Gold Speculators Reduced Bullish Bets To Lowest Since June

Gold Futures: COT Large Speculators Sentiment Vs GLD ETF

Gold speculative positions fell by -46,396 contracts last week

GOLD Non-Commercial Positions

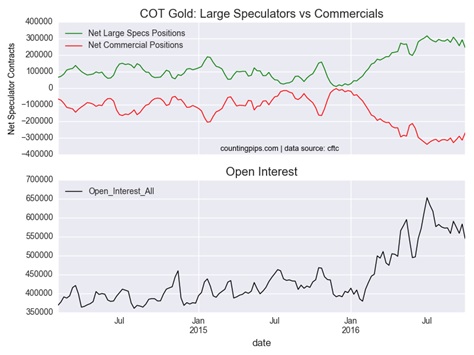

Gold speculator and large futures traders sharply cut into their gold bullish positions last week and pushed the overall net bullish level to the lowest point since June, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of COMEX gold futures, traded by large speculators and hedge funds, totaled a net position of +245,508 contracts in the data reported through October 4th. This was a weekly change of -46,396 contracts from the previous week’s total of +291,904 net contracts that was registered on September 27th.

Gold speculative positions have now fallen for three out of the last four weeks and are at the lowest level since June 7th when net bullish positions totaled 228,619 contracts.

MT4 Statistical Indicator Chart

Gold Commercial Positions

In the commercial positions for gold on the week, the commercials (hedgers or traders engaged in buying and selling for business purposes) reduced their overall bearish positions to a net total position of -271,242 contracts through October 4th. This was a weekly change of +43,352 contracts from the total net position of -314,594 contracts on September 27th.

SPDR Gold Shares (NYSE:GLD)

Over the weekly reporting time-frame, from Tuesday September 27th to Tuesday October 4th, the price of the (GLD) Gold ETF GLD, which tracks the gold spot price, dropped from approximately $126.62 to $120.97, according to ETF price data of the SPDR Gold Trust ETF (GLD).

COT Gold: Large Speculators vs Commercials

*COT Report: The weekly commitment of traders report summarizes the total trader positions for open contracts in the futures trading markets. The CFTC categorizes trader positions according to commercial hedgers (traders who use futures contracts for hedging as part of the business), non-commercials (large traders who speculate to realize trading profits) and non-reportable traders (usually small traders/speculators).

********

Courtesy of Courtesy of CountingPips.com