Gold: Pullback as a Springboard

In recent weeks, gold has experienced significant fluctuations, marked by an impressive rally and subsequent pullback. As the price of gold reached new heights, investors have been keenly observing the dynamics at play. This article delves into the recent movements in gold prices, analyzing key milestones, market consolidations, and the factors influencing these trends. With a focus on technical indicators and potential future scenarios, we aim to provide a comprehensive overview of the current state of the gold market and what it may mean for investors moving forward.

Review

With the breakout above the resistance zone between USD 2,520 and 2,535, the gold price was able to ignite the next stage of its two-year rally on September 12th. Prices quickly shot up to a new all-time high of USD 2,685 by September 26th. Since the end of June alone, the gold price has thus gained around USD 400.

However, over the past three weeks, the gold market initially entered a volatile consolidation phase at a high level. With the pullback to a low of USD 2,605 on Tuesday of this week, the bears were temporarily able to make an appearance again. However, the psychological mark of USD 2,600 was easily defended, resulting in a significant recovery to USD 2,661 by Friday.

In addition to the first U.S. interest rate cut and a weaker U.S. dollar, it was probably primarily the further increasing geopolitical escalations in the Middle East that led to the strong rally in the gold market.

The overbought situation and weaker-than-hoped-for stimulus packages in China temporarily caused the healthy pullback during the week. Furthermore, there had been no substantial price correction since August. In this respect, the pullback has at least released some hot air. Despite the strong reaction on Friday, a direct continuation of the rally is not yet certain. To do so, the gold price would need to break through the three-month downtrend and overcome the USD 2,660 mark. Subsequently, it would be crucial to surpass the recently reached all-time high of USD 2,685. Only when these technical hurdles are cleared could one speak of a resumption of the uptrend.

Chart Analysis – Gold in US-Dollar

Weekly chart: Small pullback within the intact uptrend

Gold in US-Dollar, weekly chart as of October 12th, 2024. Source: Tradingview

After gold had reached our first major price target of USD 2,535 in mid-August, a sideways consolidation followed between USD 2,470 and USD 2,530. Within this four-week breather, however, it soon became clear that gold wanted to move higher, and thus a new breakout was only a matter of time.

With the sustained rise above USD 2,530, the next upward thrust began on September 12th, which caused the gold price to virtually explode to USD 2,685 within just two weeks. Here, however, the vigorous rally bounced off the upper edge of the superordinate uptrend channel in textbook fashion, and gold slid about USD 80 lower overall in the last three weeks.

Nevertheless, this pullback has not led to a sell signal in the weekly stochastic so far. Rather, the oscillator sits firmly in the saddle with both lines above 80, bullishly embedded, and has continued to secure the higher-order uptrend. Hence, should the pullback extend, this will likely be played out primarily over time rather than price once again.

Overall, the weekly chart remains bullish. In the very best case, the pullback is already over. Alternatively, a multi-week consolidation could bring a bottom in the range between USD 2,585 and USD 2,550. At the latest, a broad and very strong support zone awaits between USD 2,530 and USD 2,470.

Daily chart: New sell signal quickly equalized again

Gold in US-Dollar, daily chart as of October 12th, 2024. Source: Tradingview

On the daily chart, the bears had taken control during the course of this week. The stochastic confirmed this with a clear sell signal. However, the significant recovery on Friday has already pushed the bears back into a corner. Given the strong upward momentum of recent weeks and months, new buyers are quickly entering the market even at relatively modest pullbacks.

Whether the stochastic oscillator can therefore reach its oversold zone remains to be seen. In any case, this would require a continuation of the consolidation or pullback. With more time and lower prices, a possible ideal target would be the rapidly rising, but still relatively distant 50-day moving average line (USD 2,545).

On the upside, the bulls first need a rise above Friday’s high of USD 2,661 and in the next step above the all-time high of USD 2,685. If this fails to materialize, the breather could play out within the flat downward trend channel in the form of a bullish consolidation flag. In this case, the remaining downside risk would likely be limited to prices between USD 2,590 and USD 2,610.

In sum, the daily chart is neutral. While the stochastic oscillator still indicates more need for correction, Friday’s recovery has forced a stalemate. If the potential flag formation persists, the rally could resume soon. Alternatively, the 50-day line would be preferable as the target of the pullback. The daily chart calls for patience.

