar. That move ended the 25-year Bretton Woods international monetary system, making the dollar the world’s reserve currency. Since then, the price of gold has soared from $35/oz to almost $3,000/oz because the dollar is really just another fiat currency, without any backing. Today those chickens have come home to roost. America cannot continue to spend more to finance its past than to secure its future. Trump’s tariffs lessen imports into the US, and thus usage of the dollar. Tariffs also create uncertainty and inconsistency. Consequently we believe that despite recent dollar strength, the US dollar is particularly vulnerable as an array of ultimations and demands as part of Maganomics will dent not only US power but also its currency.

Mr. Trump and his people are considering an all-effort to devalue the US dollar which would be a step towards a currency war, reminiscent of the Dirty Thirties with exchange controls, tariffs, quotas and export subsidies. China’s PBoC recently weakened the renminbi to its lower range helping China’s exports. We believe the tit-for-tat volley against the dollar is the beginning of a currency war which could easily morph into other wars.

The Best Trump Trade is Gold

Mr. Trump designs for a weaker dollar, rests on hopes of another grand bargain like the Plaza Accord in 1985, when Japan, West Germany, France, UK and US jointly weakened the greenback by manipulating their currencies upward. With little regard for allies, those participants are unlikely to agree this time, particularly since the US has turned inward and the Accord subsequently resulted in rampant inflation in the US and decades-long deflation in Japan. Still Trump and his people are pushing for international intervention to weaken the dollar. Ironically, Trump’s tariffs may do that.

While Mr. Trump complains that interest rates are too high, his economic plans and spending will keep rates higher for longer. China, with $3.2 trillion of reserves, was once the biggest buyer of US debt and the second largest holder of US debt. China is no longer a buyer probably because of the anti-China sentiment. Moreover, the end of Fed’s quantitative tightening programme removes another buyer of Treasuries. If not them who will buy US debt? Wall Street hedge fund peers of the new Treasury Secretary and Commerce Secretary already hold a sizable portion of Treasuries and are searching for strategies to hedge their positions. It is the dollar’s status as a reserve currency that allows the country to run up big deficits. But now the recent rise in US bond yields exposes risk in once super safe US debt at a time an unbridled Trump pushes for growth at the expense of debt. At the same time, America’s red ink, trade war and stretched finances undermines the dollar’s exorbitant privilege.

And now, so desperate are Trump’s cadres that trial balloons are floated that the Federal Reserve will add crypto currency to its balance sheet, essentially backstopping crypto, making it real money. However, a pyramid on top of a dollar pyramid would only collapse under its own weight. President Trump has even established a “crypto advisory council.” Is crypto like gold? Is it even a currency? Crypto is neither. It is an asset like a Mercedes or a house but not a currency. Cryptos can be stolen, by hackers and money launderers for dirty money. The basic definition of a currency is a unit of account, exchangeable and most of all, a store of value. Moreover crypto is not held in the reserves of central banks like gold, nor is it fungible like gold. Simply, the primary reason to buy crypto is to sell it at a higher price to someone else – the greater fool theory. America is hardly in financial shape to finance itself and should they pursue this monetization route, the house of cards will collapse.

Gold, the Next Battlefield

Gold is money. Consequently gold is going to be a good thing to have, particularly when the US dollar as a percentage of global reserves has fallen to 57 percent, a 30-year low according to the International Monetary Fund (IMF). Only ten years ago, the dollar’s share was 66%. The euro usage has ticked up to 20 percent. We believe the decline in the dollar as a reserve currency is due to a pick-up in central banks’ purchases of other alternatives. Although gold is not a “foreign exchange reserve” asset, gold is a reserve asset and central banks have been increasing their holdings, buying more than 1,000 tonnes or 20 percent of the world's production at the expense of the dollar. Last year, total physical demand was almost 5,000 tonnes, a record high.

Gold is also expressed in dollars and some central bankers have even swapped their US Treasury holdings for gold, signaling, in our opinion, a more fractious global order. Gold is indestructible, peace is not. China too has tripled their gold reserves since 2008 and the Shanghai Gold Exchange has become the largest physical gold player in the world. China bought 10 tonnes in December 2024 resuming gold purchases after a six-month pause. Should the world wean itself off the US dollar, it would reshape the global economy and geopolitical landscape. Gold is a hedge against this regression.

The Best Trump Trade Is Gold

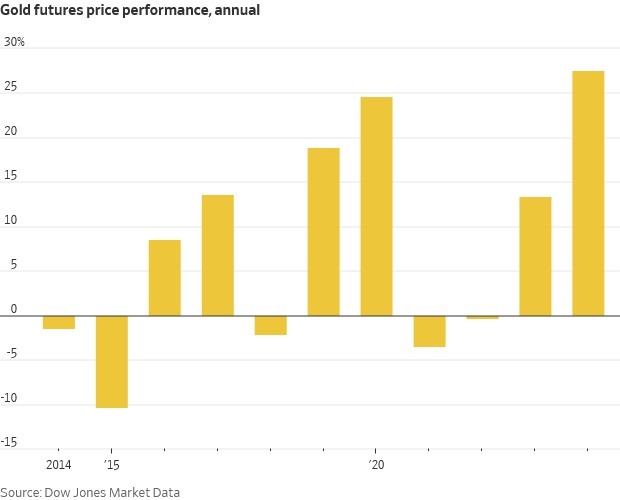

Gold has been on an astonishing run, smashing records, in all currencies. To a certain extent, that makes sense given that bubbles keep getting bigger, inflation remains resilient, America’s deficits keep widening (currently 8 percent of GDP) and, with Trump 2.0 the world is riskier and more uncertain. Gold is both a hedge against calamity and a store of value (thus the outperformance in all currencies). We continue to believe gold will surpass $3,000/oz with a new target at $3,300/oz. The best Trump trade is gold.

Today there is a shortage of physical bullion as buyers scramble to buy physical on fears of tariffs resulting in a repatriation of bullion back to Comex markets with almost 400 tonnes moved from London to Comex’s NY vaults. We also believe that major central bank buying has squeezed the physical market, causing a scramble among derivative players for physical such that New York prices are trading at a premium to London, the world’s major market. The tightness is due to more demand than supply. Peak gold has arrived.

On the other hand, gold shares are under-owned and have not duplicated bullion’s record setting performance, yet. Fundamentally gold stocks are cheap. Most have generated strong free cash flow, possess stellar balance sheets yet the lack of an institutional following has meant gold stocks have become value plays. The seniors have boosted dividends and accelerated share buybacks to attract institutional interest, but it has not been enough to attract new buyers. The problem is growth or the lack of growth. There have been few discoveries and production growth is flat since the industry has not replaced declining reserves. Consequently there has been a pickup or focus on M&A activity because it is cheaper to acquire reserves on Bay Street rather than spend the dollars to explore. In addition, growth can be had through acquisition since the market cap per reserves in the ground for the top dozen miners are trading at $700/oz.

Consequently we believe the mining developers are attractive. Of our list of 20 developers, 10 percent have already been taken over in the past year. At this time there are more buyers than sellers. First, there are the mining companies themselves looking to grow, then there are sovereign players or state backed entities such as China’s Zijin looking to acquire ounces in the ground and expand their geographic footprint. The industry is stuck in a game of musical chairs, but there are so few chairs. There has also been a lack of capital for exploration so there have been fewer discoveries. Most miners today are extending existing deposits (brownfield) development and so the explorers are unusually cheap. The problem is that it can take 15 years from first discovery to first production (permitting issues, financings and time to validate economics), so only “size” deposits stand a chance. Thus the developers with projects to come on stream within the current cycle are best able to capitalize on the current bull market.

Finally there is geopolitical risk. In central Africa, countries are nationalizing gold mines that sees Barrick in a standoff with the Mali government. Countries are finding it easier to pluck the golden goose but as Kyrgyzstan discovered, operating a mine is not an easy task. History shows that nationalization does not create value but instead destroys value, so governments have learned. With the low hanging fruit picked, we suggest patience. Barrick’s Tanzanian assets are producing record ounces only years after negotiating with the government. Similarly, Barrick’s Papua New Guinea assets are finally up and running after a lengthy “negotiating” period with the government. Most gold mines have long lives and, patience and “buy the dip” strategy makes sense.

