Gold & Silver Equities To Rise Like The Proverbial Phoenix

Since September 2011 gold, silver and precious metal equities (i.e. HUI Index) have been correcting after a 10-year bull run that started in early 2001. Since their 2011 peaks, gold has fallen 33%, silver is down 57%, while the HUI Index has plummeted a whopping 60%. However, today there are distinct ‘lights appearing’ at the end of this correction tunnel.

In a recent Bloomberg article, market pundit Debarati Roy made the following bullish observations:

Billionaire Paulson Sticks With Gold Wager as Prices Rebound

New York (Nov 15) “Billionaire hedge fund manager John Paulson, who cut his gold holdings by more than half in the second quarter, maintained his bet on the metal over the next three months as prices rebounded.

Paulson & Co., the largest investor in the SPDR Gold Trust GLD), the biggest exchange-traded product for the metal, held 10.23 million shares as of Sept. 30, unchanged from June 30, according to a government filing yesterday. Billionaire George Soros took a stake in the Market Vectors Gold Miners ETF.

Global bullion demand tumbled 21 percent last quarter as investors pulled 118.7 metric tons out of ETFs and similar products, World Gold Council data show. Prices that fell into a bear market in April have rebounded 9.2 percent since reaching a 34-month low on June 28 as purchases of coins and jewelry rose. The metal is still headed for its first annual loss since 2000 as equities rallied and inflation failed to accelerate after Federal Reserve purchases of assets in the debt markets to enhance its policy of easy credit.

Paulson Cuts

Paulson maintained his SPDR holdings after a second-quarter reduction from 21.8 million shares at the end of March. Armel Leslie, a spokesman for Paulson & Co. with WalekPeppercomm, declined to comment on the filing.

Global gold ETP holdings tumbled 29 percent this year, reaching the lowest since 2010 this week, while more than $64 billion was wiped from the assets, data compiled by Bloomberg show. Prices are down 33 percent since reaching a record $1,923.70 in September 2011 as some investors lost faith in the metal as a store of value and amid concern that the Fed will begin trimming its $85 billion in monthly bond purchases.

Paulson’s PFR Gold Fund fell 16 percent in September, bringing the 2013 decline in the $350 million fund to 62 percent, according to a report to investors obtained by Bloomberg News in October.

‘High Inflation’

The risk of “high inflation in the future” makes gold a desirable long-term investment, Paulson & Co. wrote in the report. The view contrasts with Goldman Sachs Group Inc.’s Jeffrey Currie, who has said bullion is a “slam dunk” sell in 2014. In an Oct. 18 report, the bank forecast prices at $1,100 in 12 months. The metal climbed 8.4 percent in the third quarter, the first gain in a year.

“Physical demand helped prices rise, but that has not made gold attractive enough for investors to rush back,” Lance Roberts, who oversees $600 million as chief executive officer of STA Wealth in Houston, said in a telephone interview. “Unless something dramatic and drastic happens, the tide is unlikely to change.”

In the third quarter, Soros Fund Management LLC bought 1.1 million shares of the Market Vectors Gold Miners ETF. The purchases come after the New York-based hedge fund sold its entire stake of 2.67 million shares in the miners ETF in the three months through June 30, along with dumping all of its 530,900 SPDR shares.

Gold Miners

The world’s largest gold miners were forced to take at least $26 billion of write-downs this year even as they lowered spending plans and fired workers. The Market Vectors Gold Miners ETF (GDX) fell 47 percent this year.

ETP holdings “need to stabilize to offer better support to prices,” Barclays Plc said in a report yesterday. “In addition to Fed tapering expectations weighing upon investor sentiment, the performance of alternative assets has exacerbated this weakness despite tapering expectations being delayed.”

The metal jumped 70 percent from the end of 2008 through June 2011 as the U.S. central bank bought more than $2 trillion of debt. Fed Chairman Ben S. Bernanke is contemplating how to finish a third round of so-called quantitative easing that has swelled the central bank’s balance sheet toward $4 trillion. “

(Source: http://www.bloomberg.com/news/2013-11-15/billionaire-paulson-sticks-with-gold-wager-as-prices-rebound.html)

FAST-FORWARD To November 2013:

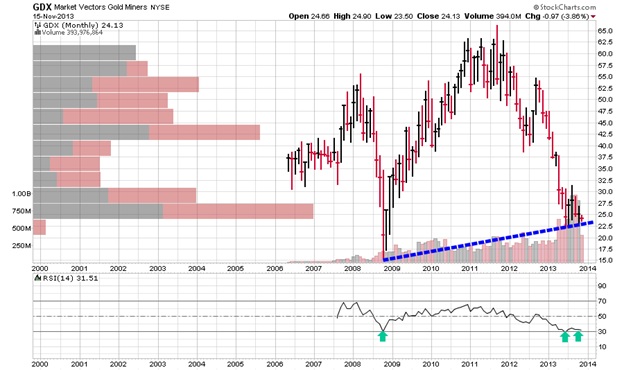

All corrections eventually end…and this bear is already quite long in the tooth – as clearly demonstrate all the following charts. All show prices that have fallen to upward trending support. Moreover, the RSI technical indicator has recently put in a bottom…suggesting the bottom is well-nigh near for precious metal equities.

Below are long-term charts of HUI, GDM, GDX & XAU -

HUI Index may well have bottomed.

