Gold In The Post-Election Market

Gold and silver resumed their uptrend this week to challenge recent highs, last seen on 23 January.

The best levels were mid-week, before some end-of-week profit-taking took place. In early European trade this morning (Friday) gold was trading at $1213, up $22 from last Friday’s close, and silver at $17.33, up 20c. Gold is up 5.5% and silver 9.5% on the year so far and must be among the best performing asset classes. Can this be sustained?

The current spurt comes at a time of dollar weakness, on profit-taking following the post-Trump election rally. There is little doubt that the post-election euphoria is wearing off somewhat, as the markets digest the unprecedented pace of executive orders being issued from the White House, some of them pregnant with unintended consequences. However, it is too early perhaps to call a top for the dollar measured against other currencies. Gold’s performance in the four major currencies is the subject of our next chart

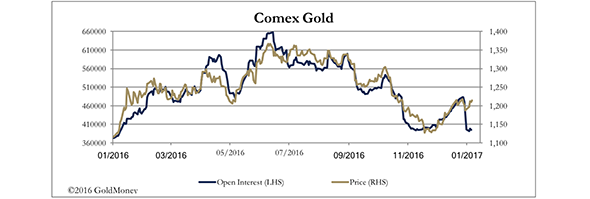

Something extraordinary has happened in recent futures trading. Open interest peaked at 483,408 contracts on Comex on 23 January, the day gold hit its January high. As the market consolidated, open interest collapsed to 391,449 by Monday, while the gold price lost only $20. Preliminary figures for last night (Thursday) showed gold’s open interest had recovered a little to 403,133 contracts.

This action is shown in our next chart, and illustrates the dramatic divergence between open interest and the gold price.

This tells us that the bullion banks, which built bear positions on the January rally, for some reason have been panicked into closing them along with bearish hedge fund managers. In effect, the bear squeeze appears to have cracked the bullion banks’ resolve, as well, perhaps, as that of the hedge funds, which shorted gold as a way of playing the strong dollar. The breakdown of short and long positions will be available later tonight, when the Commitment of Traders report for last Tuesday is released after the market close.

A new factor for markets is President Trump’s readiness to comment on currency rates, starting by accusing the Chinese of devaluing the yuan to gain competitive advantage, and then Germany of benefiting from a weak euro. These accusations suggest that Trump might put pressure on the Exchange Stabilisation Fund through the Treasury to intervene to push the dollar lower, setting off a new round of competitive devaluations. And talking about rubbing up the Germans the wrong way, one wonders if Germany might in turn put pressure on America to speed up the repatriation of its gold.

This week the Fed decided to leave interest rates unchanged, a decision expected by the markets, which hardly moved. Presumably, the FOMC is waiting to gauge the scale of fiscal stimulus from the Trump administration before timing the next interest rate rise.

********

The views and opinions expressed in this article are those of the author(s) and do not reflect those of Goldmoney, unless expressly stated. The article is for general information purposes only and does not constitute either Goldmoney or the author(s) providing you with legal, financial, tax, investment, or accounting advice. You should not act or rely on any information contained in the article without first seeking independent professional advice. Care has been taken to ensure that the information in the article is reliable; however, Goldmoney does not represent that it is accurate, complete, up-to-date and/or to be taken as an indication of future results and it should not be relied upon as such. Goldmoney will not be held responsible for any claim, loss, damage, or inconvenience caused as a result of any information or opinion contained in this article and any action taken as a result of the opinions and information contained in this article is at your own risk.