Gold Price Forecast – Gold And Miners Are About To Take The USDX Cue

These are trying times, as far investors' vigilance and patience goes. Neither gold, miners, nor the dollar are making stunning moves, yet they're still sending valuable messages. How come? They're in tune with our previously identified odds for their next moves.

Don't be lulled by the relative calm just because the precious metals market hasn't travelled far, and by the fact that practically everything what we wrote in yesterday’s extensive Gold & Silver Trading Alert, remains up-to-date.

The situation in the USD Index is just as it was yesterday.

Shortly after invalidating its breakdown below the late-July lows, the USD Index broke above its declining short-term resistance line. It then consolidated and paused below the declining medium-term resistance line.

The above happened shortly after Fed announced a more dovish approach, which theoretically should have made the USD Index decline. This resilience is bullish, and it’s something that suggests that the USD Index is about to break above the declining resistance line rather sooner than later.

Back in March, the short-term breakout in the USD Index was the thing that triggered the powerful rally in it, as well as a powerful plunge in the precious metals market. It’s generally a useful gold trading tip to monitor the USD Index’s performance.

As far as gold is concerned, we previously wrote the following – and it remains up-to-date:

After topping at its triangle-vertex-based reversal, gold declined and is now trading at its declining resistance line, which turned into support. This could generate a rebound, especially that at the same time gold finally broke below the rising medium-term support line. This breakdown is a big deal, as all previous attempts were invalidated.

Since this support is so strong, we expected a rebound, quite possibly back to it. Such a verification (if gold doesn’t invalidate the breakdown that is) would be very bearish for the short term.

Once again, we saw just that. Gold rallied one more time, but it managed to rally back above the previously broken resistance. The breakdown was therefore confirmed, and the outlook remains very bearish, especially given the indications from gold’s long-term chart and its self-similar pattern.

The next support is at $1,700, which is where – approximately – gold topped and bottomed multiple times earlier this year. That’s also the 61.8% Fibonacci retracement based on this year’s upswing.

At this point, you might be wondering why gold moved higher yesterday despite the above.

Two points follow.

First of all, this move higher was not a big deal – gold moved barely above the most recent high, and it didn’t move close to gold’s early-September high. It doesn’t invalidate the self-similar pattern in gold that we’ve been featuring in the previous weeks.

Second, this small move higher is in perfect tune with what we wrote about the mining stocks yesterday.

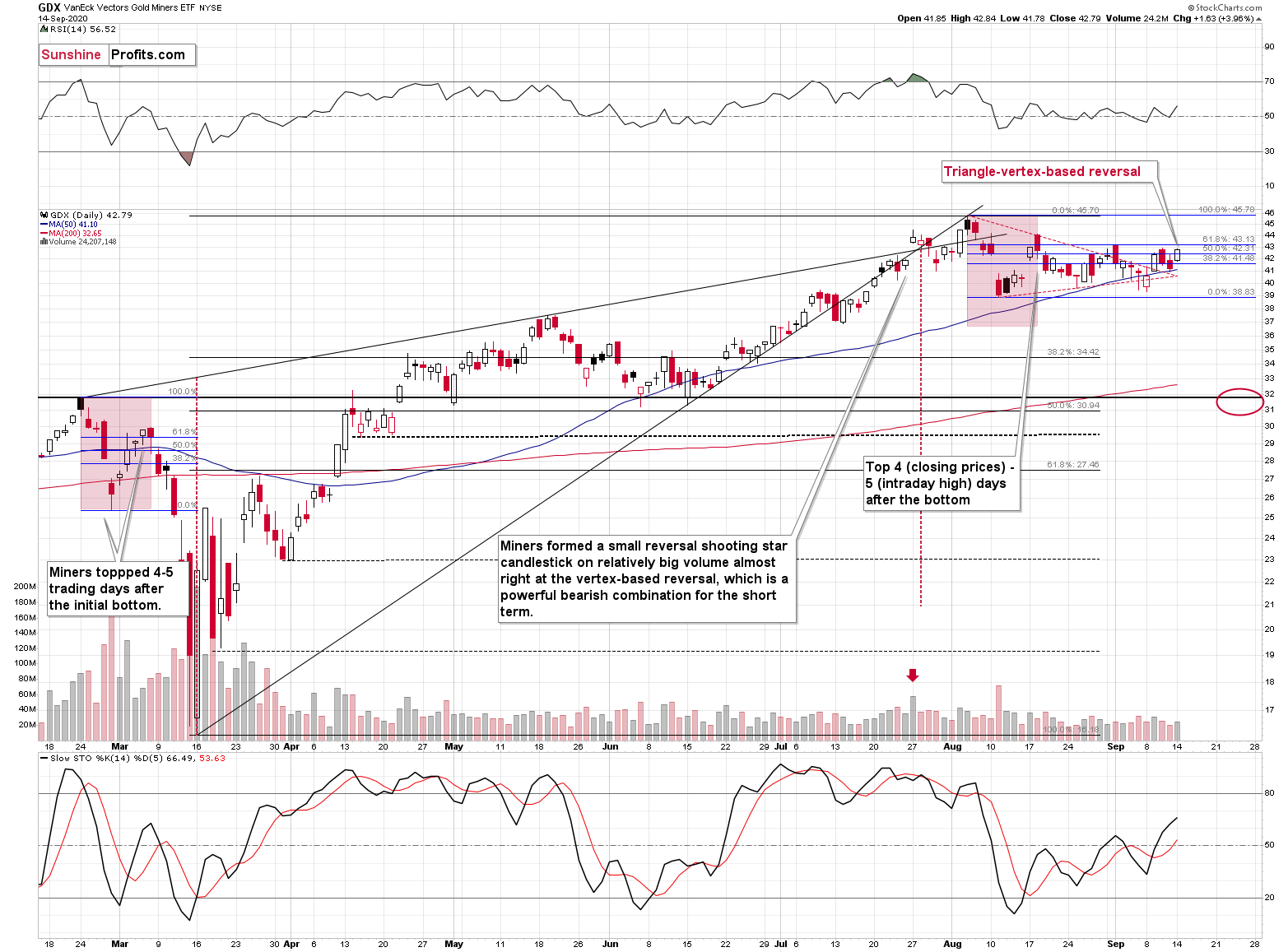

Namely: Based on the triangle (marked with red, dashed lines), we get a vertex. This means that it wouldn’t be surprising to see an intraday rally that is followed by a decline later today or tomorrow.

That’s exactly what happened in the miners yesterday. They moved higher. They didn’t move above their September highs, so this move was not a big deal (just as the one in gold), but it was enough to make the current triangle-vertex-based reversal point bearish. Based on this point, it seems that miners are ready to decline. Perhaps this is the way in which – very indirectly – the markets “are saying” that the USD Index is about to break above its declining resistance line.

The outlook remains bearish and our comments from three weeks ago remain up-to-date:

Now, since the general stock market moved above the previous highs and continues to rally, we might or might not see a sizable decline early this week. Back in March, the slide in miners corresponded to the decline in the general stock market, and this could be repeated, or we could see some sideways trading after the slide resumes, once stocks finally decline.

That’s exactly what happened. The general stock market continued to move higher, and mining stocks have been trading sideways instead of declining – or rallying. Before miners’ pause (and S&P’s breakout) miners were repeating their late-February and early-March performance. The implications of the self-similar pattern were bearish, and they continue to be bearish, only the timing changed.

Summary

The days of USDX trading below its declining resistance line are about to be over, and that won't leave the precious metals sector unmoved. After gold broke below its medium-term rising support line, a verification might come but it won't change the bearish nature of such a move. Given the turning point, it seems that the short-term upswing might already be over.

The following days are not likely to be pleasant times for anyone who refuses to jump on the bullish bandwagon just because prices moved higher in the previous months. But what’s profitable is rarely the thing that feels good initially. As silver often moves in close relation to the yellow metal, forecasting gold’s rally without a bigger decline first is thus likely to be misleading. The times when gold is lastingly trading well above the 2011 highs will come, but they are unlikely to be seen without being preceded by a sharp drop first.

Naturally, the above is up-to-date at the moment of publishing and the situation may – and is likely to – change in the future. If you’d like to receive follow-ups to the above analysis, we invite you to sign up to our gold newsletter. You’ll receive our articles for free and if you don’t like them, you can unsubscribe in just a few seconds. Sign up today.

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager

Sunshine Profits - Effective Investments through Diligence and Care

* * * * *

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be subject to change without notice. Opinions and analyses are based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are deemed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Przemyslaw Radomski,

Przemyslaw Radomski,