Gold Mining Success Lies in Proper Capital Allocation - Ralph Aldis:

“The proper use of capital allocation is to maximize long-term value per share.”

That’s according to Ralph Aldis, USGI’s resident gold expert and, since 2001, portfolio manager of our two precious metals funds—Gold and Precious Metals Fund (USERX) and World Precious Minerals Fund (UNWPX).

That’s according to Ralph Aldis, USGI’s resident gold expert and, since 2001, portfolio manager of our two precious metals funds—Gold and Precious Metals Fund (USERX) and World Precious Minerals Fund (UNWPX).

In a recent Gold Report interview with Kevin Michael Grace, Ralph expresses his thoughts on what’s moving gold prices today and also singles out some of his favorite companies in the gold, silver and royalty spaces.

More important, however, Ralph argues that for gold mining companies to succeed, they need to practice prudent capital allocation and know the proper value of their assets.

Below are some highlights from the interview:

Q: The price of gold is flirting with a five-year low. Do you attribute this solely to the strength of the U.S. dollar, or are there other factors at work?

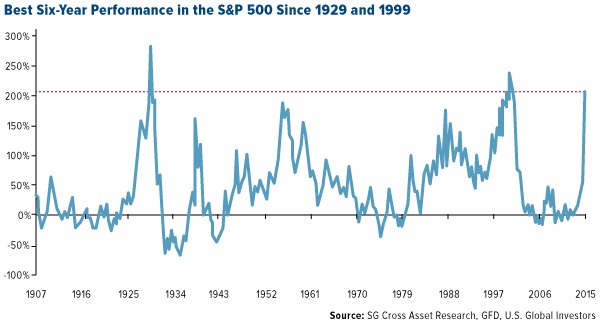

A: There are other factors. Most important is the strength of the equity markets. Looking at a six-year window, we have seen, for the third time in the last hundred years, the highest returns for such a period. This happened before in 1929 and 1999. These phenomenal returns have been fueled not by fundamentals but rather by the U.S. Federal Reserve, which is trying to jumpstart the economy.

All this has taken people's eyes off gold, but it won't go on forever.

Q: How do you see the mining industry adjusting to lower gold prices?

A: I look at the income statements from all the mining companies and calculate their breakeven point. Right now, it is about $1,149 per ounce. The forecasted average 2015 gold price remains about $1,200 an ounce. If the gold price continues to fall, companies will adjust. Some projects won't be built, but that is good because those are marginal projects.

About 40 CEOs in the mining industry have lost their jobs in the past couple of years. The new generation of mining CEOs is focused more on profit than growth. They know that even if the gold price falls more, the suppliers to them must drop their prices. If the gold price goes $100 per ounce lower, the smart companies will survive. Meanwhile, gold miners now benefit from lower energy prices, while the stronger U.S. dollar has been very positive for Canadian and Australian miners.

Q: Why do you believe gold stocks can still deliver favorable returns?

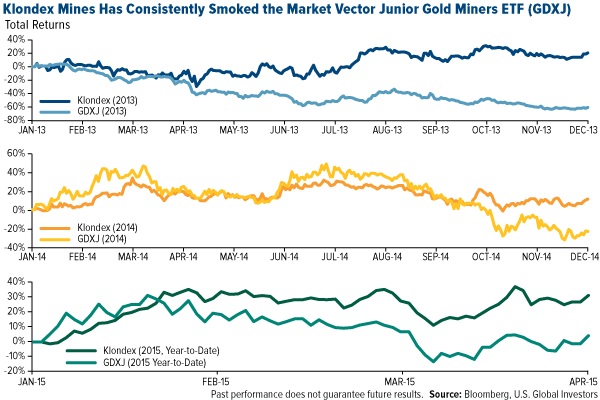

A: Because of the mindset of some of these new CEOs. One company doing the right things is Klondex Mines. It was up 29 percent in 2013, while the Market Vectors Junior Gold Miners ETF was down 61 percent. In 2014, Klondex was up 21 percent, while the Market Vectors Junior Gold Miners ETF was down 23 percent.

Klondex is my favorite junior producer anywhere. Some people might say it has a short-life resource statement, but the recent discoveries at Fire Creek are not yet in the resource statement. And the free cash flow it generates will pay for its exploration program at Midas. I expect more discoveries from Klondex and a bigger resource statement. Its very robust ore body will allow it to produce gold at even lower prices, should the market demand that. I talk to its management team, and they understand capital allocation.

Q: Could you explain the “Five Principles of Capital Allocation” and how they pertain to mining, given that mining companies typically have no revenues for years after their founding?

A: These five principles are the work of a Credit Suisse writer, Michael Mauboussin. They apply to some companies in the exploration and development phase but obviously more so to producers.

1. The first principle is "Zero-Based Capital Allocation." This means, for instance, that you don't give your exploration department $20 million this year solely because they received $20 million last year. Companies need a strategy to determine the proper amount of capital spending.

1. The first principle is "Zero-Based Capital Allocation." This means, for instance, that you don't give your exploration department $20 million this year solely because they received $20 million last year. Companies need a strategy to determine the proper amount of capital spending.

2. The second principle is "Fund Strategies, Not Projects." In other words, capital allocation is not about assessing and approving projects; it is about assessing and approving strategies and then determining the projects that support those strategies. It is a common mistake for explorers to continue to push a project forward—particularly if it is its only project—even though it lacks the potential for great returns.

Randgold Resources is a good example of the proper approach. When it evaluates a project, it's looking for grade sufficiently high that it can produce a good margin at a $1,000 pit shell or even an $800 pit shell. Restricting your return calculation to the pit shell is more conservative, as you are only including those ounces contained within the mine's engineering plan.

3. Number three is "No Capital Rationing." Typically, miners believe that capital is scarce but free. They believe that profits are free money, or if they're raising equity, they sometimes don't seem to care enough about dilution. Properly speaking, capital is plentiful but expensive. Profits need to be spent in a manner that results in future profitability. And equity financing is only plentiful if you have a good project.

4. Number four is "Zero Tolerance for Bad Growth." In other words, don't throw good money after bad. Barrick Gold Corp. fell into that trap with its Pascua-Lama project in Argentina. Long before its price tag reached $8.5 billion, the company should have thought hard about whether it would ever generate good returns. Mining companies should always seek to upgrade their portfolios.

5. Number five is "Know the Value of Assets and Be Ready to Take Action to Create Value." So many people in the mining industry don't know the value of their assets. We value companies based on their resource statements, and we get a very high correlation to where these stocks trade. But we constantly see companies decide to spend, for example, $1.8 billion on a project that the market values at only $800 million. It makes no sense to spend that much because similar projects could be acquired for less capital.

Q: What's your favorite gold producer elsewhere in the world?

A: I like Mandalay Resources Corp. Its management is very experienced in rescuing assets that have been mismanaged. Mandalay has turned around the Cerro Bayo silver-gold mine in Chile and the Costerfield gold-antimony mine in Australia. Last year, it bought the Björkdal gold mine in Sweden from Elgin Mining, and I think Mandalay will turn that around too.

Management owns a lot of stock. Mandalay pays a healthy dividend: 5.4 percent. The market has not yet completely woken up yet to this stock. We still think it's easily a 100 percent gain. It's one of our top five holdings.

Q: What's your favorite royalty company?

A: Osisko Gold Royalties probably has the safest royalties. It has a lot of room to grow but not so much as to draw the attention of Franco-Nevada Corp., Royal Gold Inc. or Silver Wheaton.

One of the advantages Osisko Gold Royalties has is that its assets are not dependent on other commodities. Franco-Nevada has oil exposure, and maybe oil prices don't go up very soon. Royal Gold has base metal exposure in some of its assets, and if prices of those were to drop tremendously, some of its assets could be shuttered. Osisko doesn't have those worries.

********

Please consider carefully a fund’s investment objectives, risks, charges and expenses. For this and other important information, obtain a fund prospectus by visiting www.usfunds.com or by calling 1-800-US-FUNDS (1-800-873-8637). Read it carefully before investing. Distributed by U.S. Global Brokerage, Inc.

Gold, precious metals, and precious minerals funds may be susceptible to adverse economic, political or regulatory developments due to concentrating in a single theme. The prices of gold, precious metals, and precious minerals are subject to substantial price fluctuations over short periods of time and may be affected by unpredicted international monetary and political policies. We suggest investing no more than 5% to 10% of your portfolio in these sectors.

There is no guarantee that the issuers of any securities will declare dividends in the future or that, if declared, will remain at current levels or increase over time.

Fund portfolios are actively managed, and holdings may change daily. Holdings are reported as of the most recent quarter-end. Holdings in the Gold and Precious Metals Fund and World Precious Minerals Fund as a percentage of net assets as of 12/31/2014: Barrick Gold Corp 0.00%, Elgin Mining 0.00%, Falco Resources Ltd (World Precious Minerals 0.01%), Franco-Nevada Corp (Gold and Precious Metals Fund 6.97%, World Precious Minerals Fund 1.32%), Klondex Mines Ltd (Gold and Precious Metals Fund 10.00%, World Precious Minerals Fund 9.78%), Mandalay Resources Corp (Gold and Precious Metals Fund 3.38%, World Precious Minerals Fund 2.28%), Market Vectors Junior Gold Miners ETF 0.00%, Newmont Mining Corp. (Gold and Precious Metals Fund 1.05%, World Precious Minerals Fund 0.22%), Osisko Gold Corp 0.00%, Randgold Resources Ltd. (Gold and Precious Metals Fund 2.30%, World Precious Minerals Fund 1.43%), Royal Gold Inc. (Gold and Precious Metals Fund 5.99%, World Precious Minerals Fund 1.51%), Silver Wheaton Corp (Gold and Precious Metals Fund 1.36%, World Precious Minerals Fund 0.45%), Virginia Mines, Inc. (Gold and Precious Metals Fund 1.14%, World Precious Minerals Fund 10.35%) .

The S&P 500 Stock Index is a widely recognized capitalization-weighted index of 500 common stock prices in U.S. companies.

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. By clicking the link(s) above, you will be directed to a third-party website(s). U.S. Global Investors does not endorse all information supplied by this/these website(s) and is not responsible for its/their content.

Frank Holmes is the CEO and Chief Investment Officer of

Frank Holmes is the CEO and Chief Investment Officer of