Gold & Silver Bull Has More Time Left Than You Think

Gold’s break out of a 13-year cup and handle pattern is likely the start of a new secular bull market.

However, as we wrote last week, a new secular bull market in the entire precious metals sector cannot begin until Gold breaks out against the conventional 60/40 investment portfolio.

Some are concerned that the weak relative performance indicates the bull market is over or that precious metals are dead money forever.

The reality is the secular bull market in precious metals has yet to start.

There are two key indicators to watch.

The first is Gold breaking out against the 60/40 portfolio, while the other is the S&P 500, after years of an uptrend, losing its 40-month moving average.

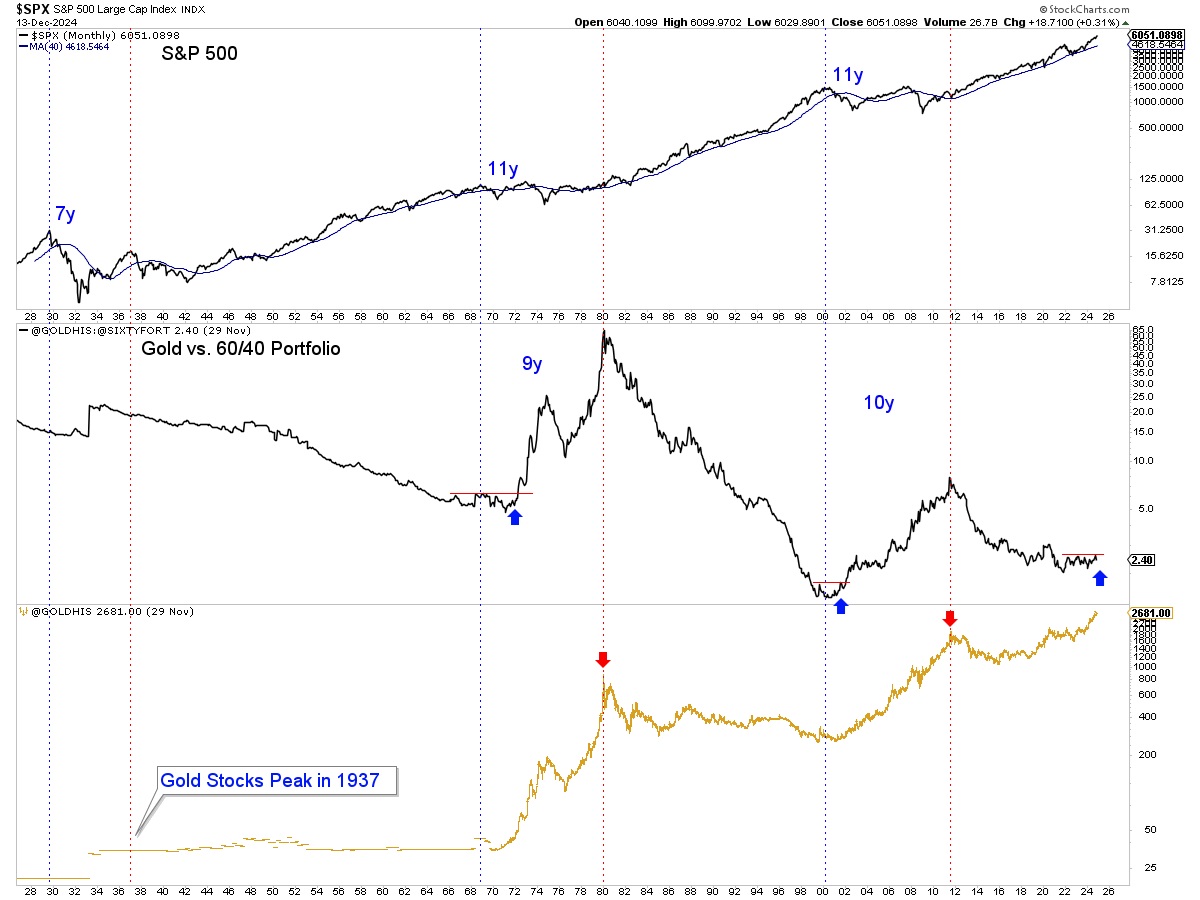

We plot the S&P 500, Gold against the 60/40 portfolio, and Gold.

The last two secular bull markets in Gold and precious metals ended 11 years after the S&P 500 reached its secular peak or 10 years after the S&P 500 lost its 40-month moving average (late 1969 and 2001).

Gold and precious metals peaked 9 years and 10 years after the Gold to 60/40 Portfolio ratio began its advance to the breakout.

At present, precious metals are trending higher, as they did with the stock market in the mid 1960s. That is the best historical comparison.

Even if in 2025, we get these bullish signals for precious metals (S&P 500 peaks, Gold breaks out against the 60/40 Portfolio), the secular bull market could last midway through the next decade. If the secular bull in the stock market continues for another 13 months, we could see a precious metals peak in 2036-2037.

When Gold begins to outperform the 60/40 Portfolio and stock market in earnest, Gold, Silver, and other leveraged plays will soar as fresh capital moves into the sector.

For now, it is best to position in the quality companies that will lead in the current macro environment.

*********