This 2001 to present HUI graph clearly shows the index has reached the 13-year uptrend support. Consequently, HUI should soon begin to rebound with its eye again on 600 in early 2014. And with Dr. Janet Yellen running the US Fed, it’s a virtual fait accompli that gold and HUI are destined to make new all-time record highs early next year.

GDM Index may also have bottomed.

This 2001 to present graph of the GDM clearly shows the index has reached 13-year uptrend support. It is imperative to notice the RSI indicator is screaming bottom...Bottom...BOTTOM !!!

Ditto with the Market Vector Gold Mine ETF (GDX) ...it's at multi-year trend support with RSI bottoming:

Likewise the Gold & Silver stocks index (XAU) is forging a multi-year bottom as is its RSI:

All the above charts show the trends of baskets of precious metal stocks (i.e. Indexes and ETFs). But how about an individual gold stock…like one of the world’s oldest and largest gold miners? Newmont Mining (NEM) is the world’s quintessential gold mine. The 30-year chart of NEM clearly shows the stock bottomed (as measured by RSI technical indicator) in 1984, 1998, 2001, 2008…and now just recently. Consequently, it is logical to conclude that all precious metal stocks indexes are likewise bottoming. The succeeding four bull rallies saw NEM stock price rise an average of +315% within the next 25 months from each RSI bottoming. And therefore if we assume that NEM is presently bottoming, it projects a price of $116/share by January 2016.

CAVEAT EMPTOR: As all serious students of the markets know, Technical Analysis is not an exact science. Nonetheless, it provides lines of probability that greatly increase an investor’s long-term trading profitability. In fact to invest without the use of Technical Analysis and charts is tantamount to driving your car from New York to San Diego without the aid of road maps. You may eventually get to your destination, but will have (occasionally) lost your way and valuable time in reaching your goal.

A Sine Quo Non Fundamental Reason for Investing In Gold

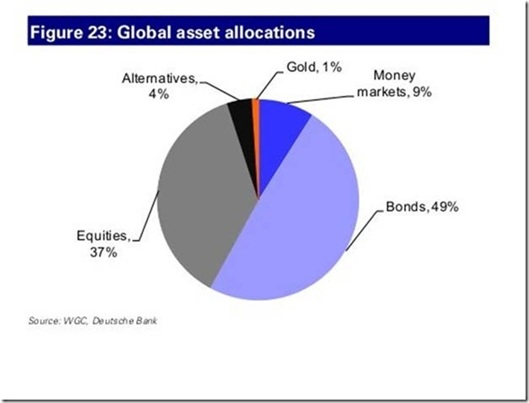

Nearly all Objective Investment Advisors and Conservative Brokerage Companies recommend that all investors have a minimum of 5% to 10% of their total portfolio in gold. And even though all precious metal investments have enjoyed fabulous appreciation since 2001 (the recent correction notwithstanding), the world’s total investing public has a mere 1% of its assets allocated to GOLD. However, once common sense prevails and the public awakens to the incredible long-term performance of precious metal investments, a virtual stampede will emerge to snap up gold, silver, HUI, GDM, GDX & XAU type investments. And history is testament that gold allocations will in the not too distant future jump to 5%-10% of the world’s total investments, resulting in precious metal values going parabolic. The Deutsche Bank Global Asset Allocations data shown below are irrefutable – galvanizing one’s attention.

Global Asset Allocations

The chart below shows total Global Asset Allocations. Specifically, the world’s total investing public has allocated their investments per the following:

Bonds………………………… ……49%

Equities (ie stocks)………………37%

Money Markets……………………9%

Alternative Investments… ……4%

GOLD………………………… ……1%

(Courtesy of SilverDoctors.com & Deutsche Bank)

Gold seer Ed Bugos comments the following on proposed gold allocation (http://www.goldenbar.com ) :

“Our recommendation is to have 20-30% allocation in gold and silver bullion (equally at this ratio), and to overweight the forsaken gold equity class. I am comfortable with as much as a 40% exposure to this undervalued sector (but keep 80% of that exposure to the higher quality producers, as per our current recommendations in the table below). The time for small allocations here is over. Investors should have up to two thirds of their financial portfolios positioned in bullion and the related equities.”

Fundamental Factors Supporting A Bullish Gold Forecast:

Because of the pervasive communication power of the Internet (aided by TV networks finally becoming aware of GOLD and SILVER’s outstanding performance), it is logical and reasonable to expect that Global Asset Allocation to GOLD will grow exponentially going forward. Moreover, added impetus for GOLD INVESTMENT GROWTH will be fueled by other factors, such as:

- Growing number of new ETF’s investing in GOLD and SILVER

- Increasing number of Central Banks diversifying FOREX Risk by buying GOLD

- Greatly increased media advertising of precious metal products

- Currency wars throughout the world, thus debasing the value of their money

- More implementation of Yellen Quantitative Easing in the US, Euro Union and Japan

- Word of mouth advertising to family and friends, thus increasing overall demand

- Insatiable growing demand of China and India for gold and silver (world’s #1 & #2 consumers)

Economics-101 dictates that when demand for a commodity increases – and supply is either stable or diminishing, the price of that commodity must inevitably rise. In the case of GOLD, the annual supply is flat. However SILVER’s case demonstrates yearly deficits, because more than 60% of the annual mine production is consumed by industrial usage.

Each intelligent investor must determine if he/she has enough gold and silver investments to guarantee the family’s future and a comfortable retirement.