Gold Stocks: Surfing An Institutional Wave

As it often does, gold is pausing ahead of this week’s FOMC meeting. I don’t expect Janet Yellen to raise rates this week, although recent jobs reports and the oil price rally are likely tempting her to do so.

The limited recovery from the meltdown in global stock markets after her first rate hike is likely to convince Janet to hold off, but only until the next meeting.

That is when a fresh and potentially horrific US stock market meltdown is most likely.

That’s the daily gold chart. The sell-off that began last week is building the right shoulder of a solid inverse head and shoulders pattern, which is strengthening the overall technical picture.

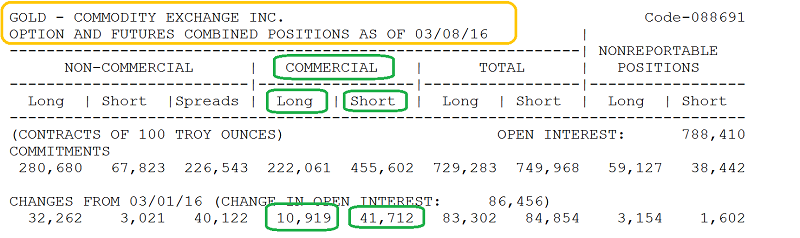

Take a look at key liquidity flows into and out of gold. That’s a snapshot of the latest COT report, and I’ve highlighted the commercial bank actions in green.

The banks clearly are not afraid to “chase some price” in this general price area, as they added long positions as well as short ones quite recently.

The COT reports offer a look at what the banks have done in the past. Take a look at the chart to understand what they are likely doing in the present. That’s a short term gold chart, using five minute bars.

Note the sizable volume bars that are appearing. In my professional opinion, the banks have already covered tens of thousands of short positions, just in the past few trading sessions.

If my right shoulder projection plays out, I think they will have covered off many more, and will be adding long positions quite aggressively as they do that.

From a fundamental perspective, gold’s rally from December has been mainly based on three factors:

First, Janet’s rate hike created a huge panic in risk-on markets. Second, influential economists began suggesting that a new upcycle for commodities could begin later this year.

That caused money managers to commit to the entire commodity sector, on an ongoing basis as a value play.

Third, Chinese New Year buying was a strong seasonal factor.

Indian demand is often limited at this time of the year, but it has been more soft than usual because of hopes for a duty cut, and now a jeweller strike. If the strike continues, official Indian demand could be under 20 tons in March.

In the short term, it’s difficult for gold to make strong headway with Chinese New Year buying finished, and India being this quiet…unless some new fear trade catalyst is on the near-term horizon.

What could that be? Japanese central banker Kuroda left rates unchanged at the latest BOJ meeting, but many top bank economists feel he could be poised to do something drastic at the next meeting in April with his QEE program.

I’ve argued that rate hikes in America and NIRP (negative rates) in Europe and Japan are a potent combination for higher gold prices.

If Indian jewellers end their strike in April, as Janet hikes rates and Kuroda drastically ramps up QEE, gold could begin a much more aggressive rally than what has already occurred in the past few months.

While these comments about China tying gold reserves to GDP were arguably made by somebody “talking their book”, the PBOC has released official written statements about the key role of gold in the internationalization of the yuan.

The SGE gold price fix is scheduled, tentatively, for an April 19 launch date, and that time frame coincides with many other key events for price discovery in the West.

Tactics? As always, amateur investors who tend to panic during gold price pullbacks should buy put options. While I’m always massively net long gold, I also always make sure I add some short positions into rallies, following the “financial footsteps” of the commercial bank traders.

That’s the GDX weekly chart. It looks spectacular, but the most likely price action in the short term is a bit of a “sideways chop”.

That chop should see a couple of right shoulders form, as part of a big inverse head and shoulders bottom pattern. While anything is possible in any market at any time, including new lows for gold, I think the Western gold community is starting to look pretty good here, given the sizable institutional buying taking place “across the board” in gold stocks.

Because a lot of that buying is value-oriented, even if gold did “impossibly” go to a new low, the substantial institutional commitment to gold stocks that is in play now is likely to accelerate. Simply put, there’s a wave of confidence sweeping through the institutional investor community about gold stocks, and I think it’s time for the Western gold community to grab an extra gold stocks surfboard, and have some fun!

********

Special Offer For Gold-Eagle Readers: Please send me an Email to [email protected] and I’ll send you my free “Golden Jackrabbits!” report. I highlight four senior gold stocks and three juniors that are likely to stage “Jackrabbit” types of advances, during the next stage of the gold market rally, with key buy and sell tactics for each of them!

Note: We are privacy oriented. We accept cheques. And credit cards thru PayPal only on our website. For your protection. We don’t see your credit card information. Only PayPal does. They pay us. Minus their fee. PayPal is a highly reputable company. Owned by Ebay. With about 160 million accounts worldwide.

Written between 4am-7am. 5-6 issues per week. Emailed at aprox 9am daily.

Email: [email protected]

Rate Sheet (us funds):

Lifetime: $799

2yr: $269 (over 500 issues)

1yr: $169 (over 250 issues)

6 mths: $99 (over 125 issues)

To pay by cheque, make cheque payable to “Stewart Thomson”

Mail to:

Stewart Thomson / 1276 Lakeview Drive / Oakville, Ontario L6H 2M8 Canada

Stewart Thomson is a retired Merrill Lynch broker. Stewart writes the Graceland Updates daily between 4am-7am. They are sent out around 8am-9am. The newsletter is attractively priced and the format is a unique numbered point form. Giving clarity of each point and saving valuable reading time.

Risks, Disclaimers, Legal

Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualified investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is: 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially.

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website:

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website: