Gold Supply and Demand Fundamentals for Q1 2013

Global gold demand for the first quarter of 2013 declined both in terms of tonnage (-13%) and dollars (-16%).

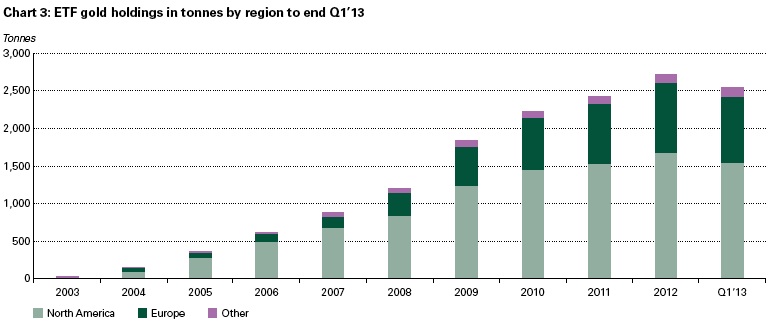

The volume decline was driven primarily by 177 tonnes of outflows from ETFs, versus inflows of 53 tonnes last year. If we remove this component from the mix, total global demand actually increased by 8% during the first quarter.

It is somewhat odd to see that investment demand in the form of bars and coins climbed by a healthy 10.3%, while ETF investment demand turned negative and total holdings dropped by over 7%. Some of this divergence can be explained by investors exiting paper positions in precious metals in favor of taking possession of the physical metal. This decision stems from a growing distrust of the banks and financial institutions that act as custodians for the popular gold and silver ETFs. Many precious metals investors do not believe that the funds actually hold all of the physical to back up the paper claims.

These concerns have been somewhat validated in recent years by lawsuits against banks for charging storage fees on silver they didn’t actually store, large investors being forced to settle in cash, multi-year delays from countries seeking to repatriate their gold holdings, a strong case for paper manipulation of the prices by the largest banks and theft of customer funds at the largest commodity brokerages. I won’t re-hash the manipulation argument in this article, but suffice to say there has been a significant divergence between the physical and paper prices, suggesting that the COMEX price is not reflective of true free market pricing.

Due to all of the reasons mentioned above, it makes sense to look at investment demand with and without the paper-driven ETF component. And while it is somewhat concerning to see total demand with ETF outflows declining, that decline of 13% is rather small given the tonnage outflows from ETFs. And it is important to keep these outflows in perspective. While it is an abrupt turnaround from the inflows in previous quarters, total ETF holdings only dropped by 7% and are still above 2011 levels. Likewise, the 10% increase in demand for bars and coins suggests that the market for physical gold and silver remains strong.

It is also worth noting that investment demand increased significantly elsewhere in the world where paper ETFs are less utilized. Total investment demand for gold rocketed 52% higher in India and 22% higher in China.

Falling prices helped to drive up consumer demand for gold and silver jewelry. This demand climbed higher across the globe including in the U.S. (+22%), India (+27%) and China (+20%). In fact, Q1 marked the first quarterly increase in jewelry demand since 2005!

Central bank buying remained strong, as 109 tonnes were added to reserves during Q1. This marked the ninth consecutive quarter of net purchases, although demand cooled off a bit (-5%) versus the first quarter of 2012.

It is also interesting to note that sales of gold by signatories of the Central Bank Gold Agreement (CBGA) were non-existent in the first quarter of 2013. Cumulative sales are running at just under 200 tonnes, which is just a fraction of the 1,600 tonnes that would be permissible to date under the agreement. In other words, central banks around the globe continue to be significantly more interested in accumulating gold reserves than disposing of them.

Supply

Total gold supply was steady during the first quarter, with a small increase of around 1%. A 4% increase in mine production was countered by a decline in similar magnitude in the supply of recycled gold. It seems that most of the unwanted or unused gold that gets recycled has already been brought into the market through the barrage of cash for gold stores and advertisements.

Gross de-hedging by producers slightly outweighed fresh hedging to equate to 3 tonnes of new de-hedging in the quarter. Gold producers have significantly reduced the size of the global hedge book in the past few years and there appears to be no appetite to start new hedges, despite the sharp drop in gold prices. This signifies that the experts and executives at top mining companies continue to be very bullish about the future price of gold.

I think the takeaway from this latest WGC report is that gold demand remains strong globally, including a noted shift to physical bullion by investors and continued buying at elevated levels from central banks. European markets were weak and the outflow from ETFs is also somewhat concerning. But these ETF speculators are fickle, moving their money around to the hottest sectors in an attempt to follow the latest trends. They will likely pile back into the gold market as the price begins moving higher. In the meantime, most of the strong-hands that are long-term gold investors continue to hold their positions and buy the dips.

Therefore, I believe the data is suggesting that we are more likely in a short-term correction than a new gold bear market as Goldman Sachs and others would like you to believe.

The data and charts above are from the World Gold Council. Click here to download their full Q1 report.

I am a buyer at current levels and believe purchasing in tranches is sound advice for any investor looking to take advantage of the discounted prices in both physical metals and mining equities. While it might be more exciting to chase exploding prices higher, the majority of profits are made by those that buy before lift-off, when everyone else is too scared to act.

If you want to follow which stocks I am buying and receive my monthly newsletter, click here to try it out for a month, quarter or year.

If you would like to find out more about our services, please watch this short video for an introduction to Gold Stock Bull.

If you would like to view all of the stocks in the GSB model portfolio, receive the monthly newsletter and get email alerts whenever we are buying or selling, click here to sign up for the Gold Stock Bull Premium Membership.

Jason Hamlin

Founder - GoldStockBull