Gold Price And Silver Price Updates

Gold sector cycle is up.

Gold Sector

$HUI is on a long-term buy signal.

Long-term signals can last for months and years and are more suitable for the long-term investors.

$HUI is on a short-term buy signal.

Short-term signals can last for days and weeks and are more suitable for traders.

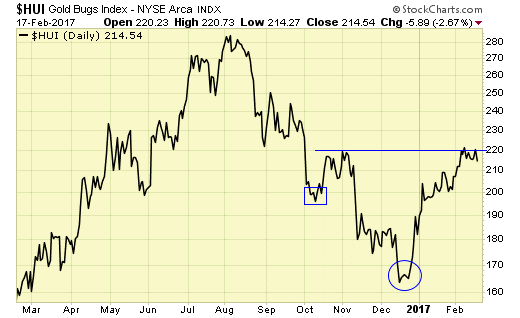

Gold stocks as represented by $HUI has met resistance. A multi week pullback will be most constructive, and if prices can find support at the 200 area, we may have an inverted Head & Shoulder bottoming pattern.

FCX – we are long from 10.64, holding for long-term gains.

Summary

Gold sector is on a major buy signal and short term is on buy signal.

Cycle is up.

Silver Sector

Silver is on a on a long-term buy signal.

Long-term signals can last for months and years and are more suitable for long-term investors.

SLV – short-term is on buy signal.

Short-term signals can last for days and weeks and are more suitable for traders.

Summary

Silver is on a long term buy signal.

Short term is on buy signal.

Silver is more volatile than gold, manage your risk.

Courtesy of www.simplyprofits.org