Recommendations

We continue to like the seniors such Agnico Eagle and Barrick as well as the developers like B2Gold, Endeavour, Eldorado and McEwen Mining.

Agnico Eagle Mines Ltd.

Agnico Eagle with operating mines in Canada, Finland, Australia and Mexico has performed well because of its growth profile. With assets largely in North America, and as the largest producer in Canada, Agnico is selling gold at a whopping $4,000/oz. Agnico is a low-cost producer and is expanding several major mines at Odyssey u/g project. Material will be processed at Canadian Malartic facilities which has excess capacity. Work continues at Detour Lake with exploration boosting reserves which is a long-life operation. Agnico Eagle recently bid $200 million for O3 Mining’s Marban Alliance project located in Val-d'Or, Québec which is a “tuck-in” acquisition and another potential part of its Canadian Malartic complex. Other potential projects include expanding Kittila and Amaruq. We like Agnico Eagle here for its growth pipeline, focused management and balance sheet. Buy.

Barrick Gold Corp.

The world’s No. 2 gold producer Barrick Gold’s 4th quarter will be an improvement over the third quarter, but of a major concern is the standoff with the Mali government at Barrick’s Loulo-Gounkoto site. Barrick has shutdown the nation’s biggest mine after the Mali government seized 3 tonnes of gold. Loulo accounts for 14 percent of Barrick’s output and government is demanding $200 million in back taxes owed under the 2023 mining law. Barrick has been through such standoffs before with Tanzanian and Papua New Guinea governments with lengthy negotiations but eventually a compromise was reached resulting in not only the reopening of the mines but also increased investment. To avoid future problems at Reko Diq in Pakistan, Barrick has brought in a significant Saudi Arabia partner to partner with the government to bring on the huge $9 billion gold/copper producer enabling Barrick to boost reserves by 17.4 million ounces. Similarly, Barrick has a number of brownfield plans, including Fourmile in Nevada where the resource is expanding and closeby the Joint Venture facilities. Barrick has an array of high-quality Tier 1 producers in Nevada and Dominican Republic as well as a growing copper profile at Lumwana which generates huge cash flow. In addition, management is lean and we continue to view Barrick as a buy and would take advantage of the Mali uncertainty.

B2Gold Corp.

B2Gold similarly saw its rich Fekola operation up for grabs with the dispute with the Mali government. But B2Gold came to an agreement with the government which allowed for the acceleration of the Fekola main and underground expansion. The Mali government has given a tentative okay and importantly B2Gold will operate under the old mining 2012 mining code while Fekola expansion will operate under 2023 mining code which will add almost 100,000 ounces. At Otjikoto, Antelope might extend the mine’s life a couple years. B2Gold is building Goose Back River in Nunavut which is on target but overbudget having spent some $1.5 billion to date. First production is expected in second quarter this year due to weather challenges and equipment delays. We like the shares here for Goose and three other operating mines.

Centerra Gold Inc.

Intermediate tier player Centerra Gold has a great balance sheet and exposure to copper and gold (and moly) which generates solid cash flow. However Thompson Creek Moly expansion is uninteresting from a internal rate of return given the price tag at almost $400 million. Mount Milligan’s life was extended with an agreement with Royal Gold. Centerra's main mines are Mount Milligan and Öksüt in Türkiye which are performing well but the company is in need of a flagship asset. Goldfield is too far off into the future. We prefer B2Gold here.

Eldorado Gold Corp.

Mid-tier player Eldorado had a weak quarter but the fourth quarter should be better due to improvements at Kışladağ in Türkiye which had recovery problems with HPGR. Efemçukuru also in Türkiye is a low cost and steady producer. As expected, problems at the huge Skouries gold/copper project in Greece hurt the quarter but we continue to believe that Skouries is a company producer. Lamaque in Québec will benefit from Ormaque. Despite delays at Skouries, we like Eldorado here for its growth prospects.