Commitments of Traders for Gold – Bearish

Commitments of Traders (COT) for gold as of October 12th, 2024. Source: Sentimentrader

As of the closing price of USD 2,622 on Tuesday, October 8th, commercial traders held a cumulative short position of 303,976 gold futures contracts. This indicates a further deterioration of the situation in the futures market, as professionals apparently see a very high need for hedging.

Overall, the CoT report is extremely negative and clearly bearish. Significantly lower gold prices would be needed before this component of our analysis could be interpreted as neutral or even counter-cyclically bullish.

Sentiment for Gold – Too optimistic

Sentiment Optix for gold as of October 12th, 2024. Source: Sentimentrader

The OPTIX sentiment index for the gold market measures 77 out of 100 points, indicating a significantly exaggerated optimism level. At the end of September, peak values of 84 were even measured. However, when the vast majority of market participants reach a consensus, they are usually wrong. After gold prices have risen by over 66% in the last two years, everyone is now extremely optimistic. As a result, a clear need for correction has built up in sentiment.

In sum, optimism in the gold market is currently strongly exaggerated. Ideally, a sharp and significant price pullback would lead to a sentiment cleansing, allowing the overarching rally to continue afterwards and potentially maintain strength until next spring.

Seasonality for Gold – Negative until mid of December

Seasonality for gold over the last 15-years as of May 6th, 2024. Source: Seasonax

From a seasonal perspective, over the last 15 years, gold has typically corrected between mid-October and mid-December. However, based on the last 56 years, the final three months of a year were characterized more by price increases. Given that the world, and consequently the gold market, has changed significantly over the past two decades, we prefer the dataset of the last 15 years. Therefore, the seasonal component for the next two months should be interpreted negatively.

Overall, the seasonality tends to point downward until the last Fed meeting of the year on December 17th and 18th.

Macro update – The international financial casino will force central banks to take unprecedented liquidity measures

After the US Federal Reserve initially reignited the global devaluation race in mid-September with a 50 basis point interest rate cut, the People’s Bank of China followed shortly after with a massive stimulus program. Following these well-timed stimulation measures, Chinese stock markets closed from October 1st to 8th for the “Golden Week”. This triggered a rally in Chinese stocks and forced short sellers to close their positions before the extended break.

While global markets initially reacted positively to China’s stimulation, a certain hangover mood has now set in. The realization is slowly dawning that China is less interested in strengthening private households’ confidence in consumption and more in preventing a total economic downturn.

China’s Half-Hearted Promises

Accordingly, the Chinese promises seem rather half-hearted, causing Chinese stocks to plummet again due to increasing skepticism towards the promised economic stimulus programs. The benchmark CSI 300 Index crashed by 7.1%. As a result, the Ministry of Finance of the People’s Republic of China announced a briefing on fiscal policy for today.

The unsettled financial and commodity markets responded to the developments of recent weeks with high volatility. First, a kind of “melt-up” began to be priced in, then priced out again, and now calls for further stimulus packages are already becoming loud again.

The Dynamics of the Uncovered Debt Money System

In an uncovered debt money system, as it prevails worldwide today, the constant search for new liquidity in international financial markets is particularly pronounced. In this system, new currency is mainly created through lending, leading to inherent instability and a continuous need for new liquidity. Money or currency creation is based on lending by commercial banks. When a bank grants a loan, it simultaneously creates new money in the form of giral money. However, this money exists only as book money and is not backed by real values like gold. Since banks are required to hold only a fraction of deposits as reserves (minimum reserve system), a multiplier effect occurs, further increasing the money supply. This process leads to a constant expansion of the money supply and an increased need for liquidity in the system.

The cause or necessity for constant new liquidity in this system arises from several factors:

- Interest burden: Since currency is created through loans, it must be repaid with interest. To service these interests, new currency is continually required, leading to a constant growth compulsion.

- Maturity transformation: Banks grant long-term loans while holding short-term deposits. This discrepancy requires constant refinancing and increases the need for liquidity.

- Systemic risks: In times of crisis, confidence in the banking system can quickly dwindle, which can lead to bank runs. To avoid such situations, banks need steady access to liquidity.

- Global interconnectedness: The increasing interconnection of financial markets and improved customer networking due to digitalization have intensified the dynamics of liquidity bottlenecks and therefore require an even greater focus on liquidity management.

- Regulatory requirements: For regulatory reasons, banks must have a buffer of their own liquid funds for everyday business, which further increases the need for liquidity.

In this system, central banks function as “lenders of last resort” to mitigate systemic risks. They can provide additional liquidity in times of crisis, which, however, leads to a further expansion of the money supply in the long term and thus logically favors inflation.

ECB Balance Sheet Has Increased More Than Tenfold

ECB Balance Sheet since 1999, August 2024. Source: Börse.de

Since 2002, for example, the balance sheet total of the European Central Bank (ECB) has increased significantly and amounted to approximately EUR 6.473 trillion at the end of August 2024, more than ten times the value of 2002. The strongest increase began in 2008 with the outbreak of the global financial crisis. By June 2022, the balance sheet total had risen to its peak of EUR 8.836 trillion due to expansionary monetary policy. Although the ECB’s balance sheet total has been declining since then, stagflationary problems within the Eurozone are simultaneously increasing.

It’s hard to say how long the rather restrictive monetary policy within the Euro zone can continue. However, the markets are already craving new liquidity like a junkie. If central bankers react half-heartedly or too late, control over market psychology could quickly be lost. The danger of a crisis cannot therefore be dismissed. Moreover, the ECB’s room for maneuver through interest rate cuts is limited, as rates are already very low. The Americans clearly have an advantage here.

Global Money Supply Grows by EUR 7.3 Trillion in the Last 12 Months

However, the starting position for the US Federal Reserve is not significantly more favorable, as US consumer core price inflation has recently risen again to 3.3%, while unemployment figures are also beginning to rise. If rising inflation with rising unemployment were to intensify into a trend, trouble looms.

Global Money Supply, as of September 29, 2024. Source: Tavi Costa

Already, liquidity in the global financial system has increased significantly by about USD 7.3 trillion in the last 12 months! Fiscal stimuli were particularly responsible for this. Regardless of the outcome of the US presidential election, the loose monetary policy of central banks is likely to continue to increase. This is due to the “competitive pressure” or “devaluation race” within the international monetary system alone. In addition, the constantly escalating geopolitical events must be cushioned.

