Gold: Summer Rally Time?

Liquidity flows into or out of the “love trade” (gold jewellery) and the “fear trade” (inflation and financial system risk), are the two main drivers of the price of gold.

Liquidity flows into or out of the “love trade” (gold jewellery) and the “fear trade” (inflation and financial system risk), are the two main drivers of the price of gold.

The strongest gold jewellery buyers are in India, and the election of Narendra Modi has already unleashed a huge wave of confidence amongst jewellers there. ‘Retailers added that the latest steps by the apex bank of allowing banks to offer gold loans and permitting more entities to import the precious metal were signs of encouragement. This could drive up overall demand by 5% to 7% in 2014 from last year’s level of 975 tonnes, said Manish Kedia, bullion retailer. Manoj Thakkar of bullion retailer Amrapali Industries said, "The premium on gold has gone down from $110 per ounce to $35 per ounce. The prices too have come down after the Reserve Bank of India provided conditional relief in gold imports restrictions by allowing Star trading houses to import gold. We are in for better times now."’ –Mineweb News, Mumbai, June 2, 2014.

While El Nino could delay the arrival of India’s monsoon season by one or two weeks, an end to the import restrictions could unleash a tremendous amount of pent-up demand, more than offsetting the lost crop revenues.

In the big picture, foreign investment is pouring into India. Last night, India’s central bank announced policy guidance, suggesting inflation will moderate and GDP growth will improve. As the economy strengthens, spirits are high, and this bodes well for the gold jewellery business during the second half of 2014.

In America, home of the world’s largest gold fear trade, signs of inflation are beginning to appear. The Fed uses an eight year business cycle, and the last few years of that cycle tend to be when inflation appears.

The US economy is entering the tail end of the business cycle now.

On that note, please click here now. Seattle’s enormous increase in the minimum wage could set off a nation-wide surge in wages, which is highly inflationary.

Here is a closer look at the Seattle plan.

Currently, most major money managers have a relatively similar outlook on major markets, including gold. If inflation begins to rise significantly over the next six months, significant disagreement about what that inflation means would almost certainly arise.

In turn, that disagreement would create a fair amount of bond market volatility. Substantial institutional liquidity flows into gold stocks is very likely in that situation.

Looking out over the next 7 months, both the love trade and the fear trade appear to favour the gold market bulls.

That’s the GDX weekly chart, and it’s clear that significant summer rallies are the norm for gold stocks, not the exception.

Look at the position of the 14,3,3 Stochastics oscillator. It’s very bullish.

I would suggest that aggressive gold stock investors should be postured in a 70% -90% net long position. Personally, I’m 90% net long and in very buoyant spirits.

That’s the daily GDX chart. Note how little price erosion in gold stocks has occurred on a year over year basis.

Compared to past years, the erosion is minor, and there’s an enormous (albeit somewhat rough) inverse head and shoulders bottom pattern in play.

This daily GDXJ chart looks good. There’s a nice bullish wedge forming, and my stokeillator (14,7,7 Stochastics series) has just flashed a crossover buy signal.

The technical posture of gold stocks meshes well, with the Western world’s transition from deflation to inflation, and with the mindboggling changes taking place in India.

The exactly launch point of a summer rally is likely impossible to predict, so I find it desirable to maintain a modest number of short positions.

Also, the monthly US Employment Situation report will be released on Friday, and gold has a rough tendency to decline or trade listlessly in the week leading up to the release of the report.

Is it possible that a substantial 2014 summer rally begins after the release of this key jobs report? I think so.

I’ve outlined a rough scenario for summer rally enthusiasts on this daily silver chart. I’ve suggested silver could move up to about $22.

Much higher prices are possible if Western world inflation and Indian buying increase significantly, and I think that’s exactly what’s going to occur.

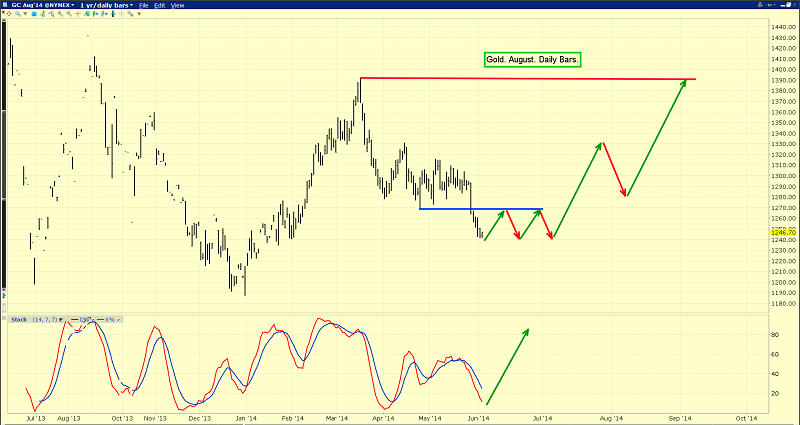

That’s the daily gold chart. Note the bullish position of my stokeillator at the bottom of the chart. A crossover buy signal appears to be imminent, and such signals tend to be followed by $50 - $150 rallies in the price of gold!

********

Special Offer For Gold-Eagle Readers: Please send an Email to [email protected] and I’ll send you my free “Stock Markets Of The World” report. As the Fed tapers QE, and begins to consider withdrawing stimulus, which global stock markets are poised to survive and prosper? I’ll show you how I’ve positioned myself in global markets, to manage the coming sea change!

Note: We are privacy oriented. We accept cheques. And credit cards thru PayPal only on our website. For your protection. We don’t see your credit card information. Only PayPal does. They pay us. Minus their fee. PayPal is a highly reputable company. Owned by Ebay. With about 160 million accounts worldwide.

Email: [email protected]

Rate Sheet (us funds):

Lifetime: $799

2yr: $269 (over 500 issues)

1yr: $169 (over 250 issues)

6 mths: $99 (over 125 issues)

To pay by cheque, make cheque payable to “Stewart Thomson”

Mail to:

Stewart Thomson / 1276 Lakeview Drive / Oakville, Ontario L6H 2M8 Canada

Stewart Thomson is a retired Merrill Lynch broker. Stewart writes the Graceland Updates daily between 4am-7am. They are sent out around 8am-9am. The newsletter is attractively priced and the format is a unique numbered point form. Giving clarity of each point and saving valuable reading time.

Risks, Disclaimers, Legal

Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualifed investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is: 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line:

Are You Prepared?

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website:

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website: