Gold Price Exclusive Update

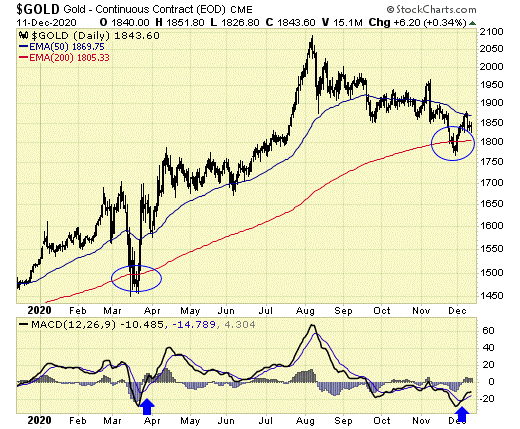

Our proprietary cycle indicator is DOWN, but appears to be bottoming.

To public readers of our updates, our cycle indicator is one of the most effective timing tool for traders and investors. It is not perfect, because periodically the market can be more volatile and can result in short term whipsaws. But overall, the cycle indicator provides us with a clear direction how we should be speculating.

Investors

During a major buy signal, investors can accumulate positions by cost averaging at cycle bottoms, ideally when prices are at or near the daily 200ema.

During a major sell signal, investors should be hedged or in cash.

Traders

Simply cost average in at cycle bottoms when prices are at or near the daily 200ema; and cost average out at cycle tops when prices are above the daily 50ema.

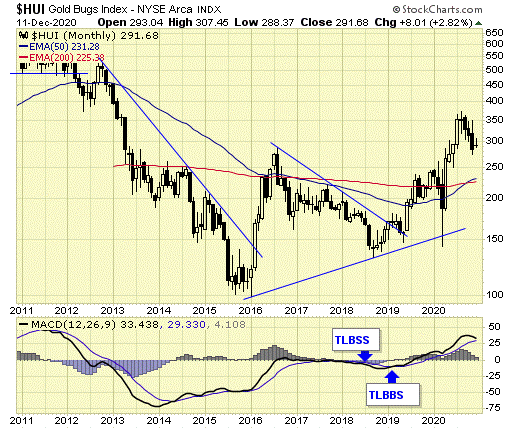

Gold sector remains on long-term BUY at the end of November.

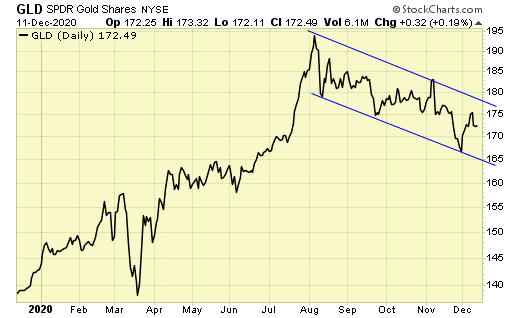

GLD is on short-term buy signal.

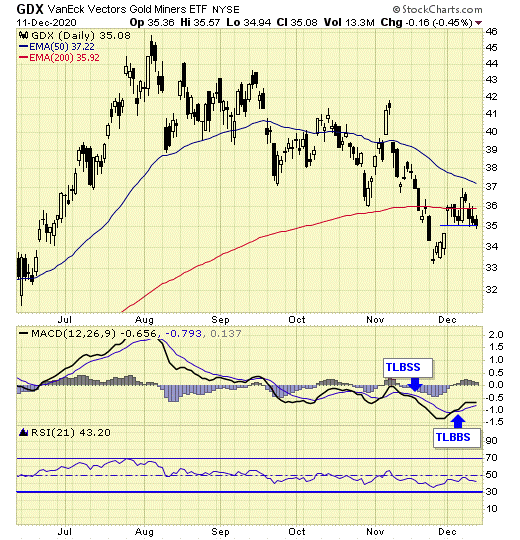

GDX is on short-term buy signal.

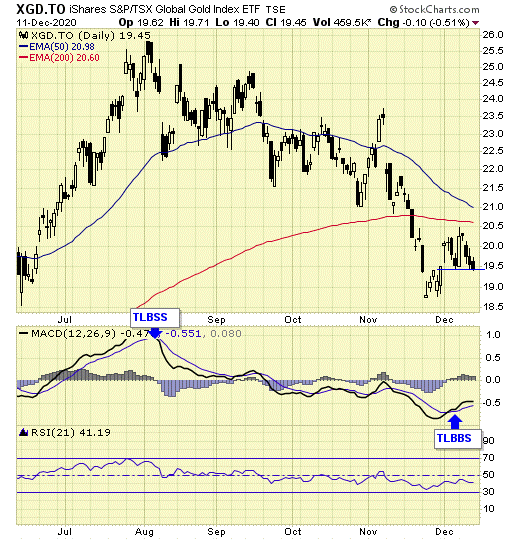

XGD.to is on short-term buy signal.

GDXJ is on short-term buy signal.

Analysis

COT data is supportive for overall higher gold prices.

Our ratio is on buy signal.

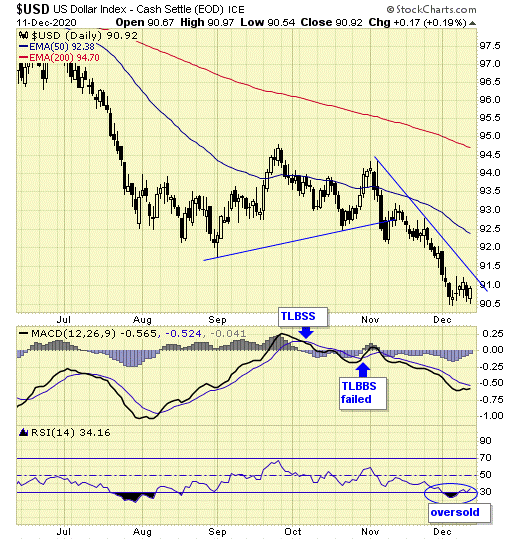

USD – on sell signal.

Gold prices have found support at the 200eam.

MACD has also turned up from the same oversold level as March.

The multi-month correction should be at completion.

The correction in GLD has established support and resistance within a down channel.

A break of resistance will confirm that the correction is complete.

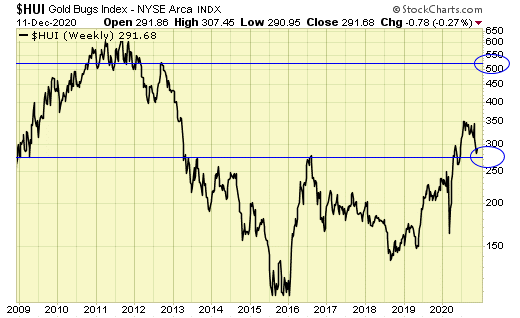

$HUI has pulled back to test support.

Summary

Long-term – on major BUY signal.

Short-term – on buy signals.

Gold sector cycle is down but could be bottoming.

The multi-month correction is at or near completion.

$$$ We are holding long and short-term positions.

Disclosure

We do not offer predictions or forecasts for the markets. What you see here is our simple trading model which provides us the signals and set ups to be either long, short, or in cash at any given time. Entry points and stops are provided in real time to subscribers, therefore, this update may not reflect our current positions in the markets. Trade at your own discretion.