Endeavour Mining PLC

Endeavour Mining is the largest gold producer in West Africa with mines in Senegal, Burkina Faso and Côte d'Ivoire. Endeavour Mining released results of a prefeasibility study at Assafou-Dibibango property in Côte d'Ivoire coast. Assafou is Endeavour’s next big mine with an attractive rate of return and mineralized strike at 3.7 km after completion of Sabodala BIOX expansion in Senegal and Lafigué mine in Côte d'Ivoire. Despite problems in West Africa military governments, we like Endeavour for its organic prospects and its growth profile. To date the miner has avoided the problems that other producers have experienced in West Africa. Buy for growth.

IAMGOLD Corp.

Mid-tier IAMGOLD’s Essakane and Westwood performed better in the last quarter. However Westwood still has high costs and grades at Essakane should be lower. IAMGOLD’s results include the final ramp up at Côté Lake in Ontario which is largely complete and in production. While Côté Lake is a long-life project, we believe that results will be uncertain given our expectations of sporadic production problems. Nonetheless, with the Côté open pit built, IAMGOLD should be generating free cash flow but the jury is still out on Côté. We prefer B2Gold here.

Kinross Gold Corp.

Kinross’ high grade 70% owned Manh Choh deposit helped Fort Knox results in Alaska. Kinross reported solid results as it builds Great Bear. Great Bear’s PEA metrics is long-life but the huge project will come on stream only later in the decade (2029). Kinross is working on an update and applied for permits, but the open pit and underground project is too far off into the future. Great Bear has yet to file its Impact Statement. In addition, we believe given the huge price tag and costs to build that it will be a long time before the company can get a return from Great Bear. Kinross shares have risen along with its peers and we would take advantage of strength and sell since most of Kinross’ other mines are mature.

Lundin Gold Inc.

Lundin Gold had one of the better results of its gold peers due to 100% owned Fruta del Norte (FDN) in southeast Ecuador. FDN is a moneymaker that enabled the company to retire debt much earlier than expected. An update of reserves and resources is expected and the Bonza Sur discovery is an opportunity to boost ounces. A PEA is planned which could boot production by 200,000 or so ounces. Exploration is a priority. We like Fruta del Norte and believe that Lundin Gold will be one of the key M&A players this year. Lundin is owned 32 percent by Newmont and the Lundin family at 26 percent. To date FDN has produced over 2 million ounces and is among the richest and lowest cost producers in the world. With a stellar balance sheet and strong cash flow, Lundin increased their dividend. We like the shares here for its growth potential. Buy.

McEwen Mining Inc.

McEwen Mining posted good results as the Fox complex in Ontario grows with the discovery of satellite deposits. Grade is also better. In addition, McEwen Copper’s Los Azules in Argentina is performing well with a feasibility study expected this year. Today with support partners Stellantis and Rio Tinto, the valuation of Los Azules is higher than the market cap of McEwen Mining so a purchaser of McEwen Mining gets the upside of the gold mines for free. We expect McEwen to monetize McEwen Copper sometime next year which will give McEwen Mining not only capital but also appreciation possibilities. San Jose and Gold Bar are generating positive cash flows. McEwen is one of the better developers and the shares have performed well. Buy.

Newmont Corp.

The world’s largest miner Newmont has sold almost $4 billion worth of non-core assets related to previous acquisitions dating back to Goldcorp and Newcrest. Newmont has attracted a lot of attention for the sale prices, but investors overlook that Newmont has also taken big writedowns on these assets. Newmont's problems was not the acquisitions but that costs remain high. Further results have been disappointing, capex remains high and the miner lowered guidance. Costs are high because of Cerro Negro in Argentina, Peñasquito in Mexico and costly work at Lihir in PNG as an example. As a result Newmont shares have been a disaster in part to the high costs and disenchantment with their acquisition strategy. Although Newmont recently pruned its top heavy employment ranks, no doubt because of its mixed results, the gold miner still has problems which will take time to sort out. We prefer Barrick here, particularly since we expect Newmont shares to continue to underperform as they wrestle with their legacy of acquisition. Sell.

John R. Ing

*******