Gold Price Update

Market Update

It´s been a nasty start into the new year. Deflation (driven by a weak China) keeps on eating into the system and now is visible for everybody. I have been writing about this many times during the last couple of years. Yet the global puzzle has become so complex that it is basically impossible to correctly interpret and evaluate what´s really going on. I therefore prefer the sober lock at the charts, even if this means to neglect the three dimensional strategic thinking.

It´s been a nasty start into the new year. Deflation (driven by a weak China) keeps on eating into the system and now is visible for everybody. I have been writing about this many times during the last couple of years. Yet the global puzzle has become so complex that it is basically impossible to correctly interpret and evaluate what´s really going on. I therefore prefer the sober lock at the charts, even if this means to neglect the three dimensional strategic thinking.

My current conclusions are the following:

- Stocks are in a bear-market and should be avoided. The mantra now is "sell the strength to either reduce your open risk or to short the general stock-market".

- Commodities in general should remain depressed yet an agressive bear-market rally should be expected soon.

- Oil has seen an impressive reversal, has probably found it´s bottom for now and is on the way back to $40.

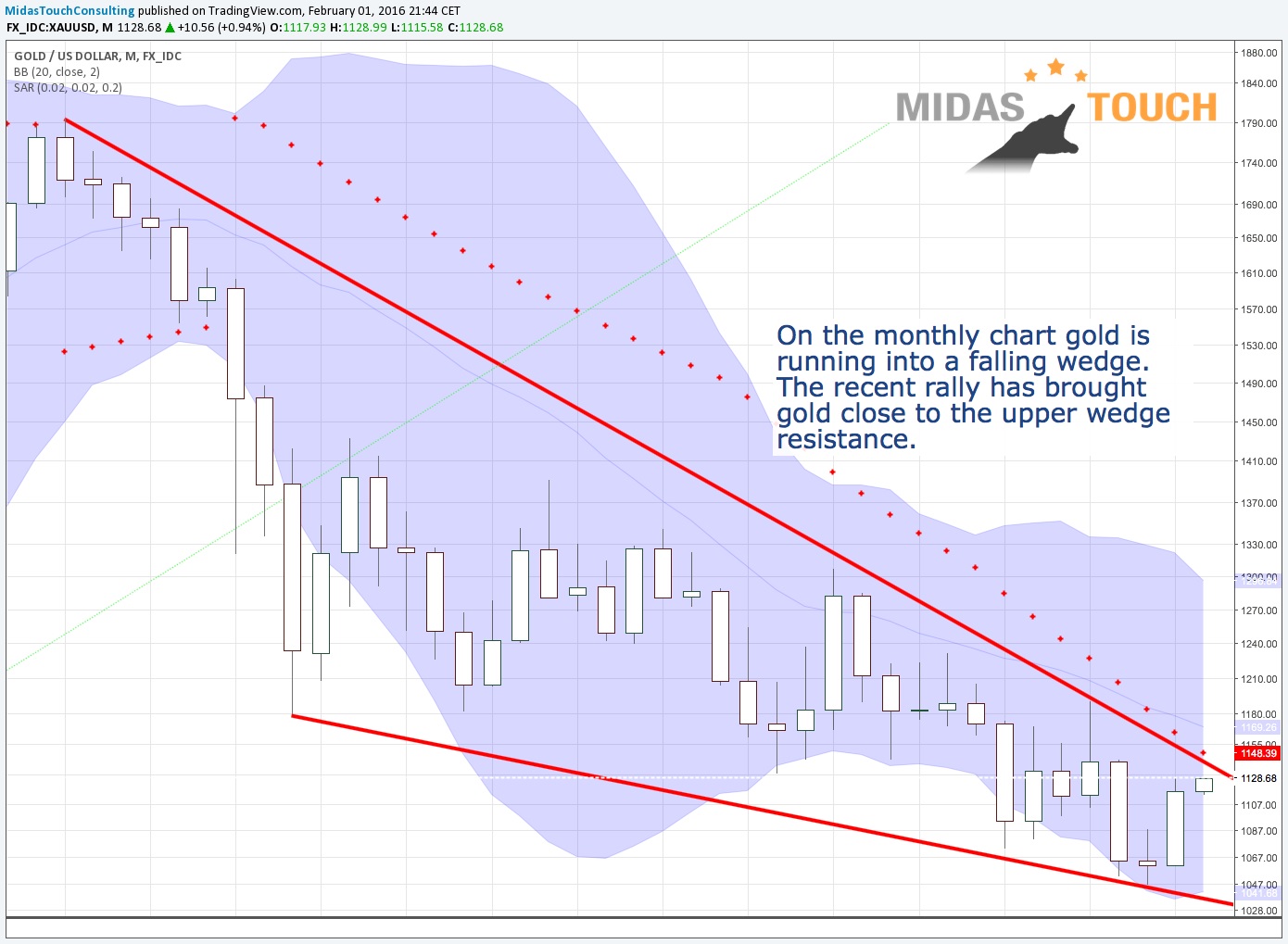

- Gold continues to run into a falling bullish wedge which still means very likely $1.000 before a new bull will start.

- South-African Miners are the "mining play" of the year as gold in South African Rand has not yet hit its technical target. Wait for a larger setback in these mining stocks before you buy.

The Midas Touch Gold Model on a Buy Signal since January 26th

The model turned bullish again on January 26th.

The recent changes include buy signals from:

Gold USD - Weekly Chart

Gold Volatility CBOE Index

SPDR Gold Trust Holdings

Gold in 4 major currencies

GDX Goldminers - Daily Chart

New Sell Signals are coming from:

Gold Seasonality

GDX Goldmine Sentiment

US-Dollar - Daily Chart

Overall it is not a strong bull signal so far, but since the miners (GDX) are joing the party we have a bull signal again. Any dip below $1,098 will very likely shift the model‘s result immediately.

Gold running into a falling wedge on the monthly chart

Long-term this is bullish, but short-term Gold is hitting massive resistance.

Gold with a good start into the new year...but already overbought

Gold had a good start into the new year. After initially failing at the resistance around $1,110 it finally broke through this number last Tuesday and quickly pushed towards the 200MA. Since mid of last week we saw a small consolidation including a test of the breakout level at $1.110. Today bulls are already coming back into the market and it looks like gold could run until the upper resistance of the wedge around $1,135 - $1,140 before this move is over.

Overall I remain skeptical towards the recovery since December. This move is not looking very impulsive and sentiment is already extremely optimistic to a certain extent. E.g. the weekly Kitco Gold Survey has posted two weeks in a row results with gold bulls > 80%. This is a clear warning signal and goes a long with the unhealthy sentiment numbers for the GDX (see my model). Besides that seasonality is now fading towards the negative cycle until mid of June. At least the CoT numbers for gold are still constructive.

Therefore, my preferred scenario sees gold failing at $1,135 - $1,140 and starting a multi-month down leg with a high probability to hit the final low around $980 - $1,025 until June. But a daily or better a weekly close above $1,140 immediately will change the picture and activate $1,190 as the next target.

Action to take:

Swing traders should patiently wait at the sidelines. There are no good setups currently in the gold-market. You don't want to buy into an overbought market.

Investors should continue to buy with both hands if Gold moves below $1,050 again until you have at least 10% of your net-worth in physical Gold and Silver.

Watchlist:

Market Vector Junior Gold Miners (GDXJ)

DRD Gold (DRD)

Endeavour Silver Corp. (EDR.TO)

McEwen Mining (MUX.TO)

Mag Silver Corp. (MAG.TO)

United States Oil Fund (USO)

Agriculture ETF (DBA)

Long-term personal believes (my bias)

Gold is in a bear market and headed towards $1,035 - $980. Once this bear is over a new bull-market should start and push Gold towards $1,500 within 2-3 years.

My long-term price target for the DowJones/Gold-Ratio remains around 1:1. and 10:1 for the Gold/Silver-Ratio. A possible long-term price target for Gold remains around US$5,000 to US$8,900 per ounce within the next 5-8 years (depending on how much money will be printed..).

Fundamentally, as soon as the current bear market is over, Gold should start the final 3rd phase of this long-term secular bull market. First stage saw the miners closing their hedge books, the 2nd stage continuously presented us news about institutions and central banks buying or repatriating gold. The coming 3rd and finally parabolic stage will end in the distribution to small inexperienced new traders and investors who will be subject to blind greed and frenzied panic.

It is free market money but surely politicians and central bankers will thrive to regulate it soon.

********

If you like to get regular updates on this model and gold you can subscribe to my free newsletter here: http://bit.ly/1EUdt2K

© Florian Grummes 2015 all rights reserved

Hohenzollerstrasse 36, 80802 Munich, Germany

Disclaimer & Limitation of Liability

The above represents the opinion and analysis of Mr Florian Grummes, based on data available to him, at the time of writing. Mr. Grummes's opinions are his own and are not a recommendation or an offer to buy or sell securities. Mr. Grummes is an independent analyst who receives no compensation of any kind from any groups, individuals or corporations mentioned in the Midas Touch. As trading and investing in any financial markets may involve serious risk of loss, Mr. Grummes recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Florian Grummes is not a Registered Securities Advisor. Therefore Mr. Grummes's opinions on the market and stocks can only be construed as a solicitation to buy and sell securities when they are subject to the prior approval and endorsement of a Registered Securities Advisor operating in accordance with the appropriate regulations in your area of jurisdiction. The passing on and reproduction of this report is only legal with a written permission of the author. This report is free of charge. You can sign up here: http://eepurl.com/pOKDb

Hinweis gemäß § 34 WpHG (Deutschland):

Mitarbeiter und Redakteure des Midas Touch Gold Newsletter halten folgende in dieser Ausgabe besprochenen Wertpapiere: physisches Gold und Silber, Bitcoins sowie Gold-Terminkontrakte.

Imprint & Legal Disclosure

Anbieterkennzeichnung gemäß § 6 Teledienstgesetz (TDG)/Impressum bzw. Informationen gem § 5 ECG, §14UGB, §24Mediengesetz

Herausgeber und verantwortlich im Sinne des Presserechts / inhaltlich Verantwortlicher gemäß §6 MDStV

Florian Grummes

Hohenzollernstrasse 36

80801 München

Germany

E-Mail: [email protected]

Website: www.goldnewsletter.de

Florian Grummes (born 1975 in Munich) has been studying and trading the Gold market since 2003. In 2008 he started publishing a bi-weekly extensive gold analysis containing technical chart analysis as well as fundamental and sentiment analysis. Parallel to his trading business he is also a very creative & successful composer, songwriter and music producer. You can reach Florian at:

Florian Grummes (born 1975 in Munich) has been studying and trading the Gold market since 2003. In 2008 he started publishing a bi-weekly extensive gold analysis containing technical chart analysis as well as fundamental and sentiment analysis. Parallel to his trading business he is also a very creative & successful composer, songwriter and music producer. You can reach Florian at: