Gold Price Update

Gold sector cycle is down.

Our proprietary cycle indicator is down.

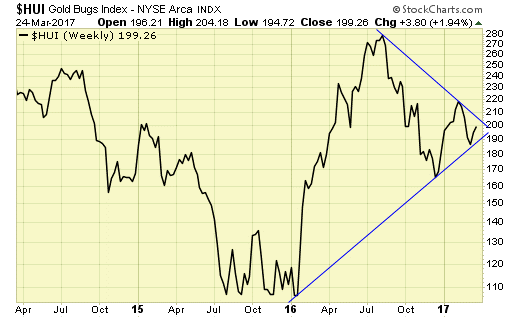

Gold sector is on major buy signal since early 2016.

Major signals can last for months and years and are more suitable for long-term investors.

COT data is supportive for higher prices.

GLD is on short-term sell signal.

GDX is on short-term buy signal.

XGD.to is on short-term buy signal.

GDXJ is on short-term buy signal.

The intermediate trend is bound by support and resistance, and a break either way will help determine the intermediate term direction.

Summary

Long-term – on major buy signal.

Short-term – on mixed signals.

Gold sector cycle is down.

A correction is in progress.

Disclosure

We do not offer predictions or forecasts for the markets. What you see here is our simple trading model which provides us the signals and set ups to be either long, short, or in cash at any given time. Entry points and stops are provided in real time to subscribers, therefore, this update may not reflect our current positions in the markets. Trade at your own discretion. www.simplyprofits.org