Drivers for the Precious Metals Sector

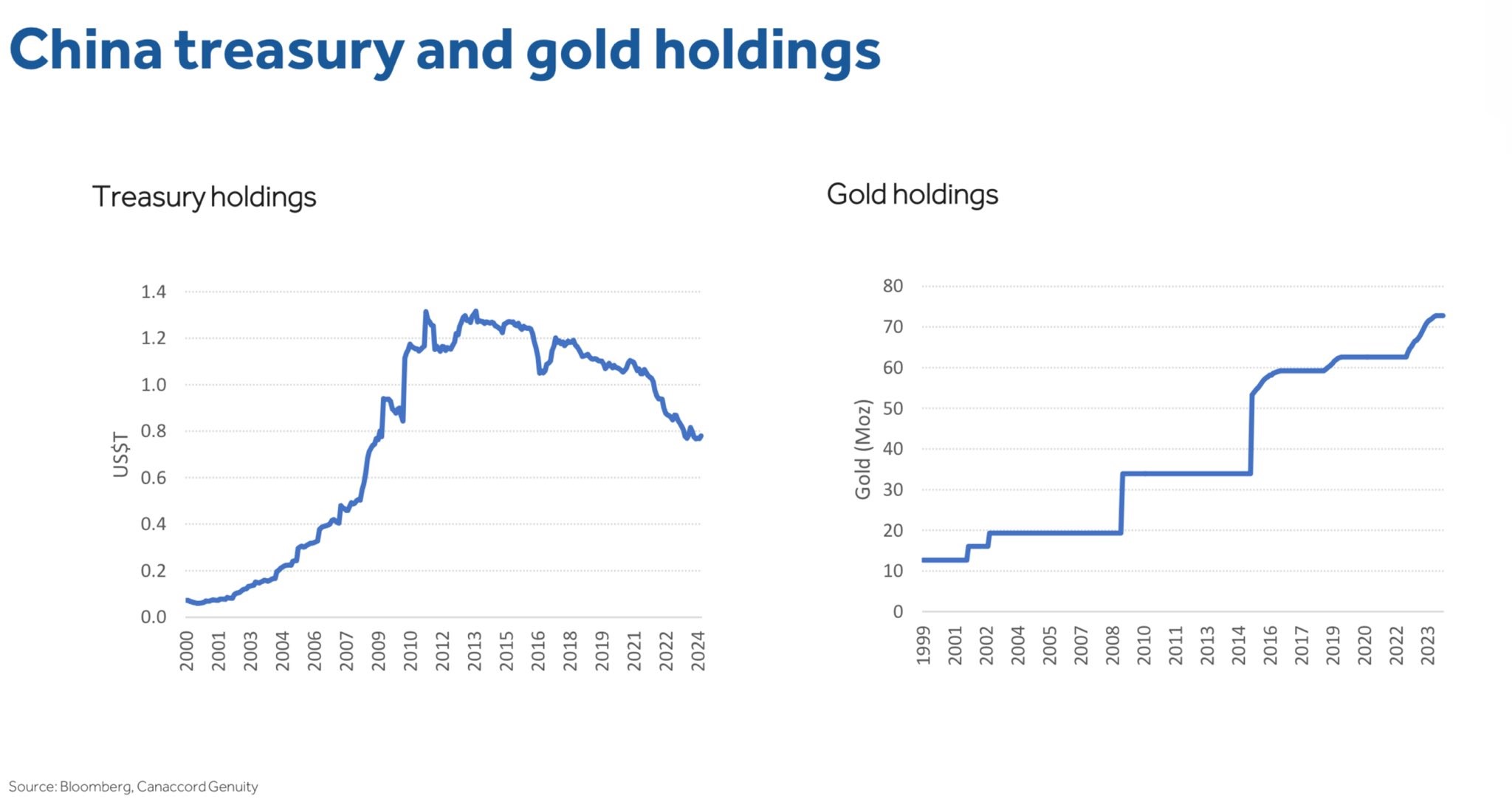

China treasury & gold holdings, as of September 17, 2024. Source: Bloomberg, Canaccord Genuity

China was one of the main drivers for the rise in the gold price to the new all-time high of USD 2,685. Although purchases by the Chinese central bank have slowed recently, there are still compelling arguments that the country will remain an important demander in the medium to long term. Moreover, central banks of emerging markets in particular are likely to use any somewhat larger gold price pullback for purchases. On top of that, small investors in the US (Cosco) and Asia are storming gold dealers. The positive dynamics in the precious metals sector are therefore likely to continue despite occasional breathers and increased volatility.

The gradual return of Western institutional investors to the precious metals sector is also expected to lead to a further increase in demand in the coming months. The gold holdings of Western ETFs have only been slowly increasing since spring and have a lot of catching up to do. This development could further strengthen the precious metals market and contribute to the medium-term expected upward movement towards 3,000 USD+x.

Conclusion: Gold – Pullback as a springboard

The gold price has taken a breather in the past three weeks and has come down by about USD 80 from its new all-time high of USD 2,685 USD. The overall rally remains intact, but a somewhat extended pause should not be surprising.

In a slightly more cautious scenario, therefore, the coming weeks could see a healthy reunion with the rapidly rising 50-day moving average line (USD 2,545). This could at least somewhat cleanse the overly optimistic sentiment values.

Alternatively, the bulls could use Friday’s recovery to push the gold price further upward. The bullish flag would thus be resolved upward soon, and the rally would likely continue more intensely. The next short-term price targets await around USD 2,700 and USD 2,745.

Either way, the pullback should serve as a springboard for the next upward movement.

However, in this environment of a strongly advancing gold price, we instead prefer the sometimes still blatantly undervalued silver mining stocks as well as platinum, which has not yet gotten into gear at all.

“October 12th, 2024, Gold – Pullback as a springboard” – analysis was initially published on October 12th, 2024, by www.celticgold.de and translated into English on October 12th, 2024.

Feel free to join us in our free Telegram channel for daily real time data and a great community. If you like to get regular updates on our gold model, precious metals and cryptocurrencies you can subscribe to our free newsletter.

********

Florian Grummes (born 1975 in Munich) has been studying and trading the Gold market since 2003. In 2008 he started publishing a bi-weekly extensive gold analysis containing technical chart analysis as well as fundamental and sentiment analysis. Parallel to his trading business he is also a very creative & successful composer, songwriter and music producer. You can reach Florian at:

Florian Grummes (born 1975 in Munich) has been studying and trading the Gold market since 2003. In 2008 he started publishing a bi-weekly extensive gold analysis containing technical chart analysis as well as fundamental and sentiment analysis. Parallel to his trading business he is also a very creative & successful composer, songwriter and music producer. You can reach Florian at: