Gold Stock Champagne

The gold price rally is accelerating. That’s the four hour bars gold chart, and the price action is solid. Gold has broken out to the upside, from a second inverse head and shoulders bottom pattern.

After a sharp pullback to the $1100 - $1108 area, gold should move nicely higher, towards my $1145 target zone.

That’s the four hour bars chart for silver, and it’s staging a solid upside breakout from a symmetrical triangle pattern this morning! The target is the $15 area, which is the break-even point for a number of silver mining companies.

From a fundamental perspective, gold now has a vast array of supportive price drivers. In the immediate term, Chinese New Year buying is a factor.

Also, India’s finance minister may be poised to unveil a massive gold import duty cut in the upcoming annual budget. That’s because supply-related collapse in oil prices has dramatically cut the nation’s current account deficit, as a percentage of GDP. The gold import duty is no longer a viable scapegoat for that shrinking deficit.

The El Nino weather system may end as early as May, and La Nina is poised to replace it. La Nina is bad news for US grain and South American crops, and good news for Indian crops, which is good news for Indian farmers, who are the world’s largest buyers of gold.

Gold peaked near $1923 in 2011, just a few months after the horrific Japanese earthquake occurred. The dollar then began soaring against the yen, but now it has stalled, and yesterday Japan announced the first monthly trade surplus since the earthquake.

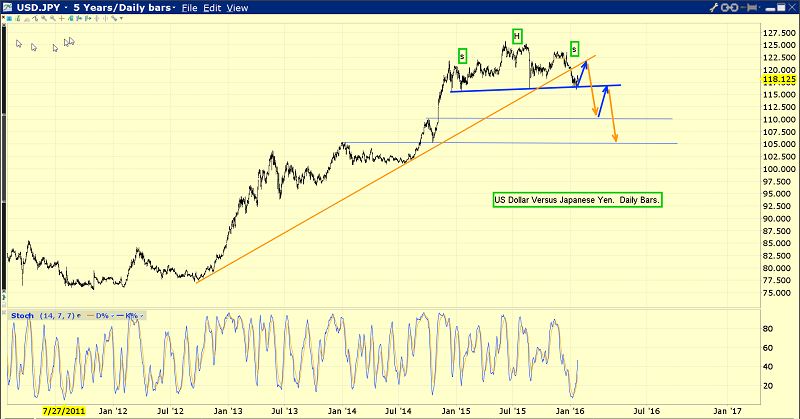

This is the important dollar versus yen daily bars chart.

Most amateur technicians follow the USDX (dollar index) chart for cues about gold, but the dollar versus yen chart is vastly more important. Large FOREX traders view the yen, not the dollar, as the world’s safe haven fiat currency.

When money flows out of the yen, it flows out of gold. When money flows into the yen, it moves into gold. The yen and gold are both poised to begin what will likely be the largest rally of the past five years.

Janet Yellen and her fellow Fed workers are scheduled to begin their next meeting today, with an announcement expected tomorrow. Goldman Sachs economists feel the US stock market will have another “wet noodle” year, and that’s my view.

Ben Bernanke was Wall Street’s best friend. He unveiled a bizarre QE program that ravaged Main Street. That program encouraged Wall Street to borrow money and use it for stock buybacks and dividends. In a nutshell, Ben Bernanke helped engineer what I call “marked to model price/earnings ratios” for US companies.

Over the past seven years, Wall Street arguably spent more money on stock buybacks and dividends than it did on company operations, and the piper must be paid.

Janet Yellen should not be confused with Ben Bernanke. She is Main Street’s friend. She proved it by tapering Ben’s horrific QE program off the board, exactly as I predicted she would. Now, she is poised to raise interest rates repeatedly, much to Wall Street’s chagrin.

US citizens (Main Street) will then put money into bank accounts, and banks will lend that money in the fractional reserve system, reversing US money velocity.

The US stock market will probably experience many more violent sell-offs as Janet hikes again, again, and again. That will fuel more FOREX trader safe haven buying of the yen, and of gold.

Janet could hike rates this week, but I think she’ll give Wall Street a break. She’ll likely wait until the spring, before hammering global stock markets with her next hike.

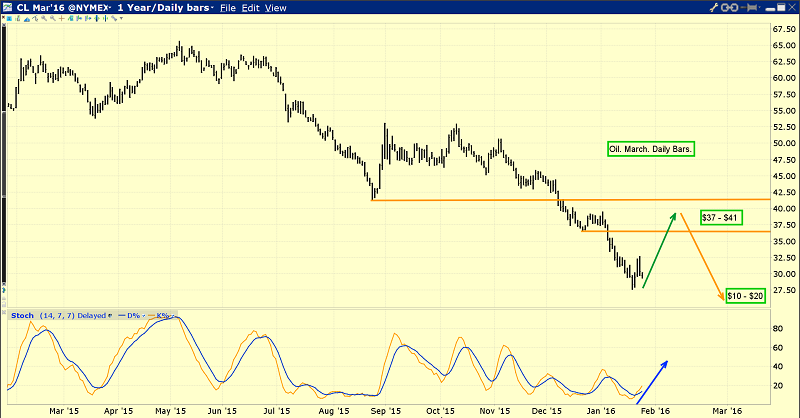

This is the daily bars oil chart. Horrifically, some oil producers are getting less than $20 a barrel for their oil right now. That’s because their oil is not the high quality “West Texas Intermediate” oil that the NYMEX uses for their benchmark pricing.

Ominously, the storage tanks in Cushing, Oklahoma are in danger of reaching full capacity, and may have already briefly done so last week.

US frackers are still pumping oil fiendishly, trying to pay substantial debt from unprofitable revenues. OPEC can produce profitably at much lower prices than the frackers, but OPEC governments need high revenues to prevent social unrest.

While oil could now rally to my $37 - $41 short term target zone, storage tanks are likely to hit full capacity by then, triggering a terrible meltdown to the $10 - $20 zone.

Civil unrest could occur in OPEC nations as the oil price tumbles, and Iran-Saudi tensions could grow, creating a gold buying frenzy by institutional investors. It’s hard to know how the US stock market would respond to such a horrific event, but I would suggest that the Western gold community may want to seek shelter from that storm, before it happens.

Barrick has just staged a solid upside breakout, and where Barrick goes, most gold stocks tend to go.

This is the key GDX daily bars chart. The massive bull wedge pattern in play suggests than an “institutional awakening” is at hand for the gold stocks sector, as the oil supply glut and Janet’s rate hikes send global stock markets into a financial gulag. I’ll dare to suggest that equity-oriented money managers are soon going to view gold stocks as asset class champagne!

********

Special Offer For Gold-Eagle Readers: Please send me an Email to [email protected] and I’ll send you my free “GDXJ Hall Of Fame!” report. Six key GDXJ component stocks are poised for years of outperformance. I highlight key buy and sell points for each of them, for both core and trading positions!

Note: We are privacy oriented. We accept cheques. And credit cards thru PayPal only on our website. For your protection. We don’t see your credit card information. Only PayPal does. They pay us. Minus their fee. PayPal is a highly reputable company. Owned by Ebay. With about 160 million accounts worldwide.

Email: [email protected]

Rate Sheet (us funds):

Lifetime: $799

2yr: $269 (over 500 issues)

1yr: $169 (over 250 issues)

6 mths: $99 (over 125 issues)

To pay by cheque, make cheque payable to “Stewart Thomson”

Mail to:

Stewart Thomson / 1276 Lakeview Drive / Oakville, Ontario L6H 2M8 Canada

Stewart Thomson is a retired Merrill Lynch broker. Stewart writes the Graceland Updates daily between 4am-7am. They are sent out around 8am-9am. The newsletter is attractively priced and the format is a unique numbered point form. Giving clarity of each point and saving valuable reading time.

Risks, Disclaimers, Legal

Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualified investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is: 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line:

Are You Prepared?

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website:

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website: